Is Loss On Sale Of Equipment An Operating Expense

The seemingly straightforward question of whether a loss on the sale of equipment qualifies as an operating expense has ignited debate within the accounting world. Misclassification can significantly skew financial statements, impacting profitability metrics and potentially misleading investors. The nuances surrounding this categorization demand careful consideration, hinging on the specific circumstances of the transaction and the nature of the business itself.

At the heart of this issue lies the fundamental distinction between operating activities and other business activities. This article delves into the complexities of classifying losses on equipment sales, exploring various perspectives and providing clarity on proper accounting treatment. We will examine how different accounting standards and interpretations can lead to varying conclusions, impacting financial reporting and corporate decision-making.

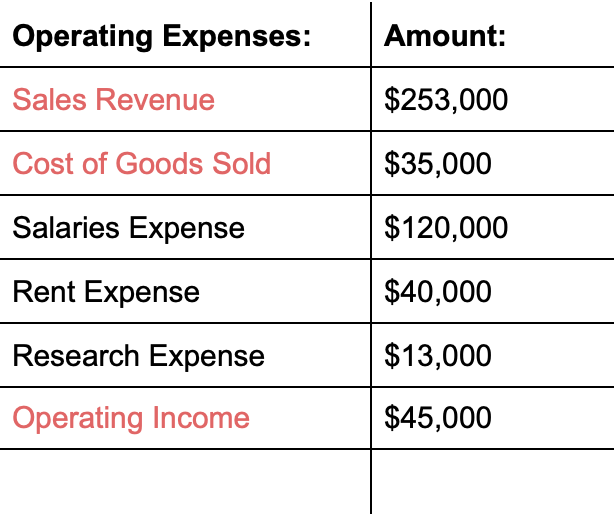

Understanding Operating Expenses

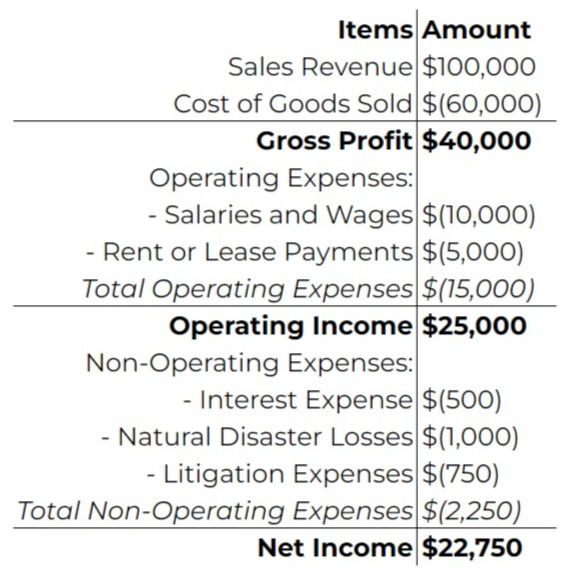

Operating expenses are the costs a company incurs to keep its business running daily. These are the expenses directly related to the primary revenue-generating activities of the business. Common examples include salaries, rent, utilities, and marketing expenses.

The key characteristic of operating expenses is their direct relationship to the company's core operations. They are incurred regularly and are essential for generating revenue. Accurate classification of these expenses is crucial for assessing a company's operational efficiency and profitability.

