Reporting Accrued Market Discount On Tax Return

As tax season approaches, many investors holding bonds purchased at a discount might be unaware of a specific tax rule: reporting accrued market discount. This can lead to unexpected tax liabilities if not properly addressed.

Understanding and correctly reporting accrued market discount is crucial for bondholders to avoid penalties and ensure accurate tax filing. The Internal Revenue Service (IRS) provides specific guidelines on how to handle this type of income, and neglecting these rules could result in audits and additional taxes owed.

What is Accrued Market Discount?

Market discount arises when a bond is purchased for less than its face value at maturity. This typically happens because of factors like rising interest rates or concerns about the issuer's creditworthiness.

The difference between the purchase price and the face value represents the market discount. Accrued market discount refers to the portion of this discount that has accumulated over the holding period, especially when the bond is sold or matures.

Who is Affected?

This tax rule primarily affects individuals, trusts, and other entities that invest in taxable bonds purchased at a discount. It's important to note that tax-exempt bonds, such as municipal bonds, are generally not subject to market discount rules.

However, there are exceptions and nuances, so consulting with a qualified tax professional is always advisable.

How to Report Accrued Market Discount

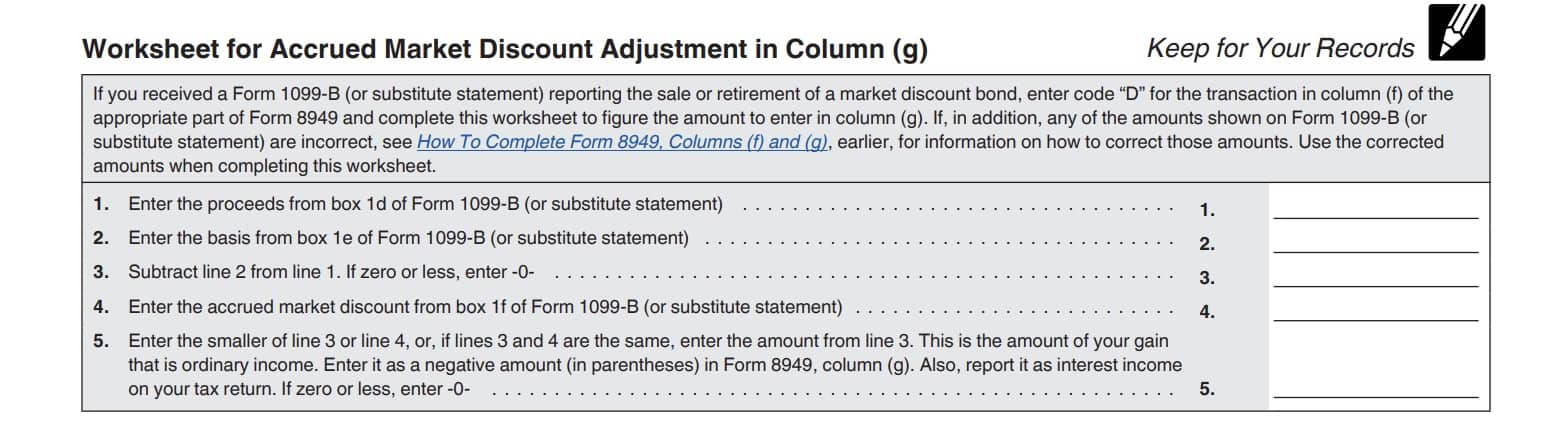

The IRS provides clear instructions on how to report accrued market discount on your tax return. The specific forms and schedules required will depend on the circumstances of your bond holdings and transactions.

