World Finance Loan Requirements For Bad Credit

Accessing credit with a less-than-perfect credit history can feel like navigating a minefield. World Finance, a prominent lending institution, offers loan products to individuals with bad credit. However, understanding the specific requirements and nuances associated with these loans is crucial for potential borrowers.

World Finance Loan Requirements: An Overview

This article delves into the loan requirements set by World Finance for individuals with bad credit. We will examine the eligibility criteria, documentation needed, and other factors considered during the application process. The information presented aims to provide clarity and assist consumers in making informed decisions.

World Finance operates across several states, primarily targeting individuals who may not qualify for traditional bank loans. Their offerings generally include personal loans, often used for debt consolidation, emergency expenses, or other financial needs.

Eligibility Criteria

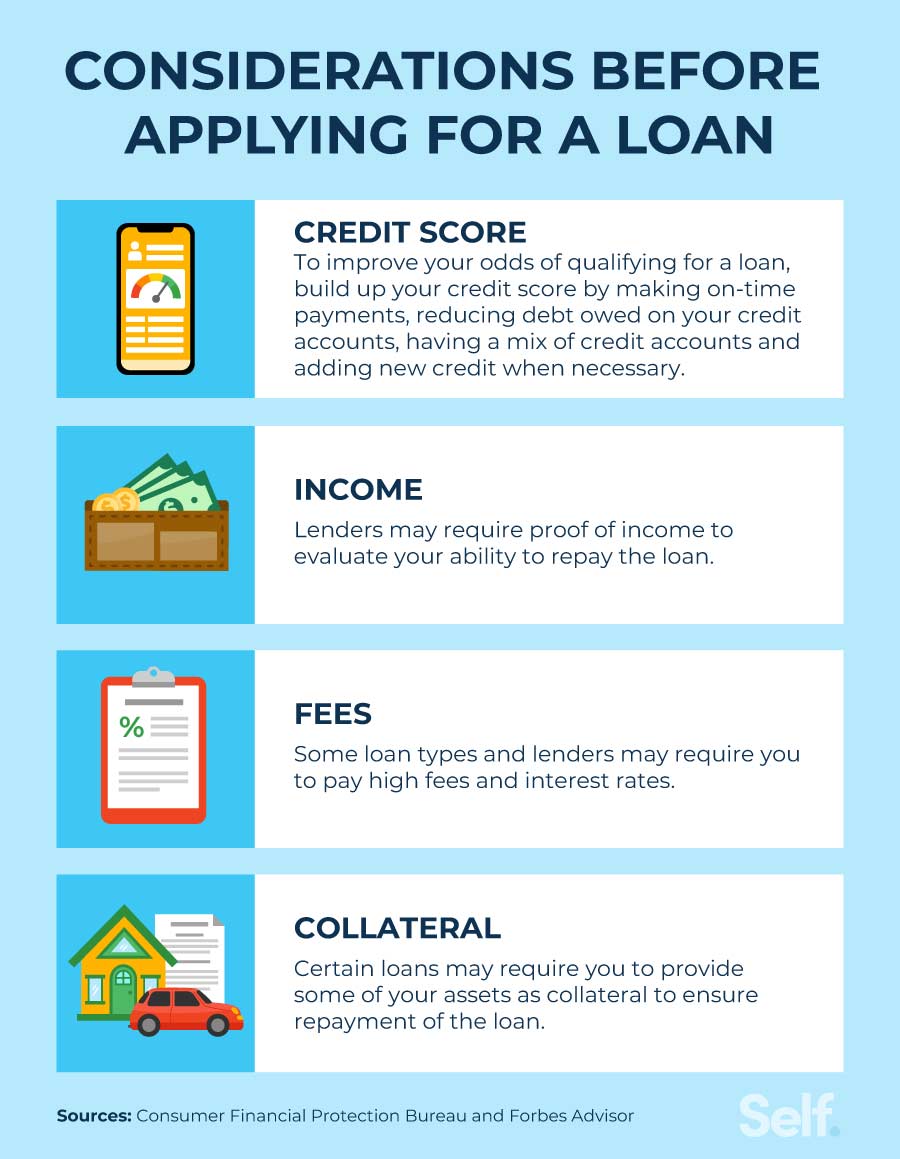

While World Finance caters to borrowers with bad credit, certain eligibility criteria must still be met. These requirements typically include a minimum age, proof of residency, and a verifiable source of income.

According to World Finance's official website and customer service representatives, consistent income is a key factor. Applicants typically need to demonstrate a stable employment history or other reliable income streams that can support loan repayments.

The amount of income required varies depending on the loan amount and the applicant's debt-to-income ratio. World Finance assesses this ratio to determine the borrower's ability to manage additional debt obligations.

