The Balance In Retained Earnings Represents

Imagine a sturdy oak tree, its branches reaching towards the sky, its roots deeply embedded in the earth. Each year, it grows a little taller, a little stronger, adding rings to its trunk that tell the story of its life. In the world of business, a similar phenomenon occurs, a gradual accumulation of strength and resilience represented by a critical financial metric: retained earnings.

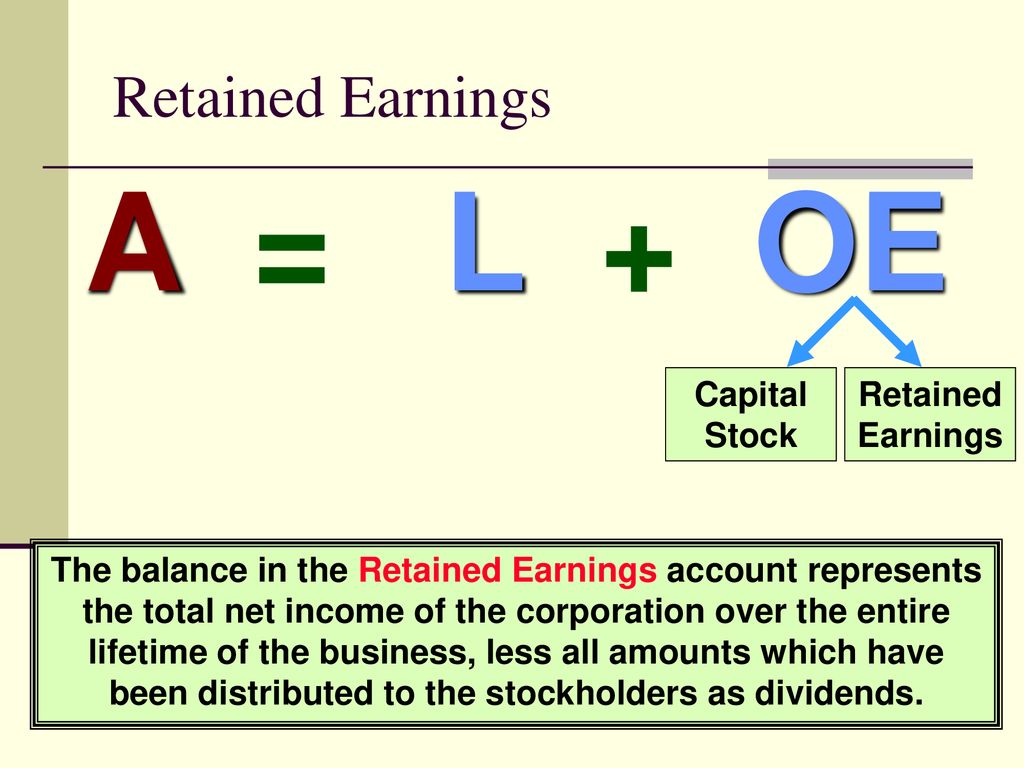

The balance in retained earnings represents the cumulative net income a company has reinvested back into its business, rather than distributing it to shareholders as dividends. It's a vital indicator of a company’s financial health, growth potential, and long-term sustainability, reflecting its ability to generate profits and utilize them effectively for future expansion.

Understanding Retained Earnings: The Foundation

At its core, retained earnings is a straightforward concept. It's the portion of a company's profit that hasn't been paid out to owners. Think of it as savings, diligently set aside to fund future projects and strengthen the company's foundation.

This reserve can be used for various purposes, from funding research and development to expanding operations into new markets.

To understand the significance of retained earnings, it’s helpful to trace its origin. The concept is rooted in fundamental accounting principles, providing a clear view of how a company uses its profits over time.

