Variable Cost Calculation A Step By Step Guide With Examples

Unlocking Profitability: A Step-by-Step Guide to Mastering Variable Cost Calculation

Many businesses, from startups to established corporations, struggle to accurately calculate their variable costs. This lack of clarity can lead to mispricing, flawed budgeting, and ultimately, reduced profitability. Understanding how to meticulously calculate these costs is paramount for making informed decisions and optimizing financial performance.

This article provides a comprehensive, step-by-step guide to calculating variable costs, complete with practical examples, ensuring businesses of all sizes can gain a firm grasp on this essential financial metric. By understanding and managing these costs, businesses can improve their pricing strategies, enhance their budgeting processes, and boost their bottom line.

What are Variable Costs?

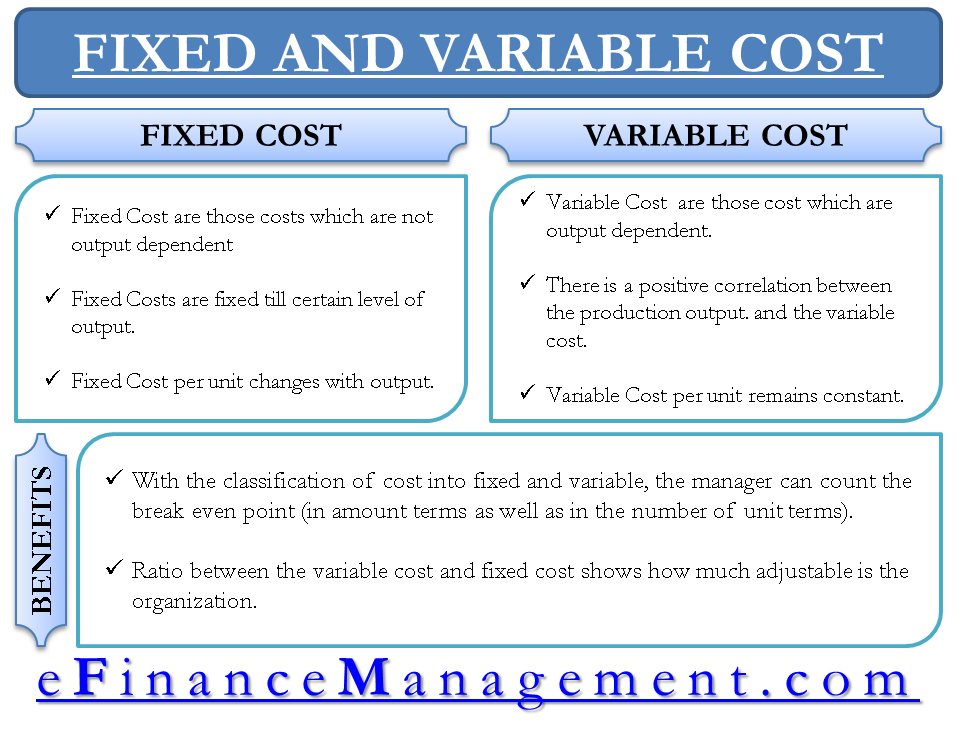

Variable costs are expenses that fluctuate in direct proportion to changes in a company's level of production or sales volume. Unlike fixed costs, which remain constant regardless of output, variable costs increase as production increases and decrease as production decreases.

Examples of variable costs include raw materials, direct labor, packaging, and sales commissions. Recognizing and accurately tracking these costs is crucial for determining the true cost of goods sold and making sound financial projections.

Step-by-Step Guide to Calculating Variable Costs

Calculating variable costs involves a systematic approach. Begin by identifying all costs that fluctuate with production volume.

Step 1: Identify Variable Cost Components. Meticulously list all expenses that change with production. This may require consulting with various departments, such as production, purchasing, and sales, to gain a comprehensive understanding of cost drivers.

