Weighted Average Method In Process Costing

In the complex world of cost accounting, businesses grapple with accurately valuing their inventory and cost of goods sold, particularly in industries employing continuous production processes. The Weighted Average Method, a popular approach within process costing, has become a focal point of discussion as companies seek the most reliable and straightforward way to allocate costs. Its impact on financial reporting, inventory valuation, and ultimately, profitability, can be substantial.

At its core, the Weighted Average Method in process costing aims to simplify the calculation of unit costs by averaging the costs incurred during a specific period with the cost of beginning work-in-process inventory. This simplification, however, presents both advantages and disadvantages. This article delves into the intricacies of this method, exploring its mechanics, benefits, limitations, and real-world implications, offering a comprehensive understanding for financial professionals and business stakeholders alike.

Understanding Process Costing

Process costing is a method used to assign costs to products in industries where similar goods are produced on a continuous basis. Think of oil refining, food processing, or chemical manufacturing.

Unlike job order costing, which tracks costs for individual projects or batches, process costing aggregates costs and then allocates them evenly across all units produced.

This averaging approach is essential for industries where it's impractical to track costs for each individual item.

The Weighted Average Method Defined

The Weighted Average Method is one of the two primary approaches used in process costing, the other being the First-In, First-Out (FIFO) method.

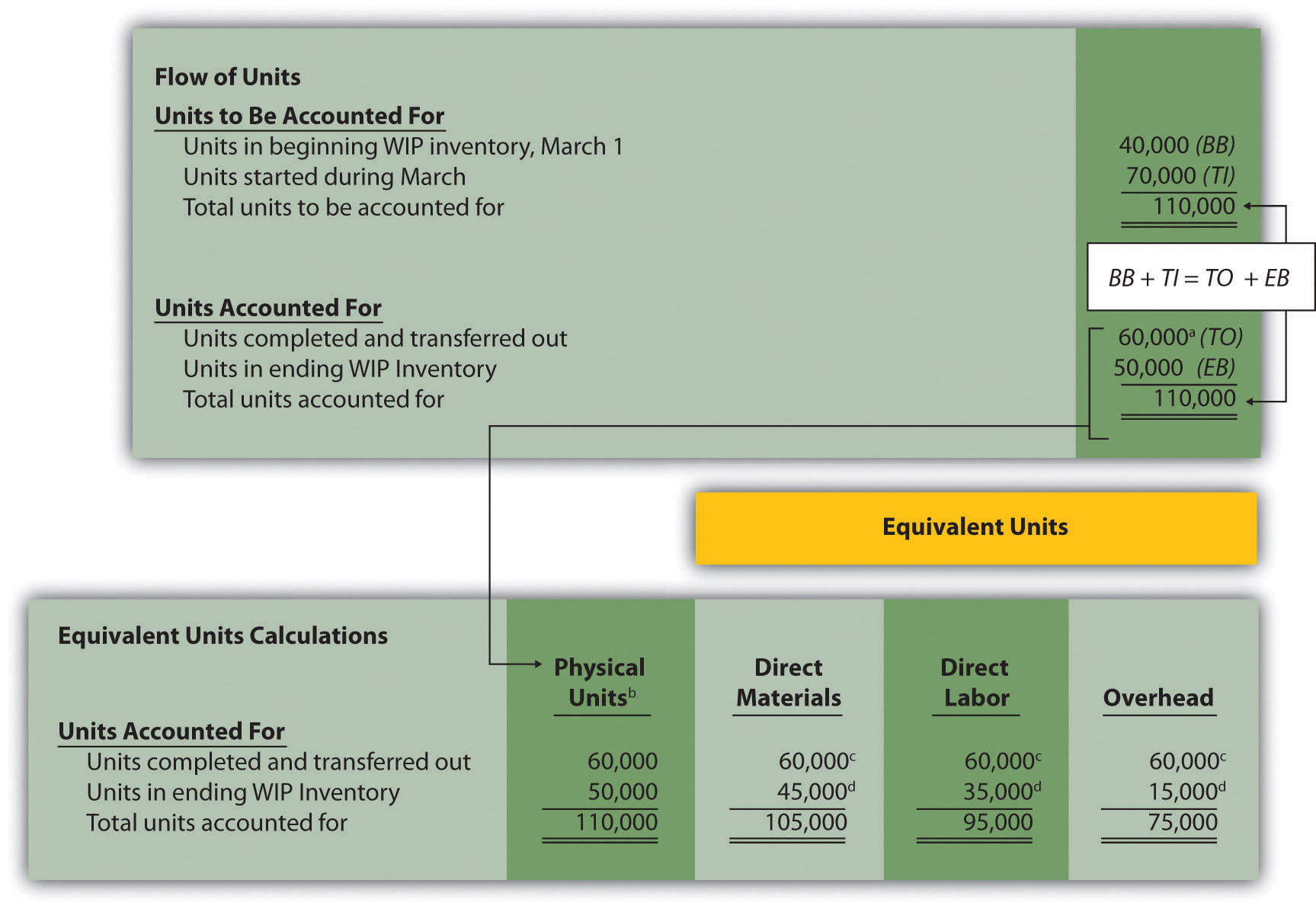

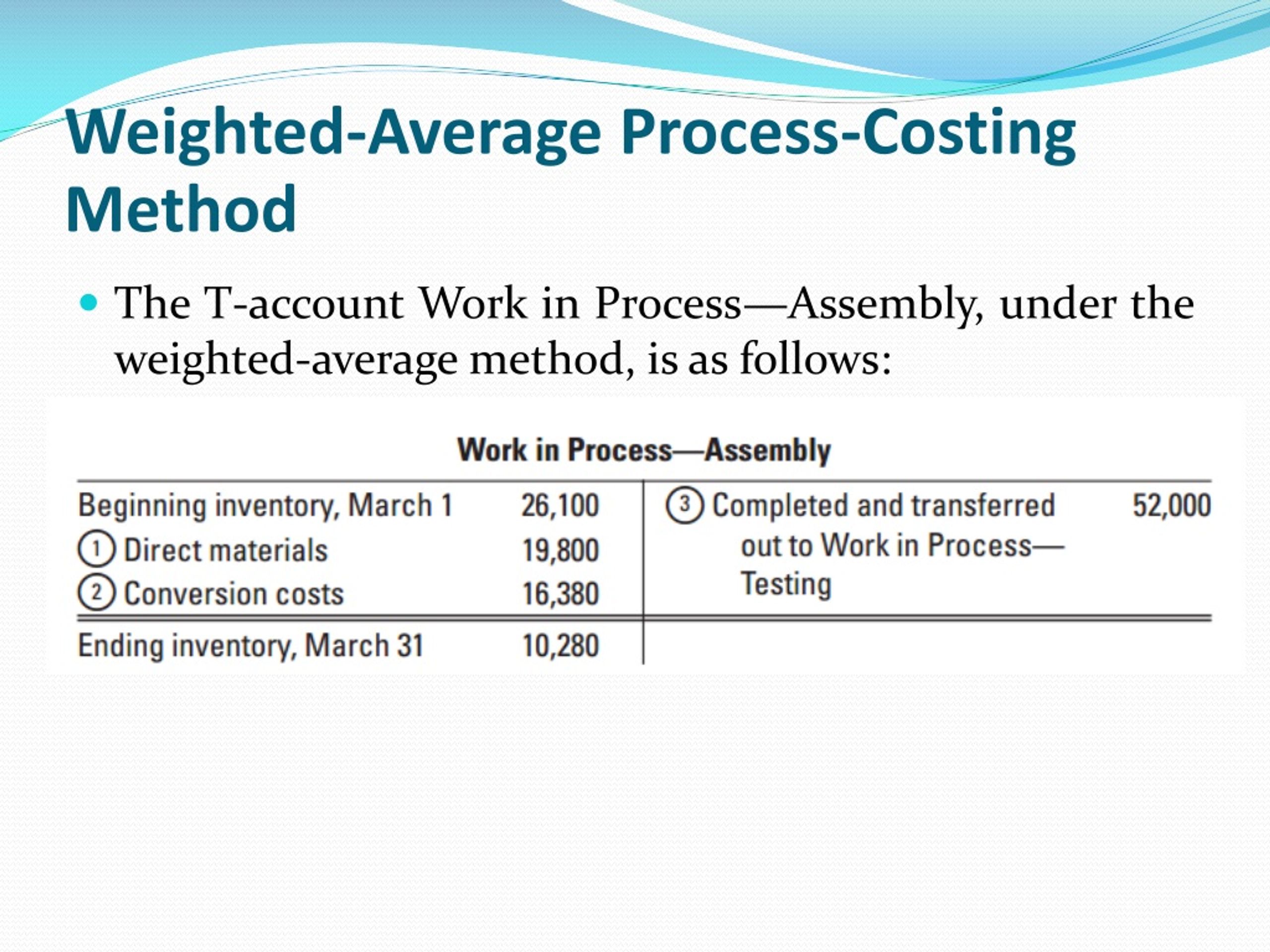

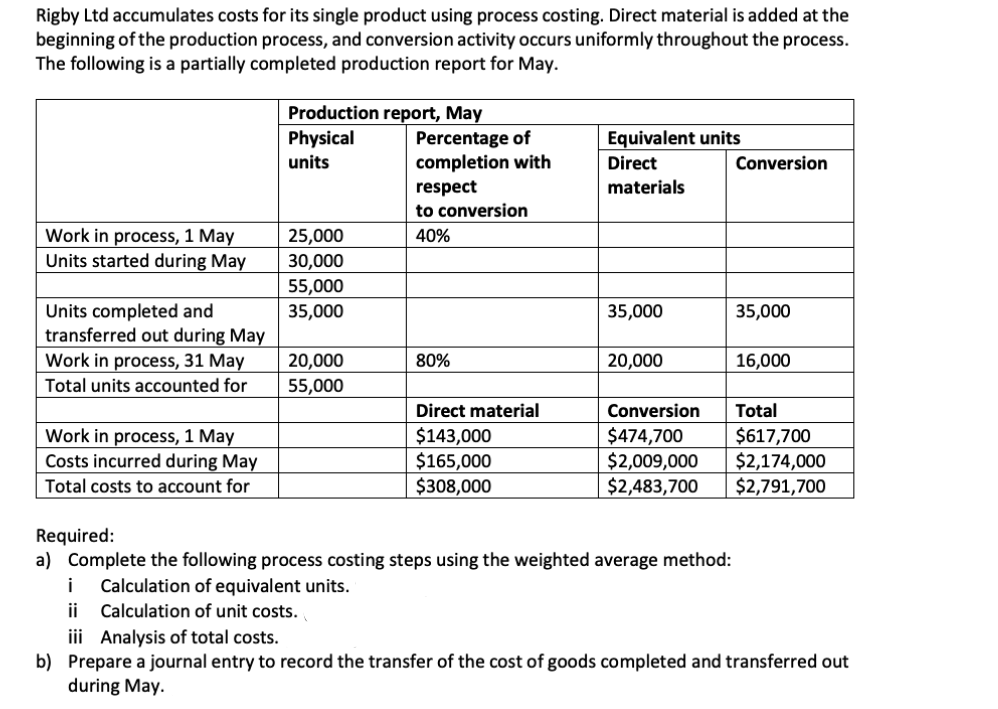

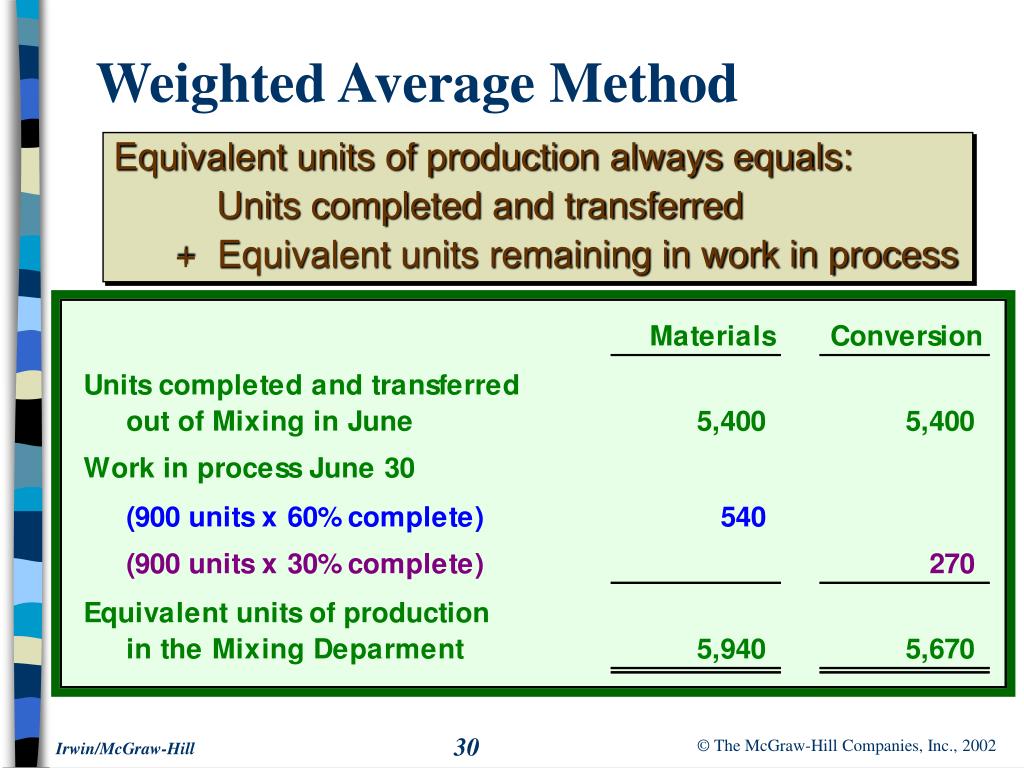

Under the weighted average method, the equivalent units of production are calculated by adding the number of units completed and transferred out to the equivalent units in ending work-in-process inventory.

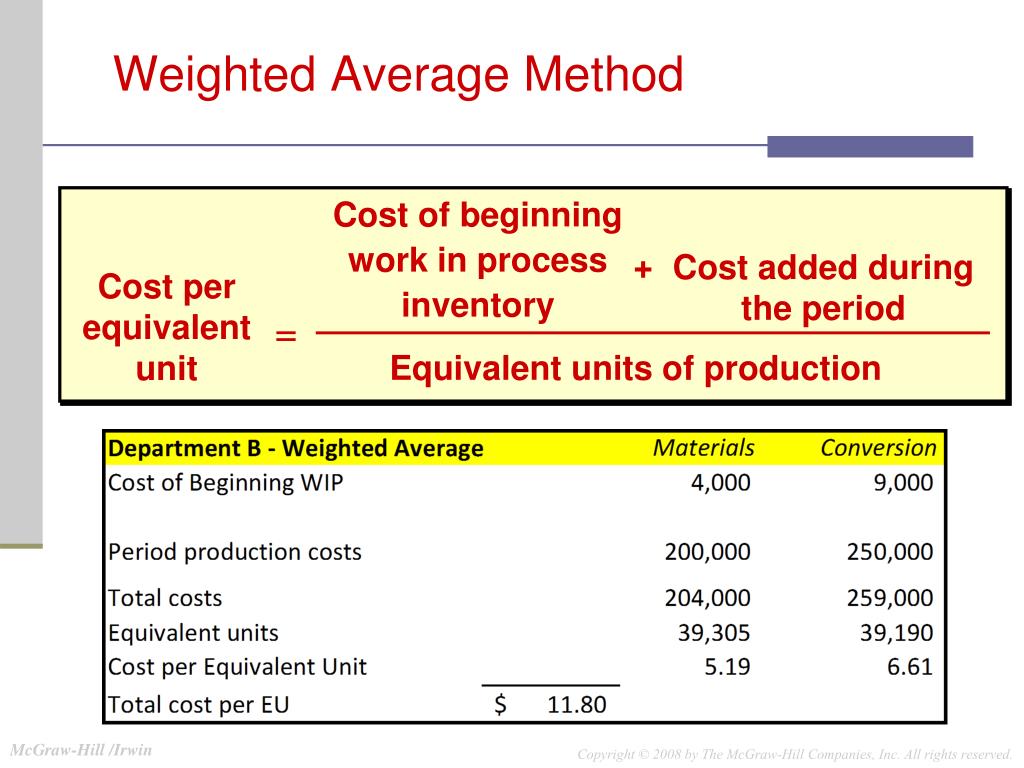

The cost per equivalent unit is then calculated by dividing the total costs (beginning work-in-process inventory costs plus costs added during the period) by the total equivalent units.

