Should I Buy The Rental House Next Door

Imagine waking up to the gentle hum of lawnmowers next door, not bothered by the noise but instead filled with a surge of possibility. The rental house next to yours, the one you’ve watched families come and go from, the one you’ve quietly assessed for its potential, is now up for sale. A whirlwind of thoughts begins: could this be the ultimate real estate move, a chance to expand your property holdings and shape your neighborhood? Or is it a path fraught with unforeseen challenges and potential headaches?

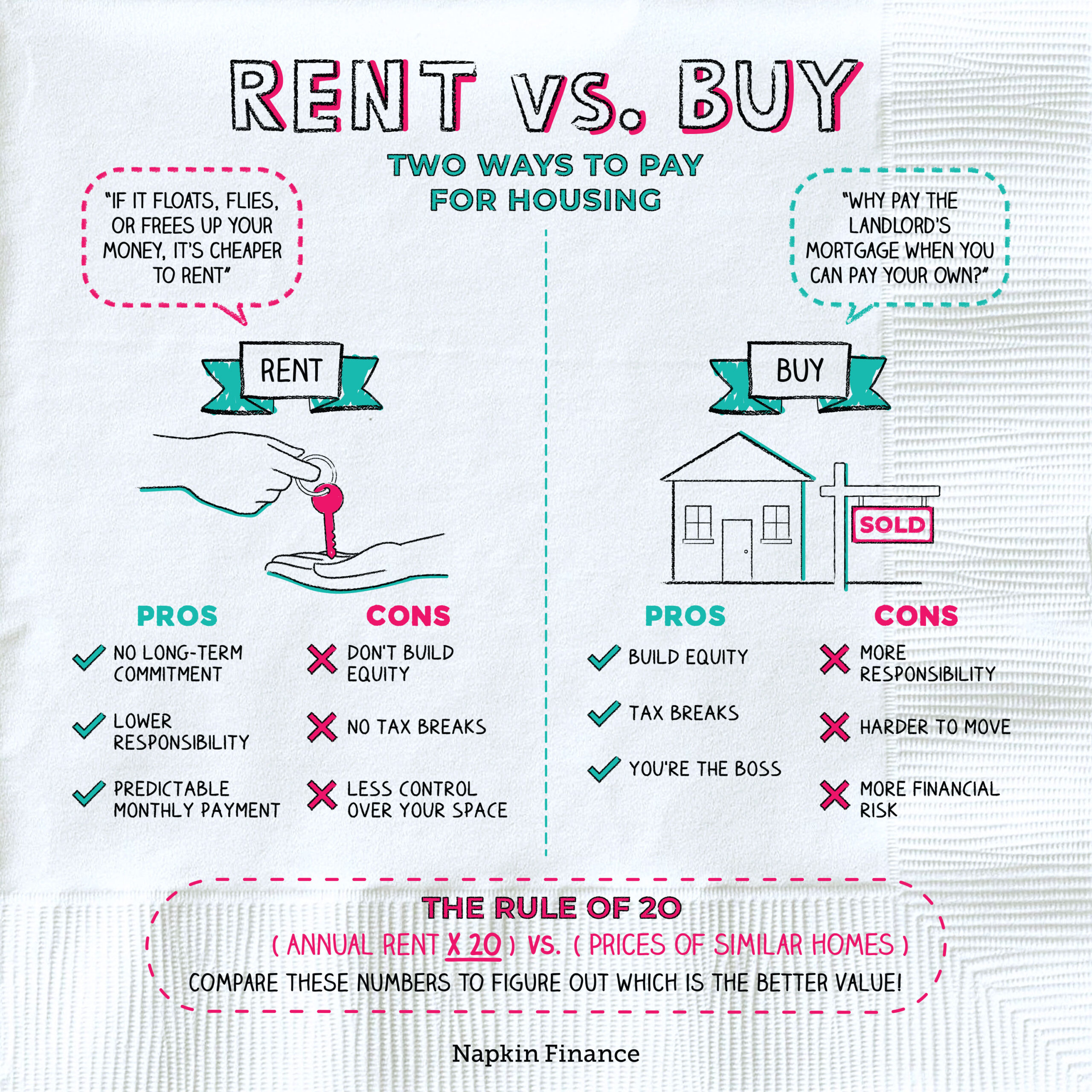

The decision of whether to buy the rental house next door is a complex one, weighing potential financial gains against practical and personal considerations. It’s a move that can offer unique advantages like increased control over your immediate environment and potential rental income, but also comes with its own set of risks, including tenant management and unexpected repair costs.

The Allure of the Neighboring Property

For homeowners, the appeal of buying the adjacent rental property is often multifaceted. Beyond the straightforward investment potential, there’s a sense of control and security that comes with owning the land right next to yours. Knowing your neighbors, or at least having a say in who they are, can significantly impact your quality of life.

Think about it: no more late-night parties disrupting your sleep, no more questionable landscaping choices impacting your property value. Owning the rental gives you leverage, the ability to screen tenants, and maintain standards that align with your own.

From a purely financial perspective, the potential for increased property value cannot be ignored. As Zillow notes, strategic property investments in desirable areas can lead to substantial returns over time. Owning two adjacent properties allows you to create a larger, more valuable land parcel should you choose to redevelop or sell in the future.

Navigating the Challenges

However, purchasing a rental property, especially one so close to home, is not without its potential downsides. Landlording, as many seasoned investors will tell you, is a job in itself. It requires a significant time commitment, from advertising the property and screening tenants to handling maintenance requests and dealing with the occasional difficult situation.

According to the National Association of Realtors (NAR), unexpected repairs are a leading cause of stress for landlords. Plumbing emergencies, roof leaks, or appliance malfunctions can eat into your profit margins and require immediate attention.

Then there's the personal aspect to consider. Living next door to your tenants can blur the lines between landlord and neighbor, potentially leading to awkward interactions and a lack of privacy. It requires a specific personality type, one comfortable with managing boundaries and maintaining a professional distance.

Due Diligence: Know Before You Buy

Before making any decisions, thorough due diligence is crucial. Start with a comprehensive inspection of the property, identifying any potential issues that could require costly repairs down the line. Obtain a professional appraisal to ensure you're paying a fair price.

Research the local rental market, examining vacancy rates and average rental incomes for similar properties in your area. Consult with a real estate attorney to understand your rights and responsibilities as a landlord.

Crucially, run the numbers. Calculate your potential rental income, factoring in expenses like property taxes, insurance, maintenance, and property management fees. Determine if the investment aligns with your financial goals and risk tolerance.

The Verdict: A Personal Choice

Ultimately, the decision of whether to buy the rental house next door is a highly personal one, dependent on your individual circumstances, financial situation, and risk appetite. There’s no one-size-fits-all answer. For some, it's a strategic investment that strengthens their financial future and enhances their neighborhood.

For others, the challenges of landlording outweigh the potential benefits, making it a move best left untouched. If you value privacy and aren’t prepared to be on-call for your tenants, this option might not be the best fit.

As you stand on your porch, contemplating the house next door, remember to weigh the pros and cons carefully, seek expert advice, and trust your instincts. The right decision is the one that aligns with your personal and financial well-being, creating a sense of peace and prosperity, right in your own backyard.