The Two Basic Sources Of Stockholders Equity Are

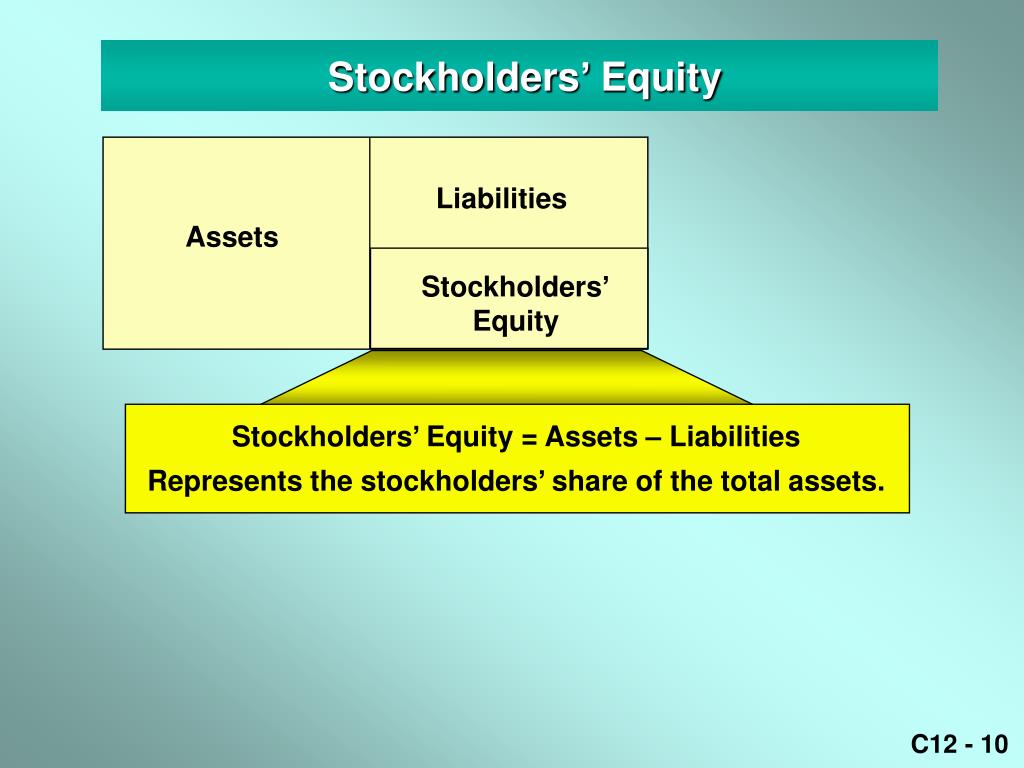

The financial health of any corporation hinges on a clear understanding of its stockholders' equity. This represents the owners' stake in the company, essentially what would be left for them if all assets were sold and debts paid. Two primary sources fuel this vital component of the balance sheet, shaping a company's growth trajectory and its ability to reward investors.

Understanding these sources is crucial for investors, creditors, and company management alike. A company's stockholders' equity, also referred to as net worth, is the residual interest in the assets of an entity that remains after deducting its liabilities. This article delves into the two fundamental components that constitute stockholders' equity: contributed capital and retained earnings, exploring their individual characteristics, significance, and their combined impact on a company's overall financial position. We'll examine how these elements reflect the company's capital raising efforts and its profitability, providing a comprehensive overview for those seeking to decipher the financial story of any publicly traded or privately held business.