Calculation Steps

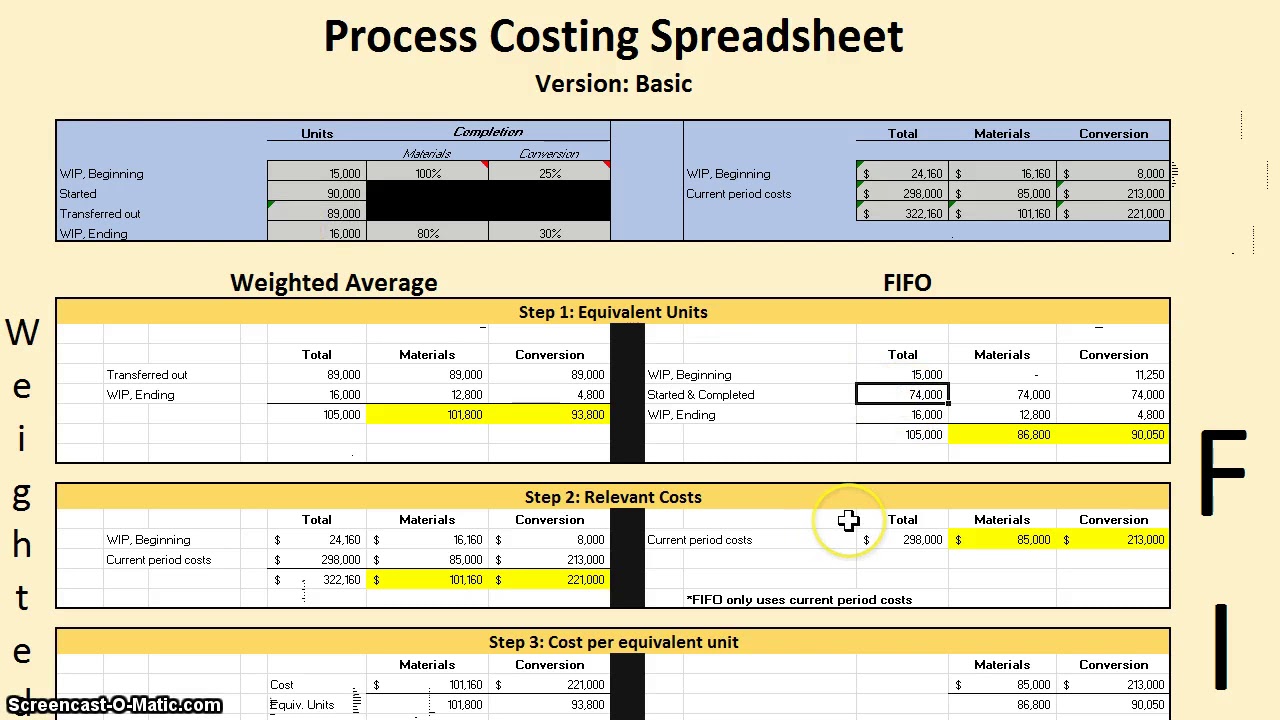

The process involves a series of key calculations:

- Determine the total costs: Sum the costs in beginning work-in-process inventory and the costs added during the period.

- Calculate equivalent units: This involves determining the equivalent number of completed units, considering the percentage of completion for both beginning and ending work-in-process inventory. Under the Weighted Average Method, the degree of completion of beginning work-in-process inventory is ignored.

- Calculate cost per equivalent unit: Divide the total costs by the total equivalent units.

- Allocate costs: Assign costs to completed units and ending work-in-process inventory based on the cost per equivalent unit.

Advantages of the Weighted Average Method

The primary advantage of the Weighted Average Method is its simplicity.

The calculations are straightforward and easy to understand, making it less time-consuming to implement compared to the FIFO method.

This ease of use can be particularly beneficial for smaller businesses with limited accounting resources.

Another advantage is that the method can smooth out cost fluctuations.

By averaging costs over the entire period, the impact of temporary price spikes or dips is minimized.

This can lead to more stable cost figures and potentially more predictable profits.

Disadvantages and Limitations

The simplicity of the Weighted Average Method comes at a cost: a potential lack of accuracy.

It blurs the distinction between costs incurred in different periods, which can distort the true cost of goods sold, especially when there are significant cost variations.

This can lead to misinformed decisions about pricing and production levels. According to a study by the American Institute of Certified Public Accountants (AICPA), companies using the Weighted Average Method should regularly assess its suitability based on the volatility of their input costs.

The method can also be misleading when evaluating performance.

Because it doesn't isolate the costs of beginning inventory, it can be difficult to assess the efficiency of current production processes.

Managers may struggle to identify areas where costs can be reduced.

