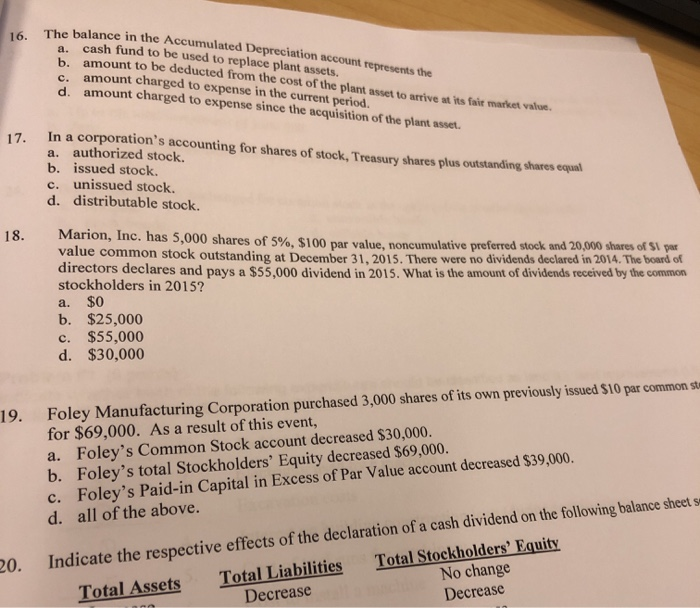

The Balance In The Accumulated Depreciation Account Represents

The seemingly simple number nestled within a company's balance sheet, the accumulated depreciation, holds significant weight in understanding a company's financial health and long-term investment strategy.

While often overlooked by casual observers, the balance in the accumulated depreciation account provides crucial insights into how a company manages its assets, reports its earnings, and plans for future expenditures. This article will delve into the meaning of this key accounting metric and its implications for stakeholders.

What is Accumulated Depreciation?