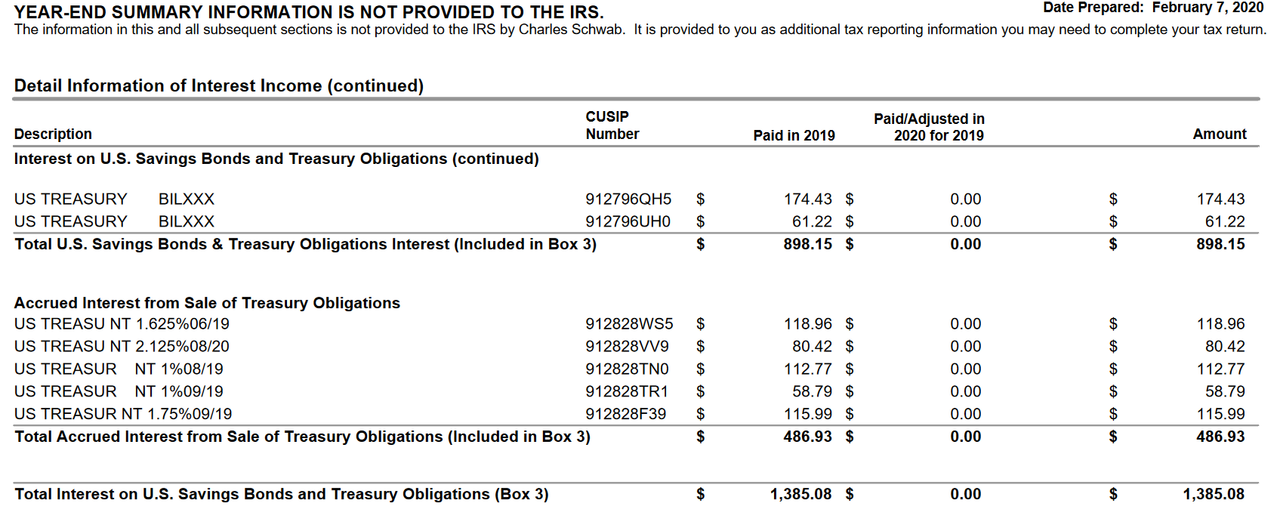

Generally, you'll need to calculate the amount of accrued market discount and report it as ordinary income. This is typically done on Schedule B (Form 1040), Interest and Ordinary Dividends.

One crucial aspect is whether you elected to include the market discount in income currently over the life of the bond. If you did, you'll report the amortized amount each year. If not, you'll generally report the accrued market discount when the bond is sold or matures.

Electing to Accrue Currently

Taxpayers have the option to elect to include market discount in income each year as it accrues. This election, under IRS Section 1278(b), can simplify tax reporting in the long run, as it avoids a potentially large taxable gain when the bond is sold or matures.

However, this election is irrevocable, meaning you cannot change your mind later. It's essential to carefully consider the implications before making this decision.