Contributed Capital: Investing in Ownership

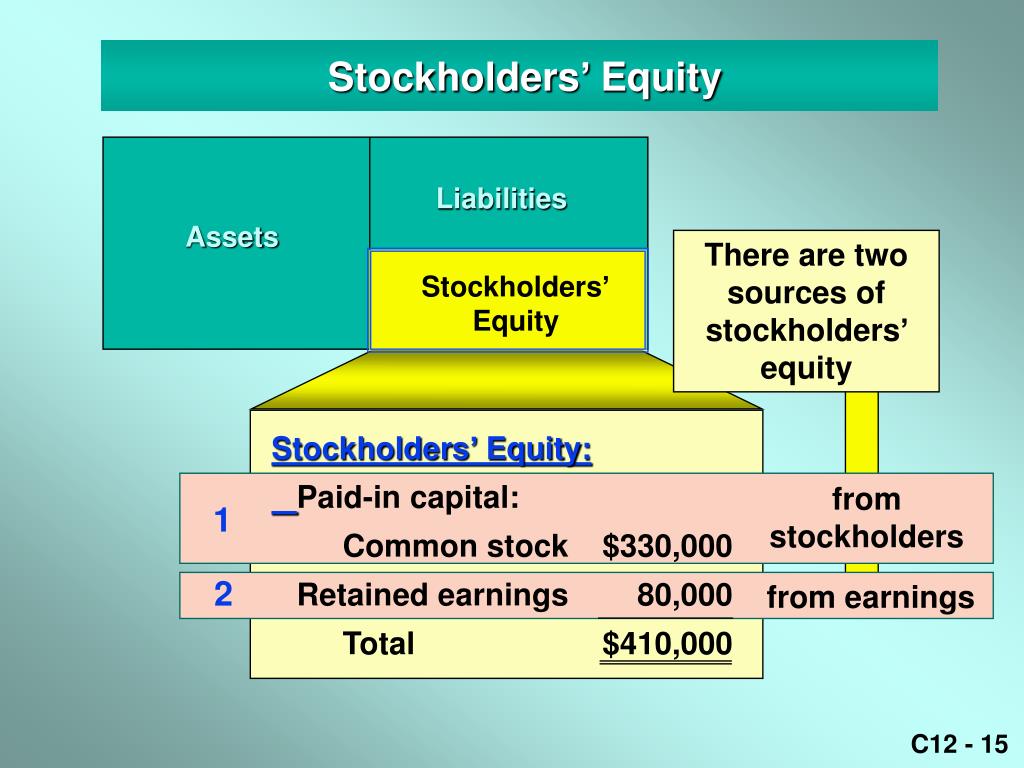

Contributed capital, also known as paid-in capital, reflects the total amount of money or other assets that shareholders have invested directly into the company in exchange for stock. This is the initial and ongoing funding source provided by investors seeking a return on their capital. It represents a direct injection of resources that fuels the company's operations and expansion.

The most common form of contributed capital arises from the issuance of common stock. Investors purchase shares of common stock, providing the company with cash in exchange for ownership rights. These rights typically include voting rights in corporate governance and the potential to receive dividends.

Another type of contributed capital stems from the issuance of preferred stock. Preferred stock often carries different rights and privileges compared to common stock. For instance, preferred shareholders may have priority over common shareholders in receiving dividends and in the event of liquidation.

Beyond the face value of the stock, additional contributed capital can arise from additional paid-in capital (APIC). This occurs when stock is sold at a price exceeding its par value. The difference between the market price and the par value is recorded as APIC, reflecting the premium investors are willing to pay for the company's shares.

According to the Securities and Exchange Commission (SEC), all issuances of stock must be properly documented and accounted for, ensuring transparency for investors. The contributed capital section of the stockholders' equity statement provides a clear picture of how much external funding the company has secured through equity offerings.

Retained Earnings: Profitability and Reinvestment

Retained earnings represent the accumulated profits that a company has earned over its lifetime, minus any dividends paid out to shareholders. This component reflects the company's ability to generate profits and reinvest them back into the business. It's a crucial indicator of a company's long-term financial performance and sustainability.

Each year, a portion of the company's net income is added to the retained earnings balance. The formula is simple: Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings. This ongoing accumulation reflects the company's growing profitability and its commitment to building value for shareholders.

Dividends represent a distribution of profits to shareholders. While dividends provide a tangible return to investors, they also reduce the amount of retained earnings available for reinvestment. A company's dividend policy reflects its balance between rewarding shareholders in the short term and funding future growth.

Retained earnings can be used for a variety of purposes, including funding research and development, expanding operations, acquiring other companies, or paying down debt. The strategic allocation of retained earnings is a critical management decision that can significantly impact the company's future performance.

A large and growing retained earnings balance typically signals a healthy and profitable company. This attracts investors and creditors, enhancing the company's financial flexibility and its ability to pursue strategic opportunities. However, an excessively large retained earnings balance may also raise questions about the company's efficiency in deploying its capital.

The Interplay: A Holistic View

Contributed capital and retained earnings work in tandem to shape a company's stockholders' equity. Contributed capital provides the initial and ongoing funding necessary to operate and grow the business, while retained earnings represent the accumulated profits generated from those investments. Together, they paint a comprehensive picture of the company's financial strength and its ability to create value for shareholders.

A company with a strong base of contributed capital and a track record of generating significant retained earnings is typically viewed favorably by investors and creditors. This signals financial stability, growth potential, and the ability to withstand economic downturns. The balance between the two can provide insight to how reliant a business is on external vs internal funding.

Conversely, a company with limited contributed capital and a small or negative retained earnings balance may be viewed as financially vulnerable. This could raise concerns about its ability to fund its operations, repay its debts, and deliver returns to shareholders. Ultimately the trend and rate of change of the two in relation to each other provide valuable insights.

Analyzing the trends in contributed capital and retained earnings over time can provide valuable insights into a company's financial health and its management's strategic decisions. It allows investors and analysts to better understand a company's ability to create shareholder value.

Looking Ahead: The Future of Stockholders' Equity

The landscape of stockholders' equity is constantly evolving, influenced by factors such as changing accounting standards, regulatory requirements, and the increasing complexity of corporate finance. As businesses navigate new challenges and opportunities, a deep understanding of the two basic sources of stockholders' equity remains essential for all stakeholders.

Companies are under increasing pressure to enhance transparency and provide more detailed disclosures about their stockholders' equity. This includes providing a clear breakdown of the different components of contributed capital and retained earnings, as well as explaining the factors that are driving changes in these balances.

The ability to effectively manage and grow stockholders' equity will continue to be a key determinant of corporate success in the years to come. Companies that can attract capital, generate profits, and reinvest them wisely will be best positioned to create long-term value for their shareholders and other stakeholders.

.jpg)