The Entry To Close The Expense Accounts Includes

The aroma of freshly brewed coffee filled the small accounting office, a familiar comfort against the backdrop of looming deadlines. Spreadsheets glowed on monitors, numbers swimming under the fluorescent lights as the team diligently worked to finalize the month's financial reports. A collective sigh of relief rippled through the room as the last few expense reports trickled in, signaling the final push to close the books.

At the heart of every successful financial reporting period lies a meticulous and often overlooked process: the closing of expense accounts. This article delves into the essential entries required to accurately and efficiently close expense accounts, ensuring financial transparency and compliance, and shedding light on its significance for organizations of all sizes.

Understanding Expense Accounts

Expense accounts are temporary accounts used to track the costs incurred by a business during a specific period. These accounts encompass a wide range of expenditures, including salaries, rent, utilities, marketing, and travel. Unlike asset, liability, or equity accounts, expense accounts are closed at the end of each accounting period.

The primary purpose of closing expense accounts is to transfer their balances to the income summary account. This process effectively resets the expense accounts to zero, ready to track expenses for the subsequent accounting period. It's a vital step in determining a company's profitability and ensuring accurate financial reporting.

The Closing Process: A Step-by-Step Guide

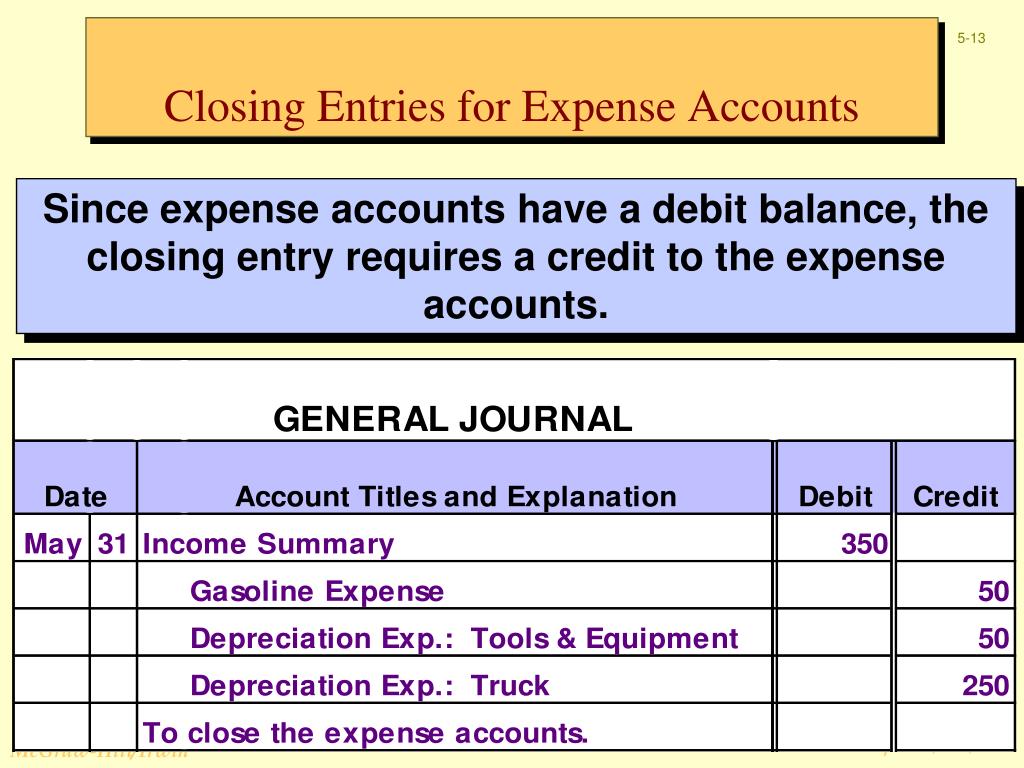

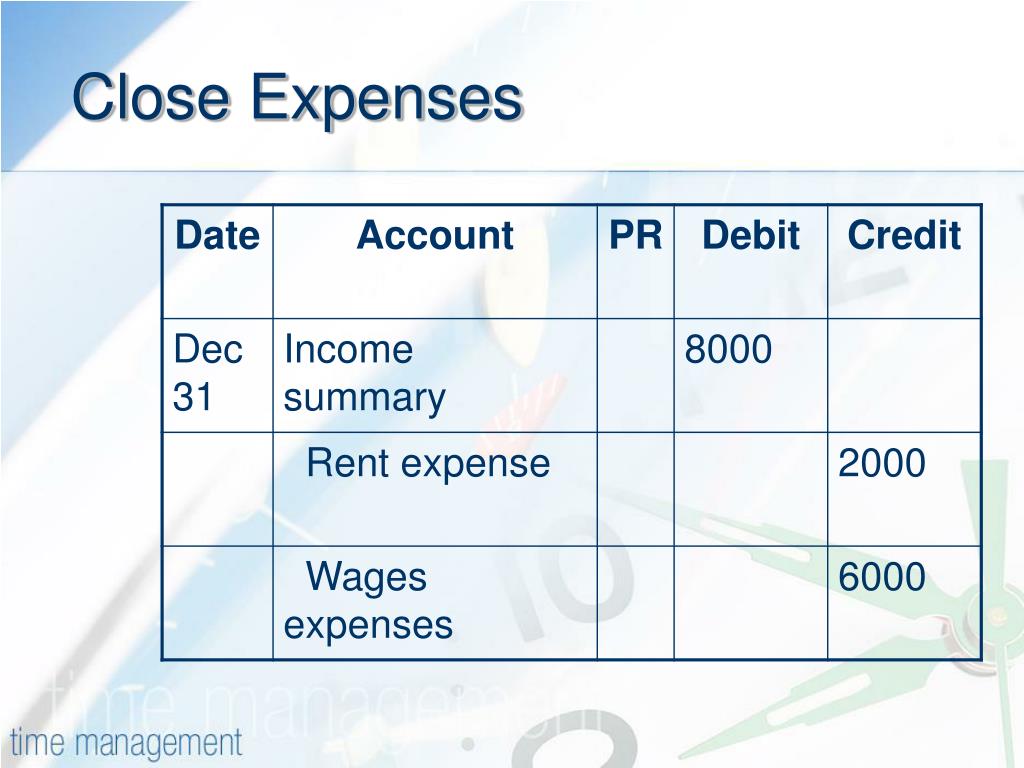

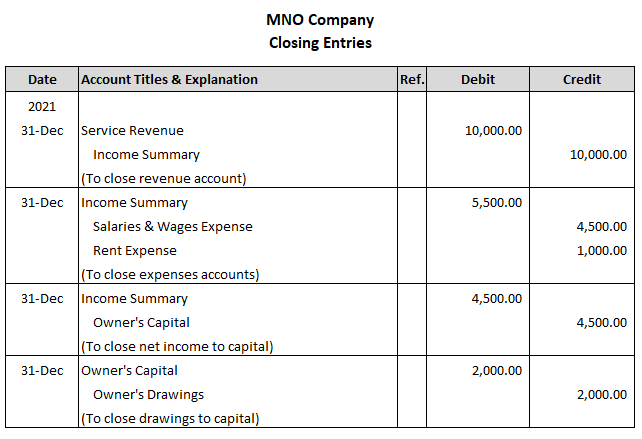

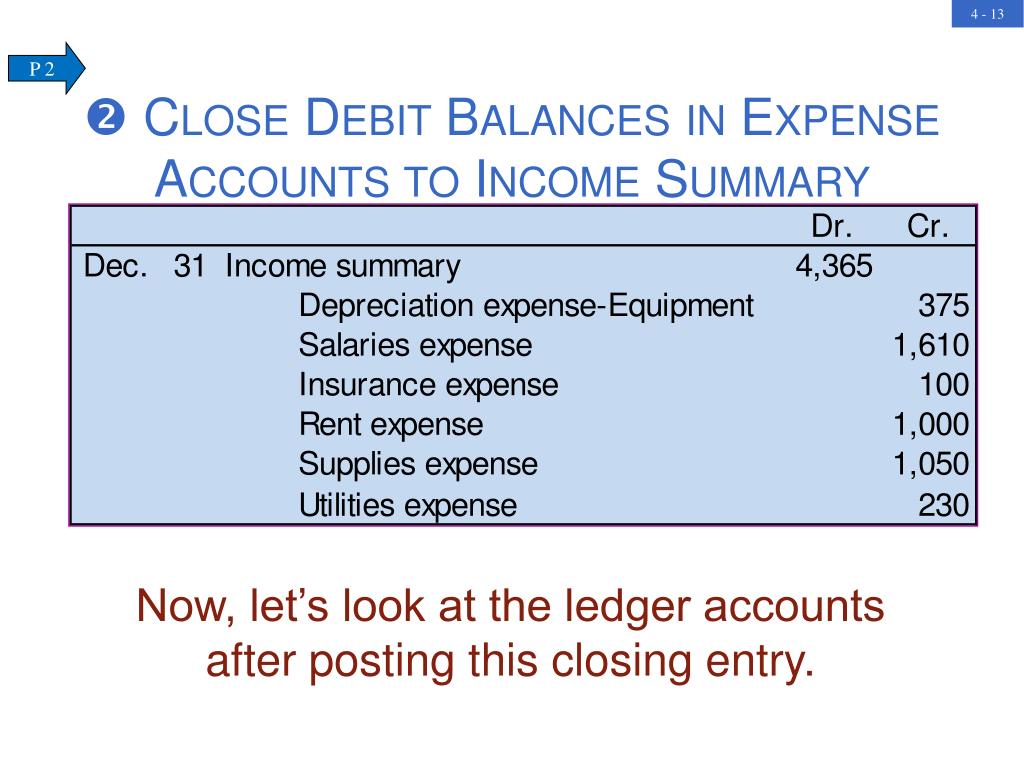

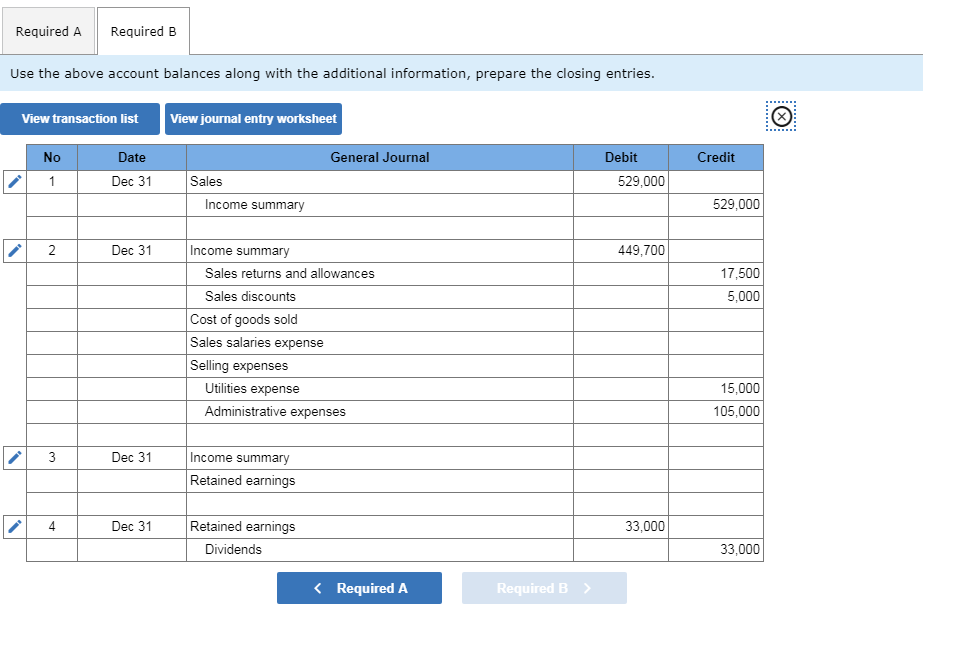

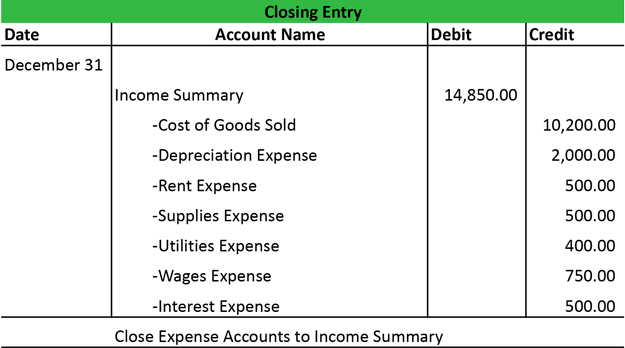

Closing expense accounts involves a series of journal entries designed to move the debit balances of these accounts to the credit side of the Income Summary account. Each step is crucial to maintain accuracy and balance in the general ledger. Here's a detailed breakdown of the process:

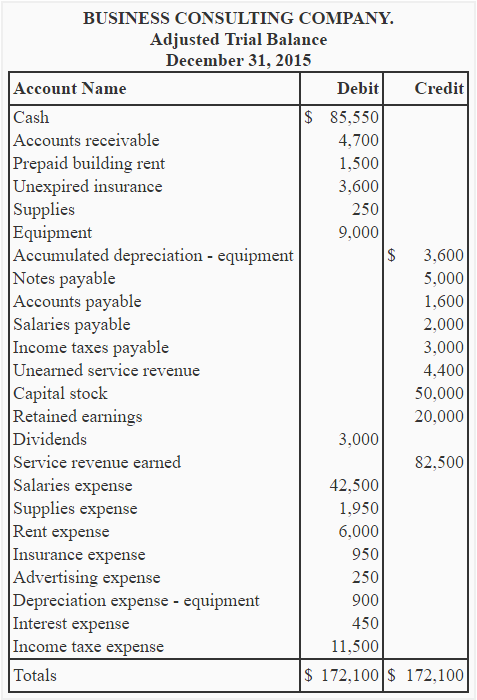

First, identify all expense accounts with debit balances. This information can be easily obtained from the trial balance, a report that lists all account balances at a specific point in time. This is the most important step.

The next step is to create a journal entry to close the expense accounts. This entry will debit the Income Summary account and credit each individual expense account.

For instance, if a company has $10,000 in Salaries Expense, $5,000 in Rent Expense, and $2,000 in Utilities Expense, the journal entry would look like this:

Debit: Income Summary - $17,000

Credit: Salaries Expense - $10,000

Credit: Rent Expense - $5,000

Credit: Utilities Expense - $2,000

After posting the journal entry to the general ledger, the expense accounts will have zero balances. The $17,000 debit to the Income Summary account will reflect the total expenses incurred during the period.

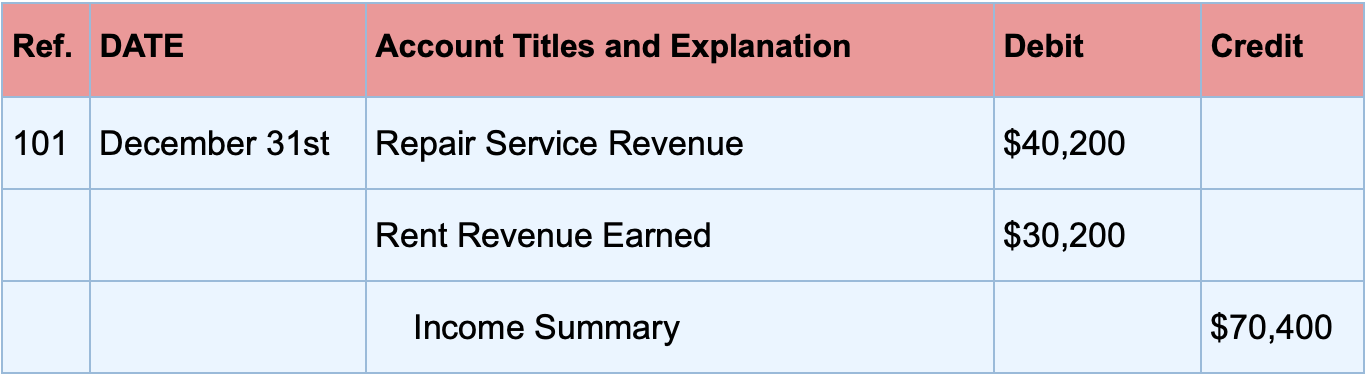

Closing the expense accounts is part of a larger closing process that also includes closing revenue accounts. After closing both revenue and expense accounts, the balance of the Income Summary account represents the company's net income or net loss for the period.

This balance is then transferred to the retained earnings account, which is a permanent equity account that accumulates the company's profits over time. The entry to close income summary looks like this:

Debit: Income Summary

Credit: Retained Earnings

The Importance of Accuracy and Timeliness

Accuracy and timeliness are paramount when closing expense accounts. Errors in the closing process can lead to inaccurate financial statements, which can have serious consequences for a business. Inaccurate statements affect the company's financial performance.

