Topline Federal Credit Union Brooklyn Park Mn

In a rapidly evolving financial landscape, TopLine Federal Credit Union, a fixture in Brooklyn Park, Minnesota, finds itself navigating a complex set of challenges and opportunities. From adapting to technological advancements to addressing community needs and maintaining a competitive edge, the credit union's strategic decisions are under increased scrutiny. The future of TopLine hinges on its ability to balance growth, innovation, and member satisfaction within an increasingly competitive market.

This article delves into the current state of TopLine Federal Credit Union in Brooklyn Park. We explore its recent initiatives, financial performance, community involvement, and the perspectives of its members and industry analysts. The aim is to provide a comprehensive overview of TopLine's position and outlook as it charts its course forward.

Financial Performance and Growth

TopLine Federal Credit Union has demonstrated consistent growth in recent years. This growth is based on publicly available data and statements from the credit union itself.

Assets have steadily increased, reflecting the credit union's ability to attract and retain members, along with their savings. Loan portfolios have also expanded, indicating active participation in the local economy.

However, like all financial institutions, TopLine faces challenges from fluctuating interest rates and economic uncertainty. Maintaining profitability while offering competitive rates to members is a delicate balancing act.

The credit union's leadership has emphasized a conservative approach to risk management. This approach may help protect it against potential economic downturns.

Key Financial Metrics

Analyzing key financial metrics, such as the net interest margin and return on assets, provides insight into TopLine's efficiency and profitability. These metrics are compared against industry benchmarks to assess its relative performance.

A healthy capital ratio ensures the credit union's stability and ability to absorb potential losses. TopLine has consistently maintained a strong capital position.

Member growth and retention rates are also crucial indicators of the credit union's success. These metrics reflect the satisfaction and loyalty of its members.

Technological Innovation and Digital Transformation

The financial industry is undergoing a rapid digital transformation. Consumers expect seamless online and mobile banking experiences.

TopLine has invested in technology to enhance its digital offerings. This includes mobile banking apps, online account management tools, and digital payment solutions.

Cybersecurity is a paramount concern in the digital age. TopLine has implemented robust security measures to protect member data and prevent fraud.

The credit union's digital strategy also includes exploring emerging technologies such as blockchain and artificial intelligence. These technologies could potentially improve efficiency and enhance member services.

Adapting to Member Needs

Understanding and adapting to evolving member needs is crucial for TopLine's long-term success. This involves gathering feedback through surveys, focus groups, and online channels.

The credit union has tailored its products and services to meet the diverse needs of its membership. This includes offering specialized loan programs, financial education resources, and personalized customer service.

Providing accessible and convenient banking options is also a priority. TopLine maintains a network of branches and ATMs, while also expanding its digital presence.

Community Involvement and Social Responsibility

TopLine Federal Credit Union is deeply involved in the Brooklyn Park community. This involvement is a key part of its mission.

The credit union supports local charities and non-profit organizations through donations, sponsorships, and volunteer efforts. These initiatives reflect its commitment to social responsibility.

Financial literacy programs are also a significant focus. TopLine offers workshops and resources to help members improve their financial knowledge and make informed decisions.

Supporting Local Initiatives

TopLine actively participates in community events and initiatives. The goal is to promote economic development and improve the quality of life in Brooklyn Park.

The credit union partners with local businesses and organizations to create opportunities for residents. This helps to stimulate job growth and foster a thriving local economy.

Investing in education and youth programs is another key area of focus. TopLine believes that empowering young people is essential for building a strong and sustainable community.

Competitive Landscape and Future Outlook

The financial services industry is highly competitive. TopLine faces competition from large national banks, other credit unions, and fintech companies.

To remain competitive, the credit union must differentiate itself by offering superior service, competitive rates, and innovative products. Building strong member relationships is essential for retaining customers.

The future of TopLine depends on its ability to adapt to changing market conditions and embrace new technologies. This includes investing in digital infrastructure, attracting and retaining talented employees, and maintaining a strong financial position.

Challenges and Opportunities

Regulatory compliance is a significant challenge for all financial institutions. TopLine must adhere to a complex web of laws and regulations.

Economic uncertainty also poses a threat. Fluctuations in interest rates and economic downturns can impact the credit union's profitability and growth.