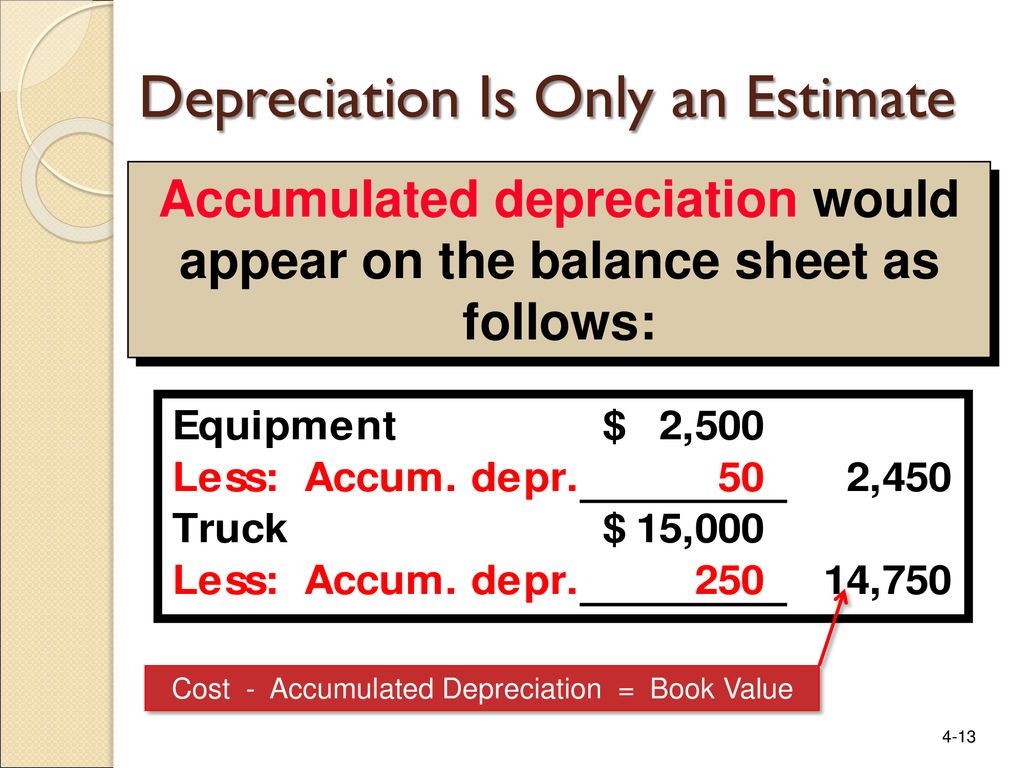

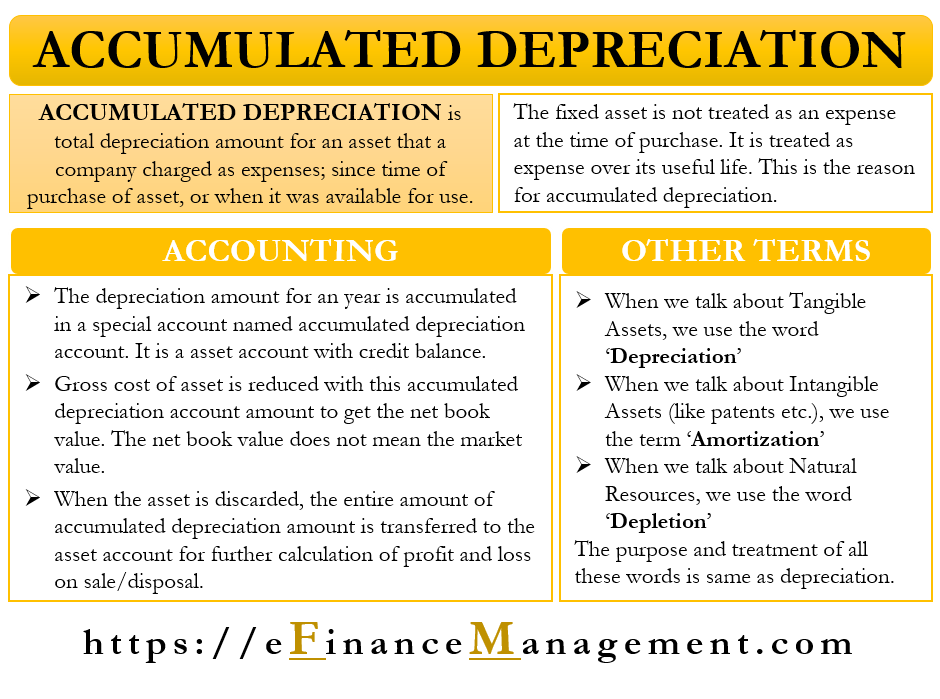

Accumulated depreciation is the cumulative amount of depreciation expense that has been recognized against an asset since it was placed into service. Depreciation, in accounting terms, represents the systematic allocation of the cost of an asset over its useful life.

Essentially, it reflects the wearing out, consumption, or obsolescence of a fixed asset like machinery, equipment, buildings, or vehicles.

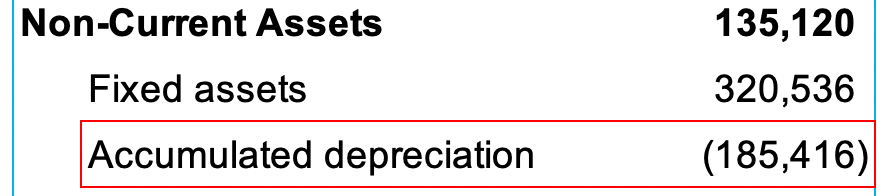

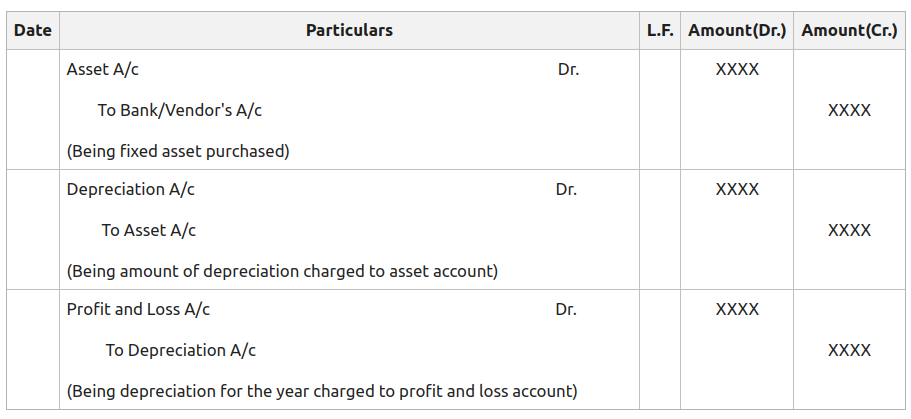

The accumulated depreciation account is a contra-asset account, meaning it reduces the book value of the related asset on the balance sheet.

