Simple Fast Loans Reviews Consumer Reports

Imagine a rainy Tuesday morning. The car stubbornly refuses to start, the rent is due next week, and an unexpected medical bill just landed on your doorstep. A wave of anxiety washes over you, and the thought, "Where will I find the money?" echoes in your mind. You're not alone; millions face similar financial hurdles every day, and in today's world of instant solutions, simple fast loans often appear as a beacon of hope.

This article delves into the world of simple fast loans, examining what Consumer Reports and other independent organizations have to say about these readily accessible financial products. We'll explore the pros, cons, and crucial considerations to help you make informed decisions should you ever find yourself considering this option. We'll cut through the marketing hype and provide a balanced perspective, empowering you to navigate the world of short-term lending with clarity and confidence.

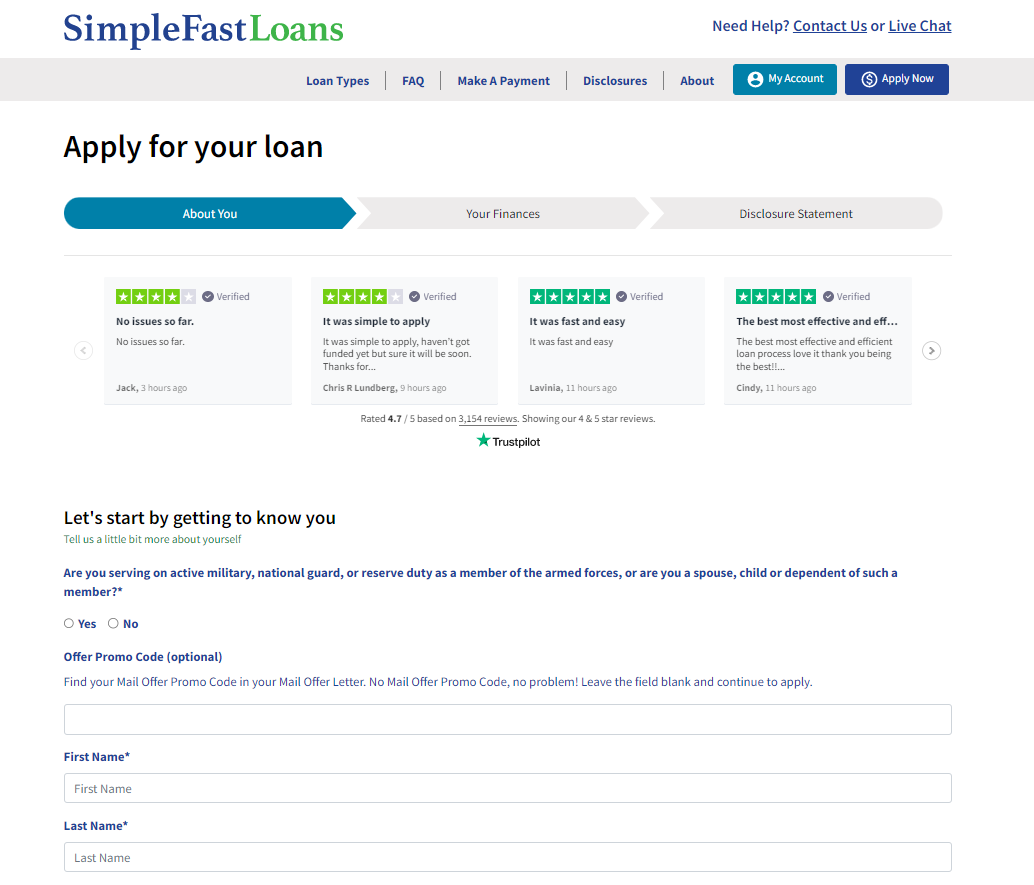

What are Simple Fast Loans?

Simple fast loans, often referred to as payday loans or cash advance loans, are short-term, unsecured loans designed to provide quick access to cash. They are typically for relatively small amounts, ranging from a few hundred to a thousand dollars, and are intended to be repaid within a short period, usually a few weeks or by your next payday.

The appeal of these loans lies in their accessibility and speed. Many lenders offer online applications and promise near-instant approval, making them attractive to individuals facing immediate financial needs.

