Simple Accounting Software For Small Business

In the bustling world of small business, where margins are tight and time is a precious commodity, the burden of managing finances can be overwhelming. Many entrepreneurs find themselves drowning in spreadsheets, struggling to reconcile accounts, and losing sleep over tax compliance.

But there's good news: a new generation of simple accounting software is emerging, offering a lifeline to small business owners seeking to streamline their financial operations and regain control of their bottom line.

This article explores the rise of user-friendly accounting software designed specifically for small businesses. We'll delve into the key features, benefits, and considerations for choosing the right solution. We will also examine expert opinions and industry trends that are shaping the landscape of small business finance.

The Rise of User-Friendly Accounting

For years, accounting software was synonymous with complexity, often requiring extensive training or the expertise of a professional accountant. This created a significant barrier for small businesses with limited resources and financial expertise.

However, the advent of cloud computing and intuitive design principles has revolutionized the accounting software market. Now, software solutions are available that are surprisingly simple to use.

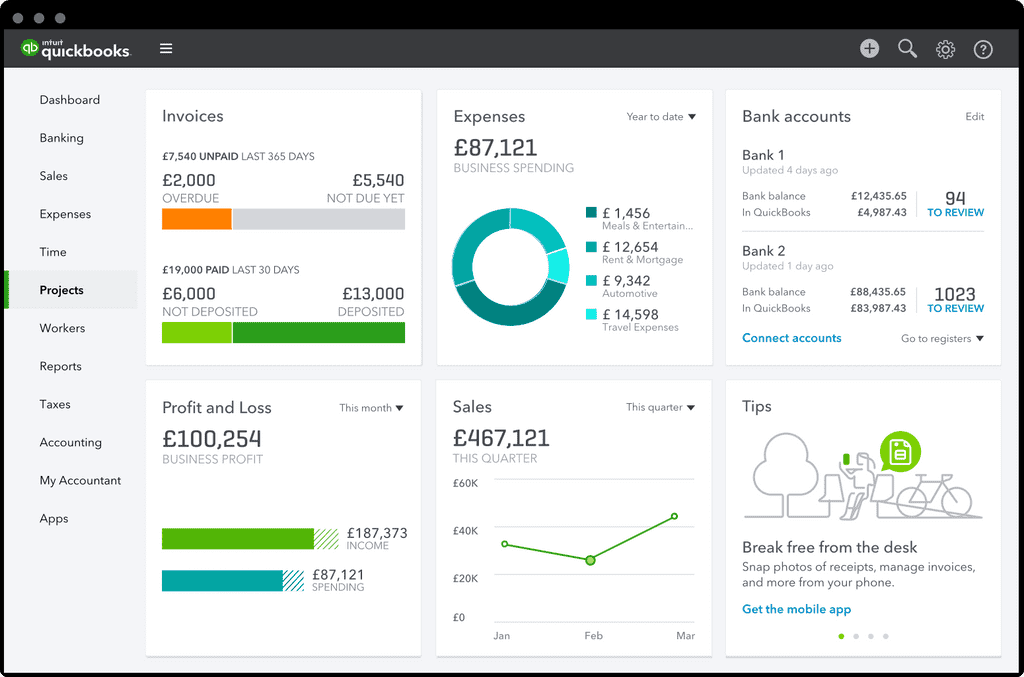

These platforms prioritize ease of navigation, automated processes, and clear, concise reporting, making them accessible to even the most novice users.

