Transfer Ira To Gold And Silver

Imagine a cozy evening, the fireplace crackling softly, as you review your retirement portfolio. The market reports flash across the screen, a sea of fluctuating numbers that seem to dance to an unpredictable tune. In these uncertain times, many are seeking a sense of security, a tangible anchor for their hard-earned savings.

The growing interest in transferring traditional IRA funds into precious metals like gold and silver reflects this desire for stability. This shift offers a diversification strategy aimed at safeguarding retirement savings against economic volatility.

The Allure of Precious Metals

For centuries, gold and silver have been regarded as safe-haven assets, stores of value that tend to hold their own, or even appreciate, during periods of economic turmoil.

This historical perception fuels the contemporary interest in including precious metals in retirement portfolios, particularly through a Gold IRA or a Silver IRA.

A Historical Perspective

The appeal of precious metals isn't new.

Throughout history, gold has served as a global currency and a symbol of wealth, a hedge against inflation and currency devaluation.

Silver, while also considered a monetary metal, has found increasing use in industrial applications, adding another layer of potential value.

Why Consider a Transfer?

The decision to transfer an IRA into gold or silver is often driven by concerns about inflation, market instability, and the potential erosion of purchasing power.

As traditional investment vehicles like stocks and bonds face uncertainty, some investors view precious metals as a way to preserve capital and potentially benefit from price appreciation.

Diversification is another key motivator, spreading risk across different asset classes to mitigate potential losses.