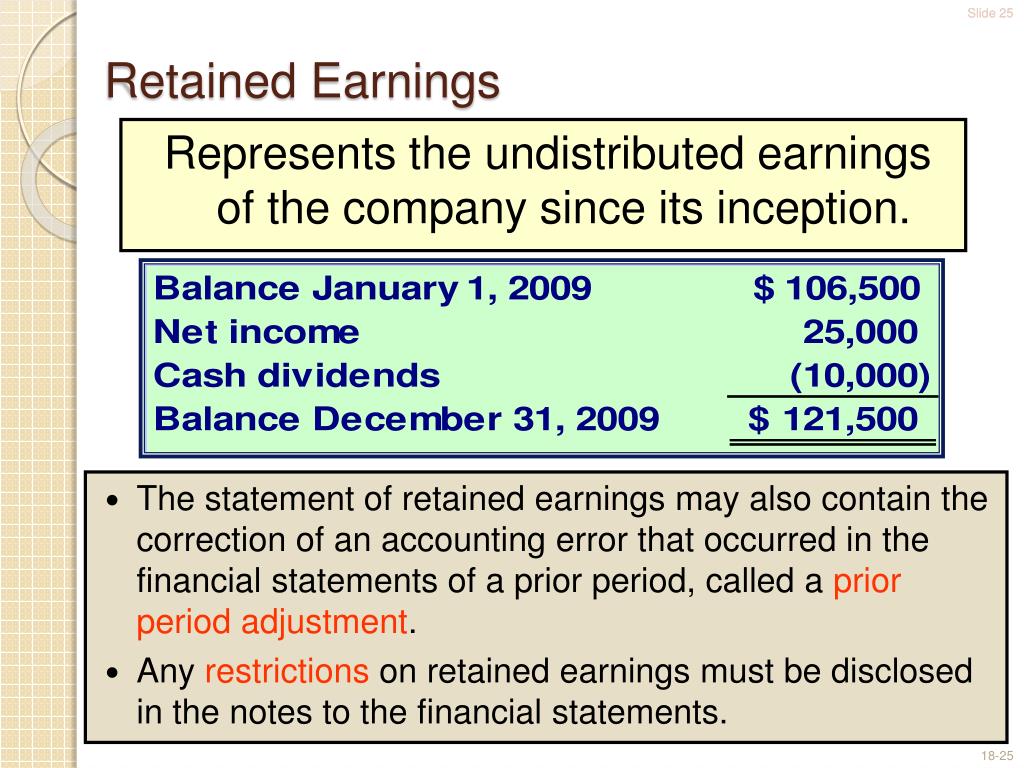

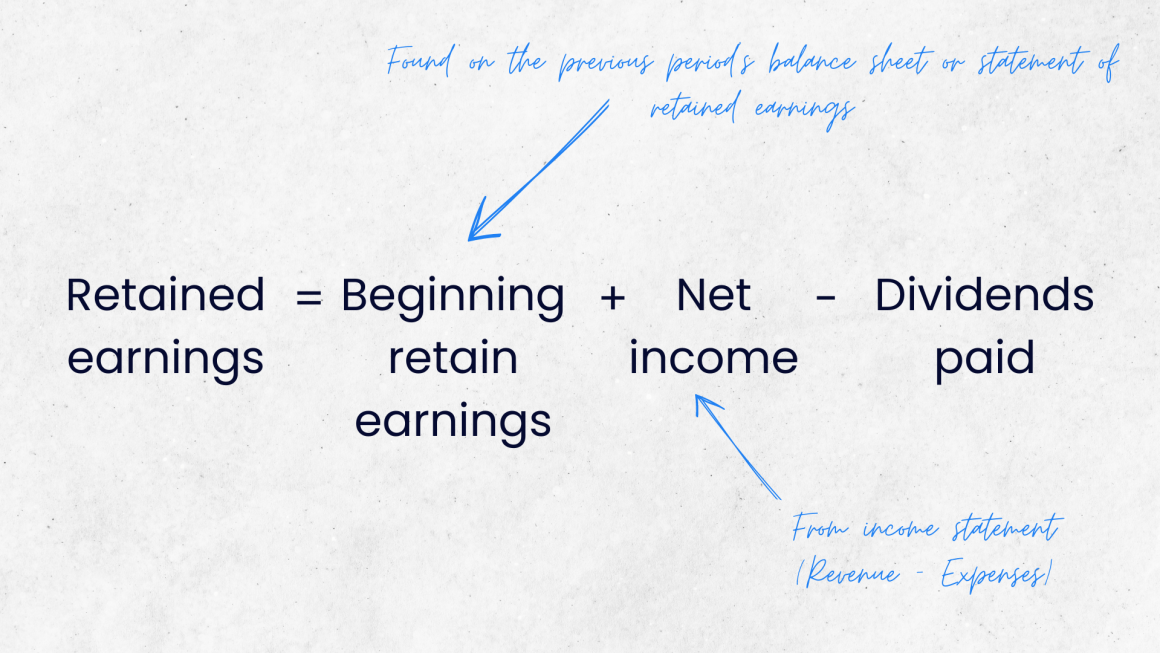

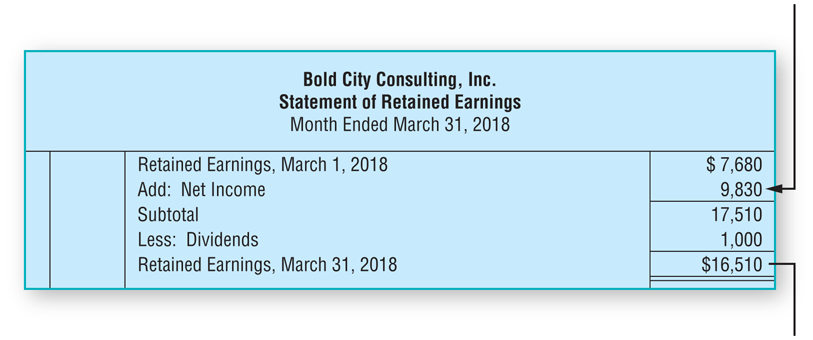

The formula for calculating retained earnings is relatively simple: Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings. This calculation reflects the changes occurring within the financial year.

The Significance of a Healthy Retained Earnings Balance

A robust retained earnings balance signals a company's ability to generate profits and manage them wisely. It indicates financial stability, which can be reassuring to investors, creditors, and stakeholders alike.

A healthy balance often translates to a higher credit rating, making it easier and cheaper for the company to borrow money for further investments.

Growth and Expansion

Retained earnings provide the financial fuel necessary for organic growth. Instead of relying solely on external financing, a company can use its accumulated profits to fund new projects, acquire new equipment, and hire additional staff.

This self-funded growth allows the company to maintain greater control over its operations and avoid the burden of debt.

Strategic Investments

Beyond immediate growth, retained earnings enable companies to make strategic investments that can reshape their future. These investments might include developing innovative technologies, acquiring competitors, or expanding into new geographic markets.

By leveraging its accumulated profits, a company can position itself for long-term success and create a competitive advantage.

Financial Resilience

A strong retained earnings balance acts as a financial cushion during challenging times. If a company faces unexpected losses or economic downturns, its accumulated profits can help it weather the storm.

This financial resilience can be the difference between survival and failure, providing a sense of security and stability.

Factors Influencing Retained Earnings

Several factors can influence a company's retained earnings balance. Net income is, of course, the primary driver. Higher profits lead to greater accumulation of retained earnings, assuming dividends are kept at a manageable level.

