The Underlying Rules Of Accounting In The Us Are Called

The integrity of financial reporting in the United States hinges on a complex and often overlooked set of principles. These principles dictate how companies record, summarize, and present their financial information, forming the bedrock of investor confidence and economic stability. But what exactly are these underlying rules, and why are they so critical?

The foundation of accounting in the U.S. rests upon what is known as Generally Accepted Accounting Principles (GAAP). These principles, a complex and evolving framework, aren't just arbitrary rules; they are the culmination of decades of debate, practical experience, and the constant need to adapt to a changing economic landscape. Understanding GAAP is crucial for anyone involved in finance, from seasoned investors to small business owners, and its influence extends far beyond the balance sheet, impacting investment decisions, regulatory oversight, and the overall health of the economy.

The Genesis of GAAP

GAAP didn't emerge overnight. Its development has been a gradual process, driven by the need to standardize accounting practices and ensure transparency. Initially, accounting practices were largely dictated by industry customs and individual preferences, leading to inconsistencies and a lack of comparability between financial statements.

The drive for standardization gained momentum in the early 20th century, fueled by the increasing complexity of business and the growing need for reliable financial information. Various professional organizations, including the American Institute of Certified Public Accountants (AICPA), played a crucial role in developing early accounting standards.

The Role of the FASB

The modern era of GAAP truly began with the establishment of the Financial Accounting Standards Board (FASB) in 1973. The FASB is an independent, private-sector organization with the primary responsibility for setting accounting standards in the United States.

Unlike its predecessors, the FASB has a more formal and transparent standard-setting process. This process involves extensive research, public comment periods, and careful consideration of the potential impact of new standards on businesses and investors.

The FASB's mission is to improve financial accounting and reporting standards by providing useful information to investors and other users of financial statements. Their work is essential for maintaining confidence in the U.S. capital markets.

