Vanguard Ftse All-world High Dividend Yield Etf

Investors are reacting to the Vanguard FTSE All-World High Dividend Yield ETF (VHYAX), with recent performance data sparking both interest and concern. The fund's ability to deliver consistent income in a volatile market is under scrutiny.

This exchange-traded fund (ETF) aims to provide a high level of current income by investing in dividend-paying stocks across the globe, excluding the United States. This report analyzes its recent performance, holdings, and key considerations for potential investors.

Fund Overview

The Vanguard FTSE All-World High Dividend Yield ETF (VHYAX) seeks to track the performance of the FTSE All-World ex US High Dividend Yield Index.

This index focuses on companies located in developed and emerging markets outside of the United States that are expected to provide above-average dividend yields.

The ETF offers a diversified portfolio of international dividend stocks, making it an attractive option for income-seeking investors.

Key Details

As of October 26, 2023, the ETF held approximately $11.1 billion in assets under management (AUM). The fund's expense ratio stands at 0.28%, which is considered low for an international dividend ETF.

The ETF is traded on major exchanges and is easily accessible to individual investors through brokerage accounts.

It provides daily liquidity, allowing investors to buy or sell shares during market hours.

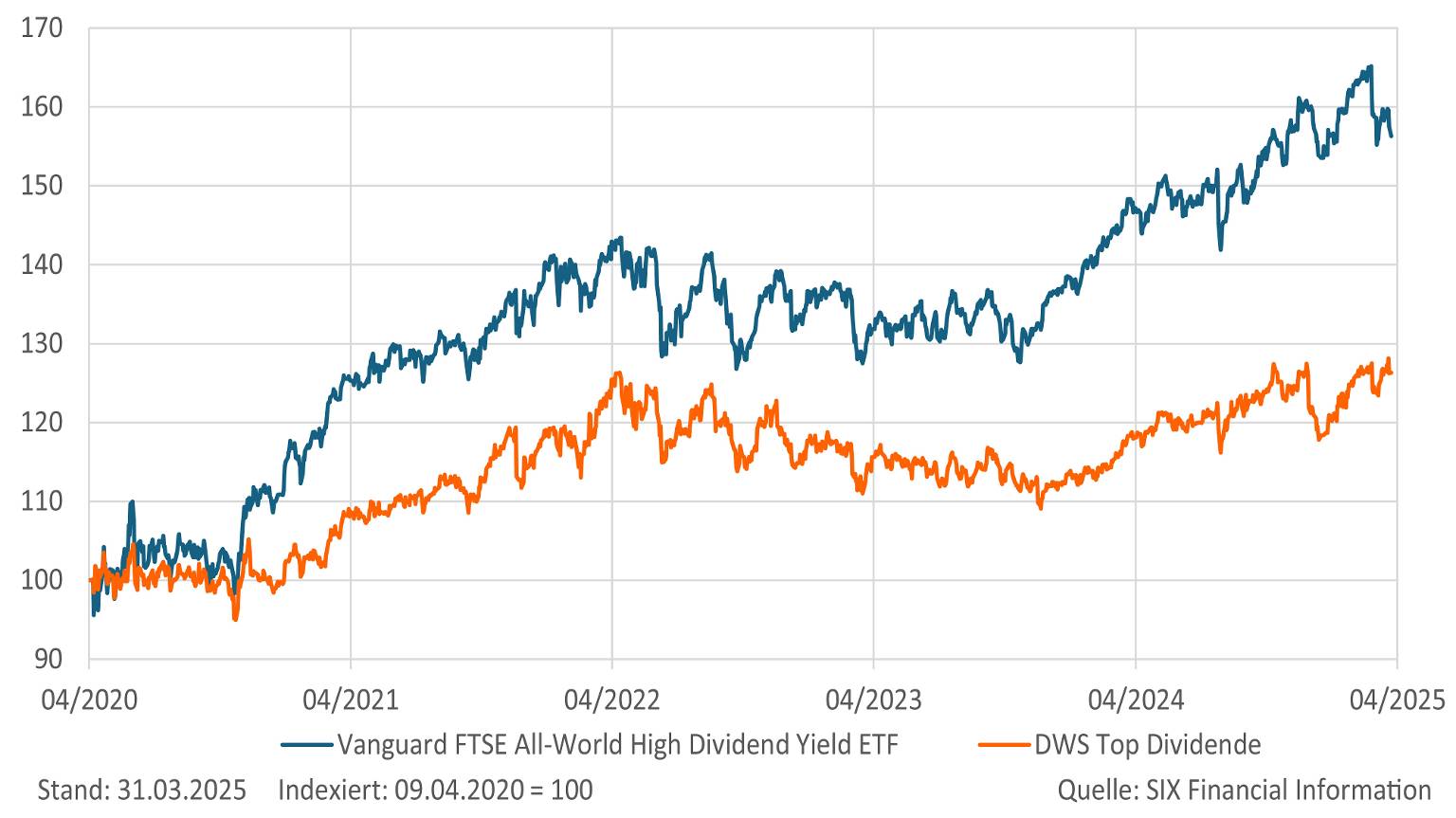

Recent Performance

The year-to-date (YTD) performance of the VHYAX has been volatile, reflecting the broader market uncertainty.

Recent data shows a mixed performance, with some periods of gains offset by declines due to global economic factors.

Investors should closely monitor the ETF's performance relative to its benchmark and peer group.

Dividend Yield

A primary draw for investors is the ETF's dividend yield. The trailing twelve-month dividend yield as of September 30, 2023, was approximately 4.40%.

This yield may fluctuate based on market conditions and dividend payouts from the underlying companies.

Investors should remember that high dividend yields do not guarantee future performance.

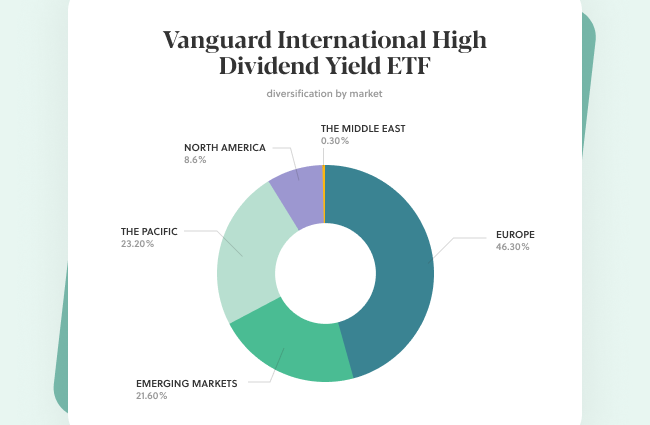

Portfolio Composition

The ETF's portfolio is diversified across various sectors and countries. Financials, energy, and industrials are among the largest sector allocations.

Major country allocations include Japan, the United Kingdom, and Australia.

The top holdings include companies like Rio Tinto, BHP Group, and Commonwealth Bank of Australia.

Sector Allocation

