The Account Type And Normal Balance Of Prepaid Expense Is

The seemingly straightforward concept of prepaid expenses often becomes a point of confusion for accounting students and professionals alike. Understanding the correct account type and normal balance is crucial for accurate financial reporting and analysis. Misclassifying these expenses can lead to skewed financial statements, impacting investment decisions and overall business strategy.

This article delves into the intricacies of prepaid expenses, clarifying their nature and importance within the broader accounting framework. It will explore the correct classification of prepaid expenses as assets with a normal debit balance, and the implications of this classification for financial statement accuracy.

Understanding Prepaid Expenses

A prepaid expense is essentially a payment made for goods or services that have not yet been fully consumed or utilized. This payment provides a future benefit to the company. Common examples include prepaid insurance, prepaid rent, and prepaid advertising.

Instead of recognizing the entire expense immediately, accountants allocate the cost over the period the benefit is received. This aligns with the matching principle in accounting. This principle requires expenses to be recognized in the same period as the revenue they help generate.

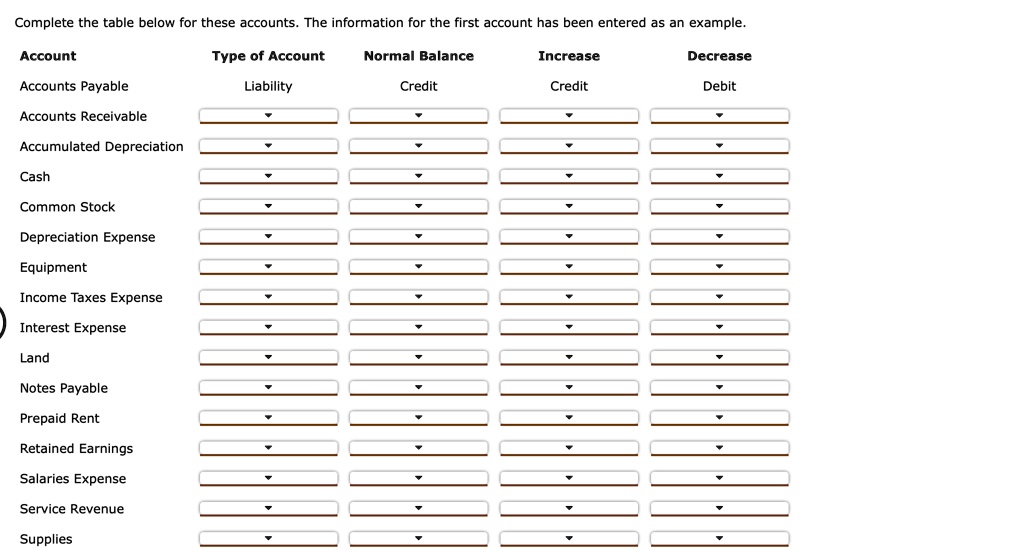

Account Type: Asset

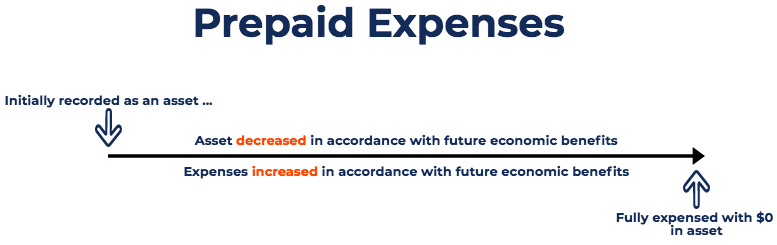

Prepaid expenses are classified as assets on the balance sheet. This is because they represent a future economic benefit to the company. The company has already paid for something that will provide value in the future.

Until the benefit is fully consumed, the prepaid expense is considered a resource available to the company. It will later be transferred to an expense account as it is used.

According to the Generally Accepted Accounting Principles (GAAP), assets are resources controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity. Prepaid expenses meet this definition perfectly.

