West Red Lake Gold Mines Stock

The buzz surrounding West Red Lake Gold Mines (TSXV: WRLG) is intensifying as the company advances its Madsen Gold Project towards production. Investors are keenly watching the stock, analyzing recent exploration results, financing activities, and overall market sentiment to gauge its potential. With the price of gold remaining a significant macroeconomic factor, the performance of WRLG is inextricably linked to both its operational progress and the broader economic landscape.

This article delves into the current state of West Red Lake Gold Mines, examining its key assets, recent developments, financial standing, and the perspectives of analysts following the company. Understanding these factors is crucial for investors seeking to make informed decisions about WRLG's stock.

Madsen Gold Project: The Core Asset

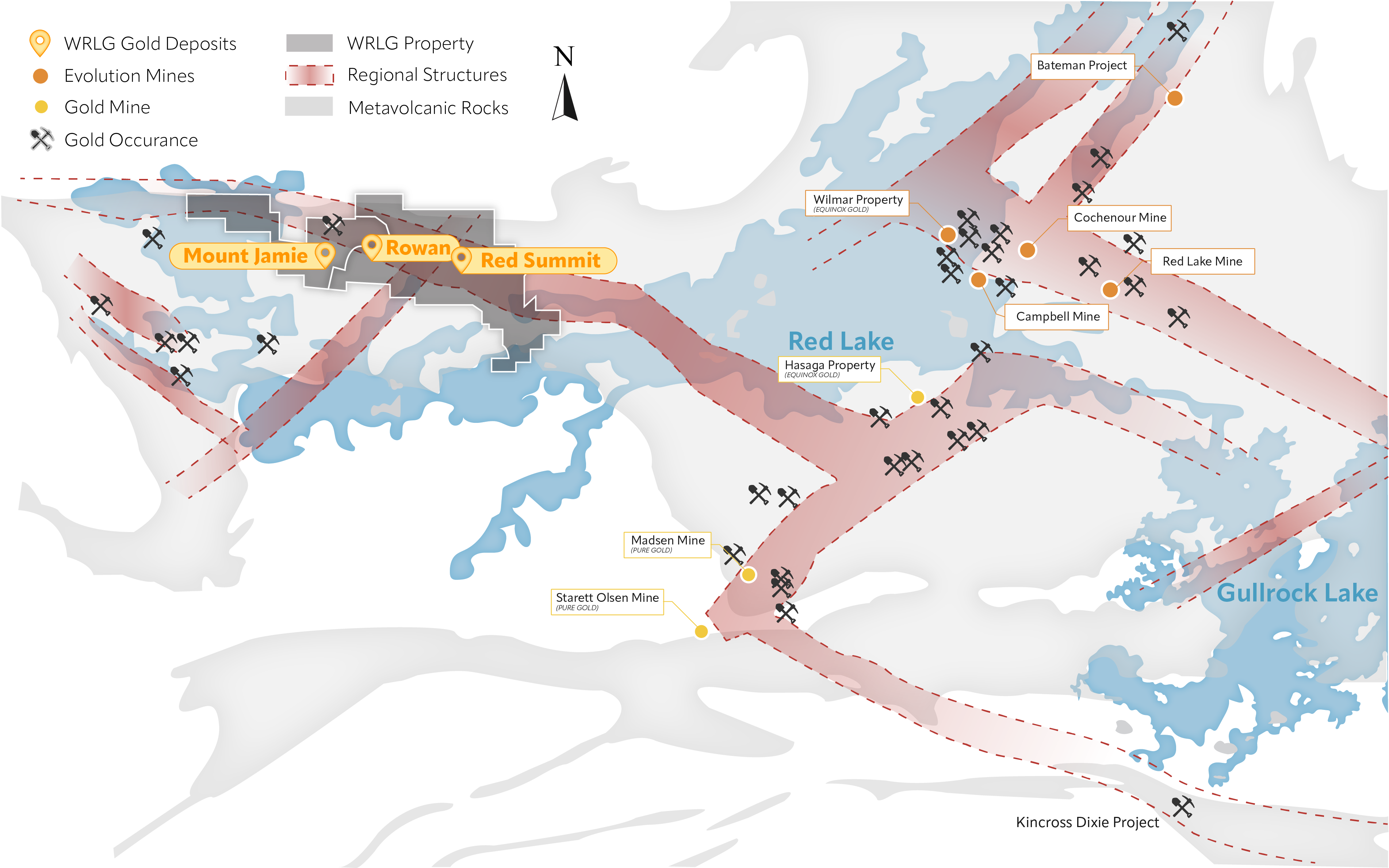

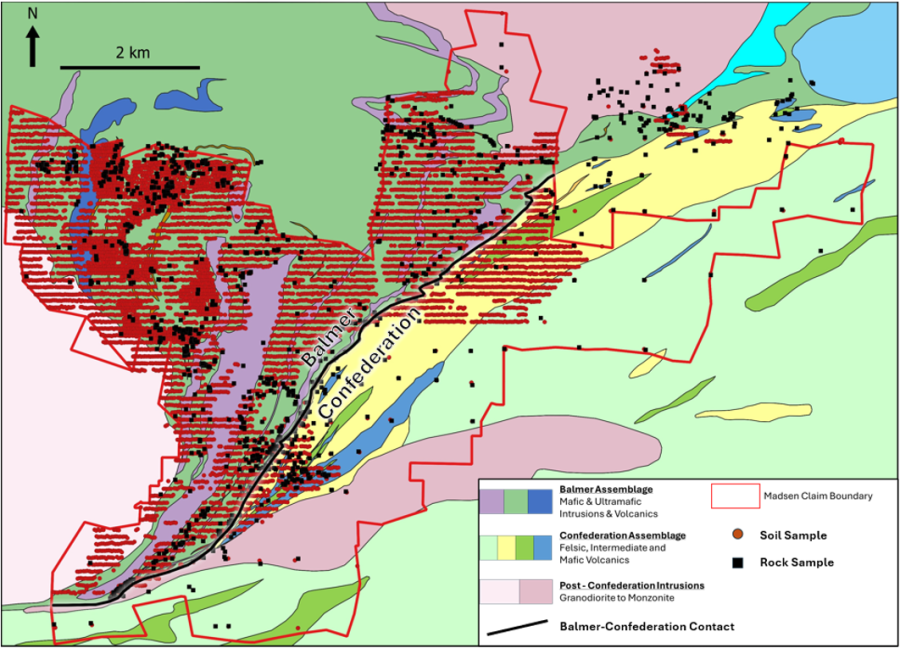

The Madsen Gold Project, located in the prolific Red Lake Mining District of Northwestern Ontario, is the cornerstone of West Red Lake Gold Mines' value proposition. The project boasts a significant historical gold production record and substantial remaining resources. The company's primary focus is on restarting production at the Madsen mine.

