Three Major Forms Of Business Ownership

Imagine you're at a crossroads, a thrilling yet daunting moment. You've got a brilliant business idea bubbling in your mind, a concept that could revolutionize the way people think about… well, anything! But before you leap, a fundamental question arises: how will you structure this venture? Will it be a solo flight, a partnership with trusted allies, or something more structured?

Understanding the different forms of business ownership is crucial for any aspiring entrepreneur. This decision impacts everything from personal liability and taxation to management structure and fundraising capabilities. Let's explore three major types of business ownership: sole proprietorships, partnerships, and corporations, highlighting their key features, benefits, and drawbacks.

Sole Proprietorship: The Independent Spirit

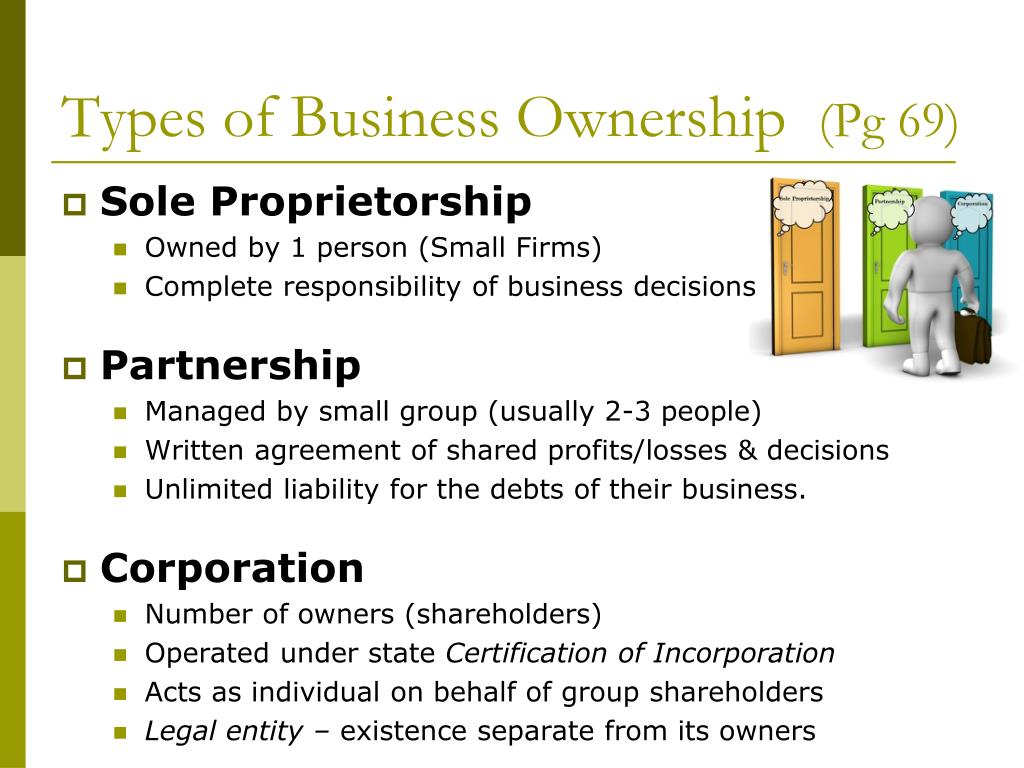

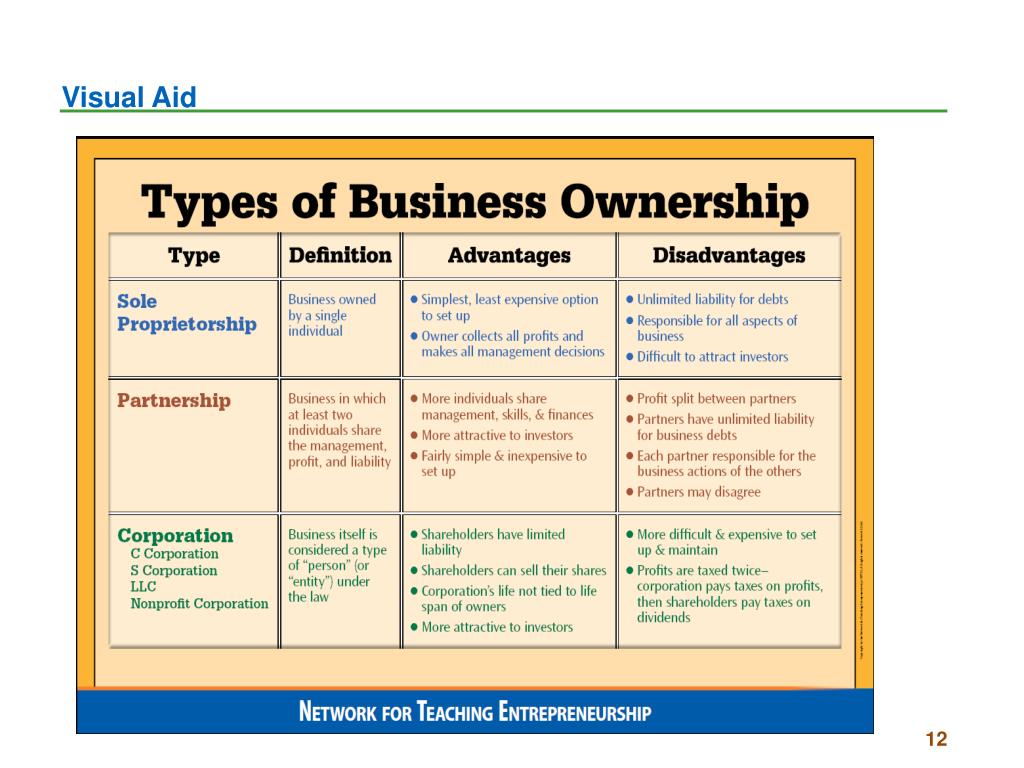

The sole proprietorship is often the simplest and most direct path to business ownership. Think of the local artisan selling handmade crafts, or the freelance writer crafting compelling narratives – often, they're operating as sole proprietors.

This structure means you, as the individual, are the business. There's no legal distinction between you and your company.

Key Features:

Simplest to set up, minimal paperwork. Direct control and decision-making. All profits flow directly to the owner.

The biggest advantage is its simplicity; setting up a sole proprietorship often involves minimal paperwork and costs. You have complete control over your business decisions, and all profits belong solely to you.

However, the primary drawback is unlimited liability. This means you're personally responsible for all business debts and obligations. Your personal assets are at risk if the business incurs debt or faces lawsuits.

According to the Small Business Administration (SBA), a significant percentage of small businesses start as sole proprietorships due to their ease of formation.

Partnership: Strength in Numbers

A partnership arises when two or more individuals agree to share in the profits or losses of a business. Think of a law firm, an accounting practice, or even a local bakery run by a group of friends.

Partnerships can leverage the diverse skills, expertise, and capital of multiple individuals.

Key Features:

Shared resources and expertise. Relatively easy to establish (though a written agreement is crucial!). Potential for greater capital infusion.

Partners can pool their resources, share responsibilities, and bring complementary skills to the table. A well-defined partnership agreement, outlining each partner's roles, responsibilities, and profit-sharing arrangements, is absolutely essential to avoid future disputes.

