The Acquisition Cost Of A Plant Asset Does Not Include

The seemingly straightforward concept of acquiring a plant asset – a building, machinery, or even a fleet of vehicles – belies a complex accounting landscape. The purchase price, while significant, is merely the tip of the iceberg. A frequent source of confusion and costly errors stems from misidentifying which expenses *cannot* be capitalized as part of the asset's acquisition cost.

This article dissects the specific costs excluded from the acquisition cost of a plant asset, providing clarity for businesses and accountants alike. Understanding these exclusions is crucial for accurate financial reporting, tax compliance, and informed investment decisions. Failure to properly account for these costs can lead to misstated financial statements, incorrect depreciation calculations, and potential regulatory penalties.

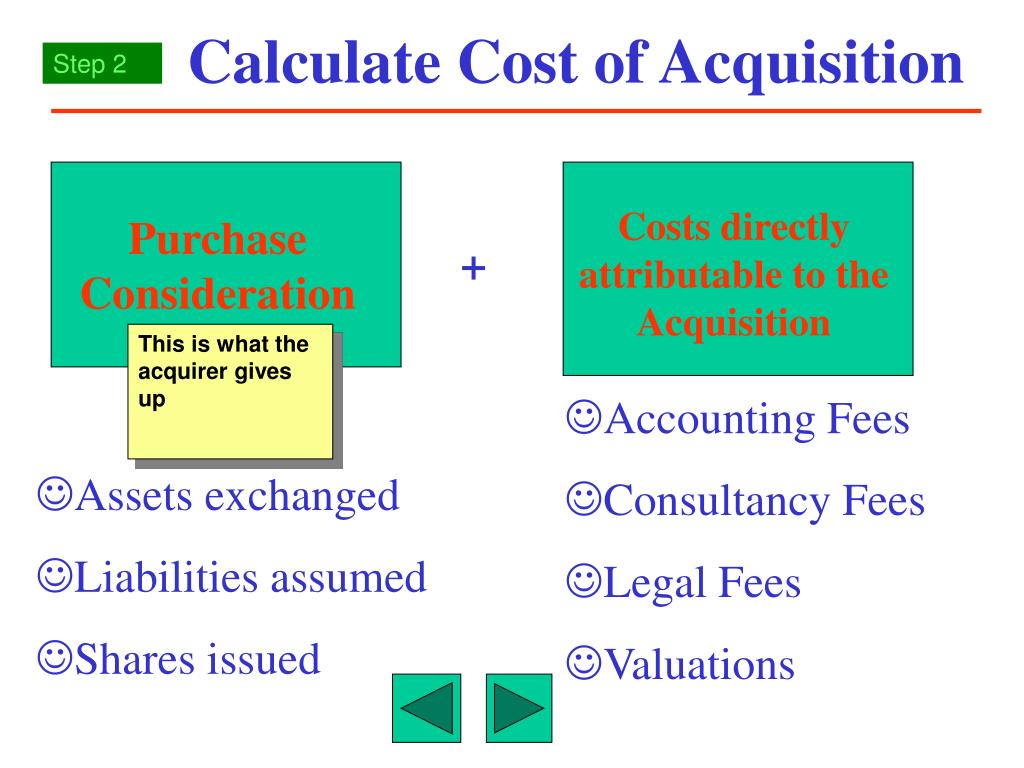

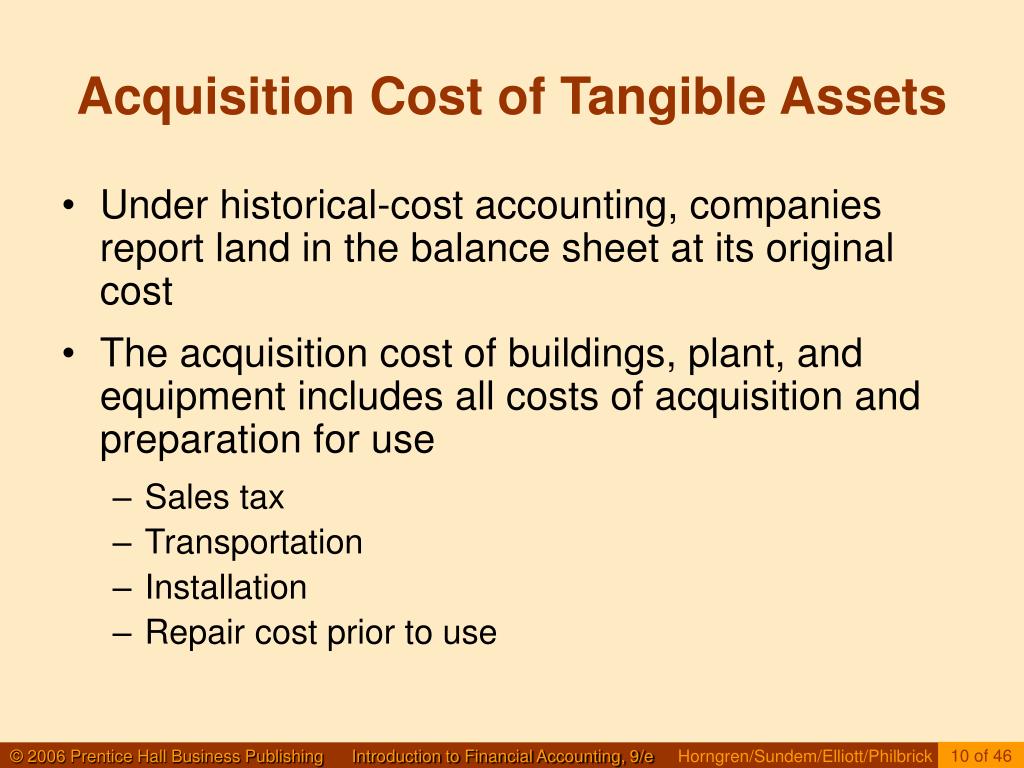

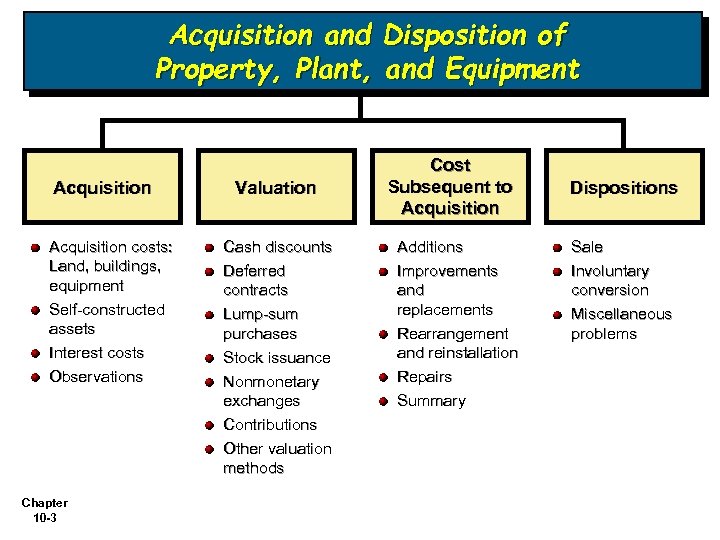

Defining Acquisition Cost: What's Included?