Loss on Sale of Equipment: The Gray Area

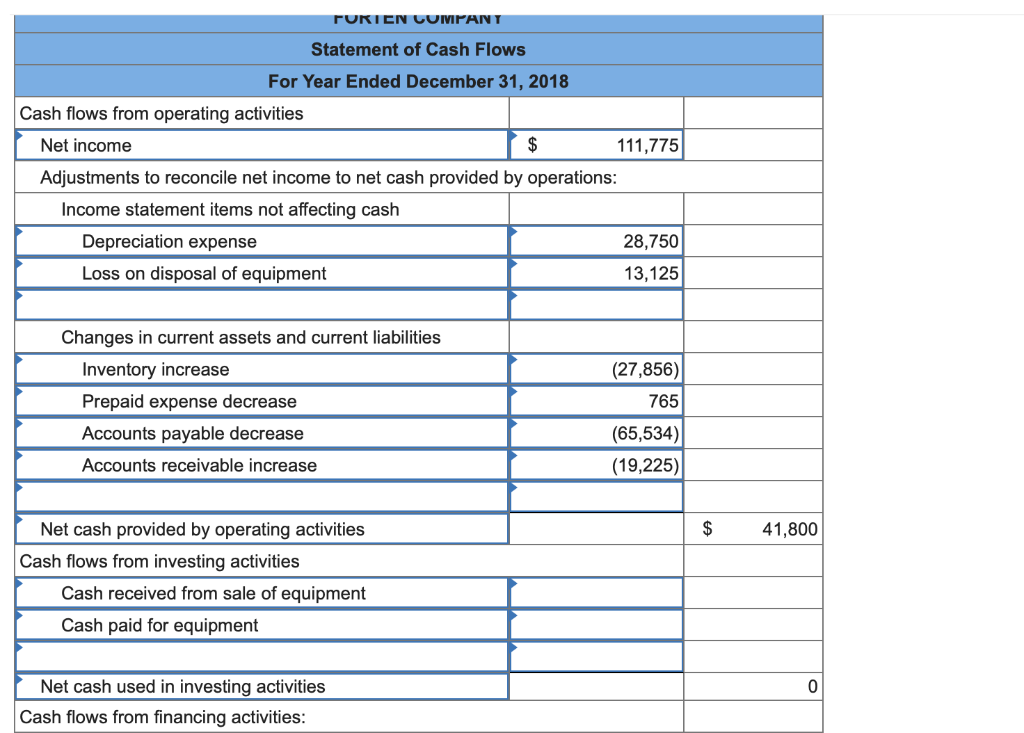

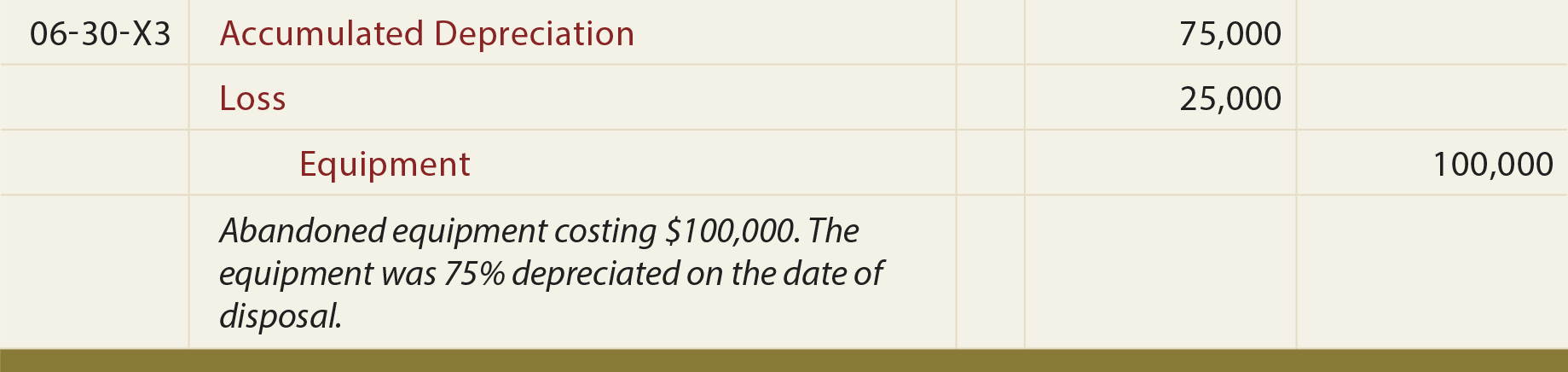

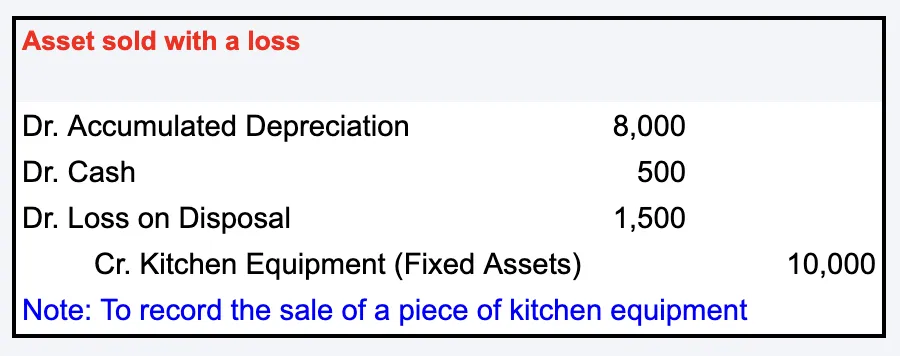

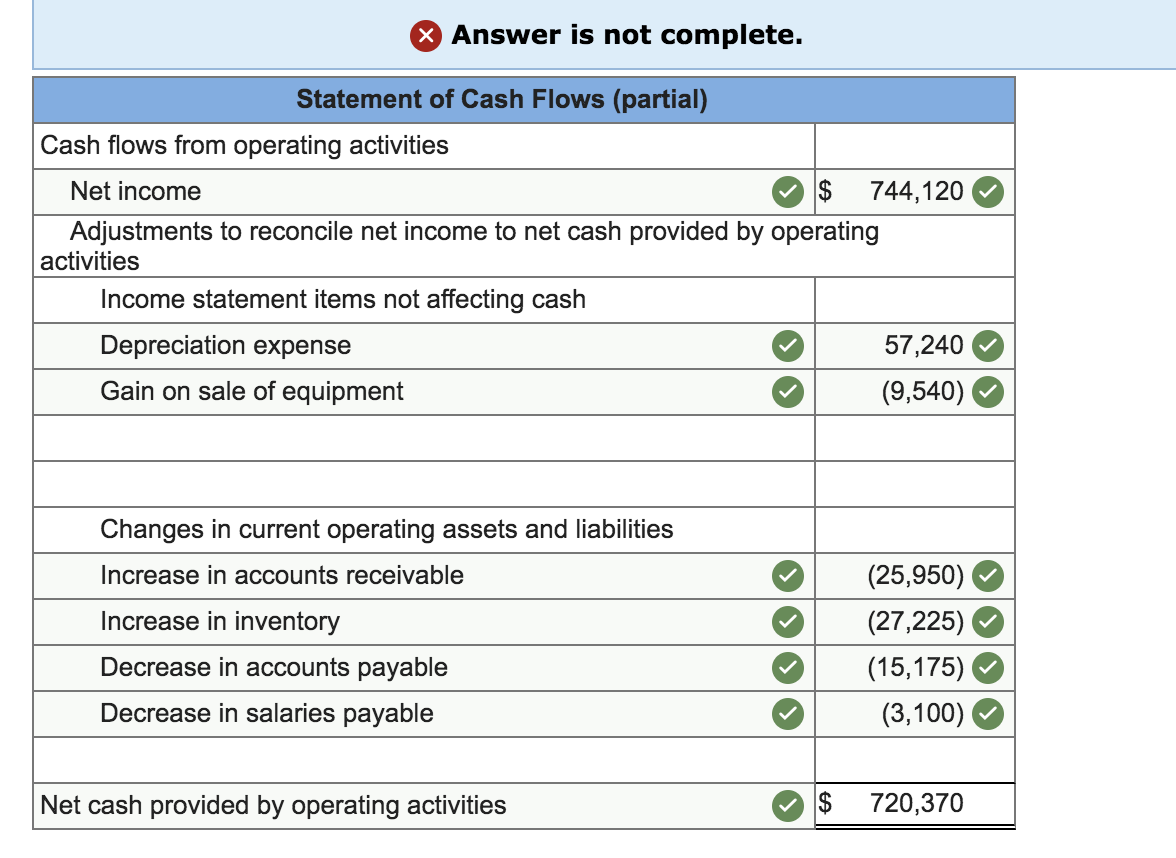

A loss on the sale of equipment occurs when the sale price is less than the equipment's book value (original cost less accumulated depreciation). The crucial question is whether this loss should be classified as an operating expense. The answer, unfortunately, is not always straightforward.