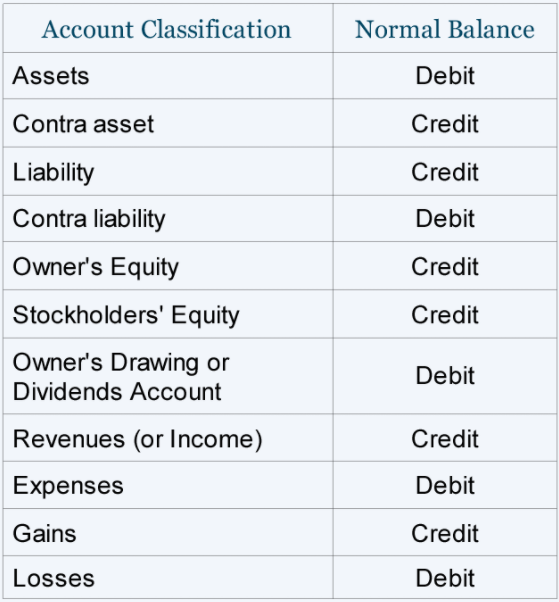

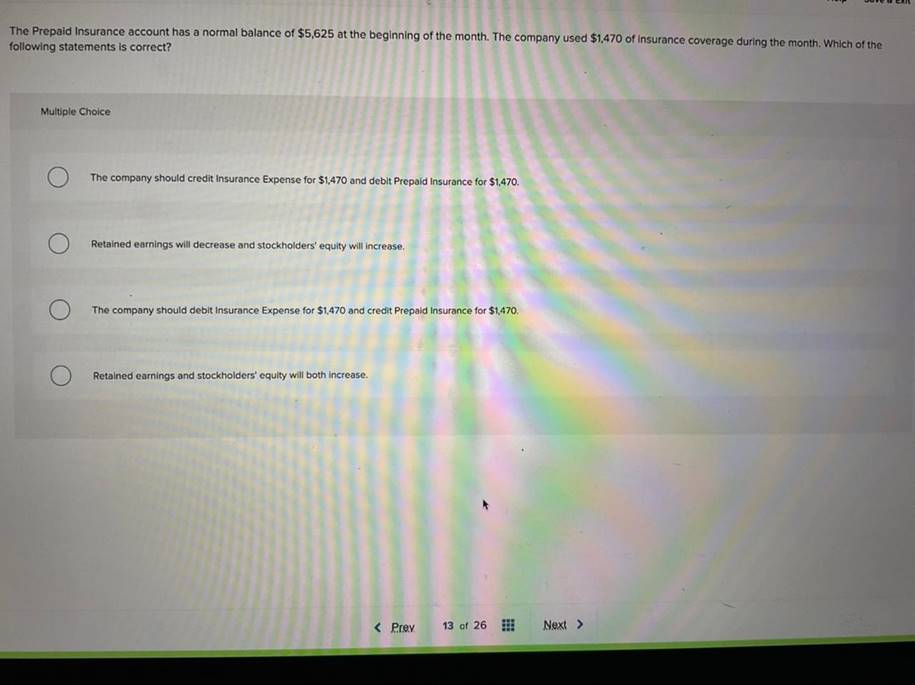

Normal Balance: Debit

The normal balance of a prepaid expense account is debit. This means that increases to the prepaid expense account are recorded as debits. Decreases, reflecting the expense being recognized over time, are recorded as credits.

The debit balance reflects the company's right to receive future benefits. This is a fundamental principle of double-entry bookkeeping.

Think of it like this: When you pay for insurance upfront, you're not immediately experiencing the expense. You are actually creating an asset, the right to insurance coverage for the period paid for. This right is increased with a debit entry.

