Small Business Accounting And Tax Software

For many small business owners, the thrill of entrepreneurship often clashes with the stark reality of financial management. Juggling sales, operations, and customer service leaves little time – or expertise – for mastering accounting and tax compliance. This challenge is amplified by the ever-changing regulatory landscape, leaving many small businesses vulnerable to errors, penalties, and missed opportunities for growth.

The solution for a growing number of businesses is adopting specialized accounting and tax software. These tools automate crucial tasks, streamline workflows, and provide real-time insights into financial performance. This article explores the burgeoning market for small business accounting and tax software, examining its benefits, key players, emerging trends, and the challenges that still remain.

The Rise of Automated Accounting

The shift towards digital accounting has been driven by several factors. Cloud computing has made sophisticated software accessible and affordable. Furthermore, the increasing complexity of tax laws requires businesses to adopt more efficient and accurate methods of tracking income and expenses.

According to a report by Grand View Research, the global accounting software market is expected to reach $20.4 billion by 2027, growing at a CAGR of 8.3% from 2020 to 2027. This growth is fueled by the increasing adoption of cloud-based solutions and the demand for real-time financial data.

Benefits for Small Businesses

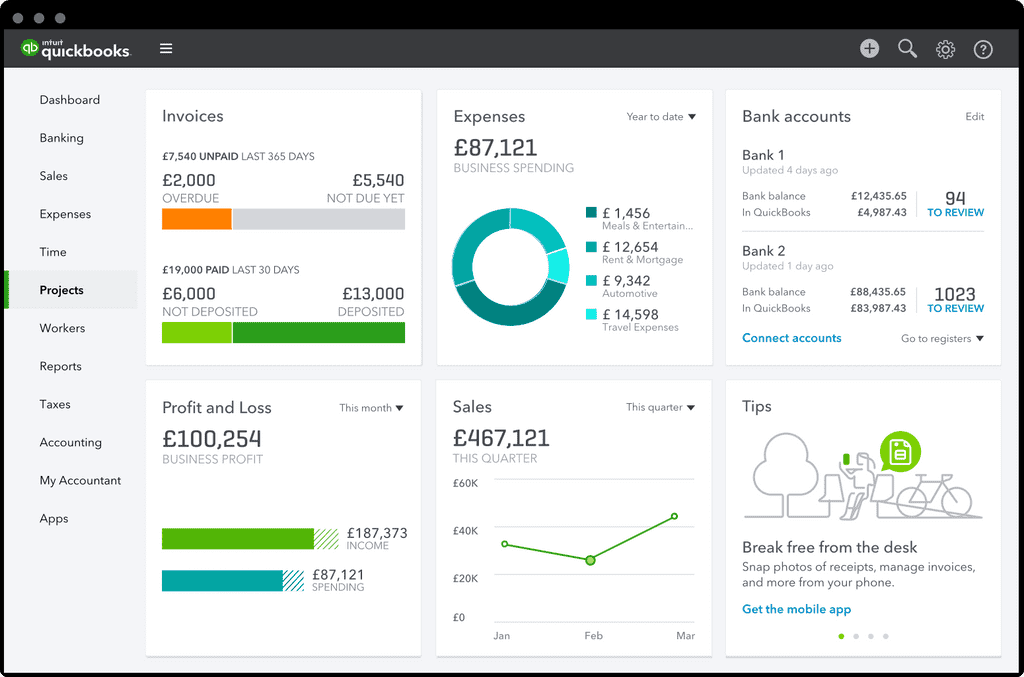

Accounting and tax software offers a multitude of benefits for small businesses. Automation reduces manual data entry, minimizing the risk of errors and freeing up valuable time. The software provides real-time visibility into key financial metrics, allowing business owners to make more informed decisions.

Tax compliance is significantly improved. The software helps businesses track deductible expenses, calculate taxes owed, and prepare accurate tax returns. Features like automated reconciliation and invoice generation further streamline operations.