Documentation Requirements

Applicants are generally required to provide several documents to support their loan application. This documentation is crucial for World Finance to verify the information provided and assess the borrower's financial situation.

Commonly requested documents include a government-issued photo ID, proof of address (e.g., utility bill or lease agreement), and proof of income (e.g., pay stubs or bank statements). Some applicants may also be asked to provide references.

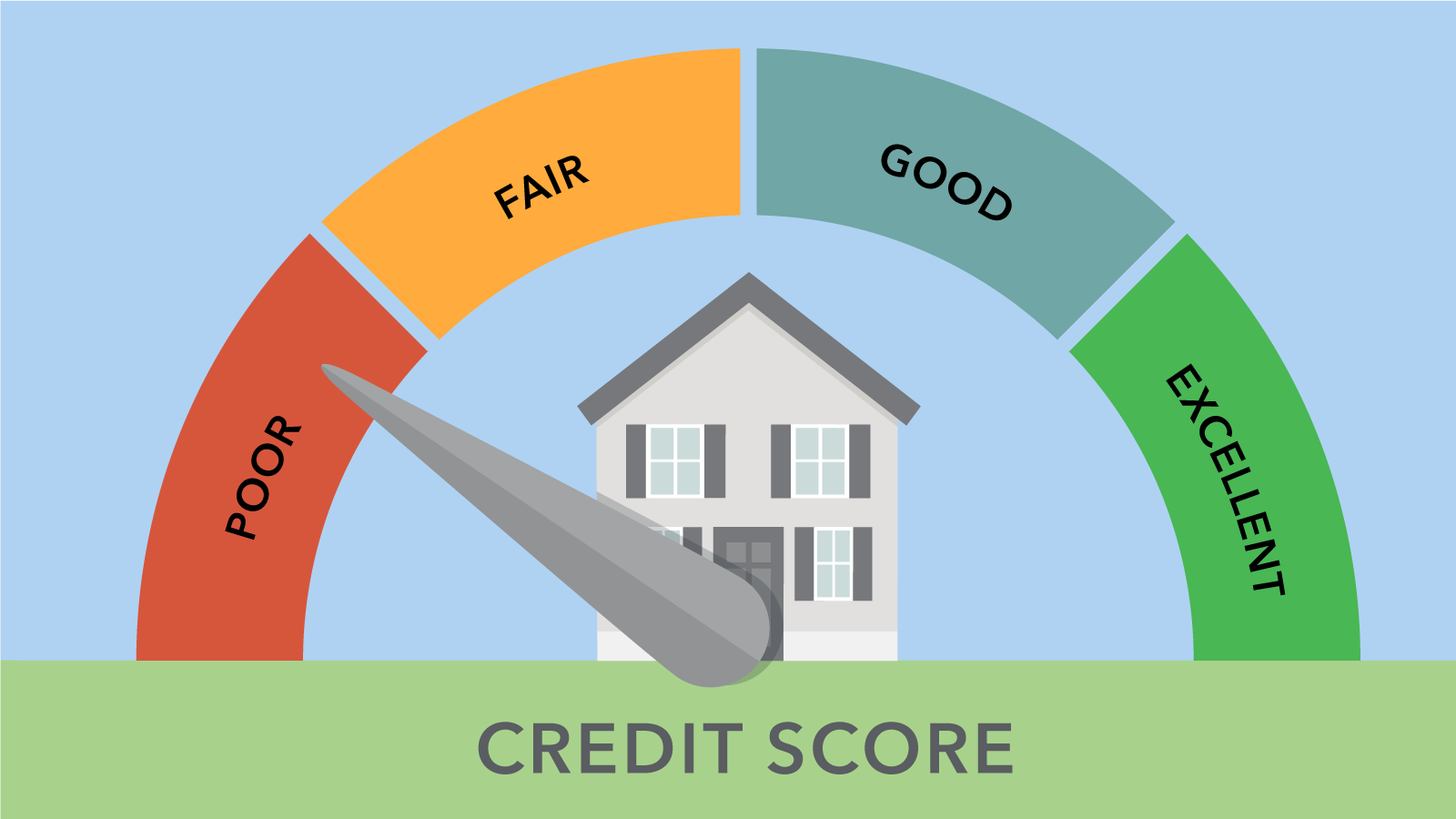

World Finance may also request access to the applicant's credit report to gain a comprehensive understanding of their credit history. This information is used to evaluate the risk associated with lending to the individual.

Interest Rates and Fees

Loans offered to individuals with bad credit typically come with higher interest rates and fees compared to those offered to borrowers with good credit. This reflects the increased risk assumed by the lender.

World Finance's interest rates and fees vary depending on the loan amount, loan term, and the applicant's creditworthiness. It is essential for borrowers to carefully review the loan agreement and understand all associated costs before accepting the loan.

