Section 12 G Of The Securities Exchange Act Of 1934

The realm of securities regulation is a complex tapestry woven with threads of investor protection, market integrity, and corporate transparency. Within this intricate framework, Section 12(g) of the Securities Exchange Act of 1934 stands as a critical, yet often overlooked, provision. This seemingly simple clause dictates the registration requirements for companies reaching a certain size and shareholder base, triggering a cascade of compliance obligations and shaping the informational landscape available to investors.

Section 12(g) acts as a gateway, determining when a private company must step into the public arena and adhere to the stringent reporting standards mandated by the Securities and Exchange Commission (SEC). Understanding its intricacies is crucial for businesses navigating growth, investors seeking informed decisions, and regulators striving to maintain fair and efficient markets. This article delves into the depths of Section 12(g), exploring its implications, complexities, and the ongoing debates surrounding its application in the modern financial landscape.

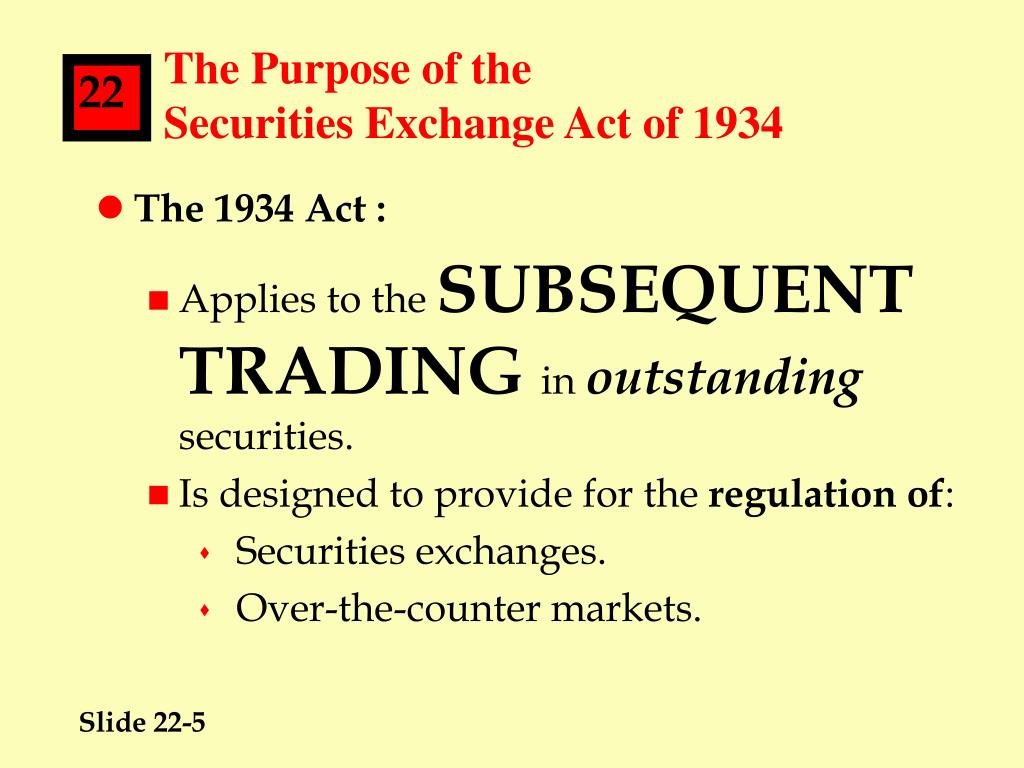

The Core of Section 12(g): Triggering Registration

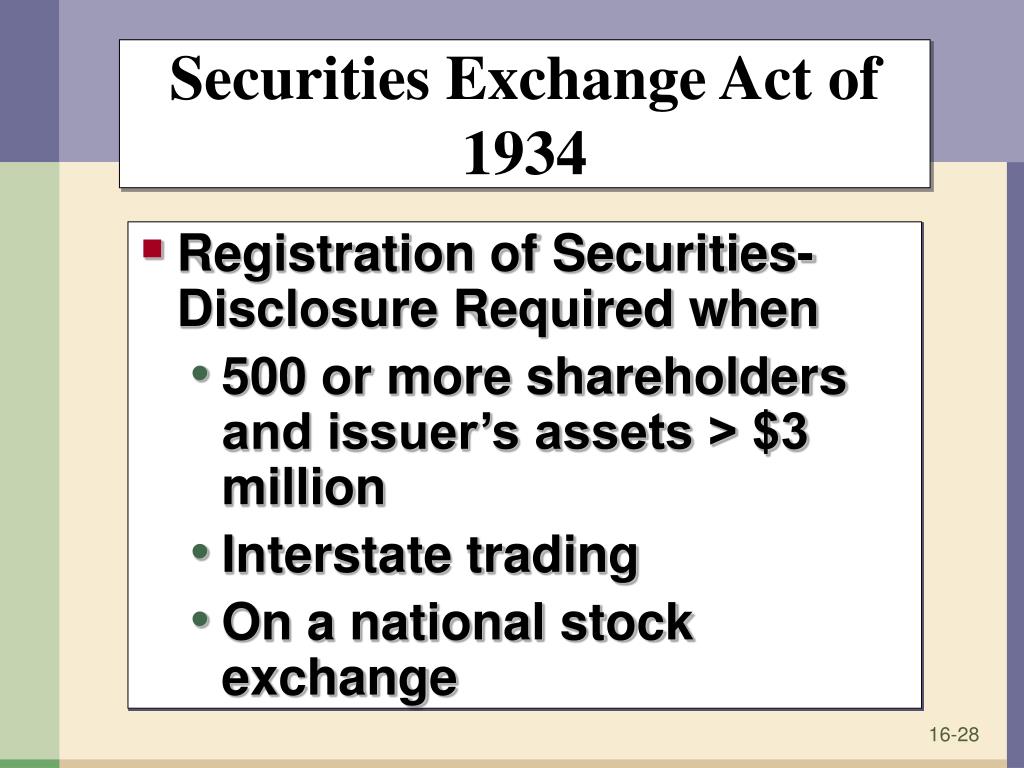

At its heart, Section 12(g) mandates that companies with total assets exceeding $10 million and a class of equity securities held by 2,000 or more persons (or 500 or more persons who are not accredited investors) must register those securities with the SEC.

This registration necessitates the filing of comprehensive information about the company's business, financial condition, management, and ownership structure. Once registered, these companies become subject to the periodic reporting requirements of the Exchange Act, including the filing of annual reports (Form 10-K), quarterly reports (Form 10-Q), and current reports (Form 8-K) to disclose material events.

The underlying rationale is to provide investors with the information necessary to make informed investment decisions, prevent fraud, and ensure a level playing field in the market. By requiring larger, more widely held companies to disclose their financial health and operational details, Section 12(g) aims to promote transparency and investor confidence.

The Impact on Companies and Investors

For companies approaching the thresholds of Section 12(g), the decision to register or remain private is a strategic one with far-reaching consequences. Registration brings significant costs and burdens, including legal and accounting fees, increased administrative overhead, and the constant scrutiny of public markets.

However, it also opens doors to new opportunities, such as easier access to capital through public offerings and increased liquidity for shareholders. Furthermore, becoming a public company can enhance a company's reputation and attract a broader range of investors.

From an investor's perspective, Section 12(g) registration provides a wealth of information that would otherwise be unavailable. Access to audited financial statements, detailed management discussions, and disclosures of material events allows investors to assess the risks and rewards of investing in a company with greater accuracy.

Navigating the Complexities and Exemptions

While the basic premise of Section 12(g) is straightforward, its application can be complex, particularly in certain situations. There are several exemptions and nuances that companies must consider when determining whether they are subject to the registration requirements.