The Allure of Speed and Convenience

In a world where time is money, the speed and convenience of simple fast loans are undeniable draws. Traditional loan applications often involve lengthy paperwork, credit checks, and waiting periods, which can be impractical when facing an urgent financial situation.

Simple fast loans, on the other hand, often require minimal documentation and boast quick turnaround times. Many lenders offer 24/7 online applications and deposit funds directly into your bank account, sometimes within hours of approval.

Consumer Reports Weighs In

Consumer Reports, a non-profit organization dedicated to providing unbiased product testing and consumer advocacy, has consistently raised concerns about the potential risks associated with simple fast loans. They emphasize the importance of understanding the terms and conditions before committing to a loan.

According to Consumer Reports, the high interest rates and fees associated with these loans can quickly trap borrowers in a cycle of debt. The organization urges consumers to explore alternative options before resorting to simple fast loans.

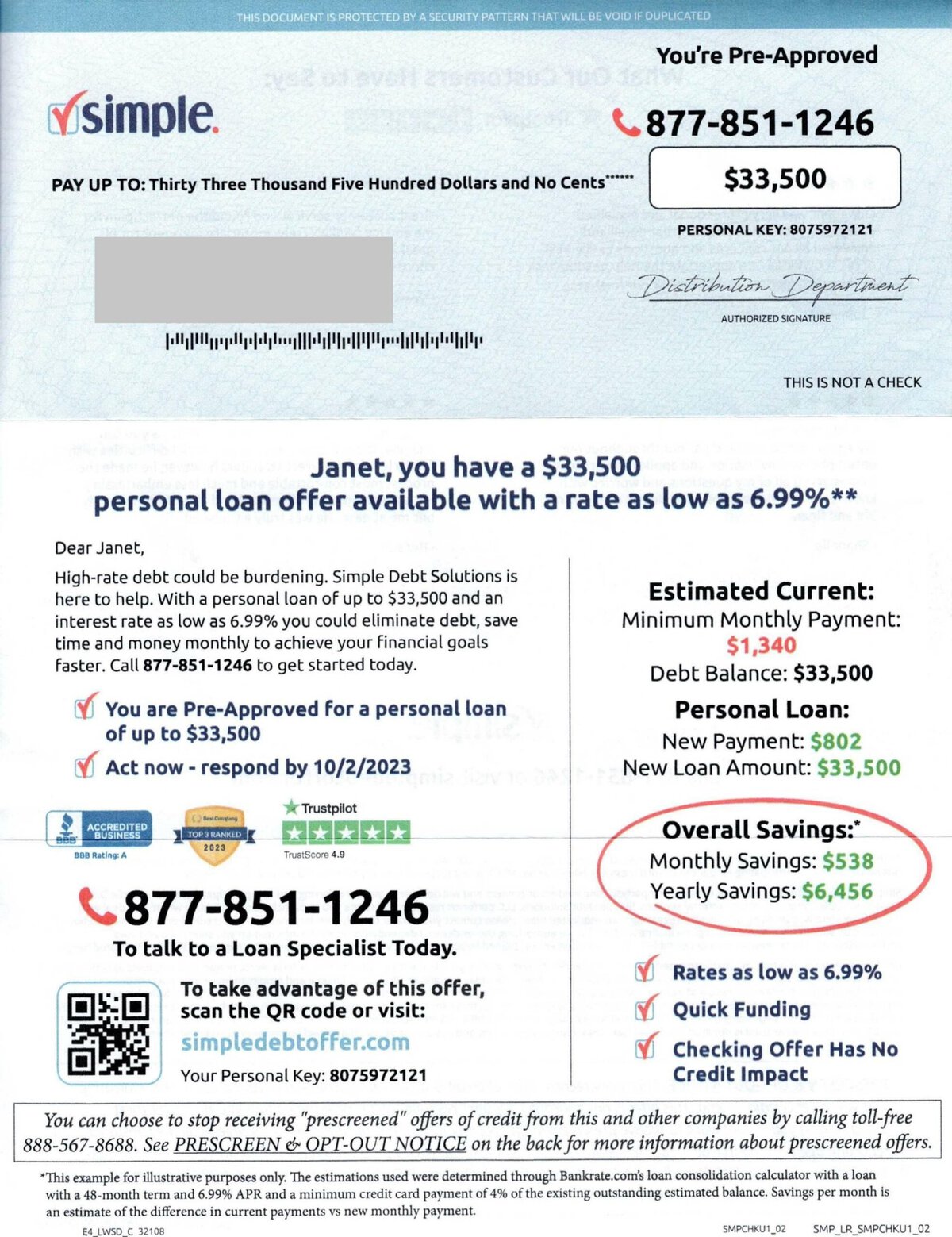

Understanding the Fine Print: Interest Rates and Fees

The cost of borrowing with simple fast loans can be significantly higher than traditional loan options. Annual Percentage Rates (APRs) can range from 300% to over 600%, far exceeding the rates charged by credit cards or personal loans.