Key Players and Features

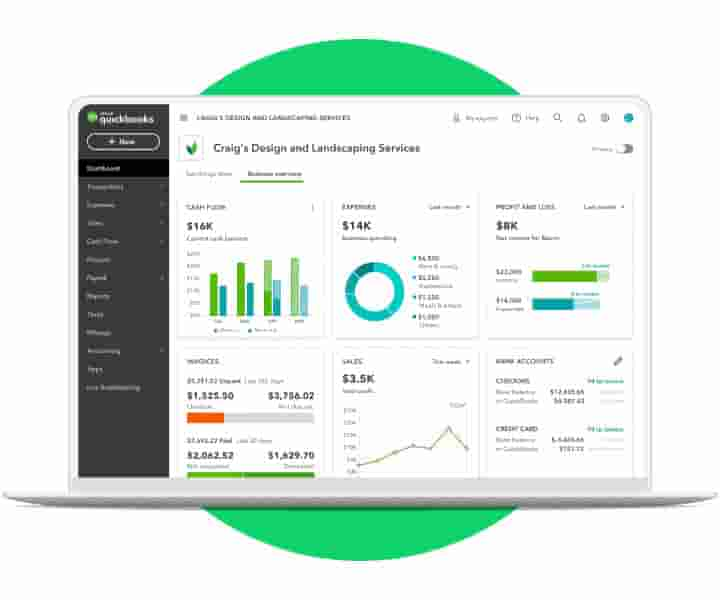

The market is dominated by established players like QuickBooks, Xero, and Sage. Each offers a range of features tailored to different business needs. These features typically include invoice management, expense tracking, bank reconciliation, financial reporting, and payroll integration.

QuickBooks Online, for example, is popular for its user-friendly interface and extensive features. Xero is known for its strong focus on collaboration and integration with other business applications. Sage offers a more comprehensive suite of solutions suitable for larger small businesses.

Emerging players are also disrupting the market with innovative solutions. Some focus on specific industries or offer unique features like AI-powered insights and predictive analytics. These newer platforms often offer more competitive pricing and a more modern user experience.

Challenges and Considerations

Despite the benefits, adopting accounting and tax software is not without its challenges. The initial setup can be time-consuming, requiring businesses to migrate data and configure settings. There's a learning curve involved with mastering the software's features.

Data security is a critical concern. Businesses must choose software providers with robust security measures to protect sensitive financial information. Cost can also be a barrier for some small businesses, particularly those with limited budgets. Subscription fees and additional charges for features can add up.

Integration with existing business systems is another consideration. The software should seamlessly integrate with other applications like CRM systems, e-commerce platforms, and payment processors. Lack of integration can lead to data silos and inefficiencies.

Emerging Trends and the Future

The future of small business accounting and tax software is being shaped by several emerging trends. Artificial intelligence (AI) is playing an increasingly important role. AI-powered features like automated bookkeeping, fraud detection, and predictive analytics are becoming more common.

Blockchain technology is also emerging as a potential game-changer. It can enhance transparency and security in financial transactions, reducing the risk of fraud. Mobile accounting is gaining traction, allowing business owners to manage their finances on the go.

The increasing focus on data analytics will provide businesses with deeper insights into their financial performance. This will enable them to make more data-driven decisions and optimize their operations.

Expert Opinion

"Small businesses that embrace technology, especially cloud-based accounting software, are better positioned for long-term success,"says Sarah Johnson, a CPA specializing in small business taxation.

"The efficiency gains and improved financial insights can be transformative."

She further adds, "However, it’s crucial to choose the right software based on your specific needs and budget. Don’t hesitate to seek professional advice to ensure a smooth implementation."

Conclusion

Small business accounting and tax software is no longer a luxury but a necessity in today's competitive landscape. While challenges remain, the benefits of automation, improved accuracy, and real-time insights far outweigh the costs. As technology continues to evolve, these tools will become even more sophisticated, empowering small businesses to thrive in an increasingly complex world.

![Small Business Accounting And Tax Software 11 BEST Small Business Accounting Software [TOP SELECTIVE]](https://www.softwaretestinghelp.com/wp-content/qa/uploads/2021/01/Small-Business-Accounting-Software.png)