Relation Of Earnings To Insurance Provision

The chasm between the haves and have-nots in America isn't just about luxury cars and vacation homes anymore. Increasingly, it's about something far more fundamental: access to healthcare. A growing body of evidence reveals a stark correlation: your income significantly dictates the quality and extent of your insurance coverage, leaving millions vulnerable and exacerbating health disparities across the nation.

This isn't merely an observation; it's a crisis demanding urgent attention. The ability to afford comprehensive health insurance, and therefore access timely and effective medical care, is increasingly determined by one's earnings. This translates into delayed diagnoses, inadequate treatment, and ultimately, poorer health outcomes for low-income individuals and families.

The Crushing Weight of Premiums and Out-of-Pocket Costs

The core issue lies in the affordability of health insurance. Employer-sponsored plans, while often subsidized, still require employees to shoulder a portion of the premium, deductibles, and co-pays. For low-wage workers, these costs can be crippling.

According to data from the Kaiser Family Foundation (KFF), the average family premium for employer-sponsored health insurance in 2023 was over $23,000. Even with employer contributions, the employee share can represent a significant percentage of a lower-income worker's budget.

Beyond premiums, out-of-pocket costs represent another substantial barrier. High deductibles, often exceeding several thousand dollars, force many to delay or forgo necessary care, even when insured. This is especially true for individuals with chronic conditions who require frequent medical attention.

The Affordable Care Act (ACA) aimed to address this issue through subsidies for individuals purchasing insurance on the marketplace. However, these subsidies are often insufficient, particularly for those with incomes slightly above the eligibility threshold, leaving them facing exorbitant premiums.

The Medicaid Gap: A Safety Net With Holes

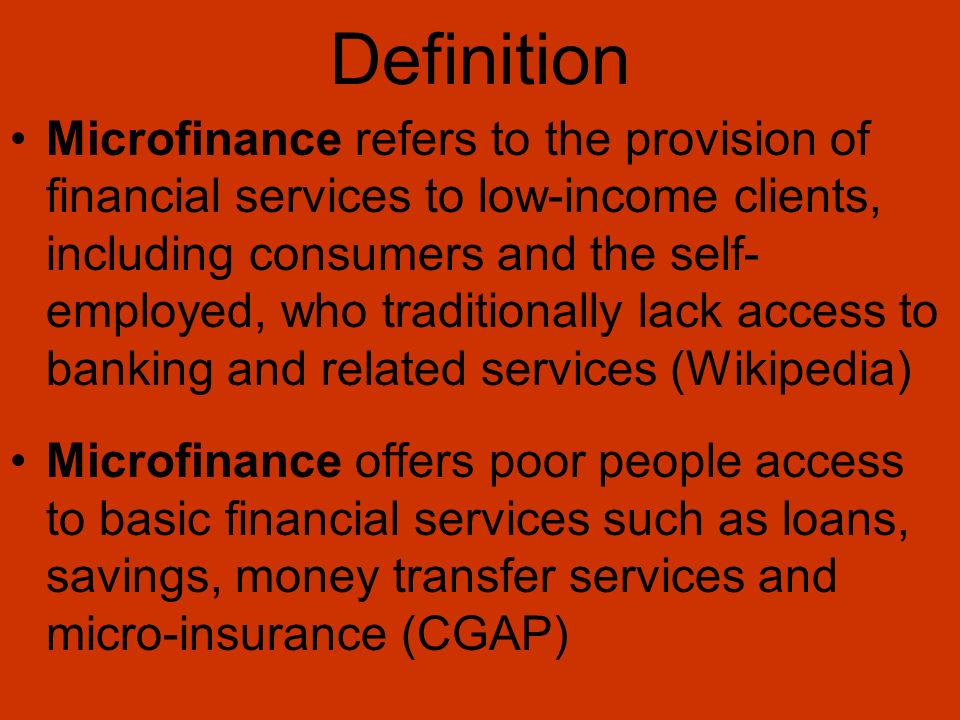

Medicaid, the government-funded health insurance program for low-income individuals and families, serves as a crucial safety net. However, its effectiveness is hampered by eligibility restrictions and variations in coverage across states.

States that have expanded Medicaid under the ACA have seen significant reductions in uninsured rates and improved access to care for low-income residents. Conversely, states that have refused expansion continue to leave millions uninsured and vulnerable.

Furthermore, even in states with expanded Medicaid, challenges persist. Limited provider networks, bureaucratic hurdles, and social stigmas can prevent eligible individuals from accessing the care they need. This creates a situation where even those with government assistance may not receive adequate healthcare.

The Impact on Health Outcomes and Social Mobility

The relationship between earnings and insurance provision extends far beyond individual health concerns. It has profound implications for social mobility and economic opportunity.

Individuals with inadequate health insurance are more likely to experience chronic health conditions, miss work due to illness, and face financial hardship due to medical debt. This can create a cycle of poverty and ill-health, making it difficult to escape low-wage jobs.

