Questions To Ask When Buying A Business

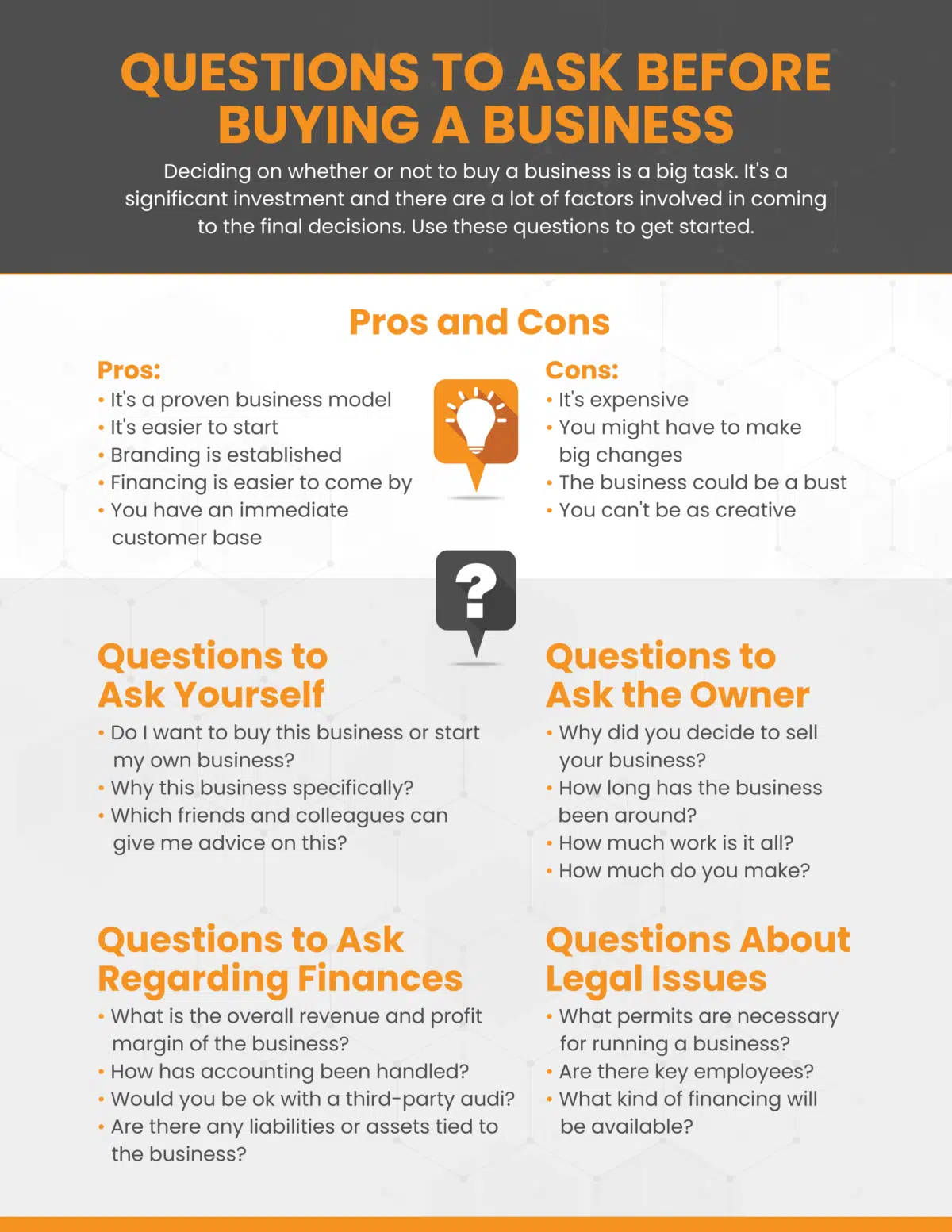

Buying a business is a high-stakes decision. Due diligence is paramount to avoid financial disaster.