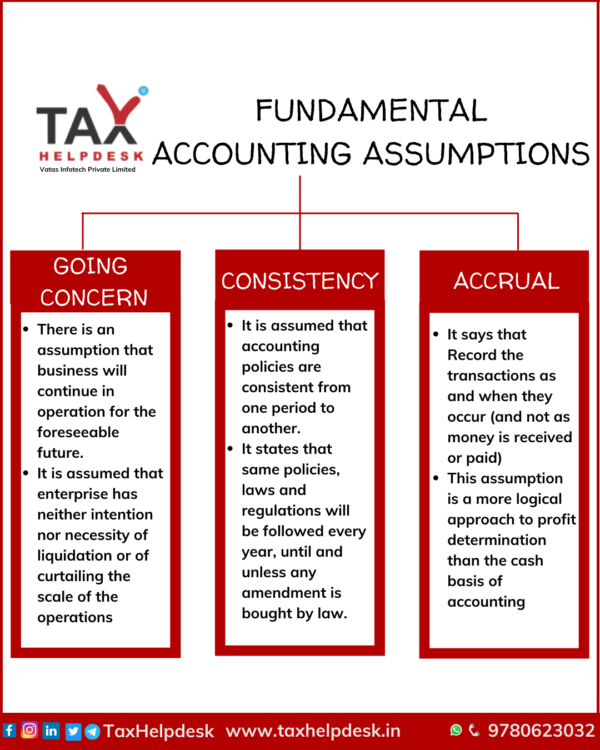

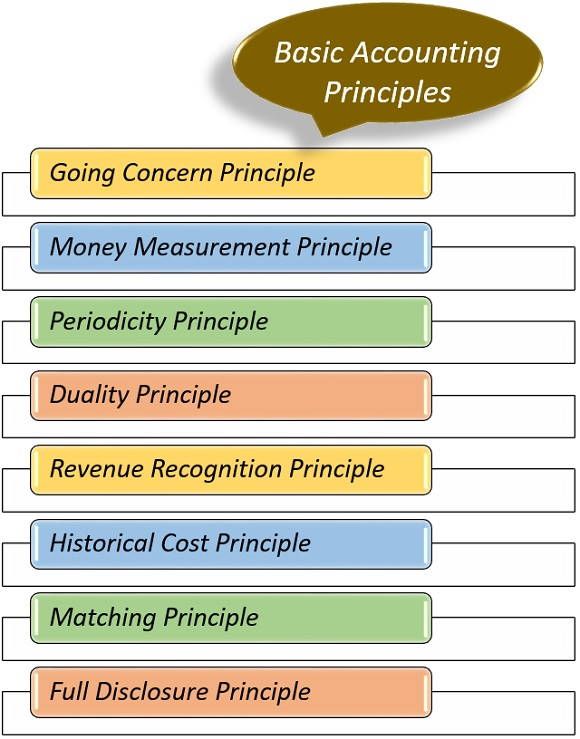

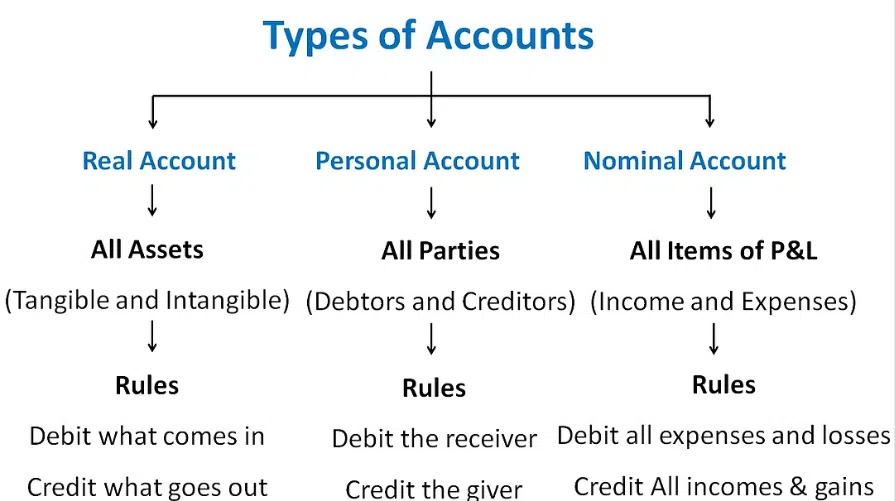

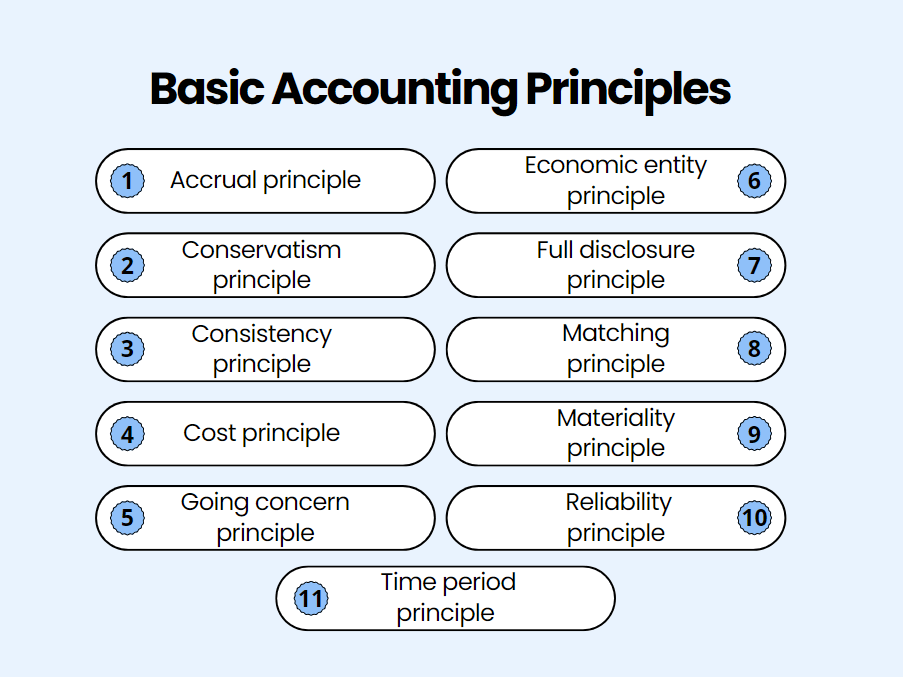

Key Principles Underlying GAAP

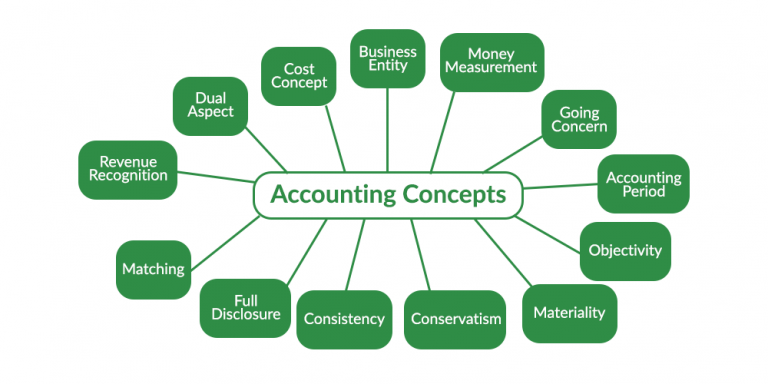

