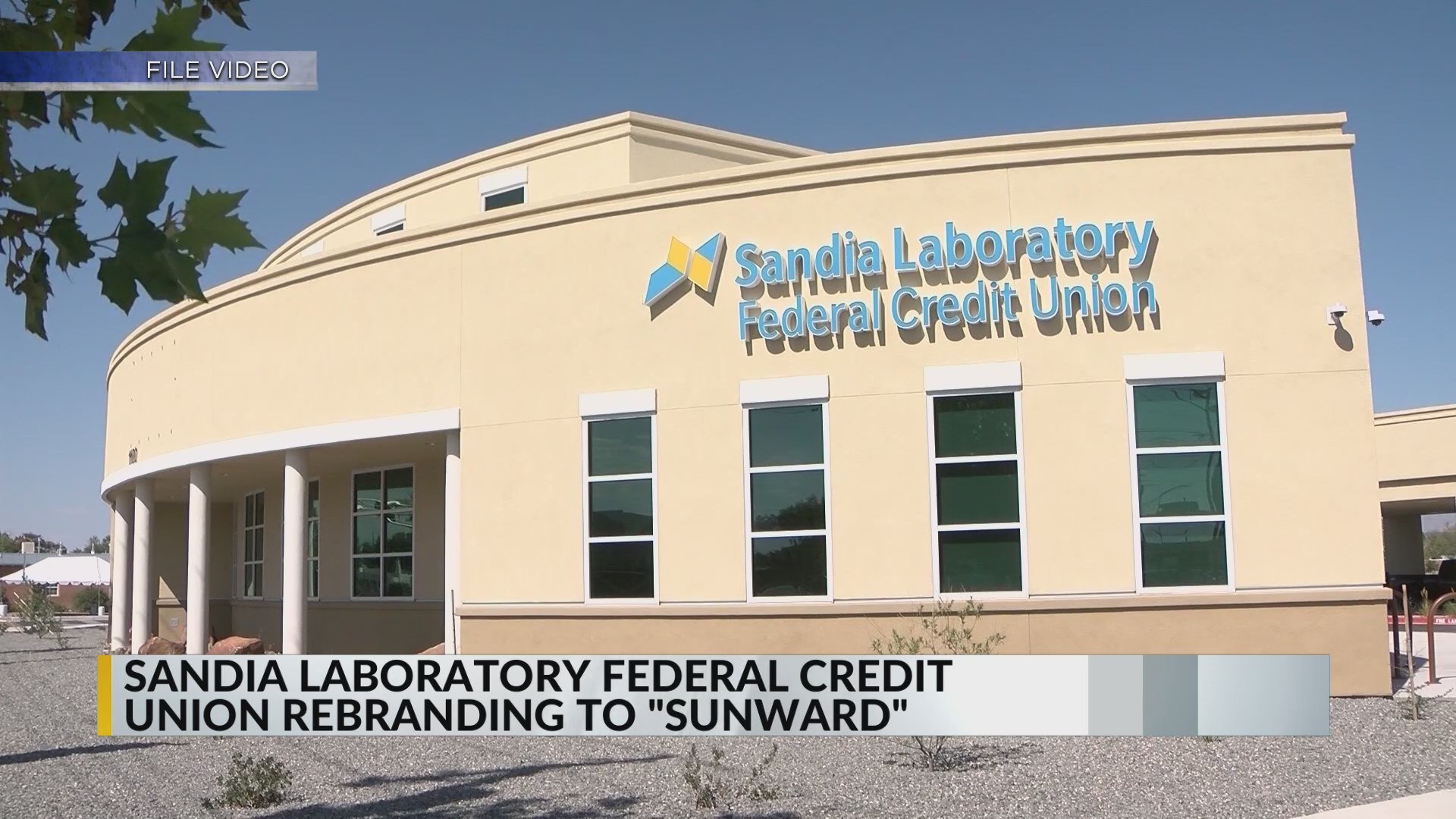

Sandia Laboratory Federal Credit Union Albuquerque Nm

Imagine a crisp Albuquerque morning, the Sandia Mountains painted rose-gold by the rising sun. Cars hum along Eubank Boulevard, and amidst the bustling city life, a familiar sign stands proud: Sandia Laboratory Federal Credit Union, or SLFCU, as many locals affectionately call it. It's more than just a financial institution; it's a cornerstone of the community, a trusted partner for generations of New Mexicans.

Sandia Laboratory Federal Credit Union (SLFCU) has grown from humble beginnings to become a significant financial institution in New Mexico. This article delves into the history, mission, and impact of SLFCU, exploring its role in the financial well-being of its members and the broader community.

A Foundation Built on Service

SLFCU's story began in 1948, born out of the needs of employees at Sandia National Laboratories. It was a time of innovation and scientific advancement, and these employees needed a financial institution that understood their unique needs. The initial focus was simple: provide affordable financial services to the workforce at Sandia Labs.

