Simple Accounting For Small Business

For many small business owners, the world of accounting can feel like navigating a complex maze. Juggling daily operations, marketing efforts, and customer service often leaves little time or resources for mastering intricate accounting principles. Fortunately, keeping track of finances doesn't have to be a daunting task.

Simplified accounting methods are gaining traction, offering a lifeline to entrepreneurs seeking clarity and control over their financial health. These approaches emphasize practicality and ease of use, empowering business owners to manage their books effectively without requiring extensive accounting expertise.

The Rise of Simplified Accounting

The core concept of simple accounting revolves around streamlining processes and focusing on essential financial information. This shift is driven by a growing awareness that complex accounting systems can be overwhelming and ultimately counterproductive for small businesses. Simpler methods are designed to be accessible and actionable, allowing owners to readily understand their financial performance.

Who is benefiting from this trend? Small business owners across diverse industries, from freelancers and startups to established family-run businesses, are embracing simplified accounting solutions. They are finding that these methods free up valuable time and reduce stress, enabling them to concentrate on their core business activities.

Key Features of Simple Accounting

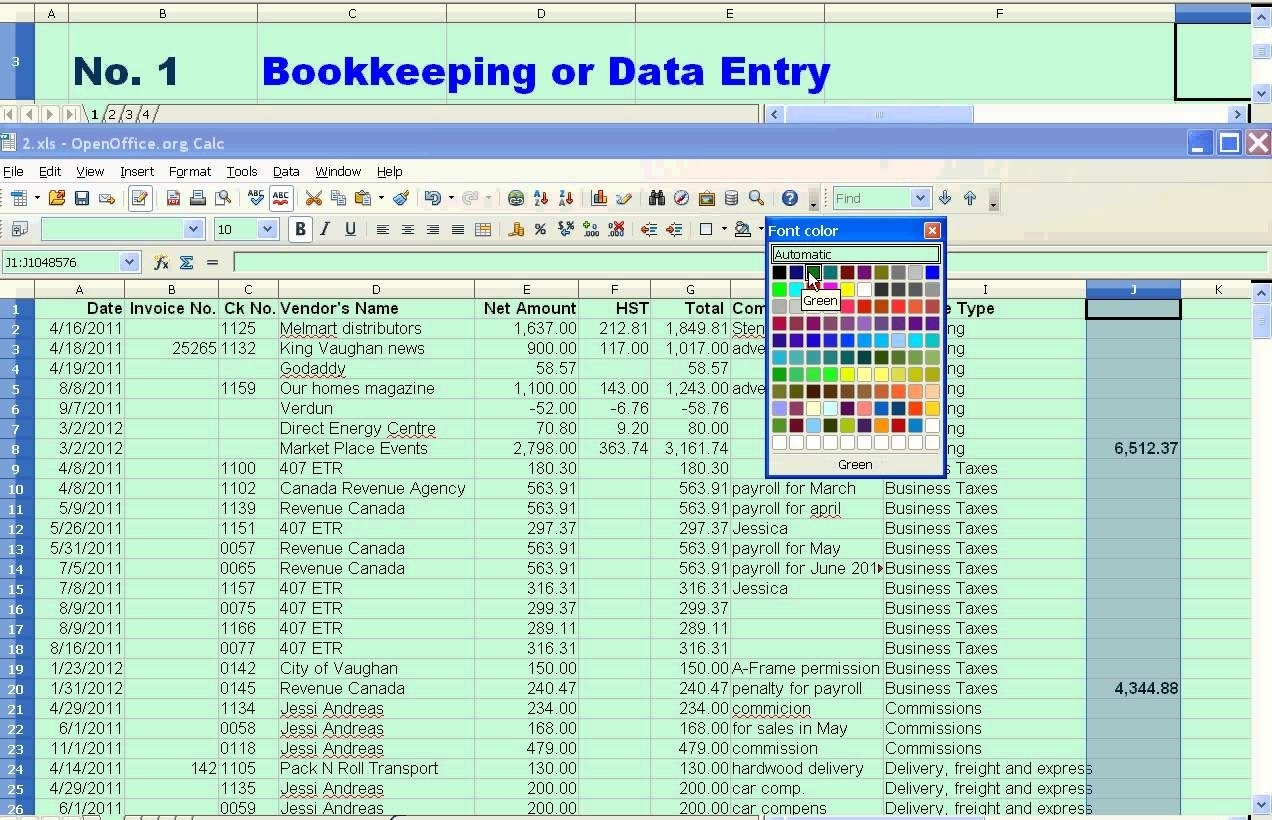

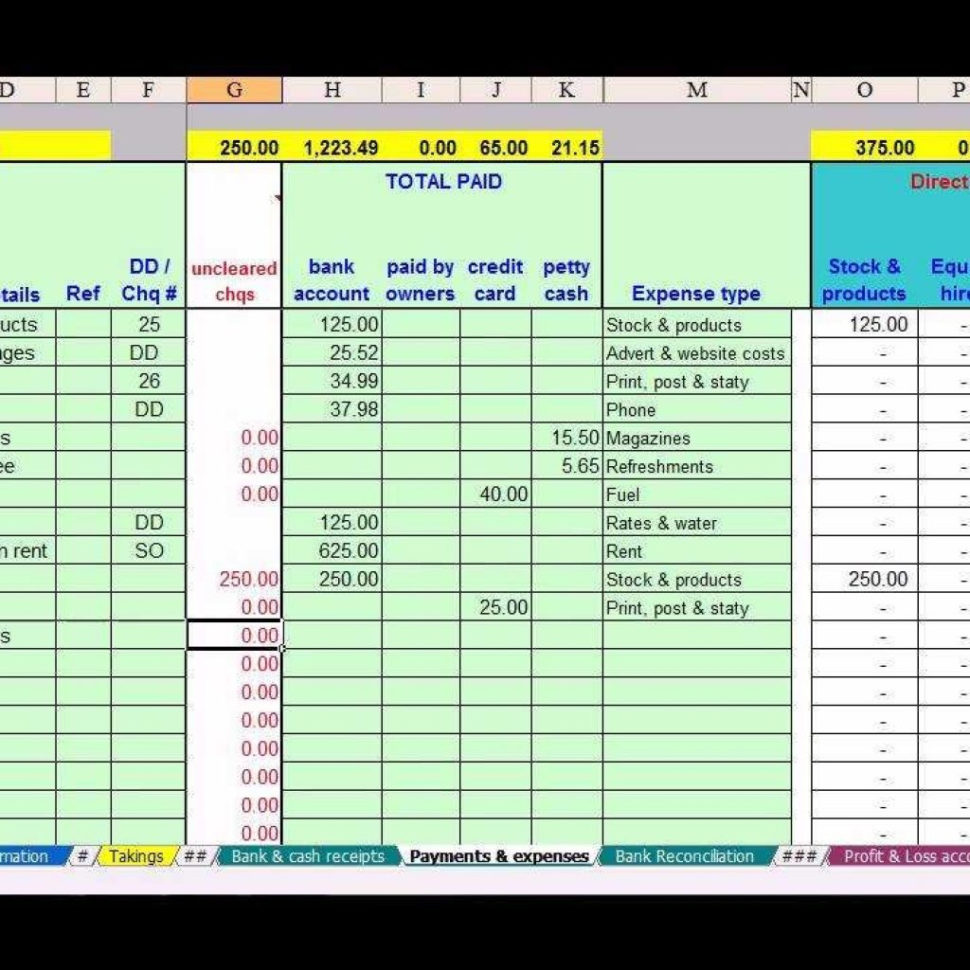

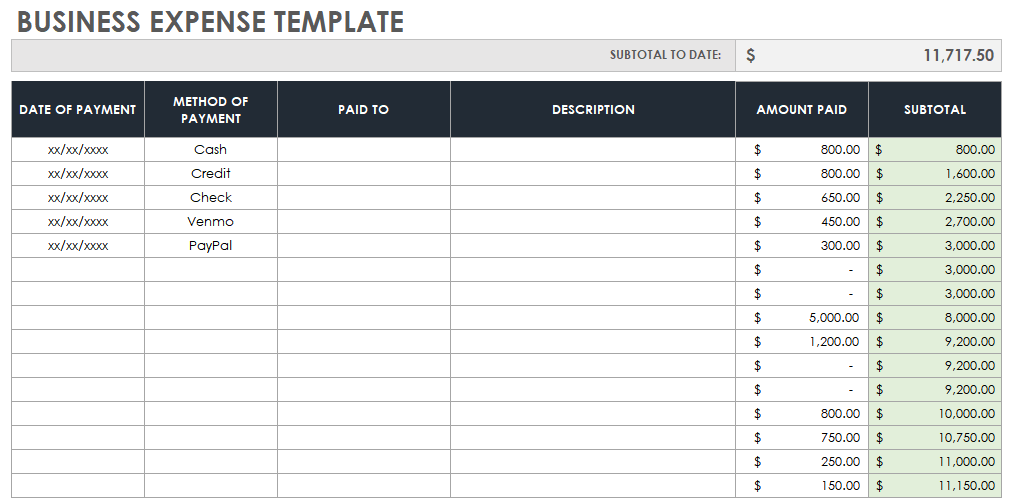

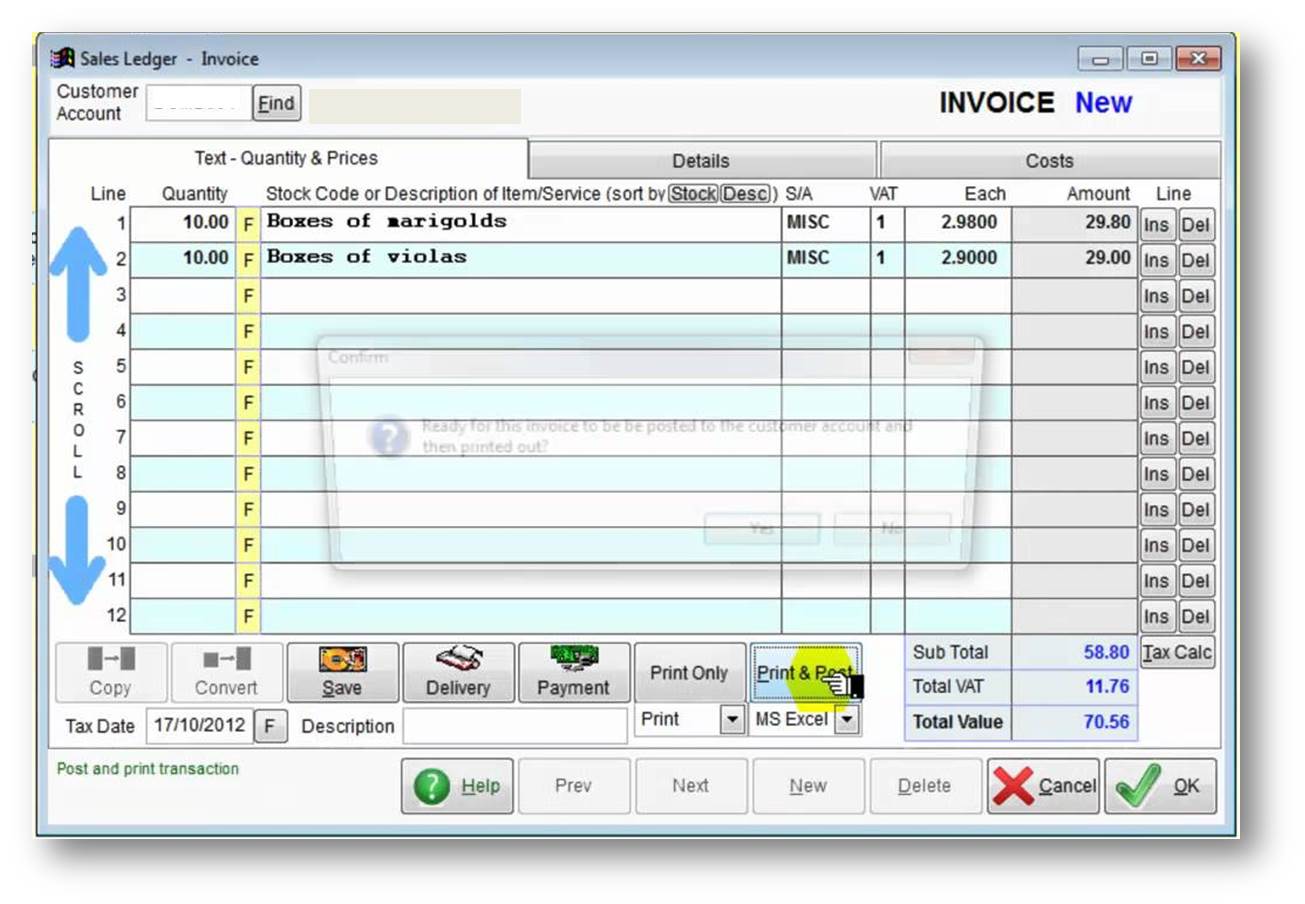

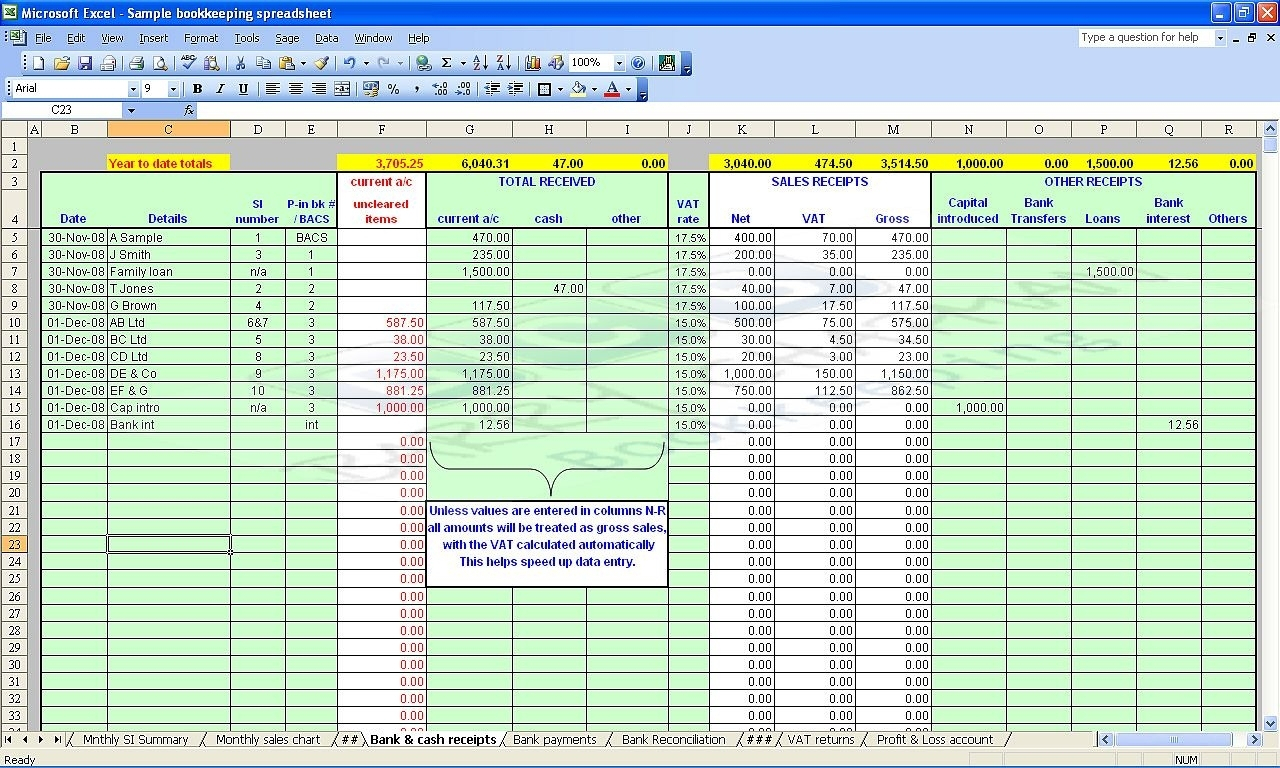

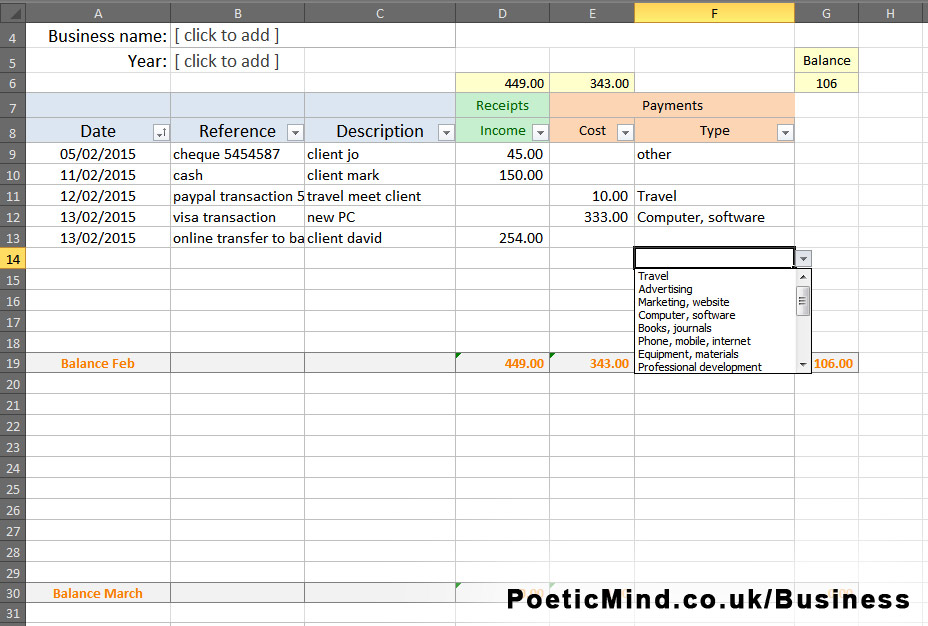

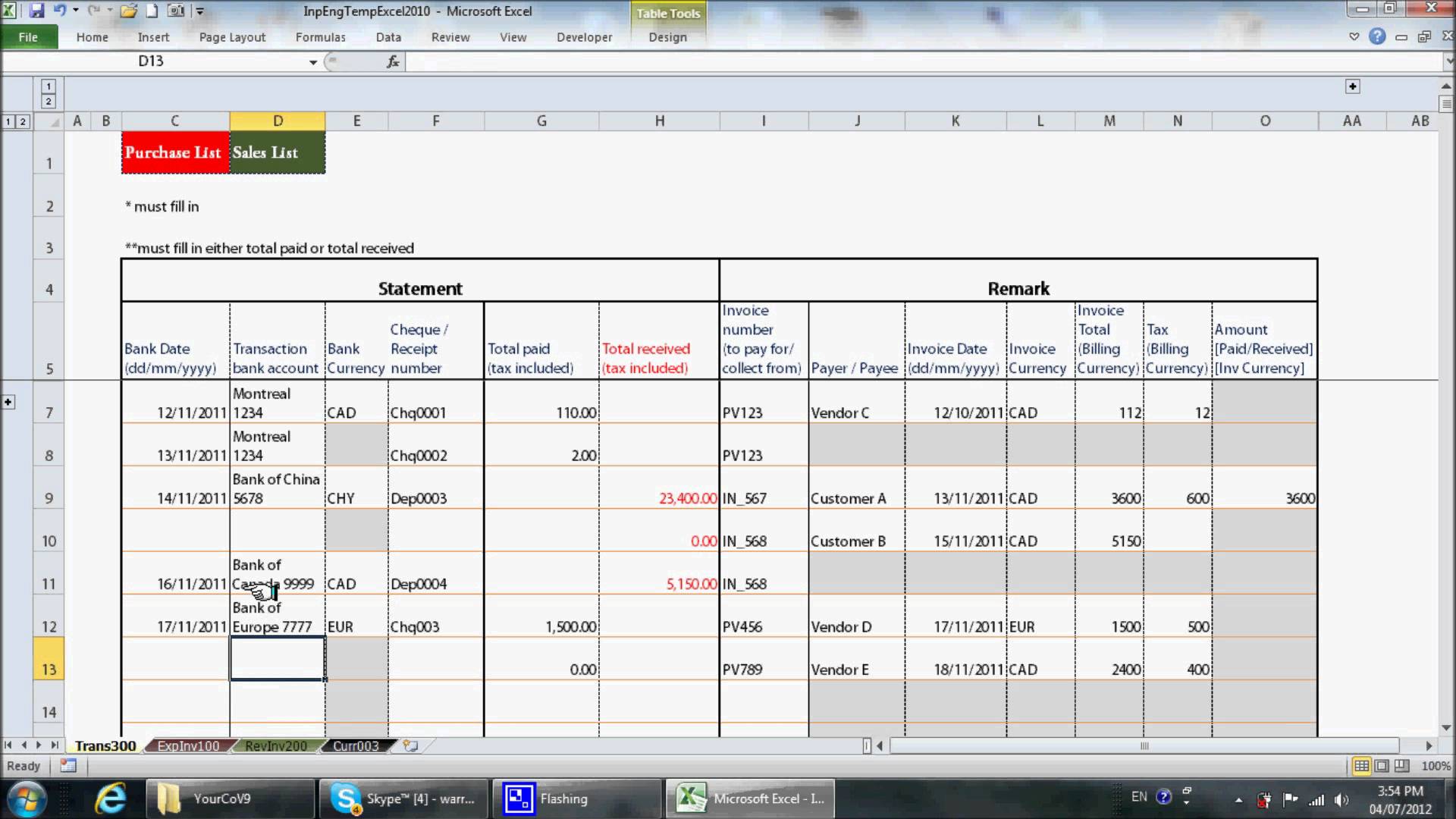