Significance of the Accumulated Depreciation Balance

The balance in the accumulated depreciation account isn't just a technical figure; it’s a vital indicator of several key aspects of a company's financial position.

Reflecting Asset Value

The most obvious significance lies in its impact on the reported value of a company's assets. By subtracting accumulated depreciation from the original cost of an asset, the balance sheet presents a more realistic picture of the asset's remaining value, often referred to as its book value.

This is important because relying solely on the original cost would overstate the asset's worth, especially as it ages and deteriorates.

Impact on Profitability

Depreciation expense, which contributes to the accumulated depreciation account, is an expense recognized on the income statement.

This expense reduces a company's reported profit, impacting key profitability ratios like net profit margin and earnings per share. Therefore, understanding the depreciation policies used is crucial for analyzing a company's profitability.

Capital Expenditure Planning

A large and growing accumulated depreciation balance can signal that a company's assets are nearing the end of their useful lives.

This information is crucial for strategic planning and capital expenditure decisions. Companies can use this data to forecast when they will need to replace aging assets and allocate funds accordingly, potentially avoiding disruptions in operations.

Methods of Calculating Depreciation

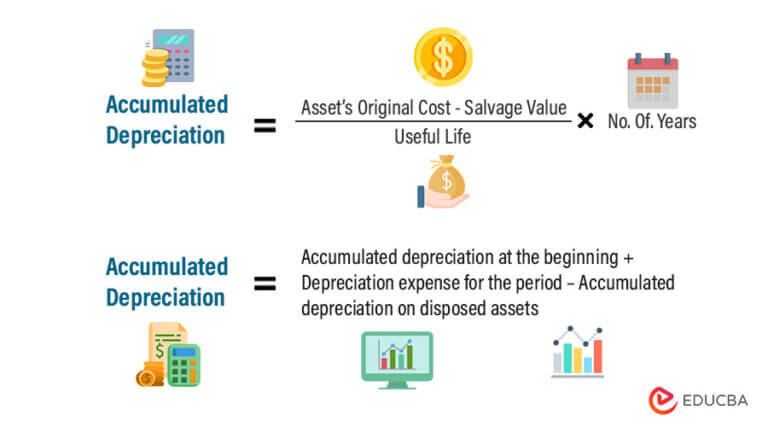

Several methods exist for calculating depreciation, each with its own implications for the accumulated depreciation balance. The most common methods include:

- Straight-Line Depreciation: This method allocates the cost of the asset evenly over its useful life.

- Declining Balance Depreciation: This accelerated method results in higher depreciation expense in the early years of an asset's life and lower expense later on.

- Units of Production Depreciation: This method bases depreciation on the actual use or output of the asset.

The choice of depreciation method can significantly affect the accumulated depreciation balance in any given period. Companies typically disclose their depreciation methods in the footnotes to their financial statements.

Limitations and Considerations

While informative, the accumulated depreciation balance isn't a perfect measure. It relies on estimates of an asset's useful life and salvage value, which are inherently subjective.

Technological advancements or unforeseen circumstances can also render an asset obsolete faster than anticipated, impacting its actual value and the accuracy of the accumulated depreciation balance.

Furthermore, different industries have different asset lifecycles and depreciation patterns. Comparing accumulated depreciation across companies in different sectors requires careful consideration of these factors.

Impact on Stakeholders

The accumulated depreciation balance affects various stakeholders, including investors, creditors, and management.

Investors use this information to assess the quality of a company's assets and its capital expenditure plans. Creditors rely on it to evaluate a company's ability to repay its debts. Management uses it for internal decision-making, such as budgeting and resource allocation.

“Understanding the balance in the accumulated depreciation account is essential for anyone analyzing a company's financial health,” said Dr. Emily Carter, a professor of accounting at the University of Chicago. “It provides valuable context for interpreting other financial metrics and assessing the long-term sustainability of the business."

Conclusion

The balance in the accumulated depreciation account is a critical component of financial reporting.

It reflects the wear and tear on a company's assets, impacts profitability, and informs capital expenditure planning. By understanding this seemingly simple number, stakeholders can gain valuable insights into a company's financial health and long-term prospects.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)