Like sole proprietorships, partnerships generally have pass-through taxation, meaning profits are taxed at the individual partner level, avoiding double taxation. However, partners typically face unlimited liability, meaning each partner can be held responsible for the business debts of the partnership, even if they were not directly involved.

There are variations, such as limited partnerships, where some partners have limited liability, but these usually come with restrictions on management involvement.

Corporation: A Separate Legal Entity

A corporation is a more complex business structure, legally separate from its owners (the shareholders). Think of large, established companies like Amazon, Apple, or even your local bank.

This separation provides significant advantages, but also involves more regulatory oversight and administrative burden.

Key Features:

Limited liability for shareholders. Easier to raise capital through the sale of stock. Potential for perpetual existence.

The key benefit of a corporation is limited liability. Shareholders are not personally responsible for the corporation's debts and obligations, protecting their personal assets. Corporations can also raise capital more easily by selling stock to investors.

However, corporations face more complex regulations and administrative requirements, including corporate taxes. A significant drawback of traditional corporations (C corporations) is double taxation: the corporation pays taxes on its profits, and then shareholders pay taxes on dividends they receive.

There are alternatives like S corporations, which offer pass-through taxation similar to partnerships, but with some eligibility restrictions.

According to data from the IRS, while corporations represent a smaller percentage of the total number of businesses compared to sole proprietorships and partnerships, they account for a significantly larger share of overall business revenue.

Choosing the Right Path

Selecting the appropriate business structure is a critical decision that requires careful consideration. There's no one-size-fits-all answer; the best choice depends on your individual circumstances, goals, and risk tolerance. You may want to consult with legal and financial professionals to get personalized advice.

Whether you envision yourself as a solo entrepreneur, a collaborating partner, or the head of a growing corporation, understanding these fundamental business structures is the first step toward turning your dream into a successful reality.