For example, Section 12(g) contains an exemption for foreign private issuers that meet certain conditions, such as having a limited number of U.S. shareholders and a primary trading market outside the United States. Similarly, certain types of securities, such as those issued in private placements under Regulation D, may be exempt from registration.

Determining the number of shareholders can also be challenging, particularly in cases where securities are held in street name through brokers or custodians. Companies must carefully analyze their shareholder records to accurately assess whether they have reached the registration threshold.

"The interpretation of Section 12(g) has evolved over time through SEC rulemaking and enforcement actions," explains Professor Emily Carter, a securities law expert at the University of Columbia. "Companies must stay abreast of these developments to ensure compliance and avoid potential penalties."

The JOBS Act and the Push for Modernization

The Jumpstart Our Business Startups (JOBS) Act of 2012 brought about significant changes to Section 12(g), reflecting a broader effort to ease regulatory burdens on smaller companies and encourage capital formation. One of the key provisions of the JOBS Act increased the shareholder threshold for registration under Section 12(g) from 500 to 2,000 (or 500 who are not accredited investors), providing more companies with the opportunity to remain private for longer periods.

The rationale behind this change was that the original thresholds were outdated and placed an undue burden on growing companies, hindering their ability to raise capital and create jobs. By raising the thresholds, the JOBS Act aimed to strike a better balance between investor protection and capital formation.

However, some critics argued that the JOBS Act went too far in loosening regulations, potentially exposing investors to greater risks. They contended that increasing the shareholder threshold could delay the onset of transparency and allow companies to operate in the shadows for longer, increasing the potential for fraud and abuse.

The Ongoing Debate and Future Outlook

The debate surrounding Section 12(g) continues to this day, with ongoing discussions about whether the current thresholds are appropriate and whether further reforms are needed. Some argue that the thresholds should be further increased to reflect the changing landscape of the capital markets, while others maintain that the existing levels provide adequate protection for investors.

The SEC is constantly monitoring the impact of Section 12(g) and considering potential adjustments to its rules and regulations. In recent years, the SEC has focused on clarifying the application of Section 12(g) to emerging technologies, such as digital assets and blockchain-based securities.

Looking ahead, Section 12(g) is likely to remain a critical component of the securities regulatory framework. As companies continue to grow and the capital markets evolve, the SEC will need to adapt its approach to ensure that the registration requirements remain relevant and effective.

"Section 12(g) is not a static provision," notes David Miller, a partner at Law Firm Jones & Smith specializing in securities compliance. "Its interpretation and application will continue to evolve in response to changes in the business environment and the needs of investors."

Ultimately, the goal of Section 12(g) is to strike a balance between promoting capital formation and protecting investors. Finding the right equilibrium requires ongoing dialogue and careful consideration of the costs and benefits of registration. As the financial landscape continues to shift, the SEC must remain vigilant in its oversight of Section 12(g) to ensure that it continues to serve its intended purpose.