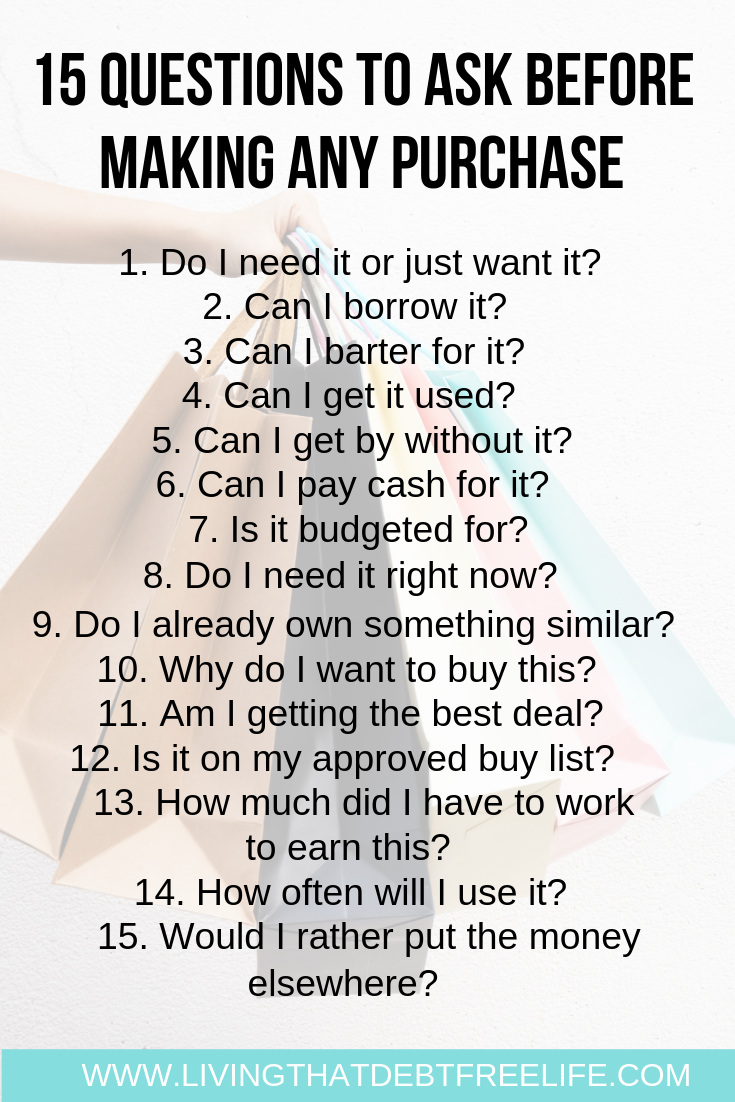

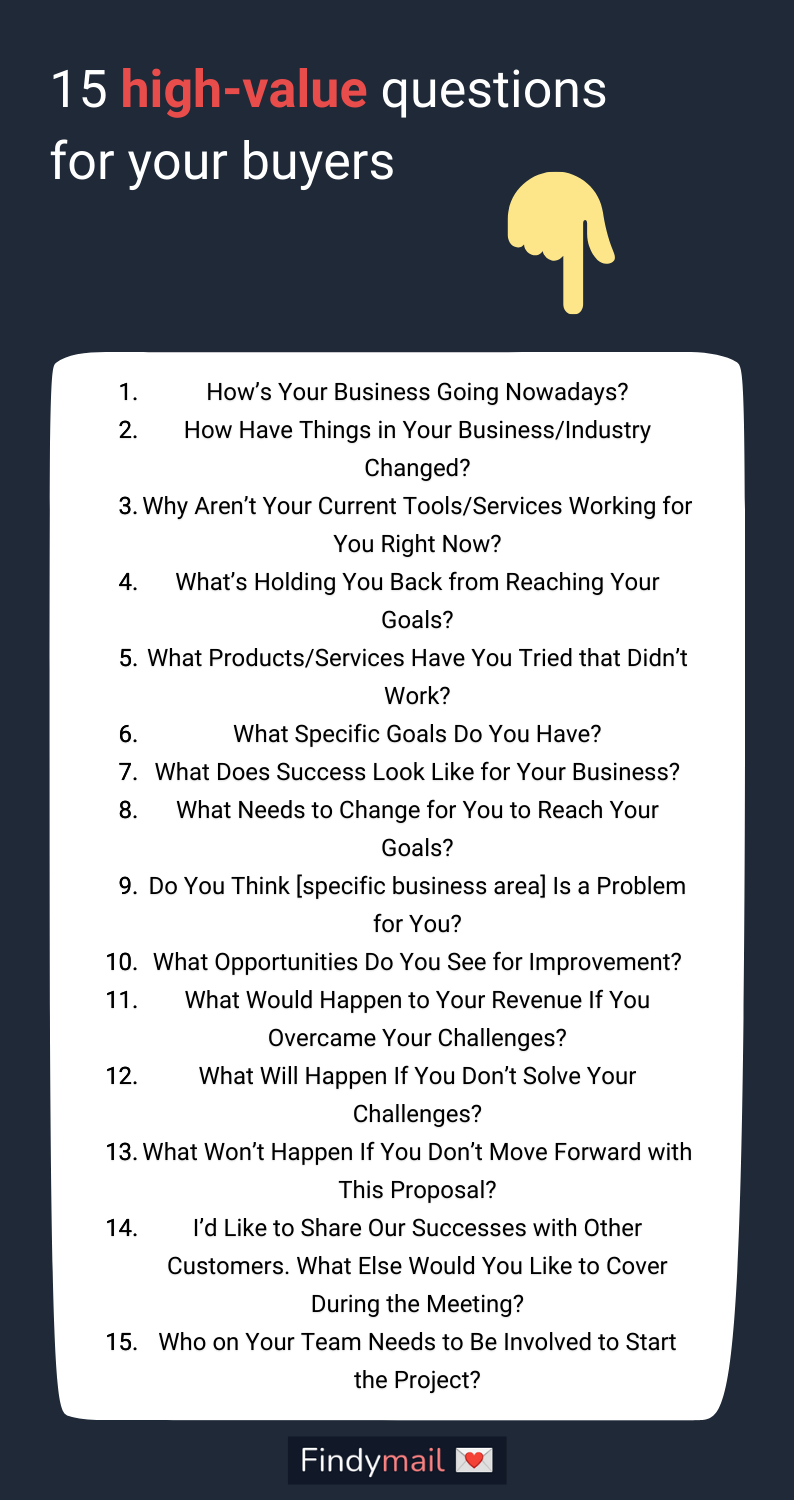

Potential buyers must ask the right questions before signing on the dotted line. This article outlines critical inquiries to ensure a sound investment.

Financial Health: Digging Deep

What is the business’s true financial performance?

Request at least three to five years of financial statements. Scrutinize profit and loss statements, balance sheets, and cash flow statements.

Verify the accuracy of reported revenue and expenses. Investigate any anomalies or inconsistencies.

Revenue Streams and Customer Base

How diversified are the revenue streams?

A business heavily reliant on a few key customers is inherently riskier. Understand customer concentration and retention rates.

Ask about the customer acquisition cost (CAC) and the customer lifetime value (CLTV). This data reveals the efficiency of sales and marketing efforts.

Operational Efficiency and Infrastructure

What are the current operational bottlenecks?

Evaluate the business's infrastructure, including equipment, technology, and real estate. Identify any required upgrades or deferred maintenance.

Assess the efficiency of current processes. Explore the potential for automation and streamlining.

Legal and Regulatory Compliance

Is the business fully compliant with all applicable laws and regulations?

Review all relevant licenses, permits, and contracts. Investigate any past or pending legal issues.

Confirm compliance with environmental, health, and safety regulations. Ensure proper intellectual property protection.

Market Analysis and Competitive Landscape

What is the business’s position in the market?

Analyze the competitive landscape and identify key competitors. Understand the business’s market share and growth potential.

Assess the impact of economic trends and industry disruptions. Determine the long-term viability of the business model.

Management and Employees

What is the strength and stability of the management team?

Evaluate the experience and expertise of key employees. Understand employee morale and turnover rates.

Determine the impact of the sale on employee relationships. Ascertain if key employees will remain with the business post-acquisition.

Valuation and Deal Structure

How was the asking price determined?

Obtain an independent valuation of the business. Compare the asking price to industry multiples and comparable transactions.

Understand the deal structure and payment terms. Negotiate favorable terms to minimize risk.

Conduct thorough due diligence and seek expert advice from legal and financial professionals. A seemingly great opportunity can quickly turn sour without proper investigation.

Don't hesitate to walk away if the answers raise concerns. It’s better to miss one opportunity than make a detrimental mistake.

Prospective buyers should consult with their advisors immediately. Prioritize these questions to mitigate risk and maximize the chances of a successful acquisition.

![Questions To Ask When Buying A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)

+(1).png?format=1500w)