The Statement Of Cash Flows Is Not Useful For

Imagine peering into a crystal ball, trying to foresee the future of a company. Balance sheets and income statements are often the go-to tools, offering a snapshot of assets, liabilities, and profitability. But what about the Statement of Cash Flows? Is it always the insightful guide we believe it to be, or are there times when its usefulness wanes, leaving us to navigate by other financial stars?

The Statement of Cash Flows, while a crucial financial document, isn't a universal panacea. Its limitations arise when assessing certain aspects of a company's financial health, particularly long-term profitability, future investment potential reliant on non-cash activities, and granular operational efficiency hidden by aggregated data. Understanding these limitations is key to a balanced financial analysis.

The Allure and Purpose of the Cash Flow Statement

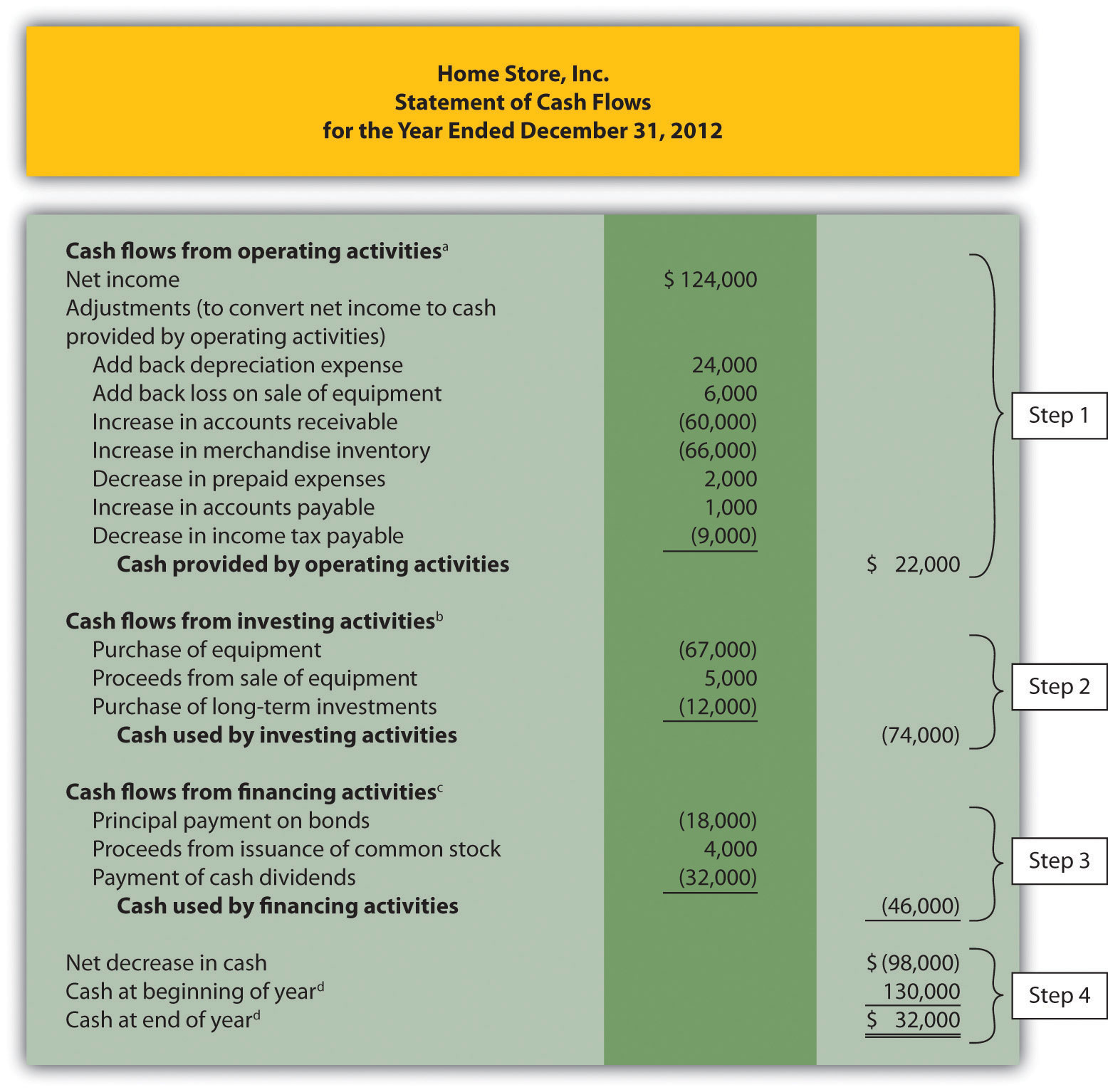

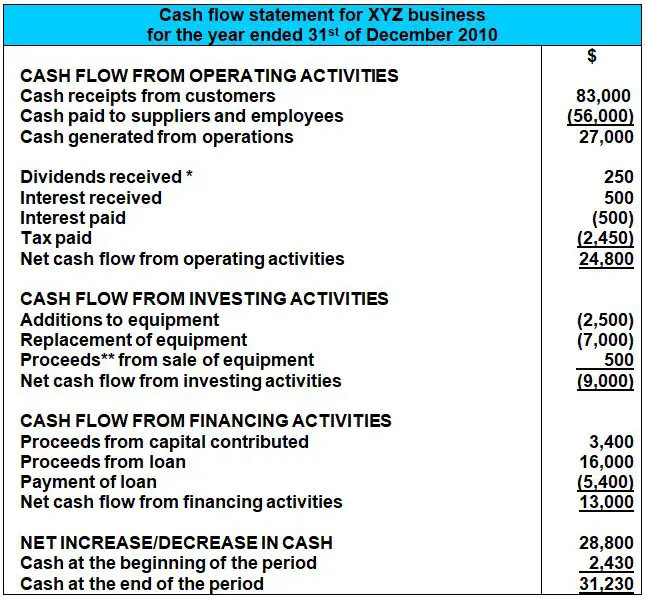

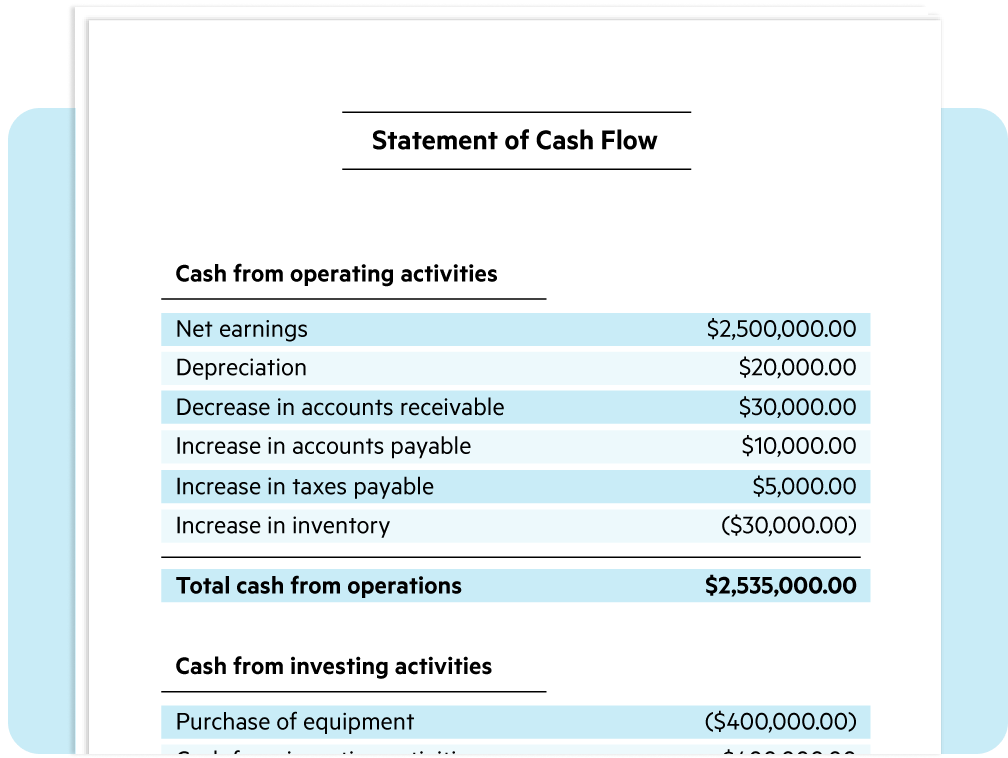

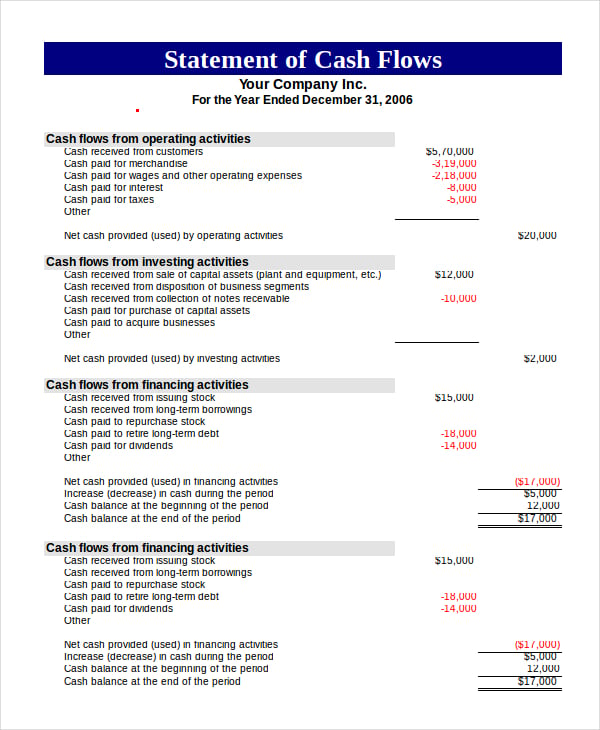

The Statement of Cash Flows reports on the movement of cash both into and out of a company during a specific period.