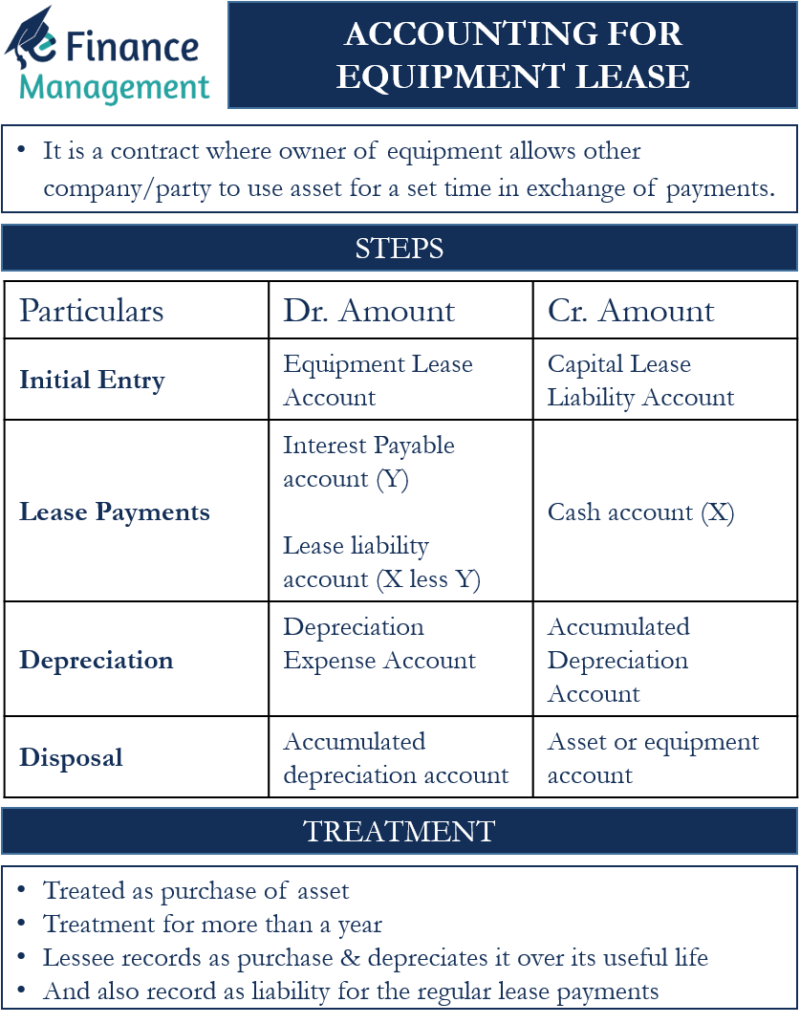

Generally, if the equipment is an integral part of the company's revenue-generating activities, the loss may be considered an operating expense. However, if the equipment is considered a non-core asset or its sale is infrequent, the loss is typically classified as a non-operating expense. This distinction hinges on the nature of the business and the role the equipment plays in its operations.

Arguments for Classifying as Operating Expense

Some argue that if the equipment was essential for generating revenue and its disposal is a normal part of the business cycle, the loss should be included in operating expenses. This view emphasizes the direct link between the equipment and the company's primary operations. For example, a trucking company regularly selling and replacing its fleet of trucks might consider the loss on sale as an operating expense.

This classification provides a more accurate picture of the company's operational efficiency. Dr. Anya Sharma, a professor of accounting at the University of California, Berkeley, states, "Including these losses in operating expenses provides a more complete view of the costs associated with running the business and generating revenue."

Arguments Against Classifying as Operating Expense

Conversely, many argue that a loss on the sale of equipment is a non-operating expense, particularly if the equipment is not central to the company's core business or the sale is infrequent. This perspective highlights the distinction between regular, recurring operating activities and occasional, one-time events.

According to Generally Accepted Accounting Principles (GAAP), gains and losses from the sale of assets are often presented separately from operating income. This separation provides investors with a clearer understanding of the company's core profitability. The Financial Accounting Standards Board (FASB) provides guidance that leans towards separating unusual or infrequent gains and losses.

Impact on Financial Statements

The classification of a loss on the sale of equipment can significantly impact a company's financial statements. If classified as an operating expense, it will reduce operating income, affecting key performance indicators such as operating margin and earnings before interest and taxes (EBIT).