In addition to high interest rates, lenders often charge various fees, such as origination fees, late payment fees, and rollover fees. These fees can quickly add up, making it difficult for borrowers to repay the loan on time.

The Debt Trap: A Cycle of Borrowing

One of the major concerns raised by Consumer Reports and other consumer advocacy groups is the risk of falling into a debt trap. Many borrowers find themselves unable to repay the loan on its original due date and are forced to "rollover" the loan, extending the repayment period and incurring additional fees.

This cycle of borrowing can lead to a situation where borrowers are paying more in fees and interest than the original loan amount. The Consumer Financial Protection Bureau (CFPB) has reported that a significant percentage of payday loans are re-borrowed multiple times, trapping borrowers in a cycle of debt.

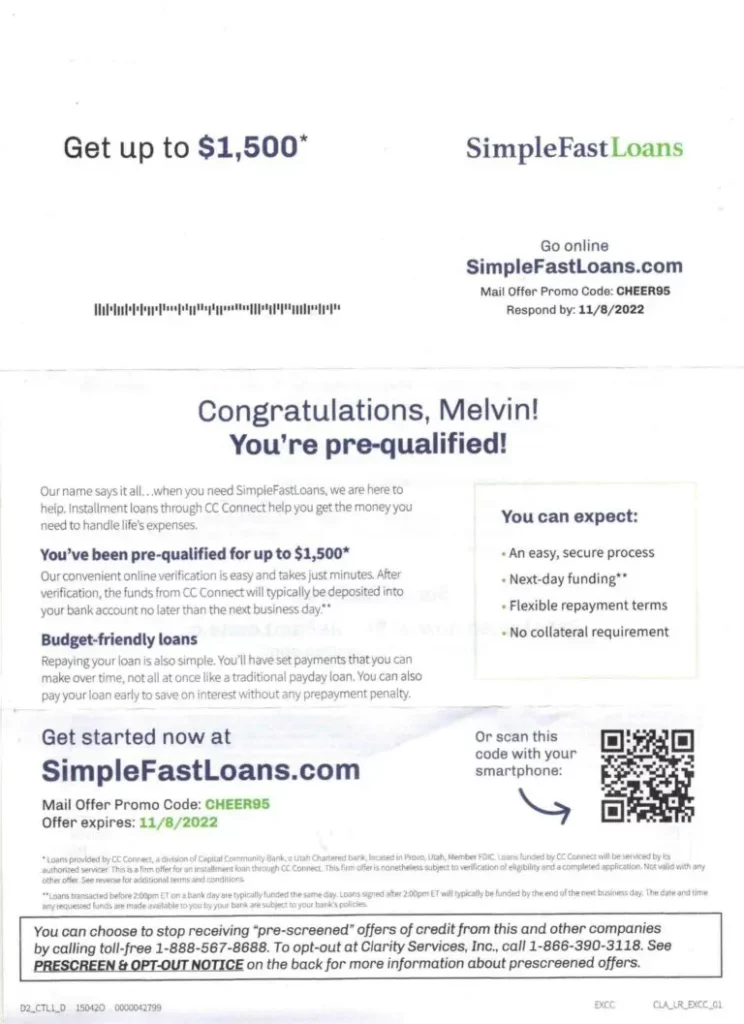

Alternatives to Simple Fast Loans

Before resorting to simple fast loans, consider exploring alternative options. These may include:

- Negotiating payment plans with creditors

- Seeking assistance from local charities or non-profit organizations

- Borrowing from friends or family

- Exploring personal loans or credit cards with lower interest rates

Many credit unions and community banks offer small-dollar loans with more reasonable terms. Exploring these options can provide a more sustainable solution to your financial challenges.