It categorizes these flows into three main activities: operating, investing, and financing.

Operating activities reflect the cash generated from the company's core business operations; investing activities involve the purchase and sale of long-term assets; and financing activities relate to how the company funds its operations through debt and equity.

It offers a tangible view of a company's ability to generate cash, pay its bills, and fund its investments.

Situations Where the Statement of Cash Flows Falls Short

Despite its importance, the Statement of Cash Flows isn't always the most helpful tool for every financial assessment.

1. Gauging Long-Term Profitability

While the Statement of Cash Flows showcases a company's short-term liquidity, it doesn't directly translate into long-term profitability.

A company might have strong cash flows today but could be facing declining sales or increasing costs in the future that the statement does not explicitly capture.

For example, a company could aggressively sell off assets to boost its short-term cash position, but this strategy isn't sustainable and wouldn't necessarily indicate a healthy, growing business.

"Cash flow is king, but profit is queen." - Unknown financial saying.

2. Evaluating Non-Cash Investing and Financing Activities

The Statement of Cash Flows primarily focuses on actual cash transactions.

Important non-cash activities, such as exchanging stock for assets or converting debt to equity, are disclosed in the notes to the financial statements but are not reflected in the main body of the report.

These transactions, although not involving immediate cash flows, can significantly impact a company's financial position and future investment potential, but are often overlooked when relying solely on the cash flow statement.

Consider a startup company that obtains equipment through a stock swap rather than cash; the Statement of Cash Flows would only indirectly reflect this major capital expenditure through depreciation expenses over time.

3. Assessing Operational Efficiency in Detail

The aggregated nature of the Statement of Cash Flows can mask inefficiencies within specific operational areas.

While it shows the overall cash generated from operations, it doesn't provide a granular breakdown of how efficiently each department or product line is performing.

For instance, a company might have a positive net cash flow from operations, but a closer look at internal reports might reveal that a significant portion of this cash comes from just one product line, while others are operating at a loss, but this level of detail is too granular for the statement of cash flow.

4. Comparing Companies with Different Accounting Methods

The flexibility in accounting methods, particularly regarding depreciation and inventory valuation, can make it difficult to compare the Statement of Cash Flows of different companies.

Companies using different depreciation methods (e.g., straight-line vs. accelerated) will report different depreciation expenses, impacting their net income and, consequently, their cash flows from operations.

Similarly, the choice of inventory valuation method (e.g., FIFO vs. LIFO) can affect the cost of goods sold and the resulting cash flows.

This variability makes direct comparisons of cash flows between companies less reliable without a thorough understanding of their accounting policies.

5. Predicting Future Cash Flows with Complete Accuracy

While the Statement of Cash Flows offers insights into past cash movements, it's not a foolproof predictor of future cash flows.

External factors, such as changes in economic conditions, shifts in consumer demand, and competitive pressures, can significantly impact a company's future cash generation abilities.

Relying solely on historical cash flow data to forecast future performance can be misleading without considering these dynamic external influences.

Many financial analysts use cash flow statement data with forecasting models to arrive at potential future cash flow. It's important to remember that these forecasts are only as good as the assumptions made to construct them.

Navigating the Financial Landscape: A Holistic Approach

Recognizing the limitations of the Statement of Cash Flows encourages a more comprehensive approach to financial analysis.

It should be used in conjunction with other financial statements, such as the balance sheet and income statement, to gain a well-rounded understanding of a company's financial health.

Analyzing financial ratios, such as profitability ratios, liquidity ratios, and solvency ratios, can provide additional insights into a company's performance and financial stability that are not immediately apparent from the cash flow statement alone.

Furthermore, considering qualitative factors, such as the company's management team, competitive landscape, and industry trends, can help to provide important context for the quantitative data presented in the financial statements.

The Enduring Value of Context and Critical Thinking

The Statement of Cash Flows is a valuable tool, but it's not a crystal ball.

By understanding its limitations and using it in conjunction with other sources of information, we can gain a more accurate and nuanced understanding of a company's financial health.

The most effective financial analysis requires a blend of quantitative data, qualitative insights, and critical thinking, empowering us to make informed decisions and navigate the complex world of finance with confidence.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)