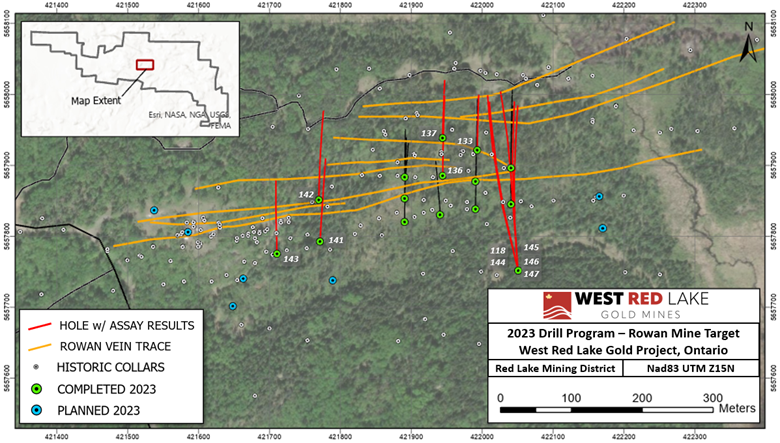

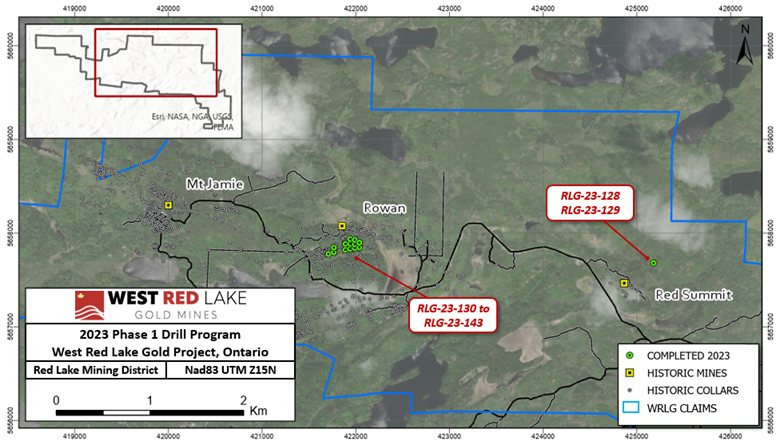

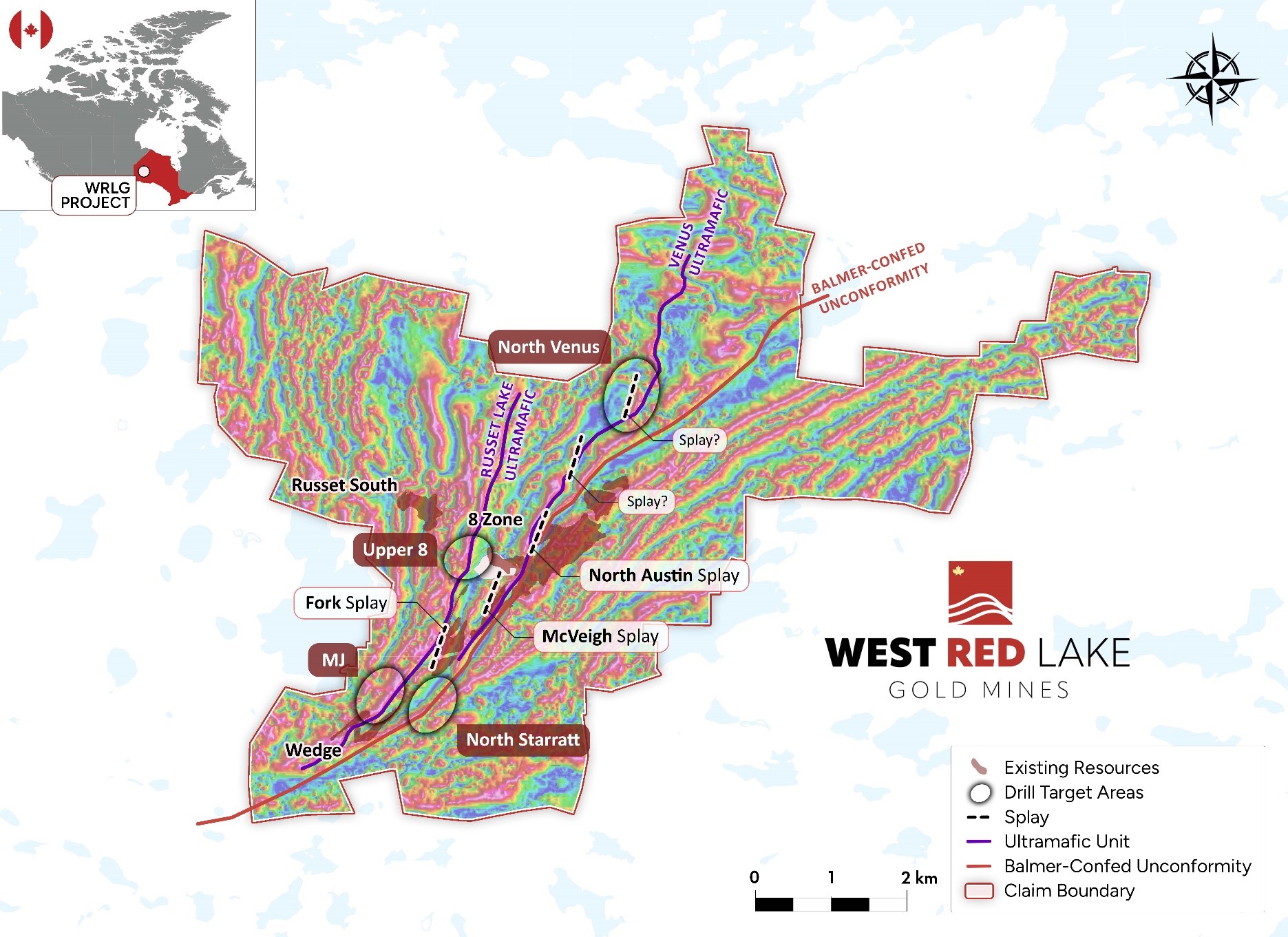

Recent exploration programs at Madsen have yielded promising results. Drilling has expanded known gold zones and identified new mineralization, contributing to the potential for resource growth. These results are meticulously analyzed by geologists and investors alike, seeking clues about the future profitability of the mine.