Key Features and Benefits

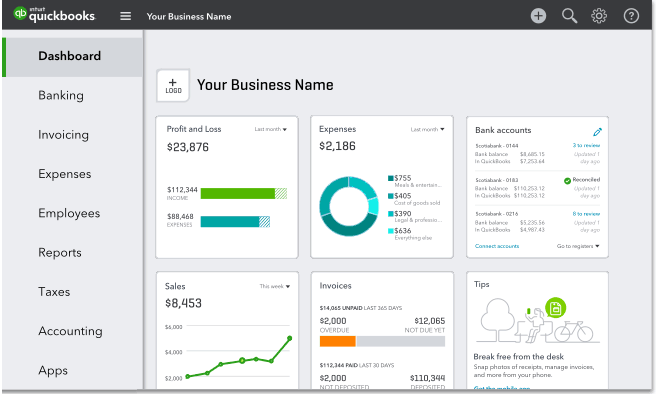

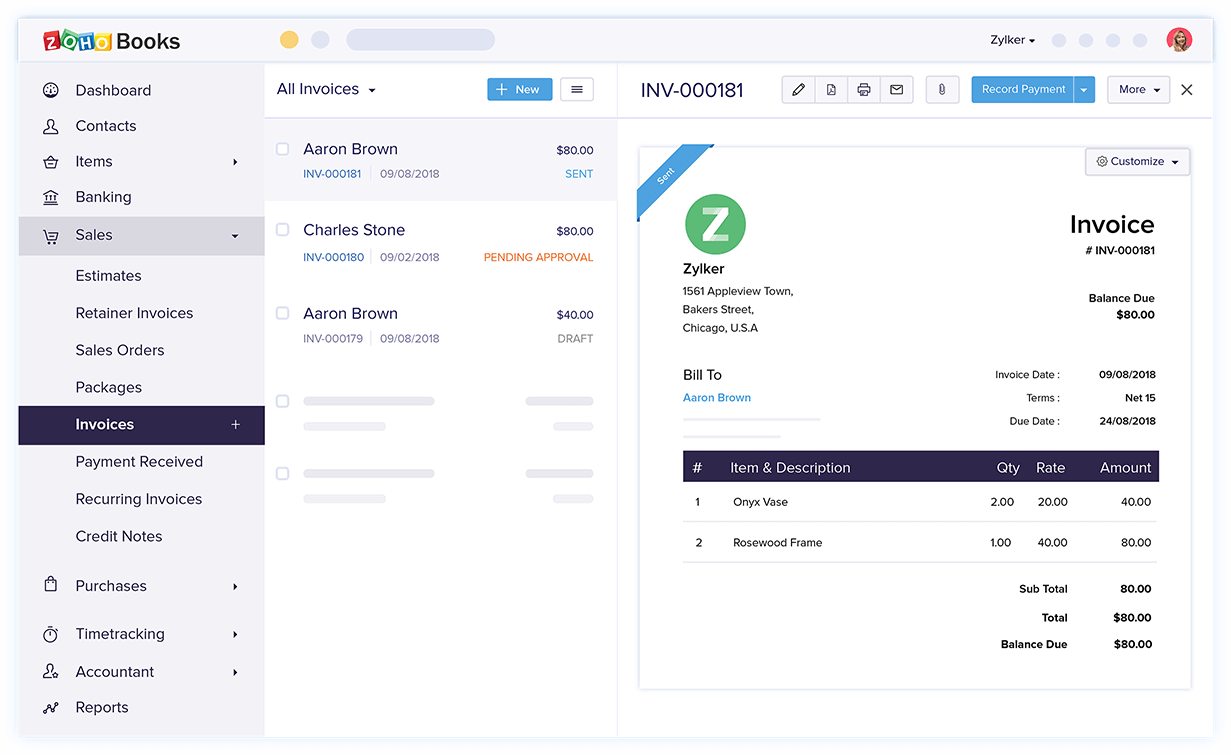

Simple accounting software offers a range of features tailored to the needs of small businesses. This includes invoicing, expense tracking, bank reconciliation, and basic financial reporting.

Many solutions offer automated features. These features can help to minimize manual data entry and reduce the risk of errors.

Cloud-based platforms provide accessibility from anywhere with an internet connection, promoting collaboration and flexibility.

According to a recent survey by Gartner, small businesses using cloud-based accounting software reported an average of 25% reduction in accounting-related administrative tasks. This is an important statistic.

This is because freeing up time and resources that can be reinvested into core business activities.

Moreover, these software solutions often come at a fraction of the cost of traditional accounting systems.

"The biggest benefit we've seen is the time savings," says Maria Rodriguez, owner of a local bakery. "I used to spend hours each week on bookkeeping, but now it takes me less than an hour."

Choosing the Right Solution

With a plethora of options available, selecting the right accounting software can be daunting. It's crucial to consider the specific needs and priorities of your business.

Consider factors such as the size of your business, the complexity of your financial transactions, and your technical expertise. Scalability is another key consideration, ensuring the software can grow with your business.

Many providers offer free trials or demo versions. These give you the opportunity to test the software before committing to a subscription.

Expert Perspectives

Industry experts emphasize the importance of integrating accounting software with other business systems, such as CRM or e-commerce platforms. According to David Miller, a CPA specializing in small business accounting: “Seamless integration streamlines data flow and reduces the potential for errors.”

He also suggests seeking advice from other business owners or consulting with an accountant to determine the best fit for your specific needs.

Data security is another critical consideration. Choose a reputable provider with robust security measures to protect your sensitive financial information.

Looking Ahead

The future of small business accounting is bright, with advancements in artificial intelligence and machine learning poised to further simplify and automate financial processes.

We can expect to see more intuitive interfaces, predictive analytics, and personalized insights that empower small business owners to make data-driven decisions.

As the digital landscape continues to evolve, embracing simple accounting software will be essential for small businesses to thrive and remain competitive. The investment will save time and money. This will also empower entrepreneurs to focus on what they do best: building and growing their businesses.