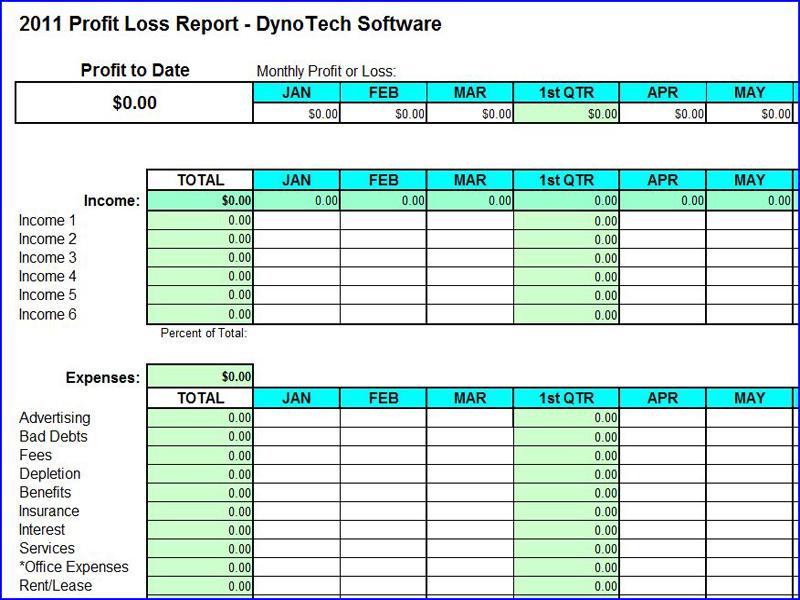

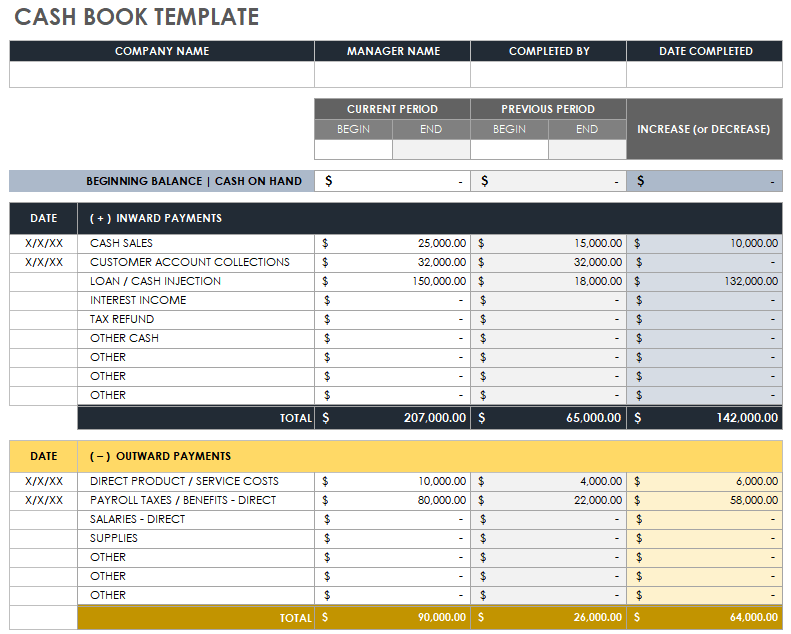

Several key features define simplified accounting approaches. One common element is the use of cloud-based accounting software designed for non-accountants. These platforms typically offer intuitive interfaces and automated processes, making it easier to track income, expenses, and cash flow.

Another important aspect is focusing on the cash basis of accounting. Unlike the accrual basis, which recognizes revenue and expenses when they are earned or incurred, the cash basis records transactions only when cash changes hands. This simplified approach provides a more immediate and straightforward view of a business's financial position.

