Valley Bank Sells $1 Billion In Property Loans To Brookfield.

Valley National Bancorp, the parent company of Valley Bank, has announced the sale of approximately $1 billion in commercial real estate loans to Brookfield Real Estate Finance Trust Inc. This transaction marks a significant strategic shift for Valley Bank as it seeks to optimize its balance sheet and navigate the evolving landscape of the commercial real estate market.

The sale, finalized recently, involves a portfolio of performing commercial real estate loans. It's crucial to understand the significance of this transaction: it reflects both Valley Bank's strategic realignment and Brookfield's continued investment in the commercial property sector. It also prompts questions about the broader health and direction of regional banking and real estate markets.

Key Details of the Transaction

The agreement between Valley Bank and Brookfield encompasses a specific segment of Valley's loan portfolio. The sold loans are all performing, meaning borrowers are current on their payments. This suggests a deliberate strategy by Valley to offload assets without signaling distress or significant risk.

The specific terms of the sale haven't been disclosed, but it's expected to provide Valley Bank with a substantial infusion of capital. This capital can then be redeployed into other areas of the bank or used to strengthen its financial position. Brookfield gains a portfolio of income-generating real estate loans.

Who is Involved?

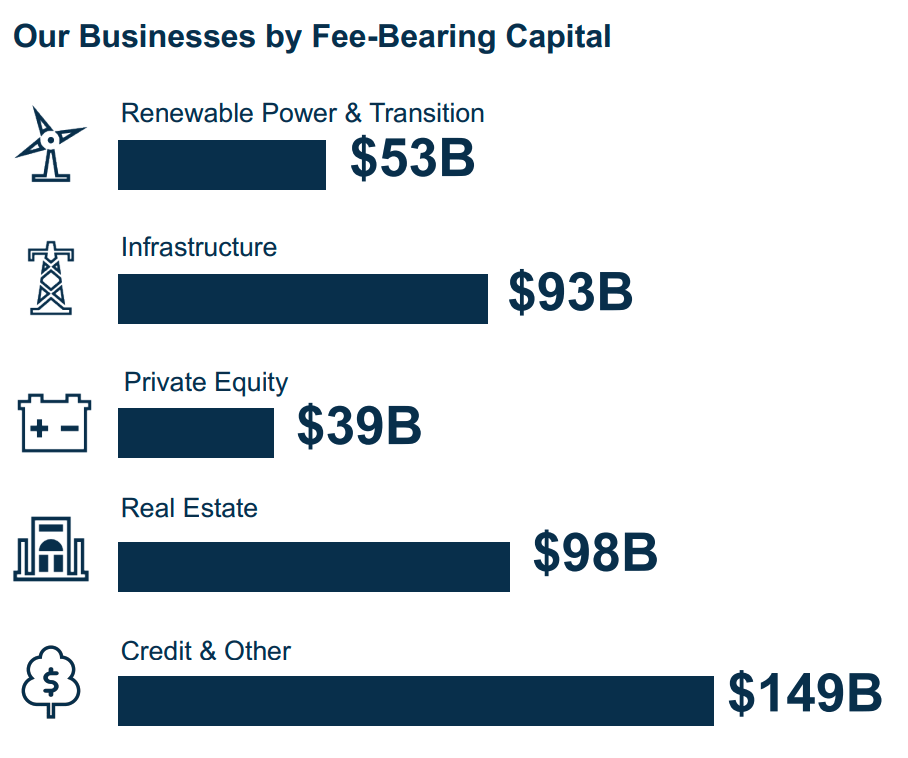

The primary parties are, of course, Valley National Bancorp and Brookfield Real Estate Finance Trust Inc. Valley Bank, a regional bank with a significant presence in the Northeast, is looking to refine its business focus. Brookfield, a global alternative asset manager, is expanding its real estate finance holdings.

The transaction also involves legal and financial advisors on both sides. These advisors played a role in structuring the deal and ensuring its compliance with regulatory requirements. The specifics of these parties are typically kept confidential.

Why Now?

Several factors likely contributed to the timing of this transaction. Regional banks are under increasing scrutiny given recent volatility in the banking sector. The current interest rate environment and concerns about commercial real estate values are also playing a role.

Valley Bank likely saw this as an opportune moment to de-risk its balance sheet and generate capital. The sale to Brookfield allows them to rebalance and potentially capitalize on other opportunities in the future. Brookfield, with significant capital reserves, views this as a strategic investment in a potentially undervalued market.

Impact and Implications

The immediate impact for Valley Bank is a strengthened balance sheet and increased financial flexibility. They can deploy the capital to improve their capital ratios, invest in technology, or pursue other strategic initiatives. The bank's overall risk profile may also improve.

For Brookfield, the acquisition represents an expansion of their real estate finance portfolio. It provides them with a stream of income from performing commercial real estate loans. It aligns with their broader strategy of investing in diverse real estate assets across different geographies.

The larger significance is in the market signal this transaction sends. It suggests a continued, albeit cautious, interest in commercial real estate lending from large investment firms. It also indicates that regional banks are actively managing their portfolios in response to market pressures.

Expert Perspectives

“This move is indicative of a broader trend we're seeing in the regional banking sector," says a financial analyst at a leading investment firm. "Banks are looking to optimize their asset portfolios and shore up their balance sheets amid economic uncertainty."

Another industry expert commented, “Brookfield's acquisition signals confidence in the long-term prospects of commercial real estate, despite current headwinds. It shows that there's still capital available for well-managed, performing assets.”

Looking Ahead

The long-term implications of this deal remain to be seen. It's contingent on the performance of the underlying real estate assets and the overall economic climate. However, it's clear that this transaction is a sign of the times, reflecting the evolving dynamics of the banking and real estate sectors.

Expect to see other regional banks exploring similar strategies as they navigate the current environment. The $1 billion sale by Valley Bank to Brookfield sets a precedent and provides insight into how institutions are responding to market challenges and opportunities.