The credit union was built on the cooperative principles of "people helping people". This philosophy remains at the heart of SLFCU's operations today. Early services were basic, but they were crucial for the economic stability of the lab's employees and their families.

Over the decades, SLFCU expanded its membership beyond Sandia Labs employees to include those working for other affiliated organizations, and eventually, residents of New Mexico. This growth reflected the credit union's commitment to serving a wider community.

Growth and Expansion

From a small operation within the lab, SLFCU has blossomed into a full-service financial institution with multiple branches across New Mexico. This expansion has allowed SLFCU to reach more members and offer a wider range of financial products and services.

Their services include traditional banking options like checking and savings accounts, loans (auto, mortgage, personal), credit cards, and investment services. SLFCU also offers online and mobile banking platforms, making it easier for members to manage their finances from anywhere.

The growth of SLFCU mirrors the economic growth of Albuquerque and the surrounding areas. As the region prospered, so did the credit union, adapting to the changing needs of its members.

A Focus on Members

One of the key differentiators of credit unions is their member-owned structure. Unlike banks, which are owned by shareholders, credit unions are owned by their members. This means that profits are returned to members in the form of lower fees, better interest rates, and improved services.

SLFCU prides itself on its commitment to member service. Employees are trained to provide personalized attention and find solutions tailored to individual needs. This commitment is reflected in high levels of member satisfaction.

SLFCU actively seeks feedback from its members to improve its services. This focus on member input helps the credit union stay relevant and responsive to the evolving needs of the community.

Community Involvement

SLFCU's commitment extends beyond financial services to encompass community involvement. They actively support local organizations and initiatives that improve the quality of life in New Mexico.

SLFCU supports educational programs. They also actively provide financial literacy resources to schools and community groups. By empowering individuals with financial knowledge, SLFCU helps them make informed decisions and build a secure future.

SLFCU also participates in charitable giving and volunteer activities. Employees are encouraged to give back to the community, fostering a culture of social responsibility within the organization.

Challenges and Opportunities

Like all financial institutions, SLFCU faces challenges in a rapidly changing landscape. Technological advancements, increasing regulatory requirements, and economic fluctuations all present ongoing challenges. They must navigate an increasingly complex and competitive marketplace.

However, these challenges also present opportunities for innovation and growth. SLFCU is investing in new technologies to enhance the member experience and streamline operations. This includes improving online and mobile banking platforms, implementing advanced security measures, and exploring new ways to engage with members.

Furthermore, SLFCU is focused on expanding its reach and serving new markets. This includes reaching out to underserved communities and offering specialized financial products and services to meet their unique needs. According to their website, they offer free financial planning services.

The Future of SLFCU

The future of SLFCU looks bright, building upon a strong foundation of member service and community involvement. As it navigates the challenges of a rapidly changing financial landscape, SLFCU is poised to continue growing and serving the needs of its members for generations to come.

SLFCU's commitment to its core values will be crucial to its continued success. By staying true to its mission of "people helping people," the credit union can maintain its competitive edge and strengthen its relationships with its members.

As Albuquerque continues to grow and evolve, SLFCU will undoubtedly play a vital role in the financial well-being of the community. It's a testament to the power of cooperative banking and the enduring spirit of New Mexico.

Financial Strength

SLFCU has consistently demonstrated financial strength and stability. This has been crucial for maintaining member confidence, especially during times of economic uncertainty.

They have strong capital reserves. This provides a cushion against potential losses and allows SLFCU to continue lending even during economic downturns.

SLFCU also maintains a diversified loan portfolio, reducing its exposure to risk and ensuring long-term financial stability.

Technology and Innovation

Recognizing the importance of technology, SLFCU continues to invest in innovative solutions to enhance member experiences. This includes mobile banking, online access, and other digital tools. It makes managing finances more convenient.

They have implemented advanced security measures to protect member data and prevent fraud. This demonstrates their commitment to protecting their members' financial well-being.

SLFCU is also exploring the use of emerging technologies like artificial intelligence and blockchain to further improve its services and operations.

Member Education

SLFCU is committed to empowering its members with financial knowledge and skills. This includes offering workshops, seminars, and online resources on a variety of financial topics.

They provide resources on budgeting, saving, investing, and debt management. It helps members make informed financial decisions and achieve their financial goals.

SLFCU also partners with local organizations to offer financial literacy programs to underserved communities.

Looking Ahead

As the sun sets over the Sandia Mountains, casting long shadows across Albuquerque, SLFCU stands as a symbol of stability and community support. It is a reminder that financial institutions can be more than just places to deposit money; they can be partners in building a stronger, more prosperous community.

The story of SLFCU is a testament to the power of cooperative banking and the enduring values of service, integrity, and community. It is a story that continues to unfold, with each new member and each new initiative, adding another chapter to the rich history of this New Mexico institution.

Perhaps the truest measure of SLFCU's success isn't just in its assets or branch locations, but in the countless stories of individuals and families whose lives have been positively impacted by their partnership with this credit union.