Investors, creditors, and other stakeholders rely on financial statements to make informed decisions. Misleading information can damage a company's reputation and erode trust. Ensuring that the expense accounts are closed correctly and on time is thus critical for maintaining the integrity of financial reporting.

Timely closing of expense accounts is equally important. Delayed financial reporting can hinder decision-making and create operational inefficiencies. A common source of inefficiency is delay in expense reporting submission.

Businesses need up-to-date financial information to assess their performance, identify trends, and make strategic adjustments. Implementing efficient closing procedures and adhering to established deadlines can help ensure that financial information is available when it is needed most.

Tools and Technologies for Efficient Expense Management

Fortunately, businesses have access to a wide range of tools and technologies that can streamline the expense management process. These tools can automate many of the manual tasks associated with expense tracking and reporting, reducing the risk of errors and improving efficiency. These tools improve the processing.

Expense management software, for example, can automate the expense reporting process. Employees can easily submit expense reports online, and managers can approve them with just a few clicks. The software can also automatically generate journal entries for closing expense accounts, saving time and effort.

Cloud-based accounting systems offer even more comprehensive expense management capabilities. These systems integrate with other business applications, such as CRM and ERP systems, providing a holistic view of financial data. This integration enables businesses to track expenses in real-time and generate reports on demand.

According to a report by Deloitte, companies that leverage technology for expense management experience significant cost savings and improved compliance. The report found that automation can reduce the time spent on expense reporting by as much as 50%.

Best Practices for Closing Expense Accounts

To ensure accuracy and efficiency when closing expense accounts, businesses should follow a set of best practices. These practices can help minimize errors, improve compliance, and streamline the closing process. It ensures a smooth process.

First, establish clear expense policies and procedures. Employees should be aware of the types of expenses that are reimbursable, the documentation required for expense reports, and the deadlines for submitting expense reports. A good policy always helps.

Second, implement a robust expense tracking system. This system should be able to track all expenses, regardless of how they are incurred. The system should also be able to generate reports that can be used to analyze spending patterns and identify areas for cost savings.

Third, reconcile expense accounts regularly. This process involves comparing the balances in the expense accounts to supporting documentation, such as receipts and invoices. Regular reconciliation can help identify errors and prevent fraud.

Fourth, document all closing procedures. This documentation should include step-by-step instructions on how to close expense accounts, as well as a checklist of tasks that need to be completed. Proper documentation is crucial.

Finally, train employees on expense management best practices. This training should cover topics such as expense policies, expense reporting procedures, and the importance of accuracy and timeliness.

The Human Element: Overcoming Challenges

While technology and best practices can significantly improve the expense management process, the human element remains crucial. Employees play a vital role in ensuring that expense reports are accurate and complete. This ensures proper reporting and documentation.

One of the biggest challenges in expense management is getting employees to submit expense reports on time. Many employees procrastinate or forget to submit their reports, which can delay the closing process. This issue can affect overall efficiency.

To address this challenge, businesses can implement a system of reminders and incentives. Sending automated reminders to employees who have outstanding expense reports can help encourage timely submissions. Offering incentives, such as gift cards or extra vacation days, can also motivate employees to submit their reports on time.

Another challenge is ensuring that expense reports are accurate. Employees may unintentionally or deliberately misreport expenses, which can lead to inaccurate financial statements. It causes problems in the balance sheets.

To prevent this, businesses can implement a system of checks and balances. Managers should review expense reports carefully to ensure that they are reasonable and supported by appropriate documentation. Audits can also be conducted to identify any irregularities.

Moreover, fostering a culture of transparency and accountability can help encourage employees to be honest and accurate when reporting expenses. When employees feel valued and respected, they are more likely to act ethically and responsibly.

Conclusion

Closing expense accounts is a critical process for businesses of all sizes. By understanding the essential entries required to close expense accounts and following best practices, businesses can ensure financial accuracy, compliance, and efficiency. With the right tools, processes, and a focus on the human element, organizations can transform expense management from a tedious task into a strategic advantage.

As the accounting team finished their work, a sense of accomplishment permeated the office. The spreadsheets were closed, the reports were generated, and the financial picture for the month was clear. While the aroma of coffee had faded, the team knew that they'd laid the foundation for sound financial decision-making in the days and months to come.