What Are Some Advantages And Disadvantages To Paying With Checks

In an increasingly digital world dominated by credit cards, debit cards, and mobile payment apps, the humble paper check might seem like a relic of the past. However, checks remain a payment option for many, especially in specific situations. Understanding the advantages and disadvantages of using checks is crucial for making informed financial decisions.

This article explores the pros and cons of paying with checks, examining their continued relevance in today's diverse financial landscape. We will delve into the specific situations where checks might be preferable and highlight the drawbacks that make digital payments a more attractive option for others.

The Enduring Appeal: Advantages of Using Checks

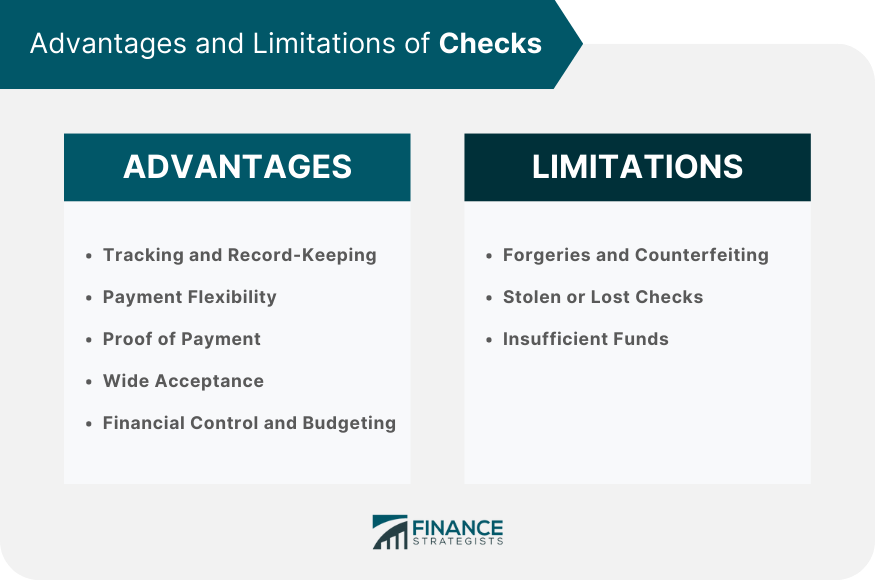

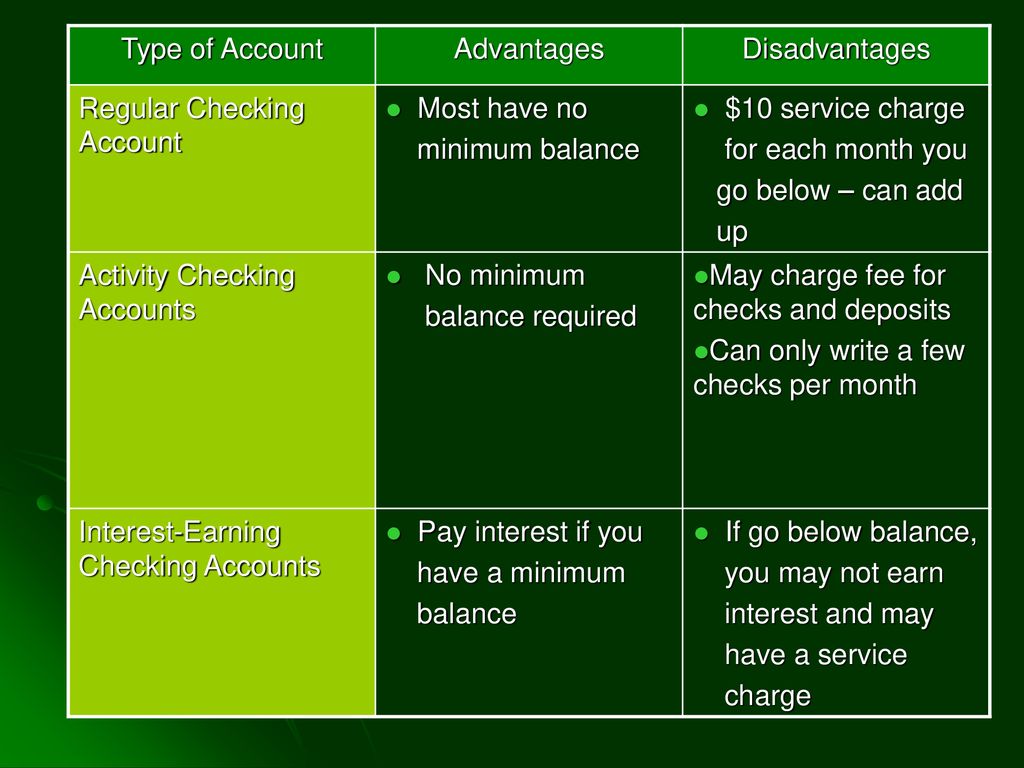

Checks offer several advantages that explain their persistence in some areas of commerce. One significant benefit is the detailed record they provide of transactions. This written record can be invaluable for bookkeeping, budgeting, and resolving disputes.

Checks also offer a degree of control over payments. Unlike automated withdrawals or recurring card payments, the payer has the ability to specify the exact amount and date of payment, adding a layer of security and preventing unauthorized charges. This control is particularly useful for paying rent or bills with variable amounts.

Detailed Record Keeping

The physical nature of a check creates a tangible record of a transaction. The payer receives a canceled check or an electronic image, complete with the payee's endorsement and date of deposit. This detailed information assists in tracking expenses, identifying errors, and reconciling bank statements. According to a survey by the Federal Reserve, while check usage has declined overall, businesses still rely on them for certain accounting practices.