Children from low-income families are particularly vulnerable. Lack of access to preventative care and timely treatment can lead to developmental delays and chronic health problems that hinder their educational attainment and future prospects. Investing in health insurance for low-income families is an investment in the future workforce.

Employer Perspectives and the Business Case for Health Equity

While the focus often centers on individual affordability, the role of employers in providing health insurance is critical. Many businesses struggle to offer comprehensive coverage to their employees, especially those in low-margin industries.

According to the National Federation of Independent Business (NFIB), the rising cost of health insurance is a major concern for small business owners. They often cite these costs as a barrier to hiring new employees and providing competitive wages.

However, some employers are recognizing the business case for investing in employee health. Studies have shown that healthy employees are more productive, have lower absenteeism rates, and are more engaged in their work. Offering comprehensive health benefits can be a key factor in attracting and retaining top talent.

Furthermore, some businesses are exploring alternative models for providing healthcare to their employees, such as on-site clinics and direct primary care arrangements. These models can help reduce costs and improve access to care, while also promoting employee well-being.

Policy Solutions and the Road Ahead

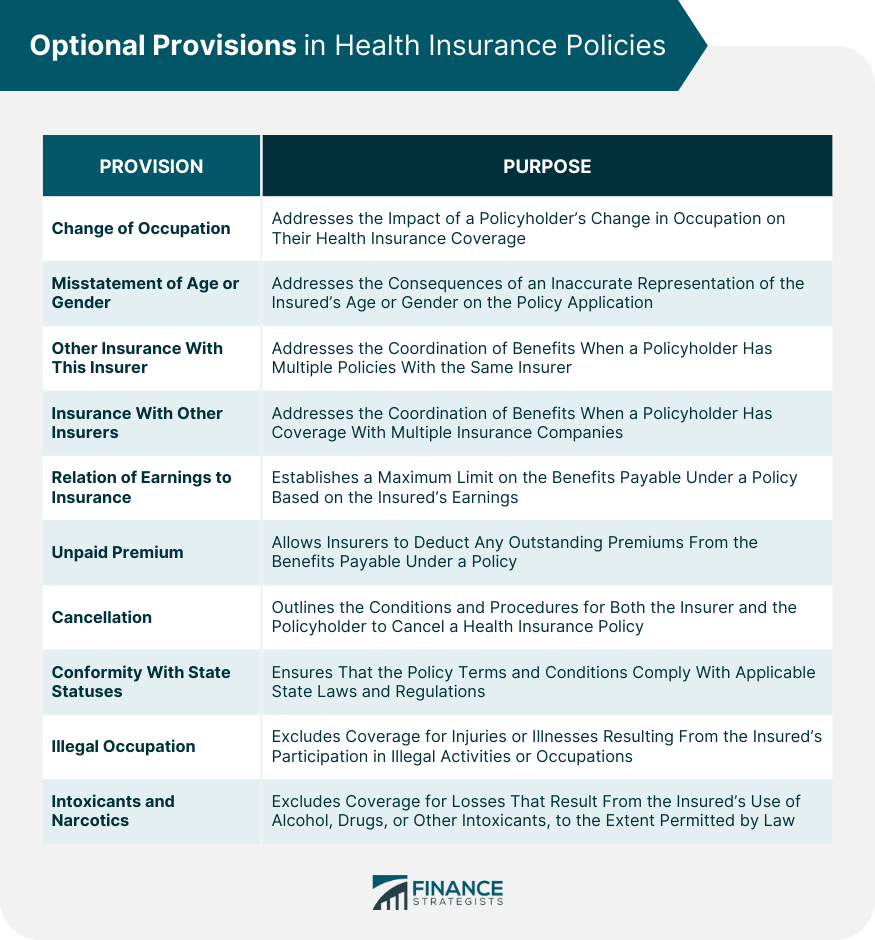

Addressing the relationship between earnings and insurance provision requires a multi-faceted approach involving policy changes, employer initiatives, and individual empowerment. Several policy solutions have been proposed, including expanding Medicaid, strengthening ACA subsidies, and implementing a public option for health insurance.

Furthermore, some advocate for raising the minimum wage and strengthening worker protections to improve the overall financial security of low-wage workers. A higher minimum wage would provide individuals with more disposable income to afford health insurance and other essential expenses.

Ultimately, creating a more equitable healthcare system requires a fundamental shift in our thinking about health insurance. It should be viewed as a basic human right, not a luxury afforded only to those with high incomes. The economic benefits of a healthy and productive workforce far outweigh the costs of ensuring universal access to healthcare.

The current trajectory, if unchanged, will lead to further entrenchment of health disparities and a widening gap between the healthy and the sick, the wealthy and the vulnerable. Ignoring this link between earnings and health insurance is not only morally untenable but also economically unsustainable. The time for decisive action is now.

.jpg)

.jpg)