Classifying it as a non-operating expense, on the other hand, will affect net income but not operating income. This distinction is crucial for investors and analysts who rely on these metrics to assess a company's performance. Misclassification can lead to a distorted view of the company's profitability and efficiency.

Examples and Case Studies

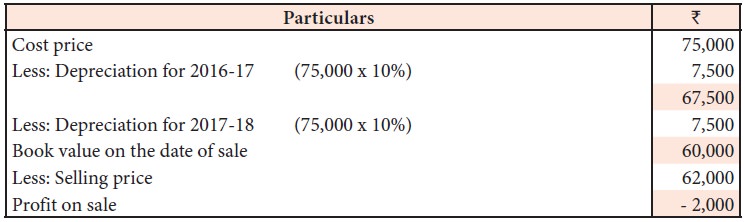

Consider a manufacturing company selling a piece of machinery used in its production line. If the machinery is regularly replaced as part of its maintenance schedule, the loss on sale might be considered an operating expense. This reflects the ongoing cost of maintaining its production capabilities.

Now, consider a software company selling office furniture it no longer needs. The loss on this sale would likely be classified as a non-operating expense. The sale of office furniture is not directly related to the company's core business of developing and selling software.

Seeking Clarity: Professional Judgment and Disclosure

Ultimately, the proper classification of a loss on the sale of equipment requires professional judgment. Accountants must carefully consider the specific facts and circumstances of the transaction. This includes the nature of the equipment, its role in the business, and the frequency of such sales.

Transparency is paramount. Companies should clearly disclose their accounting policies regarding the classification of gains and losses on asset sales. This allows investors and analysts to understand how these items are treated in the financial statements. Complete and accurate disclosure helps to build trust in financial reporting.

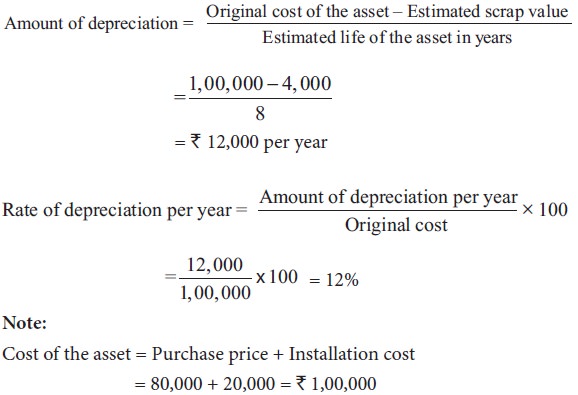

The Role of Depreciation

Depreciation plays a vital role in this scenario. If equipment has been significantly depreciated over its lifespan, the book value will be lower, potentially resulting in a smaller loss or even a gain on sale. Accurate depreciation methods, therefore, impact the ultimate gain or loss and its subsequent classification.

Companies must ensure their depreciation methods are appropriate and consistently applied. This is essential for accurate financial reporting and for making informed decisions about asset management. Improper depreciation can distort financial results and lead to incorrect conclusions.

Looking Ahead: Evolving Accounting Standards

Accounting standards are constantly evolving. FASB and other regulatory bodies continuously review and update guidelines to ensure financial reporting remains relevant and accurate. The treatment of gains and losses on asset sales may be subject to future revisions.

Companies must stay abreast of these changes to ensure compliance and maintain the integrity of their financial statements. Professional accounting organizations and continuing education are vital resources for staying informed about evolving accounting practices.

Conclusion: A Balanced Approach to Classification

Determining whether a loss on the sale of equipment is an operating expense requires careful consideration of the specific circumstances and adherence to accounting principles. There is no one-size-fits-all answer. A thorough understanding of the business, the nature of the equipment, and the intent of the sale are all essential.

By adopting a balanced approach and providing transparent disclosures, companies can ensure their financial statements accurately reflect their operational performance. Ultimately, accurate classification promotes informed decision-making and strengthens investor confidence in financial reporting.

:max_bytes(150000):strip_icc()/final_operatingloss_definition_1216-adee45fd12ea400a9ec567de43800521.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)