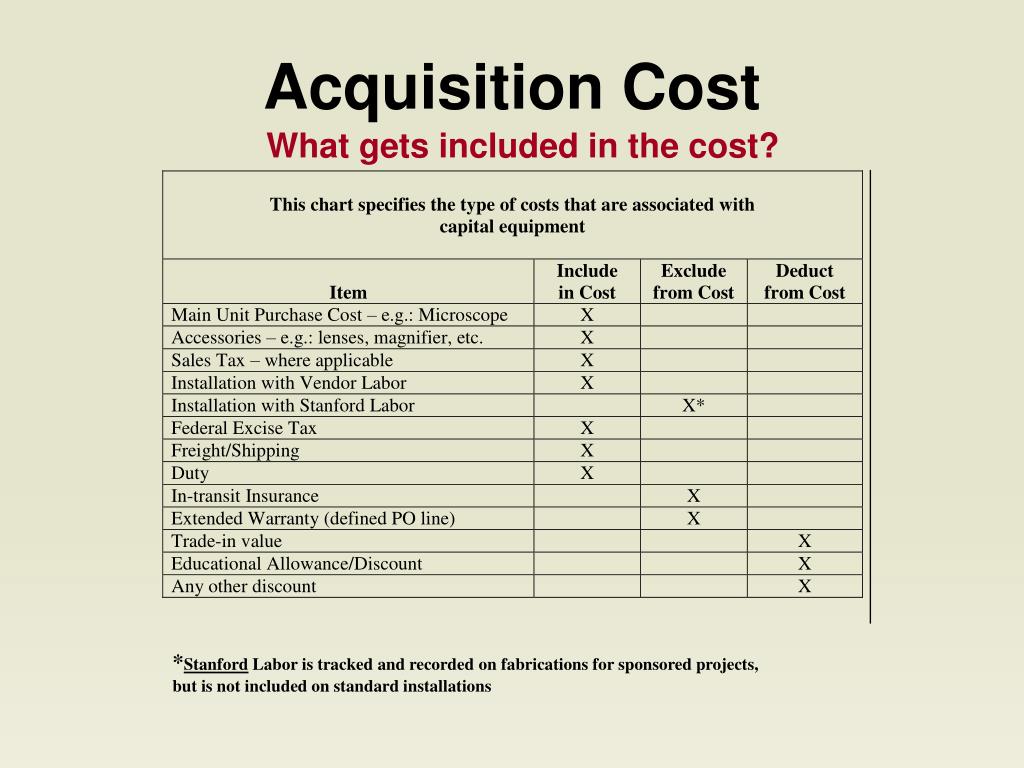

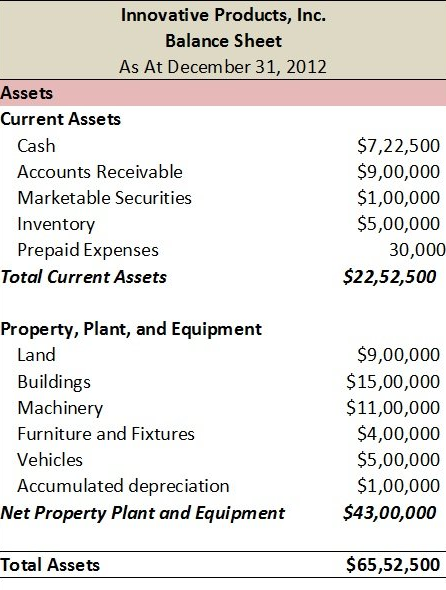

Before delving into the exclusions, it's important to establish what *is* included in the acquisition cost of a plant asset. Generally accepted accounting principles (GAAP) dictate that the acquisition cost encompasses all expenditures necessary to get the asset ready for its intended use. This includes the purchase price, freight charges, installation costs, and any applicable sales taxes.

For example, the acquisition cost of a new factory machine includes the cost of the machine itself, the cost to transport it to the factory, the expense of installing it, and any necessary testing to ensure it's functioning correctly. All these costs are capitalized, meaning they are added to the asset's balance sheet value and depreciated over its useful life.

The Crucial Exclusions: What's *Not* Included

However, certain expenses, while related to the asset, do not qualify for capitalization and are instead expensed in the period they are incurred. These exclusions are often categorized and include specific examples.

Repairs and Maintenance

Repairs and maintenance costs, particularly those that maintain the asset's existing condition rather than improve it, are a primary exclusion. Routine servicing, such as oil changes for a vehicle or minor repairs to a machine, are expensed as they occur.

The key distinction is whether the expenditure extends the asset's useful life or increases its productivity. If it does, it may be capitalized as an improvement. Otherwise, it's treated as an expense.

Training Costs

The expense of training employees to operate the newly acquired asset is another important exclusion. While necessary for the asset's utilization, training costs are considered separate from the asset's inherent value.

The rationale is that the benefit derived from training extends to the employees themselves, not solely to the asset. Therefore, these costs are expensed as incurred.

Financing Costs

Financing costs, such as interest expense incurred on a loan used to purchase the asset, are generally *not* included in the acquisition cost. Interest expense is treated as a separate expense and is recognized over the loan's term.

An exception exists for assets constructed for an enterprise's own use, where interest incurred during the construction period may be capitalized. This is less common and subject to specific accounting standards.

Administrative and General Overhead

Allocating general administrative overhead costs to the acquisition cost of a plant asset is typically *not* permitted. These overhead costs, such as executive salaries and general office expenses, are considered period costs.