Real-World Applications and Examples

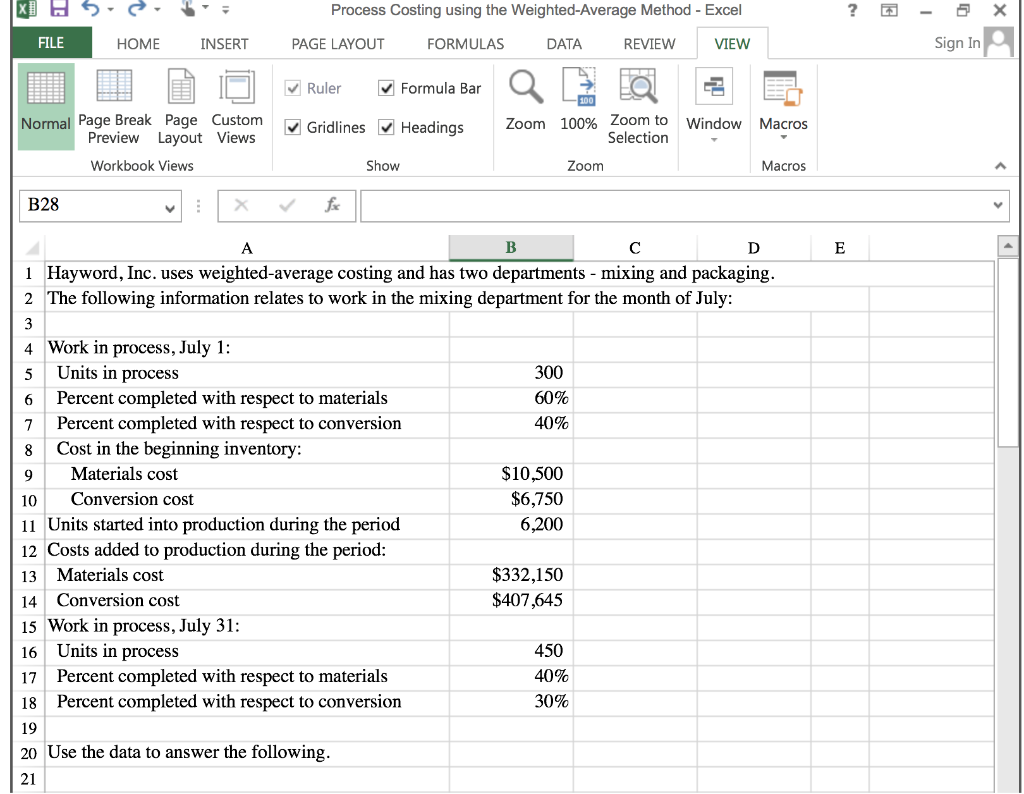

Consider a hypothetical paint manufacturing company, "ColorPlus," using the Weighted Average Method.

Assume beginning work-in-process inventory had a cost of $10,000 and represented 1,000 equivalent units. During the period, $50,000 in costs were added, and 5,000 equivalent units were produced.

The cost per equivalent unit would be ($10,000 + $50,000) / (1,000 + 5,000) = $10 per unit.

Now, if 4,000 units were completed and transferred out, the cost of goods sold would be $40,000 (4,000 units x $10). The ending work-in-process inventory, representing 2,000 units, would be valued at $20,000 (2,000 units x $10).

This simple calculation demonstrates the core mechanics of the Weighted Average Method.

Industry Perspectives

Accountants often choose the Weighted Average Method for its straightforward implementation and ease of auditability.

Dr. Emily Carter, a professor of accounting at the University of California, Berkeley, states, "While FIFO provides a more accurate picture of current costs, the Weighted Average Method is often preferred in situations where the benefits of increased accuracy don't outweigh the additional administrative burden."

However, cost accountants in industries with volatile material costs might favor FIFO because it provides a more accurate reflection of current market prices. According to a report by the Institute of Management Accountants (IMA), companies in the semiconductor industry often use FIFO due to the rapid technological advancements and corresponding price fluctuations in components.

The Future of Weighted Average Method

Despite the rise of more sophisticated cost accounting methods, the Weighted Average Method is likely to remain a relevant tool, especially for companies prioritizing simplicity and cost-effectiveness.

However, as technology continues to evolve, particularly with the advent of advanced accounting software, it is plausible that more businesses will gravitate towards methods offering greater precision, such as FIFO, even if it requires greater initial investment in system infrastructure.

The key for businesses lies in carefully evaluating their specific circumstances, considering their industry, cost structure, and the importance of accuracy versus simplicity, to determine the optimal cost accounting method for their needs.

![Weighted Average Method In Process Costing [Handout] Process Costing - Weighted Average - PROCESS COSTING](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/eb0020f63d047bc9087b48dfab7e1d31/thumb_1200_1553.png)