According to loan agreements reviewed from multiple sources, APRs from World Finance can range from around 36% to over 100%. Origination fees and late payment penalties may also apply.

Loan Amounts and Terms

The loan amounts offered by World Finance to borrowers with bad credit typically range from a few hundred dollars to several thousand dollars. The loan terms vary, but they are generally shorter compared to traditional bank loans.

Shorter loan terms mean that borrowers will need to make larger monthly payments. Borrowers need to carefully assess their budget and ensure that they can comfortably afford the required repayments.

The specific loan amount and term that an individual qualifies for depends on several factors, including their income, credit history, and debt-to-income ratio. World Finance conducts a thorough assessment to determine the appropriate loan parameters.

The Application Process

The application process for a World Finance loan typically involves completing an online application or visiting a local branch. Applicants will need to provide the required information and documentation.

Once the application is submitted, World Finance will review the information and conduct a credit check. The approval process can take anywhere from a few hours to a few days, depending on the complexity of the application.

If approved, the borrower will need to sign a loan agreement outlining the terms and conditions of the loan. The funds will then be disbursed to the borrower, typically via direct deposit or a prepaid debit card.

Potential Impact and Considerations

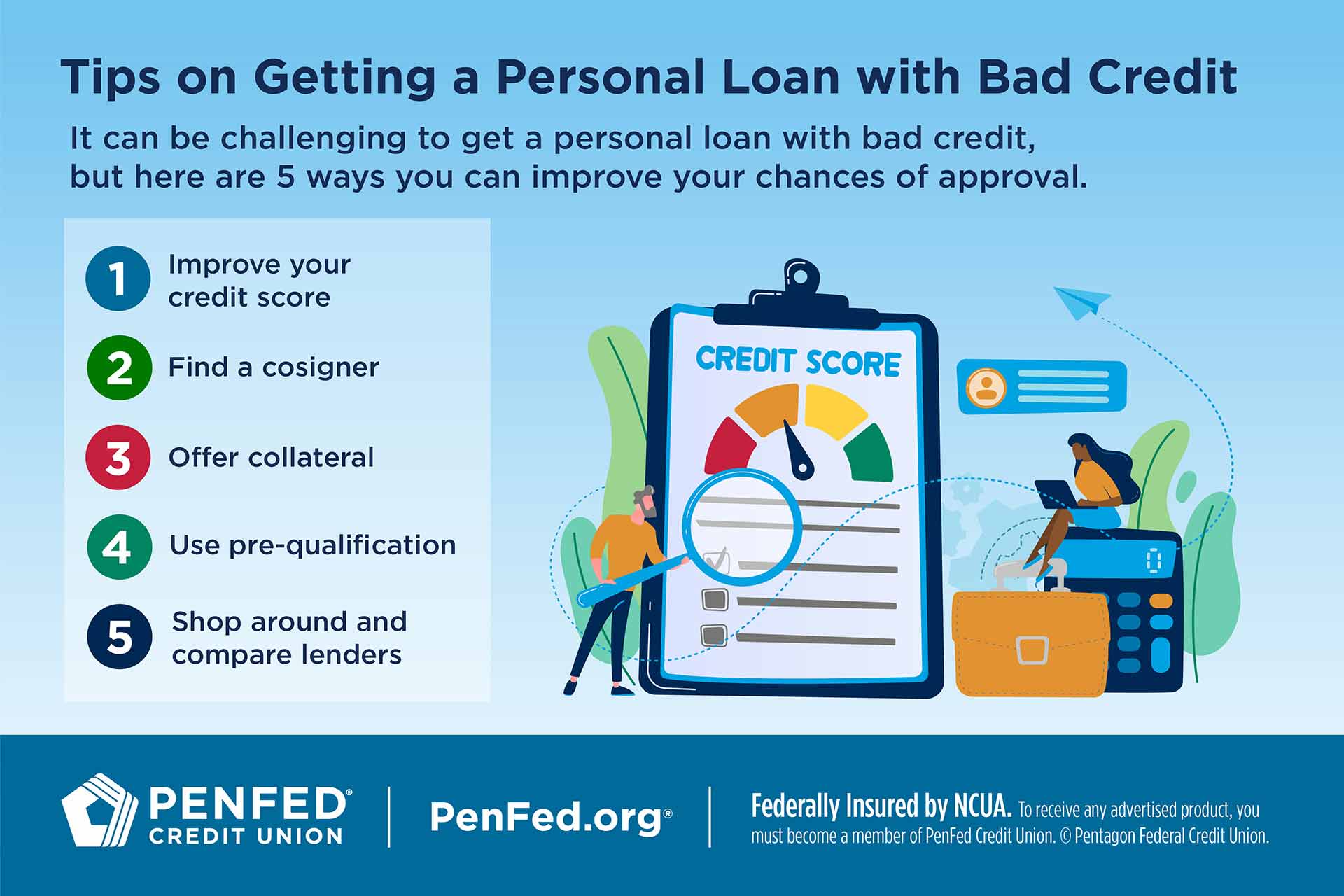

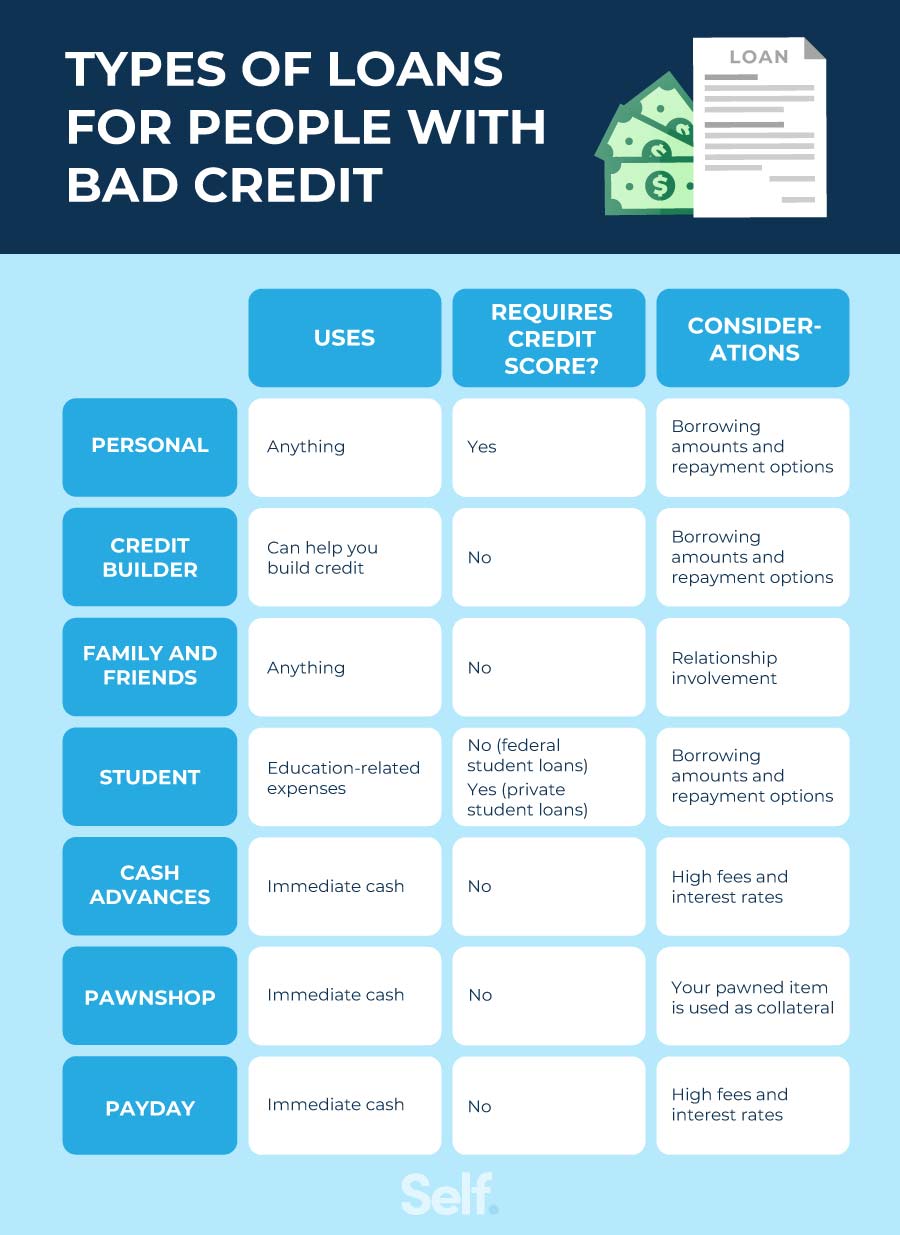

World Finance loans can provide a valuable source of funds for individuals with bad credit who need access to emergency funds or want to consolidate debt. However, borrowers should proceed with caution and carefully consider the risks involved.

The high interest rates and fees associated with these loans can make them expensive in the long run. It is important for borrowers to explore alternative options, such as credit counseling or secured loans, before resorting to a World Finance loan.

Borrowers should also ensure that they can comfortably afford the monthly payments and avoid taking out more debt than they can handle. Defaulting on a loan can further damage their credit score and lead to legal action.

According to the National Foundation for Credit Counseling (NFCC), individuals struggling with debt should seek professional advice before taking out additional loans. Credit counselors can help borrowers develop a budget, manage their debt, and explore alternative financial solutions.

Ultimately, responsible borrowing practices and a clear understanding of the loan terms are essential for individuals considering a World Finance loan with bad credit.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)