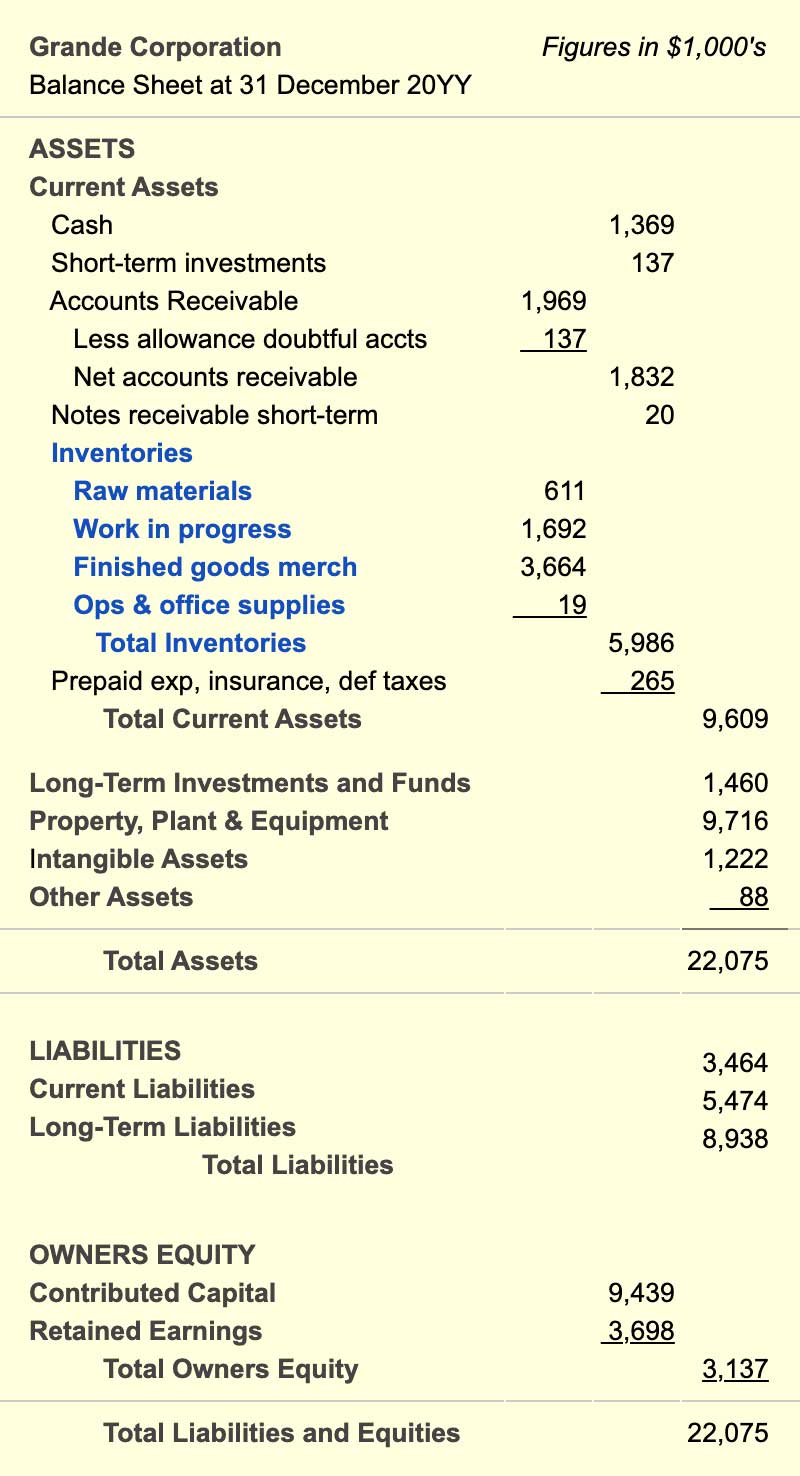

Report Three Types Of Inventory On The Balance Sheet

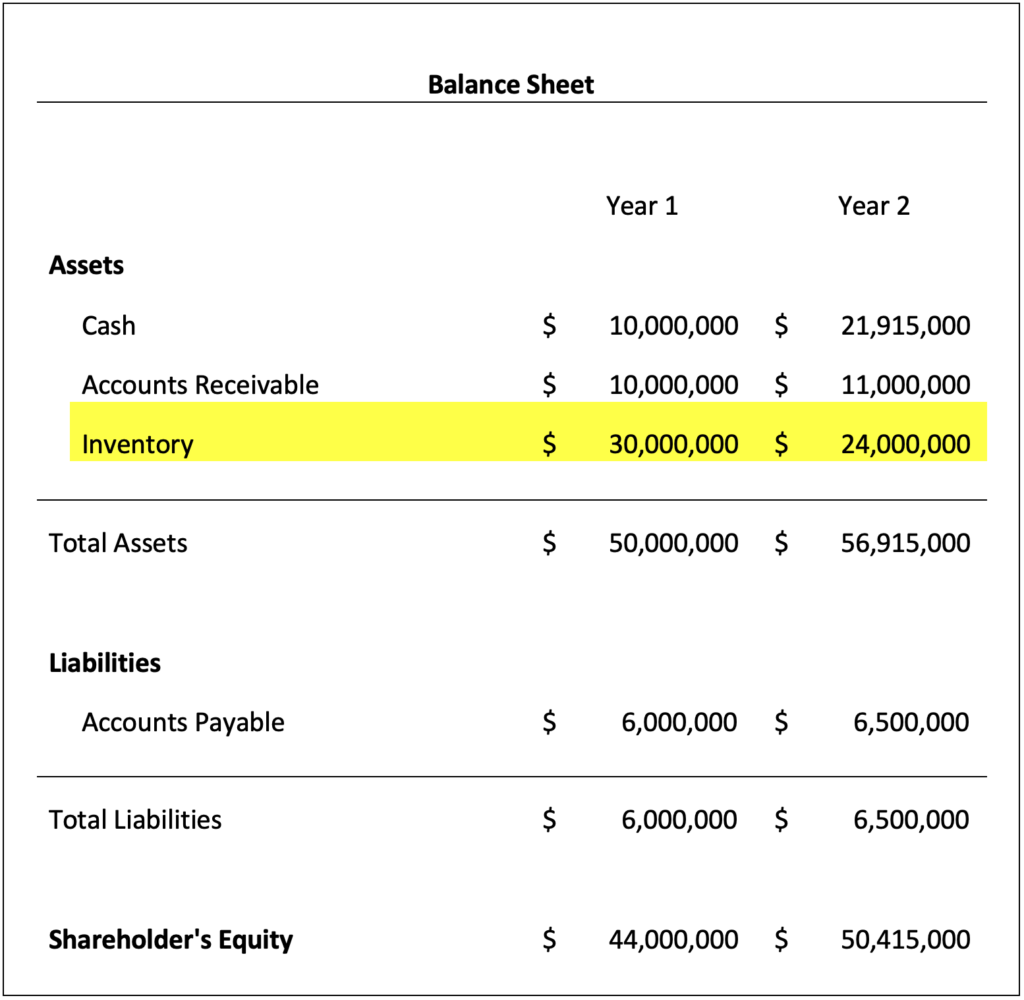

Urgent memo released: Public companies must now meticulously report three distinct inventory types on their balance sheets, demanding heightened transparency and accuracy. The directive, effective immediately, aims to provide investors with a clearer understanding of a company's financial health and operational efficiency.

This change to financial reporting standards marks a significant shift, compelling businesses to categorize and detail their inventory holdings with unprecedented precision. The goal is to standardize how inventory is valued and presented, offering greater insight into a company's ability to manage its assets.

Inventory Categorization: The New Standard

The new rule mandates the explicit identification of three primary inventory classifications:

Raw Materials

Raw materials encompass the basic inputs a company uses in its manufacturing processes. This includes resources such as steel, timber, chemicals, and components sourced from suppliers.

Companies are required to disclose the quantity and value of raw materials held in storage, offering insights into supply chain management and potential production bottlenecks. Proper reporting can help in tracking the market values of the items for cost projections.

Work-in-Progress (WIP)

Work-in-progress, or WIP, represents partially completed goods still undergoing production. These are products that have entered the manufacturing process but are not yet finished goods.

This category demands a detailed assessment of the stage of completion and associated costs, including labor and overhead. Accurate reporting of WIP is crucial for evaluating production efficiency and potential cost overruns.

Finished Goods

Finished goods are completed products ready for sale to customers. This encompasses items that have undergone the entire manufacturing process and are available for distribution.

Companies must meticulously track the quantity and value of finished goods in their inventory, providing a clear picture of sales readiness and potential revenue generation. This number informs investors about possible write downs.

Impact and Implications

The implementation of this new reporting standard is expected to have a wide-ranging impact on companies across various sectors. The transparency will enable investors to do comparisons of inventory management practices among organizations.