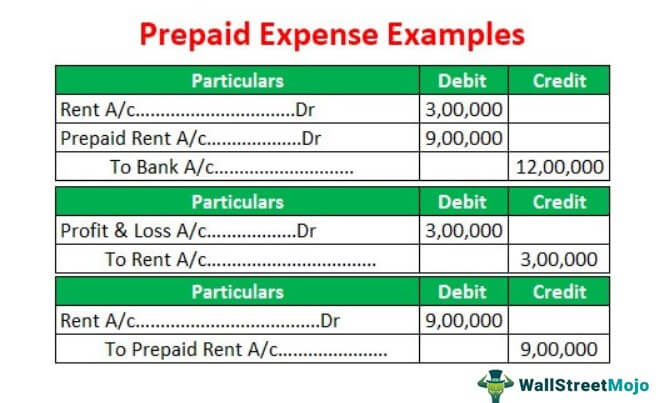

The Accounting Process

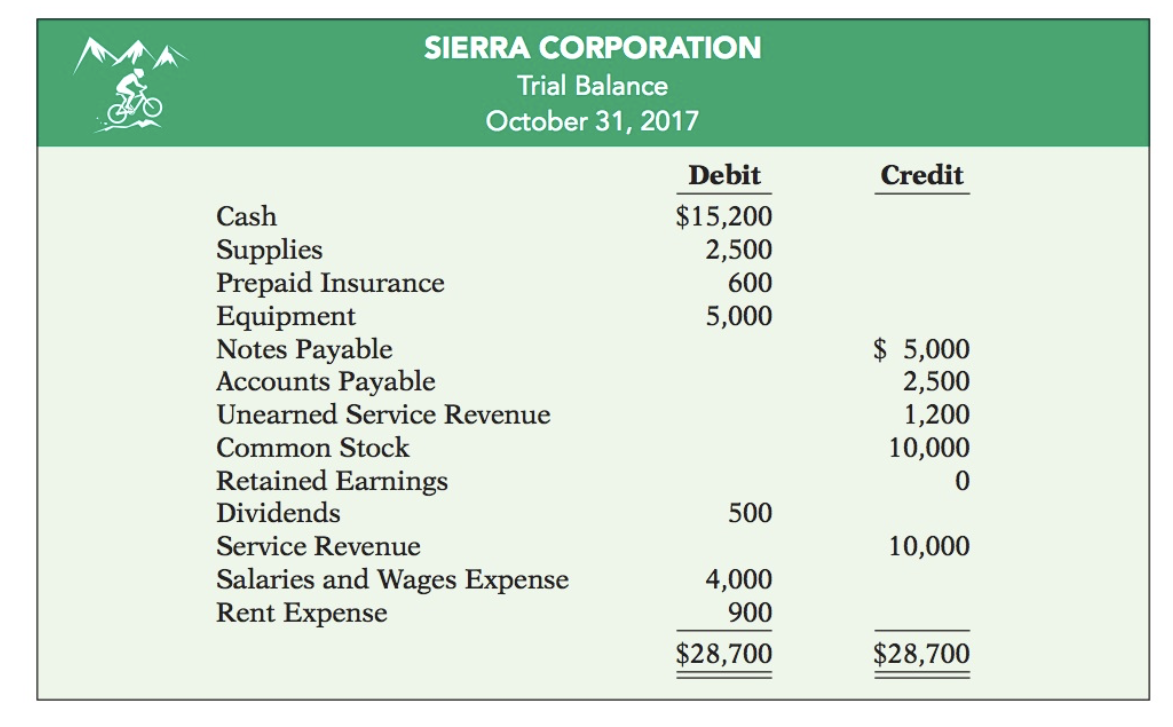

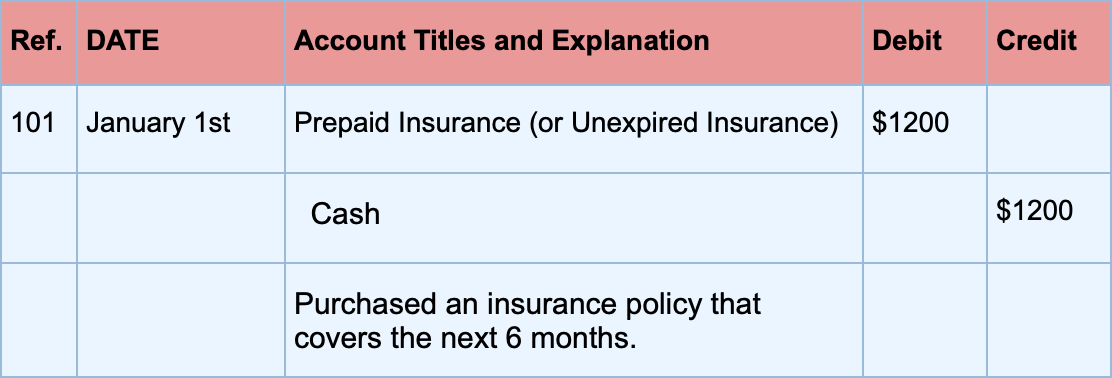

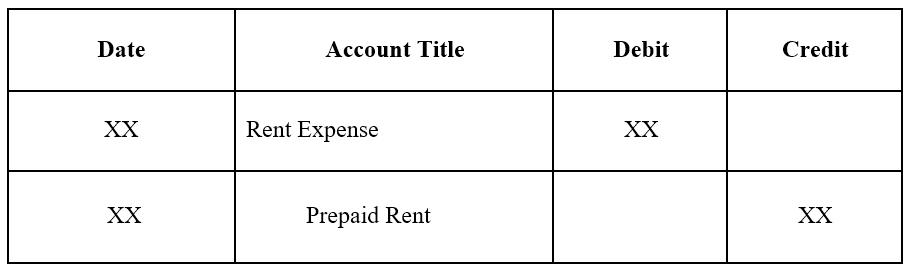

Let's consider an example: A company pays $12,000 for a one-year insurance policy on January 1st. The initial journal entry would debit Prepaid Insurance (an asset) for $12,000 and credit Cash for $12,000.

Each month, $1,000 ($12,000 / 12 months) would be recognized as insurance expense. The adjusting entry would debit Insurance Expense for $1,000 and credit Prepaid Insurance for $1,000.

This process continues until the prepaid insurance balance is zero. The full $12,000 has then been recognized as an expense over the year.

Impact on Financial Statements

The correct classification and accounting for prepaid expenses are critical for accurate financial reporting. Incorrectly expensing the entire amount upfront will result in an understatement of assets and an overstatement of expenses in the initial period. This also leads to an overstatement of net income in subsequent periods when the expense should have been recognized.

This can mislead investors and creditors, potentially affecting their decisions. Accurate financial statements are essential for transparency and trust in the financial markets.

Furthermore, misclassifying prepaid expenses can impact key financial ratios. This includes the current ratio and debt-to-asset ratio, potentially leading to inaccurate assessments of a company's financial health and stability.

Common Misconceptions

One common misconception is that prepaid expenses are liabilities. This is incorrect. Liabilities represent obligations to pay in the future, while prepaid expenses represent payments made for future benefits.