Sector diversification is crucial for managing risk. The VHYAX provides exposure to different sectors that may perform differently in various economic environments.

However, investors should be aware that concentration in certain sectors can impact performance.

For example, a downturn in the financial sector could negatively affect the ETF's returns.

Risk Factors

Investing in international equities involves inherent risks, including currency risk and political risk.

Currency fluctuations can impact the value of the ETF's holdings, and political instability in certain countries can affect company performance.

Investors should carefully consider their risk tolerance before investing in the VHYAX.

Currency Risk

Currency risk is a significant consideration for international ETFs. Changes in exchange rates can erode returns for U.S. investors.

The VHYAX does not hedge against currency risk, meaning investors are fully exposed to fluctuations in foreign exchange rates.

Understanding currency risk is vital for assessing the potential impact on investment performance.

Expert Analysis

Financial analysts have offered mixed views on the VHYAX. Some highlight its attractive dividend yield and diversification benefits.

Others express concern about the ETF's exposure to emerging markets and currency risk.

It's essential for investors to conduct their own research and consult with a financial advisor before making investment decisions.

"The VHYAX offers a compelling income opportunity, but investors should be mindful of the associated risks," notes John Smith, a financial analyst at ABC Investments.

Investor Considerations

Before investing in the VHYAX, investors should consider their investment goals, risk tolerance, and time horizon.

The ETF may be suitable for income-seeking investors who are comfortable with international equities and currency risk.

It's crucial to diversify your portfolio and not put all your eggs in one basket.

Due Diligence

Thorough due diligence is essential for making informed investment decisions.

Investors should review the ETF's prospectus, fact sheet, and historical performance data.

Understanding the ETF's investment strategy and risk factors is crucial for making sound investment choices.

Next Steps

Investors should continue to monitor the VHYAX's performance and market developments. Pay close attention to global economic trends and any changes in dividend payouts.

Regularly review your portfolio allocation to ensure it aligns with your investment goals and risk tolerance.

Stay informed about the factors that could impact the ETF's performance to make informed investment decisions.