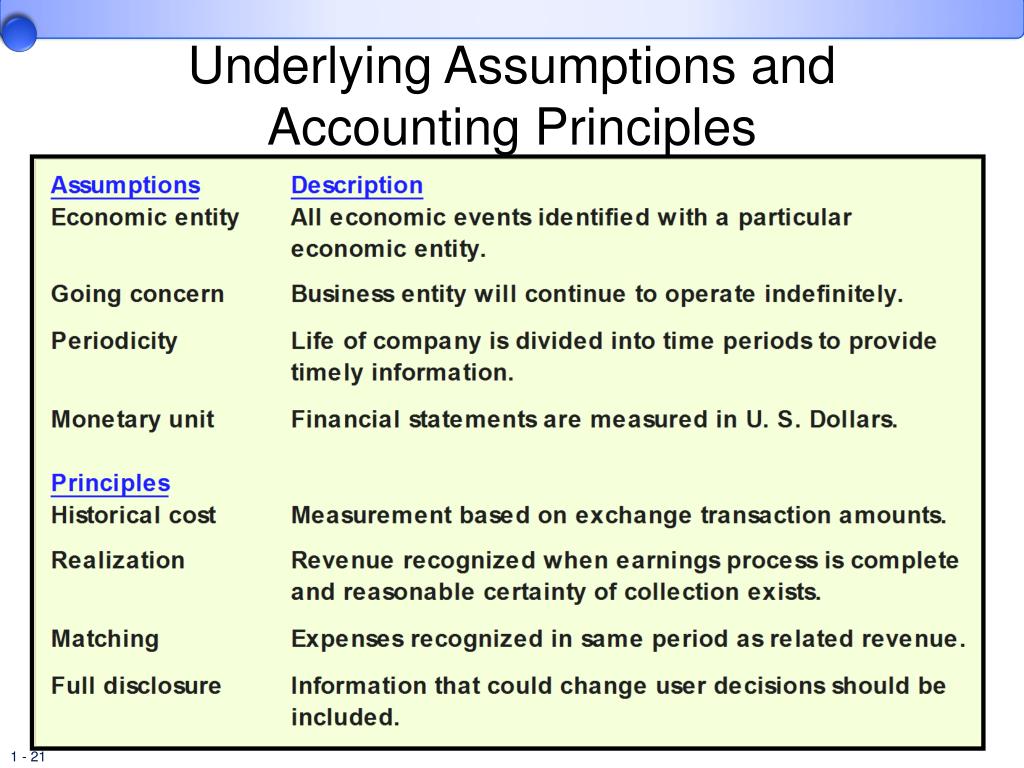

GAAP encompasses a wide range of specific rules and guidelines, but several core principles underpin the entire framework. These principles provide a foundation for consistent and reliable financial reporting.