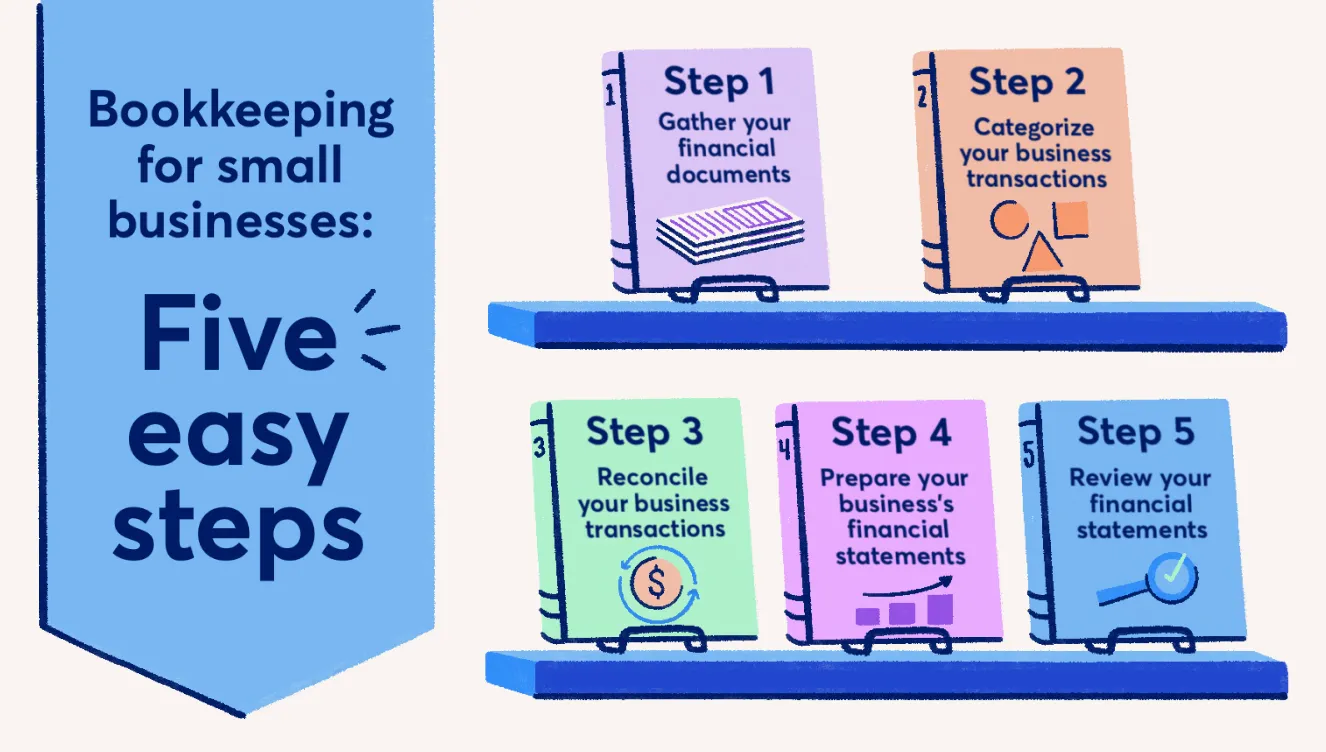

Furthermore, simple accounting emphasizes maintaining accurate and organized records. This can involve using spreadsheets, mobile apps, or simple notebooks to document all financial transactions. Regularly reconciling bank statements is also crucial for ensuring that records are complete and accurate.

What does this mean for business owners? It translates to a greater understanding of their financial performance, improved cash flow management, and better informed decision-making.

Potential Benefits and Drawbacks

The benefits of simplified accounting are numerous. Perhaps the most significant is the time saved. By automating processes and focusing on essential tasks, business owners can reclaim valuable hours that can be devoted to growing their businesses.

Simplified accounting can also lead to improved accuracy. With less complexity, there is less room for error. Furthermore, cloud-based accounting software often provides real-time financial data, allowing owners to quickly identify and address any issues.

However, it's important to acknowledge the potential drawbacks. The cash basis of accounting may not provide a complete picture of a business's financial health, particularly for companies with significant accounts receivable or payable. Where a more comprehensive view is needed, such as for securing financing or attracting investors, more sophisticated accounting methods may be required.

Additionally, while simplified accounting can empower business owners, it's still essential to seek professional advice when needed. A qualified accountant can provide guidance on complex financial matters, such as tax planning and compliance.

Impact and Future Trends

The adoption of simple accounting methods is expected to continue growing, driven by technological advancements and the increasing demand for user-friendly financial tools. New software solutions and mobile apps are constantly being developed to further simplify accounting processes for small businesses. Why is this happening? Because the need is there.

The long-term impact of this trend could be significant. By making accounting more accessible, simplified methods can empower small business owners to make more informed decisions, improve their financial performance, and ultimately contribute to a stronger economy. The U.S. Small Business Administration (SBA) offers resources and training on financial management for small businesses, acknowledging the importance of accessible accounting practices.

Ultimately, simplified accounting represents a positive step towards empowering small business owners to take control of their financial destiny. How? By making accounting less intimidating and more practical, these methods can help entrepreneurs build stronger, more sustainable businesses.

"Small businesses are the backbone of our economy, and by providing them with the tools and resources they need to succeed, we can create a more prosperous future for all." - Statement from a leading accounting software provider.

![Simple Accounting For Small Business Small Business Accounting Guide [Step-by-Step]](https://www.deskera.com/blog/content/images/2020/10/retained-earnings.png)