Dividend policy plays a critical role. Companies that prioritize dividend payouts will have lower retained earnings compared to those that reinvest a larger portion of their profits.

Accounting practices also have an impact. Changes in accounting standards or adjustments to prior period earnings can affect the reported balance of retained earnings.

For example, a significant write-down of assets would reduce net income and consequently lower the retained earnings balance.

Interpreting the Balance: A Deeper Dive

While a positive retained earnings balance is generally considered favorable, it's essential to consider the context. A very large retained earnings balance, particularly in a mature company, could suggest that the company is not effectively utilizing its profits.

Investors might question whether the company is missing opportunities for growth or strategic investments.

Conversely, a negative retained earnings balance, also known as an accumulated deficit, indicates that a company has incurred cumulative losses over time. This situation raises concerns about the company's long-term viability and its ability to generate future profits.

However, a negative balance isn't always a death knell. Young, rapidly growing companies may experience temporary losses as they invest heavily in expansion.

According to a report by the Securities and Exchange Commission (SEC), investors should always evaluate the company's stage of development, industry trends, and overall financial performance when interpreting a retained earnings balance. It is important to do the due diligence.

Retained Earnings vs. Other Financial Metrics

Retained earnings are just one piece of the financial puzzle. To get a complete picture of a company's financial health, it's essential to consider other key metrics, such as revenue growth, profitability margins, and cash flow.

Revenue growth indicates a company's ability to generate sales, while profitability margins reflect its efficiency in converting sales into profits. Cash flow measures the amount of cash a company generates from its operations.