The historical cost principle dictates that assets should be recorded at their original cost, rather than their current market value. While this principle can sometimes be criticized for not reflecting current economic realities, it provides a more objective and verifiable measure of value.

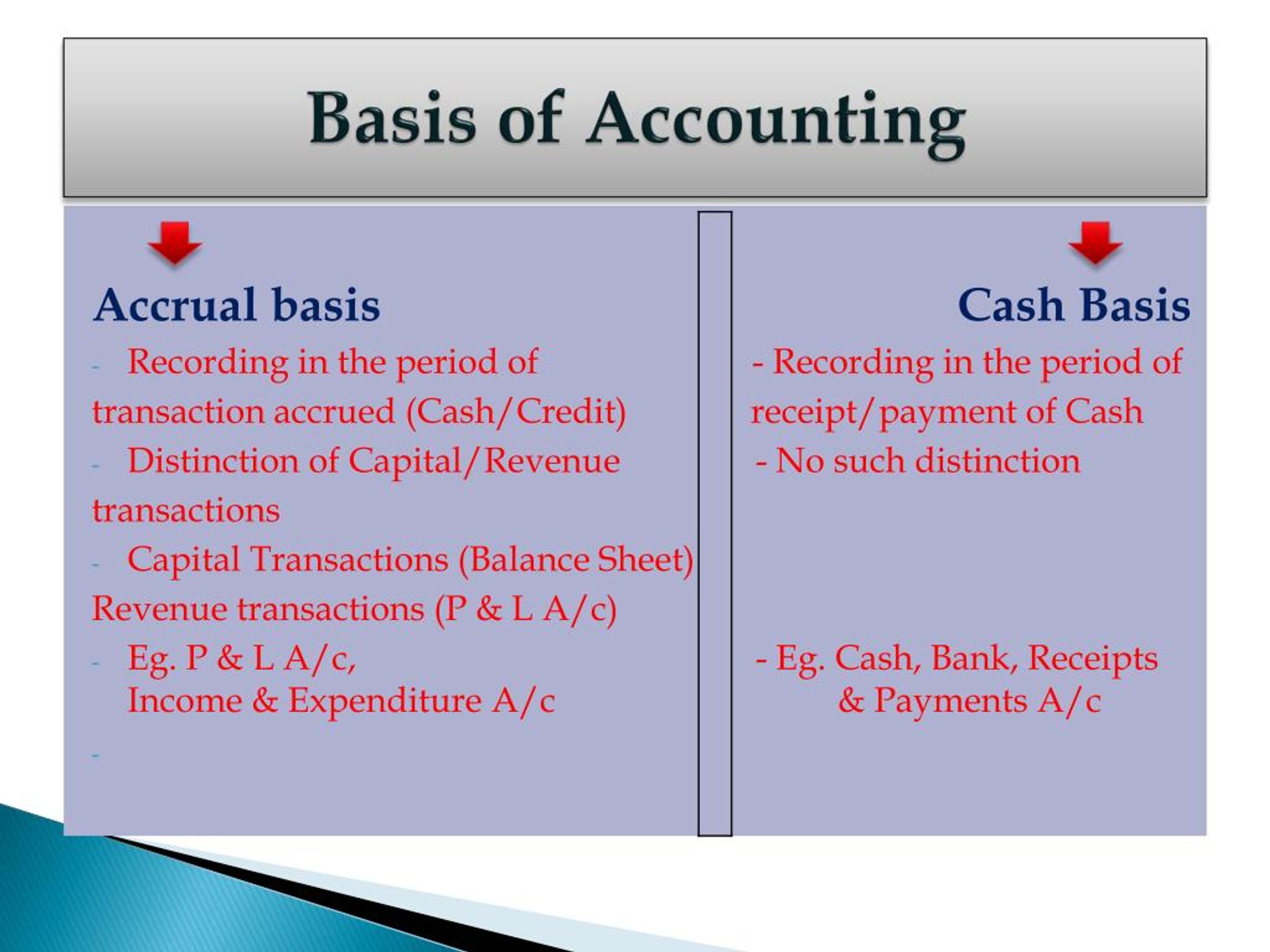

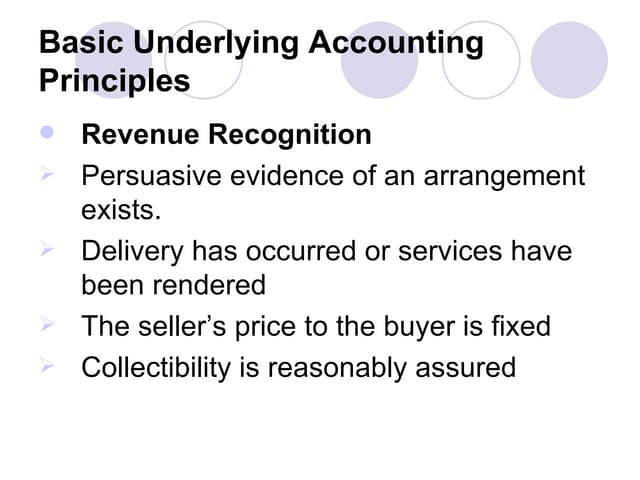

The revenue recognition principle outlines when revenue should be recognized in the financial statements. Generally, revenue is recognized when it is earned and realized or realizable, regardless of when cash is received.

The matching principle requires that expenses be matched with the revenues they help generate. This principle ensures that the costs associated with earning revenue are recognized in the same accounting period.

The full disclosure principle mandates that companies disclose all relevant information that could affect investors' decisions. This includes information about significant accounting policies, contingent liabilities, and other important events.

The Codification and its Impact

Prior to 2009, GAAP was scattered across numerous pronouncements and interpretations, making it difficult for accountants to navigate and apply. To address this issue, the FASB undertook a major project to codify GAAP into a single, authoritative source.

The FASB Accounting Standards Codification (ASC) became the single source of authoritative GAAP in the United States. This consolidation has made it easier for accountants to research and apply GAAP, improving the consistency and comparability of financial reporting.

The Codification is continuously updated to reflect new accounting standards and interpretations. It represents a significant achievement in the ongoing effort to improve the clarity and usability of GAAP.