These costs are not directly attributable to bringing the asset to its intended use. They benefit the entire organization, not just the specific asset.

Costs Incurred After the Asset is Ready for Use

Expenses incurred after the asset is ready for its intended use, but before it is actually put into service, are generally expensed. For instance, initial operating losses during a trial period are not capitalized.

These costs are considered part of the normal operating expenses of the business. They are not directly related to getting the asset ready for its intended use.

Dismantling and Restoration Costs

While initially included as part of the asset’s acquisition cost, subsequent costs associated with dismantling or restoring the site after the asset's useful life are usually accounted for under separate accounting standards related to asset retirement obligations. This typically involves estimating the future cost and recognizing a liability upfront, offset by an increase in the asset's carrying value.

These estimated costs are then depreciated over the asset's useful life. The actual costs incurred later are then compared to the estimated liability and adjusted accordingly.

The Importance of Accurate Accounting

Properly accounting for the acquisition cost of plant assets is essential for accurate financial reporting. Incorrect capitalization of expenses can lead to an overstatement of assets and an understatement of expenses in the early years of the asset's life. This can distort a company's financial performance and mislead investors.

Conversely, expensing costs that should be capitalized can result in an understatement of assets and an overstatement of expenses. This can make a company appear less profitable than it actually is. Tax implications also arise from misclassifying expenses. The depreciation expense, which is impacted by the capitalized cost, directly influences taxable income.

Looking Ahead: Navigating Complexity

The accounting rules surrounding plant assets can be complex and require careful judgment. Consulting with experienced accounting professionals is crucial to ensure accurate financial reporting and compliance with applicable accounting standards. Staying abreast of changes in GAAP and seeking clarification on ambiguous situations are essential for maintaining accurate financial records.

As businesses increasingly rely on sophisticated equipment and technology, the complexities surrounding plant asset accounting are likely to intensify. A proactive approach to understanding and applying these rules is vital for long-term financial health and success.

![The Acquisition Cost Of A Plant Asset Does Not Include [Solved] Common categories of a classified balance | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/04/660a5f0c399e9_724660a5f0c361ff.jpg)