Enhanced Control Over Payments

Checks allow the payer to determine precisely when and how much to pay. This level of control can be particularly appealing when dealing with large or infrequent payments. Furthermore, a payer can place a stop payment order on a check if necessary, offering protection against fraud or disputes, although this service typically incurs a fee.

Acceptance in Specific Situations

While many businesses now prefer electronic payments, some situations still favor checks. For example, rent payments, especially to individual landlords, are often accepted, and sometimes even preferred, by check. Some vendors and service providers, particularly smaller businesses or those in niche markets, may also prefer checks to avoid credit card processing fees.

The Drawbacks: Disadvantages of Using Checks

Despite their advantages, checks come with significant disadvantages that make them less appealing than digital payment methods. One of the most prominent is the inconvenience involved in writing, mailing, and tracking checks. This process can be time-consuming and prone to errors.

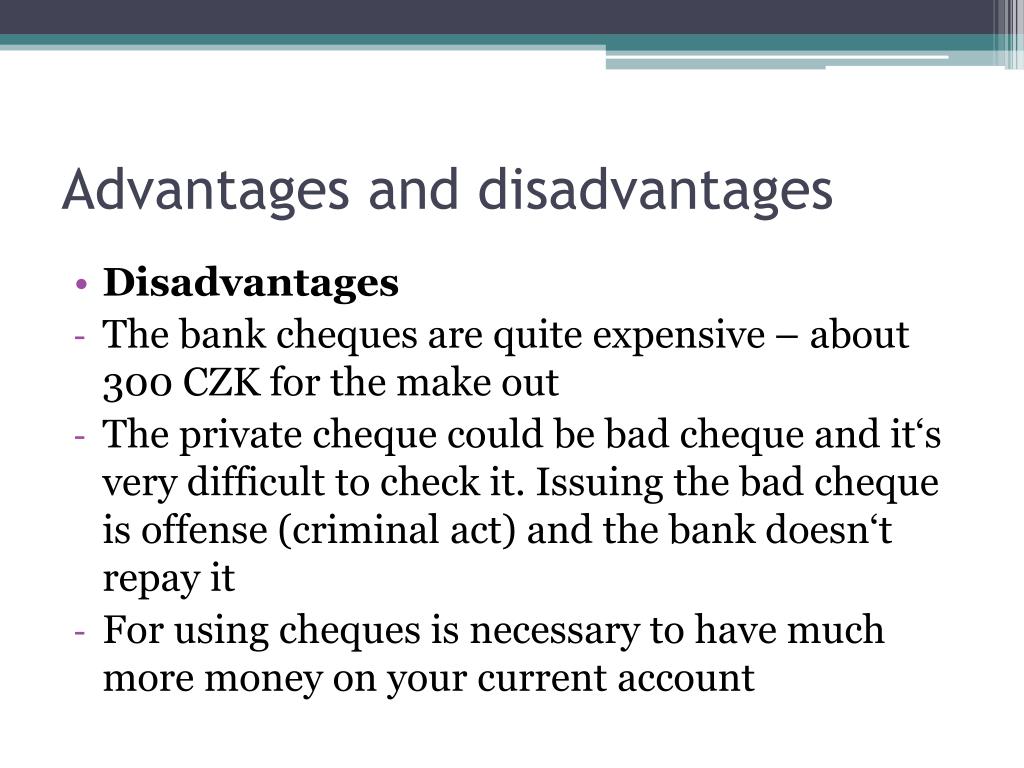

Security concerns are another major drawback. Checks can be lost or stolen in the mail, increasing the risk of fraud. Furthermore, the information printed on a check, such as the account number and routing number, can be used by criminals to create counterfeit checks or engage in other fraudulent activities.

Inconvenience and Time Consumption

Writing and mailing checks requires physical effort and time. The process can be particularly burdensome for individuals or businesses with a high volume of payments. Furthermore, the payee must physically deposit the check, which may require a trip to the bank or ATM.

Security Risks and Fraud Potential

Checks are vulnerable to theft and fraud. Stolen checks can be cashed fraudulently, and the information on a check can be used to create counterfeit checks or to access bank accounts. The American Bankers Association has consistently warned consumers and businesses about the risks of check fraud.

Processing Delays and Costs

Checks typically take longer to clear than electronic payments. This delay can be inconvenient for both the payer and the payee. Banks may also charge fees for check processing, especially for businesses. Furthermore, bounced checks can result in additional fees and penalties for both parties.

Declining Acceptance

As digital payment methods become increasingly prevalent, fewer businesses are willing to accept checks. This trend can make it challenging to use checks for everyday purchases or services. Many retailers and service providers now post signs indicating that they do not accept checks.

The Future of Checks

While check usage has declined significantly in recent years, they haven't disappeared entirely. According to data from Statista, the volume of check payments continues to decrease annually, but checks still account for a significant portion of non-cash transactions, particularly in the business-to-business sector.

Technological advancements are also impacting the way checks are processed. Many banks now offer mobile check deposit, allowing customers to deposit checks remotely using their smartphones. This innovation has made check usage more convenient, but it doesn't address all of the security and fraud concerns.

Conclusion

The decision of whether to pay with checks depends on individual circumstances and preferences. While checks offer certain advantages, such as detailed record keeping and enhanced control over payments, they also come with significant disadvantages, including inconvenience, security risks, and declining acceptance.

As digital payment methods continue to evolve and become more secure and convenient, the role of checks is likely to diminish further. However, checks will likely remain a viable payment option for specific situations and for individuals or businesses who prefer the tangible nature and control they provide. Ultimately, understanding the pros and cons of using checks empowers individuals and businesses to make informed decisions about their financial transactions.

+What+is+the+conventional+way+of+paying+by+check.jpg)