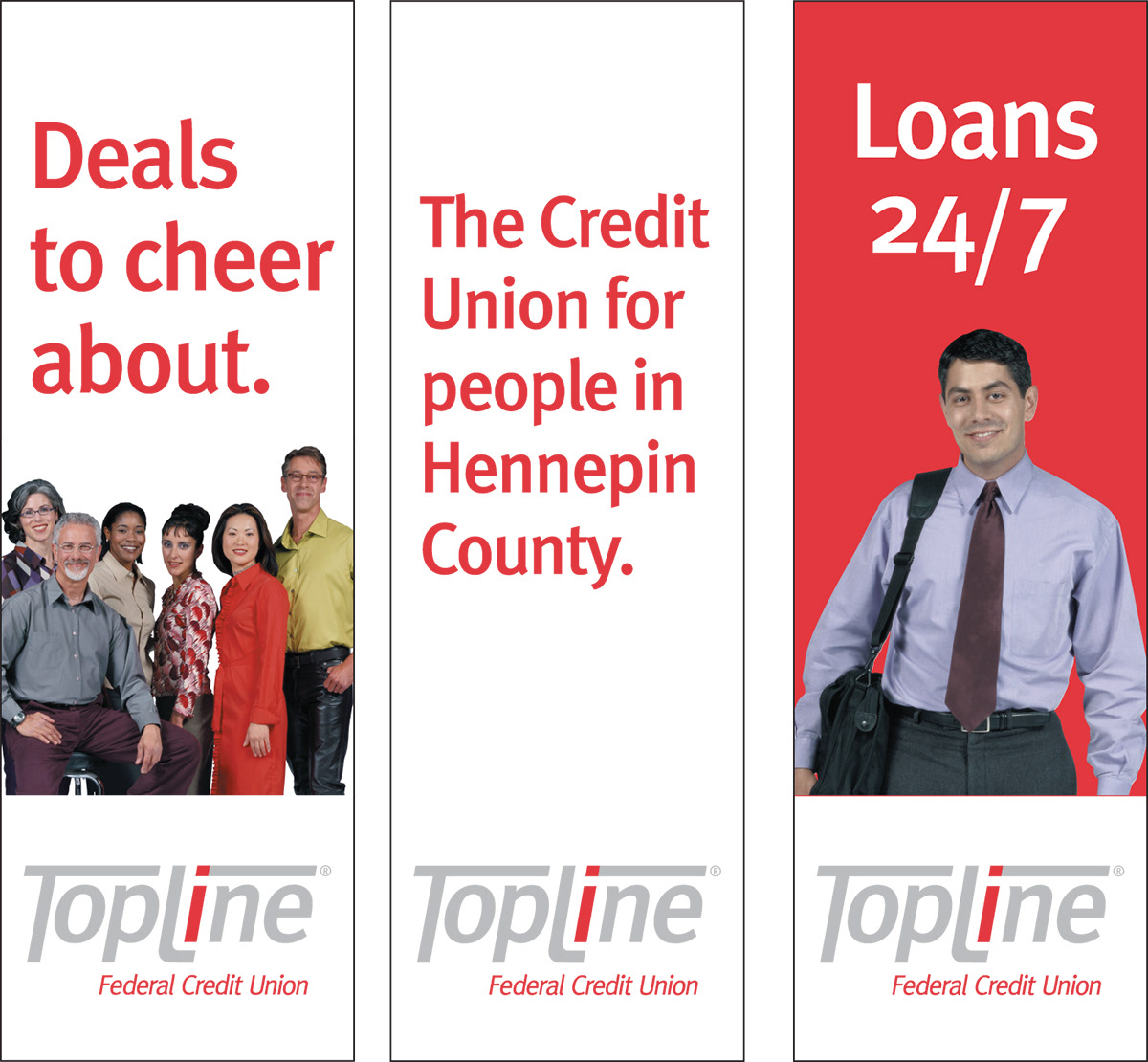

However, TopLine also has significant opportunities to expand its market share and enhance its brand. This can be achieved through strategic partnerships, targeted marketing campaigns, and a continued focus on member satisfaction.

Looking ahead, TopLine Federal Credit Union is poised to continue serving the Brooklyn Park community. It will do so by adapting to the changing financial landscape and maintaining its commitment to its members. The credit union's ability to balance innovation, community involvement, and financial stability will determine its long-term success.