Stocks Under A Dollar With Potential

Imagine a sun-drenched garden, teeming with seedlings. Some are already bursting with vibrant blooms, commanding attention with their established beauty. But nestled amongst them, are the unassuming sprouts, barely reaching above the soil, hinting at the potential that lies dormant within. These are the underdogs, the silent promises of future growth, much like the world of penny stocks, waiting for their moment to shine.

This article delves into the realm of stocks trading under a dollar, exploring the inherent risks and the tantalizing potential rewards they offer. We’ll examine what makes these stocks appealing, discuss the necessary due diligence, and spotlight a few examples that analysts are keeping a watchful eye on, all while maintaining a healthy dose of cautious optimism.

The Allure of the Underdog

Penny stocks, often defined as stocks trading below $5 per share, and in our scope, under a dollar, represent a unique and often misunderstood segment of the market. Their low price point makes them accessible to investors with limited capital, offering a tempting entry point into the world of stock ownership.

The potential for significant gains is undeniable. A small increase in share price can translate to a substantial percentage return, fueling the dreams of investors seeking rapid growth.

However, it's crucial to approach this market with eyes wide open, recognizing the elevated risks involved. These stocks are often associated with smaller, less established companies, which may be vulnerable to market fluctuations or face significant financial challenges.

Navigating the Landscape: Due Diligence is Key

Investing in stocks under a dollar requires rigorous research and a healthy dose of skepticism. Unlike established blue-chip companies, information on these smaller entities can be scarce and less readily available.

Begin by scrutinizing the company's financial statements. Are revenues growing? Is the company profitable? What is their debt load like? These are critical questions that need answers.

Pay close attention to the company's business model and competitive landscape. Is the company operating in a growing market? Does it have a unique product or service that sets it apart from its competitors?

Also, research the company’s management team. A strong and experienced leadership team can be a critical asset in navigating the challenges faced by small companies. Check for any red flags, such as regulatory issues or previous business failures.