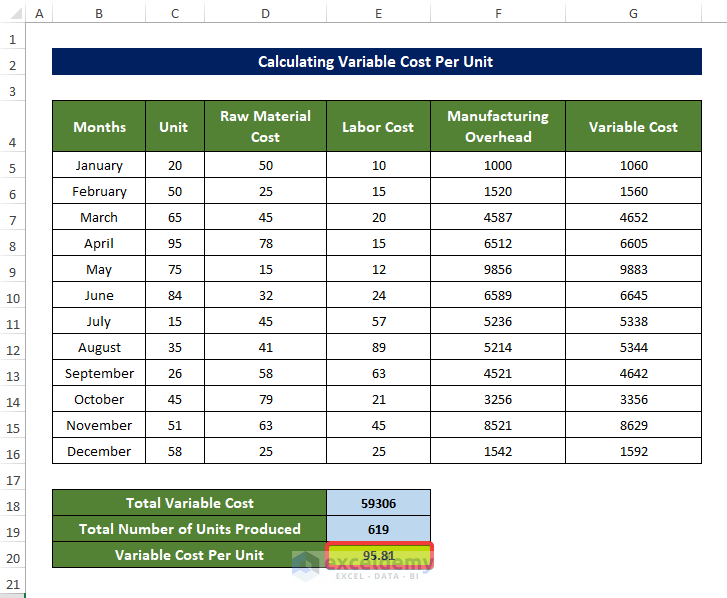

Step 2: Determine Cost per Unit. Calculate the variable cost per unit for each identified expense. This can be achieved by dividing the total variable cost for a specific period by the total number of units produced during that period.

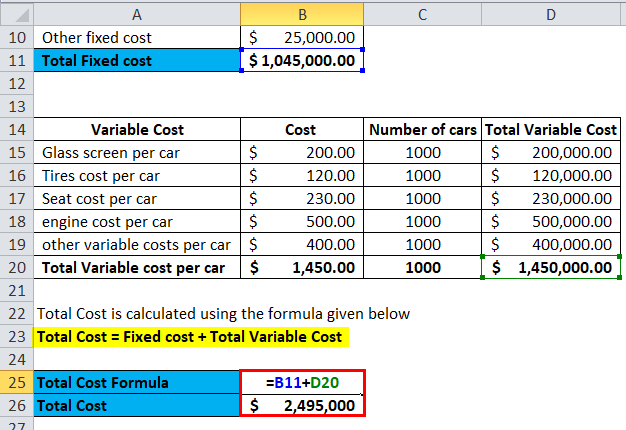

Step 3: Calculate Total Variable Cost. Multiply the variable cost per unit by the total number of units produced or sold to determine the total variable cost. This figure represents the total expense incurred due to variable costs for a specific production or sales volume.

Step 4: Analyze and Refine. Continuously analyze and refine the calculation process to ensure accuracy. Regular review of cost drivers and allocation methods can identify areas for improvement and optimize cost management strategies.

Example Calculation

Consider a small bakery, "Sweet Delights," that produces cakes. Their primary variable costs are raw materials (flour, sugar, eggs), direct labor (baker's wages), and packaging (boxes).

In January, "Sweet Delights" produced 1,000 cakes. Their raw material costs totaled $500, direct labor costs were $1,000, and packaging costs amounted to $200.

To calculate the variable cost per cake: Raw materials: $500 / 1,000 cakes = $0.50 per cake. Direct labor: $1,000 / 1,000 cakes = $1.00 per cake. Packaging: $200 / 1,000 cakes = $0.20 per cake.

The total variable cost per cake is $0.50 + $1.00 + $0.20 = $1.70. Therefore, the total variable cost for January's production is $1.70 * 1,000 cakes = $1,700.

The Importance of Accurate Variable Cost Calculation

Accurate calculation of variable costs is fundamental to several critical business functions. First, it directly impacts pricing strategies. Understanding the true cost of each unit allows businesses to set prices that ensure profitability while remaining competitive.

Furthermore, accurate variable cost information is essential for budgeting and forecasting. By projecting future sales volumes and applying variable cost rates, businesses can create realistic budgets and forecasts that guide operational decisions.

Lastly, variable cost analysis enables informed make-or-buy decisions. By comparing the cost of producing a product internally versus outsourcing it, businesses can optimize their supply chain and reduce overall expenses.

Challenges and Considerations

One of the main challenges in calculating variable costs is accurately allocating indirect costs. Some expenses may have both fixed and variable components, requiring careful analysis to separate the two.

Another consideration is the impact of economies of scale. As production volume increases, certain variable costs, such as raw material prices, may decrease due to bulk discounts. This should be factored into the calculation to avoid overestimating costs.

Future Trends in Cost Management

The field of cost management is constantly evolving, driven by technological advancements and increasing business complexity. The adoption of advanced analytics and artificial intelligence (AI) is enabling businesses to gain deeper insights into their cost structures and optimize cost allocation processes.

Furthermore, the rise of sustainable business practices is leading to greater emphasis on environmental and social costs, which may be variable in nature. Businesses are increasingly integrating these factors into their cost calculations to align with sustainability goals and meet stakeholder expectations.

Conclusion

Mastering variable cost calculation is crucial for businesses seeking to improve profitability, make informed decisions, and achieve sustainable growth. By following the step-by-step guide outlined in this article and adapting it to their specific circumstances, businesses can gain a clear understanding of their cost structures and unlock new opportunities for success. As the business landscape continues to evolve, a firm grasp on variable costs will remain a critical competitive advantage.