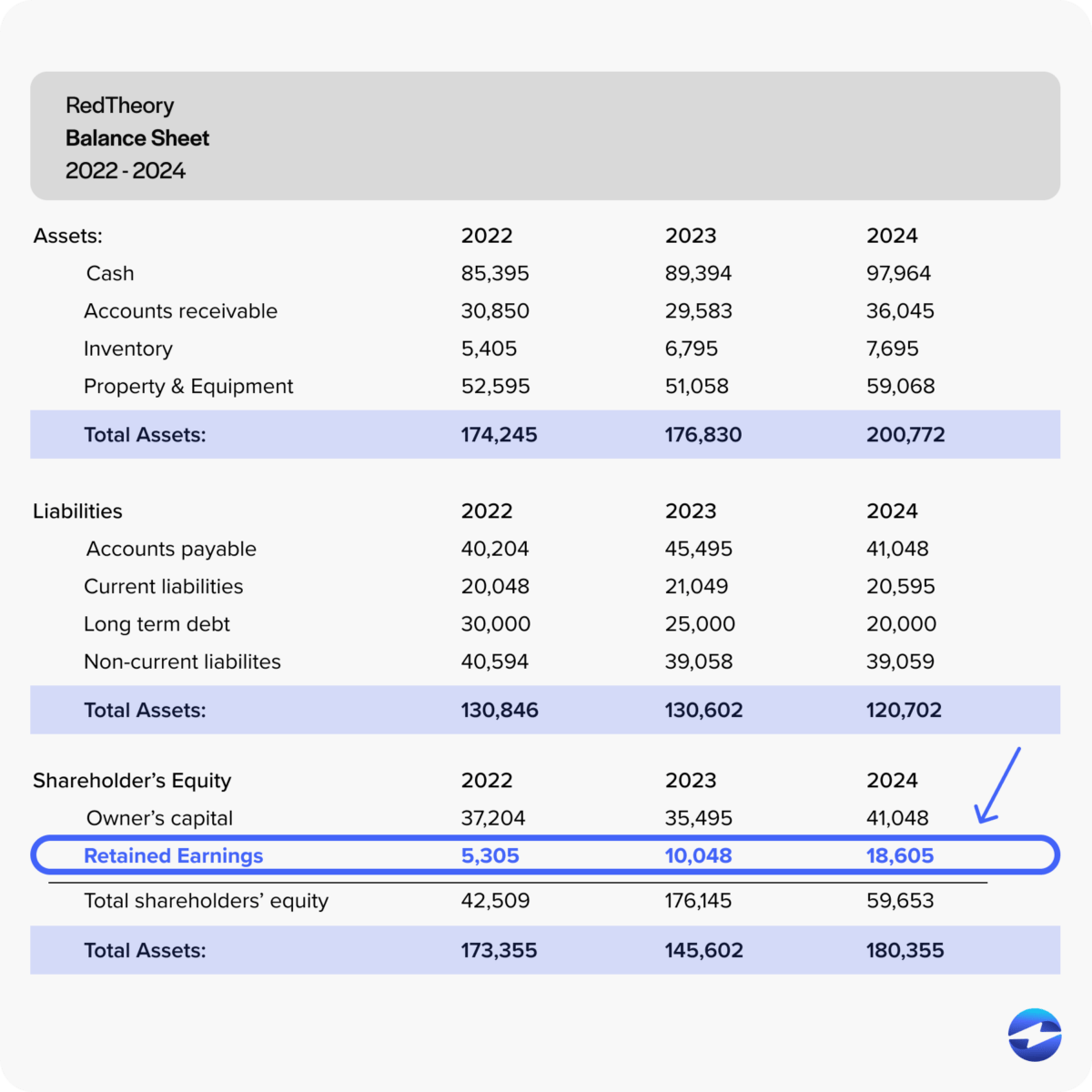

Retained earnings are closely linked to the balance sheet. The retained earnings account appears in the equity section of the balance sheet, reflecting the cumulative profits that have been reinvested in the business.

It's important to analyze the balance sheet in conjunction with the income statement and cash flow statement to gain a comprehensive understanding of the company's financial position.

Real-World Examples

Consider Apple Inc., a company renowned for its innovation and profitability. Over the years, Apple has consistently generated significant profits, a substantial portion of which has been reinvested in research and development, product innovation, and strategic acquisitions.

This prudent management of retained earnings has fueled the company's growth and solidified its position as a global technology leader.

On the other hand, a struggling retail chain might have a declining retained earnings balance due to decreased sales and increased competition. The company may be forced to cut dividends or even suspend them altogether to preserve cash.

This scenario highlights the importance of monitoring retained earnings as an early warning sign of potential financial distress.

The Future of Retained Earnings

In an increasingly complex and dynamic business environment, the role of retained earnings remains crucial. As companies navigate technological disruptions, evolving customer preferences, and global economic shifts, their ability to generate and effectively utilize retained earnings will be a key determinant of their success.

The emphasis on sustainable growth and long-term value creation is likely to further elevate the importance of retained earnings as a measure of financial strength and strategic vision.

Conclusion

The balance in retained earnings represents far more than just a number on a financial statement. It's a reflection of a company's history, its present performance, and its aspirations for the future. Like the rings of a sturdy oak tree, it tells a story of growth, resilience, and the enduring power of prudent financial management.

By understanding the significance of retained earnings, investors and stakeholders can gain valuable insights into a company's ability to thrive in the long run. In a business landscape often characterized by uncertainty, the wisdom of reinvesting in oneself remains a timeless principle, embodied in the very essence of retained earnings.