Criticisms and Challenges Facing GAAP

Despite its importance, GAAP is not without its critics. Some argue that it is too complex and rules-based, hindering innovation and adding unnecessary costs for businesses.

Others argue that GAAP is not always effective in preventing financial fraud or capturing the true economic substance of transactions. The focus on historical cost, for example, can be misleading in times of rapid inflation or deflation.

The rise of international financial reporting standards (IFRS) also poses a challenge to GAAP. While the U.S. has not fully adopted IFRS, there is ongoing debate about the potential benefits and costs of convergence.

The Future of Accounting Standards

The accounting landscape is constantly evolving, driven by technological advancements, globalization, and changing business models. The FASB must continue to adapt GAAP to meet these challenges and ensure that financial reporting remains relevant and reliable.

Areas of focus for the future include improving the accounting for intangible assets, addressing the challenges of digital assets like cryptocurrencies, and enhancing the disclosures related to environmental, social, and governance (ESG) factors. These factors are increasingly important to investors and other stakeholders.

The ongoing debate about GAAP versus IFRS is also likely to continue. While full convergence may not be feasible, greater cooperation and harmonization between the two sets of standards would benefit global investors and businesses.

Ultimately, the strength of the U.S. economy depends on the integrity and transparency of its financial reporting system. GAAP, as the foundation of that system, must continue to evolve to meet the challenges of the future and maintain investor confidence.