Tortoise Power And Energy Infrastructure Fund

As the demand for sustainable energy solutions intensifies, infrastructure funds are playing an increasingly critical role in shaping the future of power generation and distribution. Among these, the Tortoise Power and Energy Infrastructure Fund (TPZ) stands out as a significant player, navigating both opportunities and challenges in a rapidly evolving energy landscape.

TPZ, a closed-end fund, invests primarily in energy infrastructure companies, including those involved in pipelines, storage facilities, and power transmission. This diversified approach aims to provide investors with a stable income stream while capitalizing on the growth potential within the energy sector. However, the fund's performance is intricately linked to fluctuating energy prices, regulatory changes, and the ongoing transition towards renewable energy sources, creating a complex investment environment.

Fund Overview and Investment Strategy

Tortoise Power and Energy Infrastructure Fund seeks to provide investors with a high level of current income and capital appreciation. The fund focuses its investments on companies operating in the energy infrastructure space, primarily in North America.

These include pipeline operators, storage and transportation companies, and power generation and transmission businesses. This strategy aims to capture the potential benefits of a growing energy sector while mitigating risk through diversification.

Portfolio Composition and Asset Allocation

A closer look at TPZ's portfolio reveals a significant allocation to midstream energy companies. These companies are involved in the transportation, processing, and storage of crude oil, natural gas, and natural gas liquids.

The fund's asset allocation is actively managed, with adjustments made to reflect changing market conditions and investment opportunities. Specific holdings and their weightings are periodically disclosed in regulatory filings, offering investors transparency into the fund's strategy.

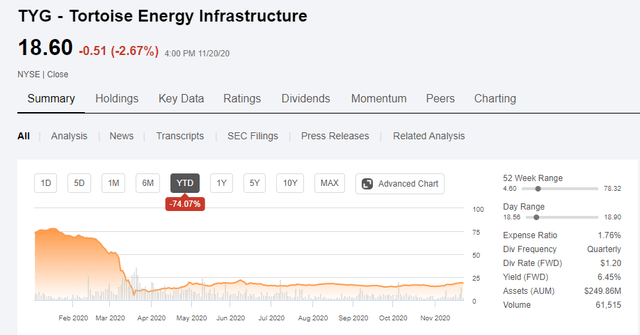

Performance and Distribution History

TPZ's performance has been subject to the volatility of the energy markets. Fluctuations in commodity prices, particularly oil and natural gas, directly impact the profitability of the companies within the fund's portfolio.

Historically, the fund has provided a consistent distribution to its shareholders, aligning with its objective of generating current income. The fund's distribution rate is influenced by its underlying investments and market conditions.

Navigating the Energy Transition

The energy transition presents both challenges and opportunities for TPZ. The shift towards renewable energy sources requires significant investment in new infrastructure, while potentially impacting the long-term viability of traditional fossil fuel infrastructure.

TPZ is adapting to this changing landscape by exploring opportunities in renewable energy infrastructure, such as pipelines for hydrogen transport and storage facilities for renewable energy. This diversification strategy aims to position the fund for long-term success in a low-carbon economy.

Renewable Energy Investments and Opportunities

Recognizing the growing importance of renewable energy, TPZ has begun to explore investments in this sector. This includes companies involved in the development and operation of wind and solar farms, as well as those focused on energy storage solutions.

By diversifying its portfolio into renewable energy infrastructure, TPZ aims to capitalize on the growth potential of this sector. This strategic shift is crucial for ensuring the fund's long-term sustainability and relevance in a rapidly evolving energy market.

Challenges and Risks

Despite the opportunities presented by the energy transition, TPZ faces several challenges. Regulatory changes, technological advancements, and shifting consumer preferences can all impact the fund's performance.

Furthermore, the fund's exposure to traditional fossil fuel infrastructure carries the risk of asset stranding, where assets become obsolete or uneconomical due to changing market conditions or regulatory requirements.

Regulatory and Market Environment

The energy sector is subject to significant regulatory oversight, impacting TPZ's investments. Changes in environmental regulations, pipeline safety standards, and energy policies can all affect the profitability and viability of the companies within the fund's portfolio.

The fund also operates in a competitive market, with numerous other infrastructure funds vying for investment opportunities. These competitive pressures can impact the fund's ability to generate attractive returns for its investors.

Impact of Government Policies

Government policies play a crucial role in shaping the energy sector and influencing TPZ's investment decisions. Tax incentives for renewable energy, regulations on fossil fuel emissions, and infrastructure spending programs can all have a significant impact on the fund's performance.

Understanding and adapting to these policy changes is essential for TPZ to effectively navigate the evolving energy landscape and maximize returns for its shareholders.

Market Volatility and Investor Sentiment

The energy market is known for its volatility, which can impact TPZ's share price and investor sentiment. Fluctuations in commodity prices, geopolitical events, and economic conditions can all contribute to market uncertainty.

Managing investor expectations and communicating the fund's long-term strategy is crucial for maintaining investor confidence and mitigating the impact of market volatility.

Expert Opinions and Analysis

Analysts have mixed views on TPZ's future prospects. Some believe that the fund's diversified portfolio and experienced management team position it well to navigate the energy transition. Others express concerns about the fund's exposure to traditional fossil fuel infrastructure and the potential for asset stranding.

Overall, the consensus is that TPZ's performance will depend on its ability to adapt to the changing energy landscape and capitalize on opportunities in renewable energy infrastructure.

Future Outlook and Recommendations

Looking ahead, TPZ's success will depend on its ability to effectively manage the risks and opportunities presented by the energy transition. Diversifying into renewable energy infrastructure, adapting to regulatory changes, and maintaining a disciplined investment approach will be crucial for generating long-term returns.

Investors should carefully consider their risk tolerance and investment objectives before investing in TPZ. While the fund offers the potential for income and capital appreciation, it is also subject to the volatility of the energy market.

Conclusion

Tortoise Power and Energy Infrastructure Fund represents a significant investment vehicle within the energy infrastructure sector, grappling with the complexities of a rapidly transforming energy landscape. Its future hinges on strategic adaptation, embracing renewable energy opportunities, and navigating the inherent risks of a volatile market. As the world moves towards a more sustainable energy future, TPZ's ability to evolve will ultimately determine its long-term viability and success.