Manufacturing, retail, and technology firms, in particular, will need to adapt their accounting systems and processes to comply with the stricter requirements. Failure to adhere to the new guidelines could result in penalties, restatements, and damage to a company's reputation.

According to a statement released by the Securities and Exchange Commission (SEC), the move aims to bolster investor confidence by providing a more accurate and transparent view of a company's inventory assets. The SEC expects firms to diligently adhere to the new regulations starting with the next fiscal quarter.

Expert Commentary

“This is a game-changer for financial reporting,” stated Dr. Anya Sharma, a leading accounting professor at the University of Finance. "It forces companies to be far more precise in how they value and present their inventory. Transparency is always welcome on Wall Street."

“The level of granularity required will necessitate significant adjustments to accounting practices,” said Mark Olsen, partner at a Big Four accounting firm. "Companies must invest in robust inventory tracking systems to ensure compliance. The increased requirements will improve reliability in financial reporting."

Challenges and Solutions

Implementing these new standards presents several challenges. Many companies will need to upgrade their inventory management systems and train their accounting staff to accurately categorize and value inventory.

Furthermore, determining the cost of work-in-progress can be particularly complex, requiring careful allocation of labor, materials, and overhead. Companies may need to seek expert advice to ensure compliance.

Some experts are advising companies to conduct thorough internal audits to identify potential gaps in their inventory reporting processes. Investing in advanced inventory management software can also streamline the process and improve accuracy.

Next Steps

Companies are urged to immediately review their current inventory accounting practices and implement the necessary changes to comply with the new reporting standards. Training sessions for accounting staff are highly recommended.

The SEC will be closely monitoring compliance with the new regulations. It is expected that the agency will provide further guidance and clarification as needed.

The long-term impact of this change will be a more informed investment community and a more transparent corporate environment. Investors will have tools to better evaluate companies inventory management policies.

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)