Another misconception is that all upfront payments are prepaid expenses. This is not always the case. For example, upfront payments for inventory are classified as inventory, not prepaid expenses.

Differentiating between prepaid expenses and other asset accounts requires careful analysis. This is regarding the nature of the payment and the timing of the benefit received.

The Role of Professional Accountants

Professional accountants play a crucial role in ensuring the accurate accounting for prepaid expenses. They possess the knowledge and expertise to properly classify and allocate these expenses over the appropriate period.

Continuing professional development is essential for accountants. This is to stay up-to-date with the latest accounting standards and best practices.

The Institute of Management Accountants (IMA) and the American Institute of Certified Public Accountants (AICPA) provide resources and guidance to help accountants navigate the complexities of accounting for prepaid expenses.

Looking Ahead

As businesses become more complex and globalized, the accurate accounting for prepaid expenses will remain a critical aspect of financial reporting. Technological advancements, such as automated accounting software, can help streamline the process. However, human judgment and expertise are still essential.

Understanding the account type (asset) and normal balance (debit) of prepaid expenses is fundamental. It is for accurate financial reporting and sound financial decision-making.

By adhering to GAAP and seeking guidance from professional organizations, businesses can ensure that their financial statements accurately reflect their financial performance and position. This contributes to greater transparency and trust in the business world.