The Importance of Financial Literacy

A key factor in avoiding the pitfalls of simple fast loans is financial literacy. Understanding your income, expenses, and budgeting techniques can help you make informed financial decisions and avoid relying on high-cost loans.

Numerous resources are available to help improve your financial literacy. These include online courses, workshops offered by non-profit organizations, and financial counseling services.

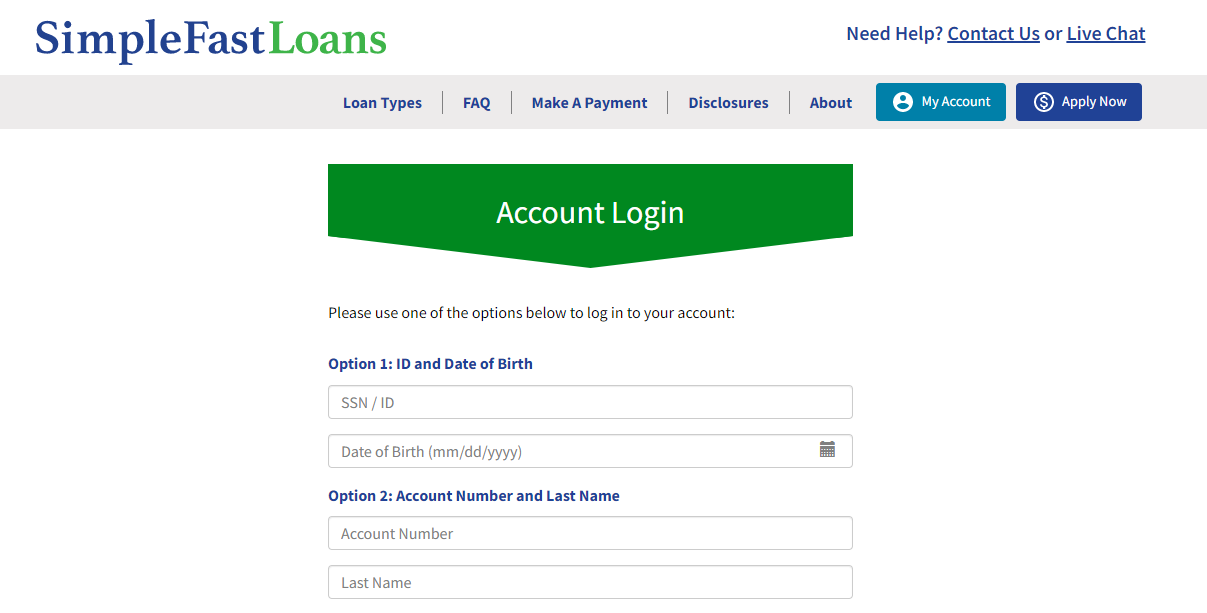

Regulation and Consumer Protection

The regulation of simple fast loans varies by state. Some states have strict laws that cap interest rates and fees, while others have more lenient regulations. The Consumer Financial Protection Bureau (CFPB) has also taken steps to regulate the industry, aiming to protect consumers from predatory lending practices.

It's crucial to understand the laws in your state and to be aware of your rights as a borrower. If you believe you have been victimized by a predatory lender, you can file a complaint with the CFPB or your state's attorney general.

Making an Informed Decision

If you're considering a simple fast loan, it's essential to weigh the pros and cons carefully. Ask yourself if you truly need the loan and whether you have the ability to repay it on time. Read the terms and conditions carefully, paying close attention to the interest rates, fees, and repayment schedule.

Don't be afraid to ask questions and seek clarification from the lender. Understanding the terms of the loan is crucial to avoiding potential problems down the road.

A Reflective Conclusion

Simple fast loans can offer a temporary solution to immediate financial needs, but they come with significant risks. Consumer Reports and other reputable organizations caution against relying on these loans as a long-term financial strategy.

By understanding the potential pitfalls, exploring alternative options, and prioritizing financial literacy, you can make informed decisions that protect your financial well-being. Remember, there are often better paths forward than the allure of quick cash, and a little planning can go a long way toward building a more secure financial future. A calm, considered approach is always the most empowering choice.

![Simple Fast Loans Reviews Consumer Reports Simple Fast Loans Review | [year] Guide](https://avocadoughtoast.com/wp-content/uploads/2022/03/Simple-Fast-Loans-Review.png)