Stocks to Watch: A Glimpse of Potential

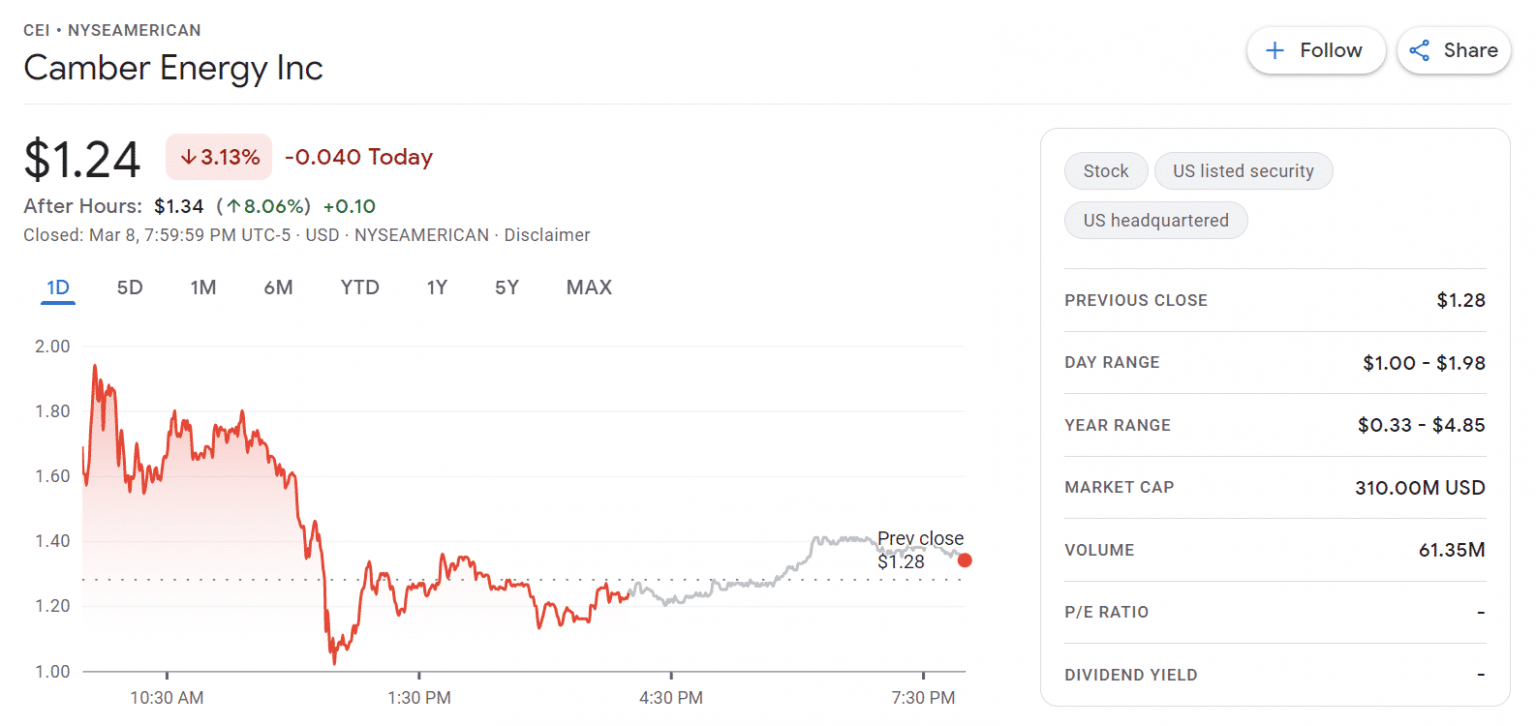

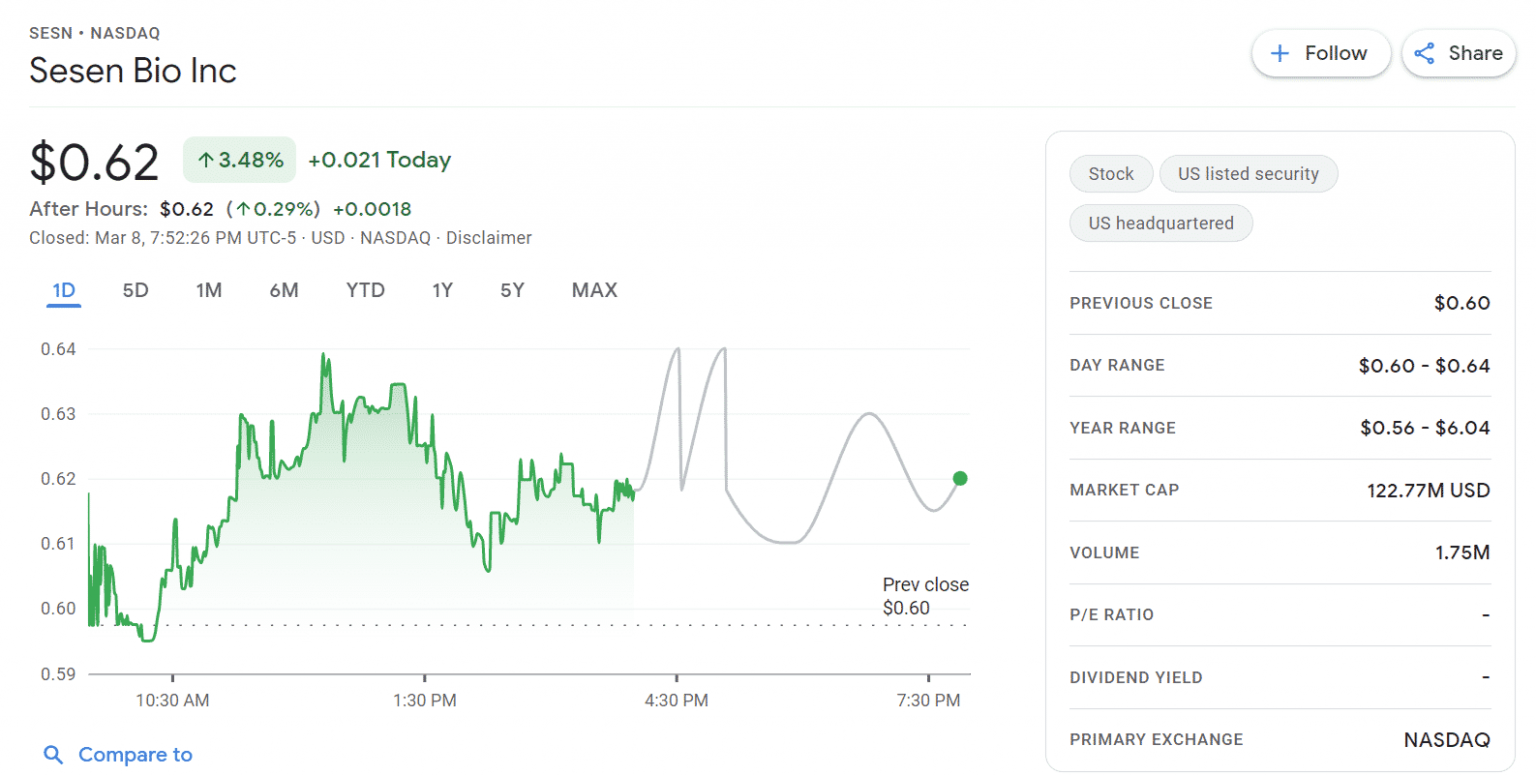

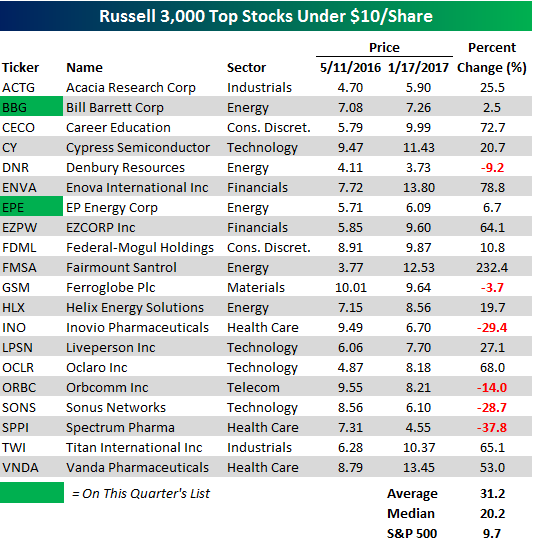

While we are not providing financial advice, it’s helpful to examine a few examples of stocks that analysts are currently watching. These examples are for illustrative purposes only and should not be interpreted as recommendations.

Reliance Global Group, Inc. (RELI)

Reliance Global Group, Inc. (RELI), an insurance and real estate focused company, has been noted for its efforts to consolidate and modernize the insurance industry. Any potential investor should monitor its revenue growth and strategic acquisitions.

TOP Financial Group Limited (TOP)

Another stock of interest is TOP Financial Group Limited (TOP), which is involved in brokerage services. Keep an eye on their trading volumes and financial performance within the brokerage sector.

Bit Brother Limited (BTB)

Bit Brother Limited (BTB), previously engaged in the tea business, is now venturing into the cryptocurrency and blockchain space. This is a very speculative stock, so its success will depend on its strategic execution in a volatile and rapidly evolving market.

Disclaimer: These examples are based on publicly available information and analyst opinions as of the time of writing. These stocks are volatile, and past performance is not indicative of future results. Investing in penny stocks involves a high degree of risk, and investors could lose their entire investment.

The Final Word: A Balancing Act

Investing in stocks under a dollar can be a high-risk, high-reward endeavor. The potential for substantial gains is undeniable, but it comes with the real possibility of significant losses.

Success in this market hinges on thorough research, a disciplined investment strategy, and a realistic understanding of the risks involved. Treat it like tending to those delicate seedlings – nurture them with knowledge and patience, but be prepared for the possibility that some may not blossom as expected.

Remember, responsible investing starts with informed decisions and a clear understanding of your risk tolerance. Don't let the allure of quick riches cloud your judgment.

"Invest in what you know,"as Peter Lynch wisely advised, and always diversify your portfolio to mitigate risk.

![Stocks Under A Dollar With Potential Best Stocks Under $10 You Never Heard of [But Should Buy Now]](https://mystockmarketbasics.com/wp-content/uploads/2022/05/best-stocks-under-10-dollars-to-buy.jpg)