Restarting Production: Key Milestones

West Red Lake Gold Mines has been actively working towards restarting production at the Madsen mine. This involves various stages, including refurbishment of existing infrastructure, completion of engineering studies, and securing necessary permits and financing. The company has made significant strides in these areas, bringing the project closer to its operational goals.

The company has announced key milestones such as the completion of mill upgrades and the resumption of underground development. These accomplishments demonstrate the company's commitment to the project and instill confidence in investors. However, potential challenges such as unforeseen technical issues or permitting delays always remain a factor.

Financial Position and Funding

Mining projects require significant capital investment, and West Red Lake Gold Mines is no exception. The company has been actively pursuing various financing options to fund the restart of the Madsen Gold Project. This includes equity offerings, debt financing, and potential partnerships.

Recent financing rounds have been closely scrutinized by the market. Investors assess the terms of these deals, including interest rates, dilution, and the involvement of strategic partners. A strong financial position is crucial for West Red Lake Gold Mines to execute its development plans successfully.

The company's financial statements are publicly available and provide a detailed overview of its assets, liabilities, and cash flow. Analysts closely monitor these figures to assess the company's solvency and its ability to meet its financial obligations. Maintaining a healthy balance sheet is paramount for long-term sustainability.

Market Sentiment and Analyst Coverage

The market's perception of West Red Lake Gold Mines is influenced by various factors, including the price of gold, overall market conditions, and specific news related to the company. Analyst coverage plays a significant role in shaping investor sentiment. Analyst reports provide in-depth analysis of the company's prospects, risks, and valuation.

Different analysts may have varying opinions on the company's prospects. Some may be bullish, highlighting the potential for significant upside, while others may be more cautious, emphasizing the risks associated with mining operations. A balanced view is crucial when evaluating analyst recommendations. Investors should perform their own due diligence and not solely rely on analyst opinions.

The price of gold has a direct impact on the profitability of the Madsen Gold Project. A higher gold price translates to increased revenues and improved margins. Consequently, investors closely monitor macroeconomic trends and geopolitical events that could affect the price of gold. Fluctuations in the gold market can significantly influence the value of WRLG's stock.

Risk Factors and Challenges

Investing in mining companies involves inherent risks. These risks include geological uncertainties, fluctuating commodity prices, environmental regulations, and operational challenges. West Red Lake Gold Mines is exposed to these risks, and investors should be aware of them.

Permitting delays can also be a significant risk. Obtaining the necessary permits for mining operations can be a lengthy and complex process. Any delays in permitting can push back the production timeline and negatively impact the company's financial performance.

Changes in environmental regulations can also pose challenges. Mining companies must comply with stringent environmental standards, and any changes in these regulations can increase operating costs. West Red Lake Gold Mines is committed to sustainable mining practices and works closely with regulatory agencies to ensure compliance.

Future Outlook and Potential Catalysts

The future outlook for West Red Lake Gold Mines is largely dependent on the successful restart of production at the Madsen Gold Project. Achieving this milestone would be a significant catalyst for the stock. Continued exploration success and resource expansion would also contribute to the company's value.

Potential partnerships and acquisitions could also provide upside potential. The company may consider strategic alliances or acquisitions to expand its portfolio of assets. These transactions could create synergies and unlock value for shareholders.

Ultimately, the success of West Red Lake Gold Mines hinges on its ability to execute its strategic plans effectively. Careful risk management, diligent operational execution, and a favorable gold price environment are essential for the company to achieve its long-term goals.

Investors are advised to carefully consider their own risk tolerance and investment objectives before investing in WRLG stock.

Thorough due diligence and a balanced perspective are essential for making informed investment decisions.