Exceptions and Special Rules

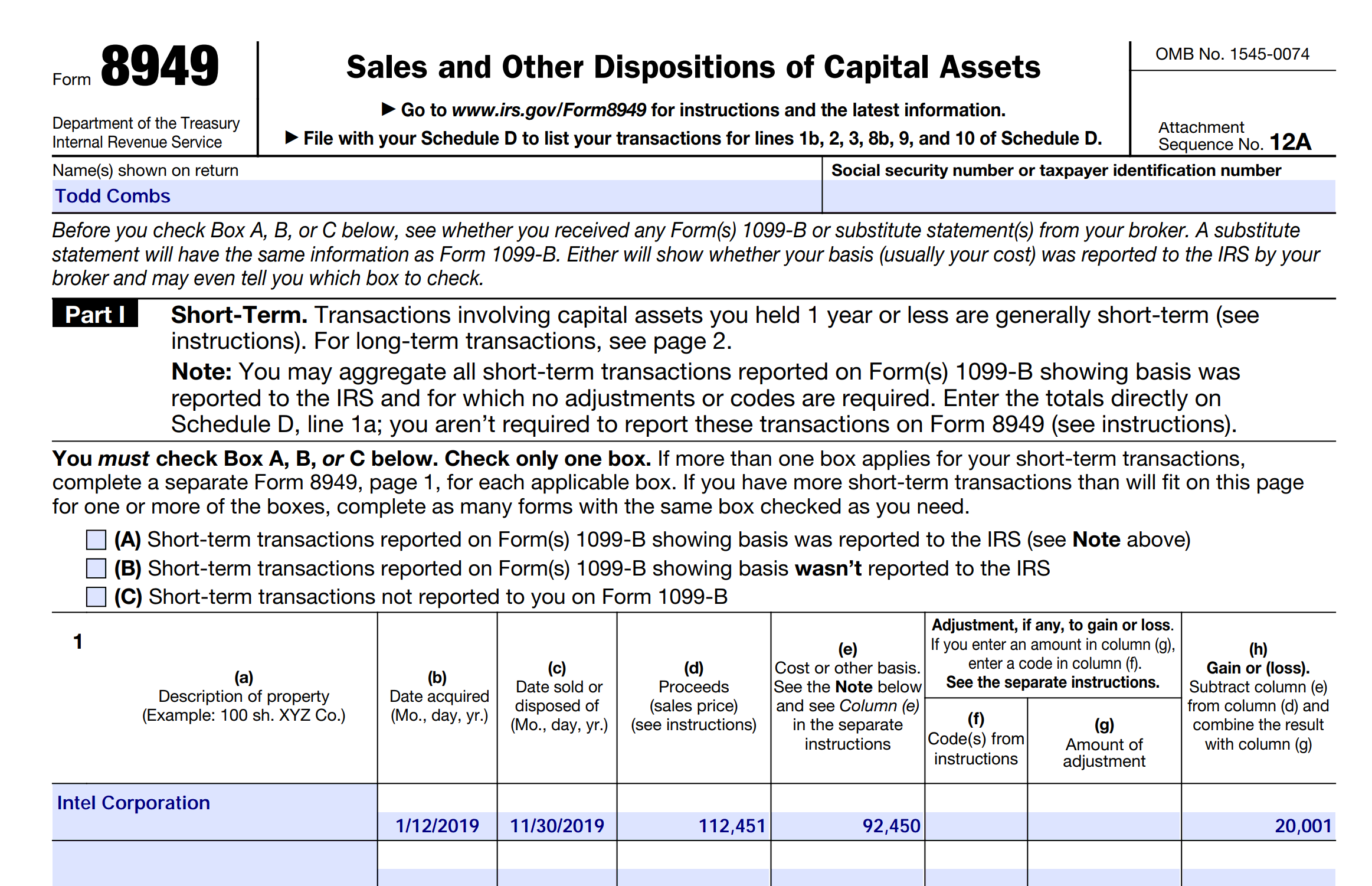

There are certain exceptions and special rules that may apply to market discount. For example, the de minimis rule states that if the market discount is less than 0.25% of the bond's face value multiplied by the number of complete years until maturity, it is considered de minimis and does not need to be reported as ordinary income. Instead, any gain on the sale of the bond is treated as capital gain.

Additionally, specific rules apply to certain types of bonds, such as those with original issue discount (OID). Understanding these nuances is crucial for accurate tax reporting.

Potential Impact on Investors

Failure to properly report accrued market discount can lead to several negative consequences. The IRS may assess penalties and interest on underpaid taxes.

Furthermore, an inaccurate tax return could trigger an audit, leading to additional scrutiny of your financial records. Staying informed about these rules is paramount for responsible investing.

Seeking Professional Advice

Given the complexities of tax law, consulting a qualified tax advisor or certified public accountant (CPA) is highly recommended. A professional can provide personalized guidance based on your specific circumstances.

They can help you navigate the market discount rules, determine the optimal reporting method, and ensure compliance with all applicable tax regulations. Taking the time to seek professional assistance can ultimately save you time, money, and potential headaches in the long run.

Resources from the IRS

The IRS offers a variety of resources to help taxpayers understand and comply with the market discount rules. Publication 550, Investment Income and Expenses, provides detailed information on this topic.

You can also find answers to frequently asked questions on the IRS website and access online tools and calculators to assist with your tax preparation. Utilizing these resources can empower you to take control of your tax obligations and avoid costly mistakes.

By understanding the rules surrounding accrued market discount, investors can ensure accurate tax reporting and avoid potential penalties. Proactive planning and professional guidance are key to navigating this complex area of tax law.