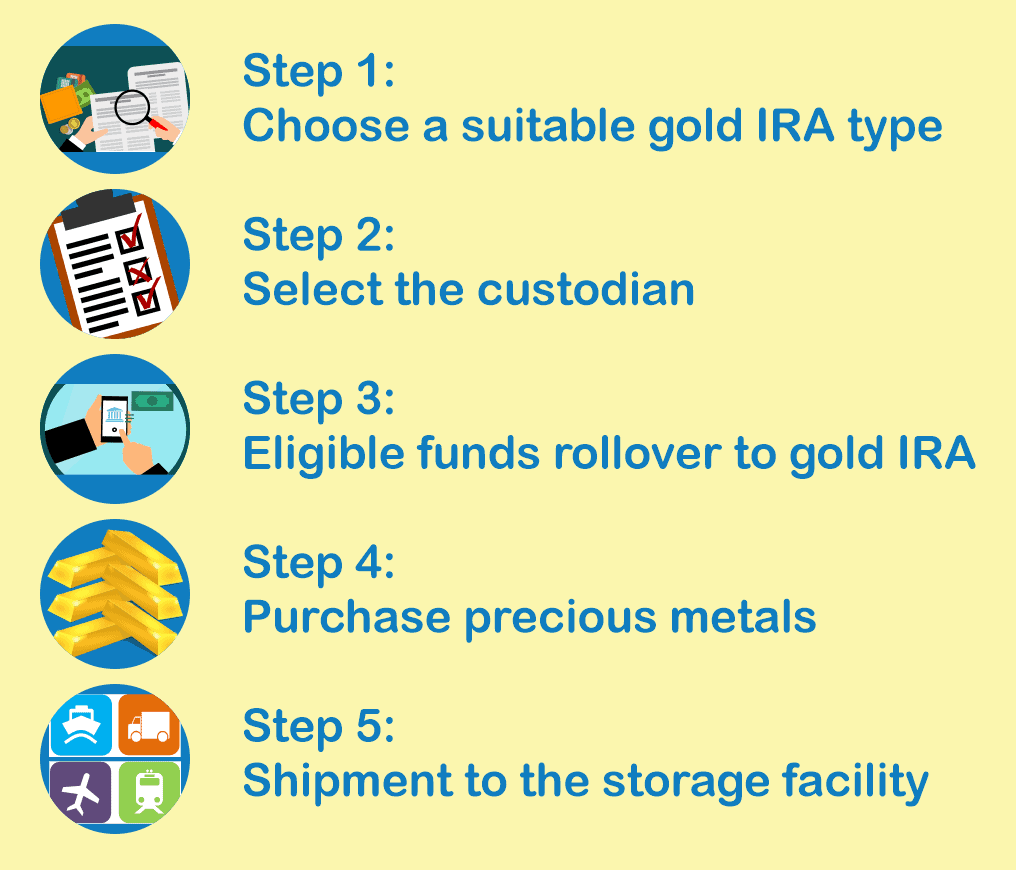

Understanding the Process

Transferring an IRA to gold or silver requires careful planning and adherence to specific IRS regulations.

It's not as simple as buying bullion and storing it at home; the IRS mandates that precious metals held in an IRA must be stored in an approved depository.

Setting up a Self-Directed IRA

The first step is typically establishing a self-directed IRA, a type of IRA that allows for a broader range of investment options beyond traditional stocks and bonds.

These accounts are offered by specialized custodians who are equipped to handle the complexities of precious metals investments.

Choosing a reputable custodian is crucial to ensure compliance with IRS rules and the secure storage of your assets.

The Transfer Mechanism

Once the self-directed IRA is established, the transfer process involves moving funds from your existing IRA to the new account.

This can be done through a direct rollover, where the funds are transferred directly from one custodian to another, or through a trustee-to-trustee transfer, avoiding potential tax implications.

It's essential to avoid directly receiving the funds, as this could be considered a distribution and trigger taxes and penalties.

Eligible Metals

The IRS has specific requirements for the type and purity of gold and silver that can be held in an IRA.

Generally, the gold must be at least .995 fine, and the silver must be at least .999 fine.

Common eligible forms include gold and silver bullion coins, bars, and rounds produced by recognized government mints or assayers.

Potential Benefits and Risks

While a gold or silver IRA can offer potential benefits, it's important to weigh the risks and consider your individual financial circumstances.

Like any investment, precious metals are subject to price fluctuations, and there's no guarantee of profit.

Potential Benefits

Historically, gold and silver have served as a hedge against inflation.

When the purchasing power of traditional currencies declines, the value of precious metals may increase, preserving your wealth.

Diversification can reduce the overall risk of your portfolio by providing a counterbalance to other investments.

Potential Risks

The price of precious metals can be volatile and influenced by various factors, including global economic conditions, interest rates, and investor sentiment.

Unlike stocks or bonds, precious metals don't generate income, such as dividends or interest.

Custodial fees and storage charges can add to the overall cost of owning precious metals in an IRA.

Due Diligence is Key

Before making any decisions, it's crucial to conduct thorough research and consult with a qualified financial advisor.

Understand the fees associated with self-directed IRAs and precious metals storage.

Carefully evaluate the reputation and track record of the custodian you choose.

Expert Opinions and Market Trends

The debate surrounding precious metals IRAs continues, with experts offering varied perspectives on their suitability as retirement investments.

Some argue that gold and silver can provide valuable protection against economic uncertainty, while others emphasize the potential risks and limitations.

Economic Outlook

Market analysts at organizations like the World Gold Council regularly provide insights into the factors influencing gold prices.

These factors include inflation, interest rates, geopolitical events, and central bank policies.

Staying informed about these trends can help investors make more informed decisions.

Financial Advisor's Perspective

Many financial advisors recommend allocating a small percentage of your portfolio to precious metals, typically around 5% to 10%, as part of a broader diversification strategy.

However, they emphasize the importance of considering your individual risk tolerance, investment timeline, and financial goals.

A financial advisor can help you assess whether a gold or silver IRA is the right choice for you.

A Path Towards Financial Security

The decision to transfer an IRA to gold or silver is a significant one that requires careful consideration and informed decision-making.

While precious metals can offer potential benefits, they're not a guaranteed path to wealth.

By understanding the process, weighing the risks and rewards, and seeking professional guidance, you can make a well-informed choice that aligns with your individual financial goals and helps you build a more secure future.