What Credit Score Is Needed For American Express Credit Card

In a world increasingly reliant on credit, securing the right credit card can be a game-changer. For many, an American Express card represents a gateway to premium rewards, exclusive benefits, and enhanced purchasing power. However, the allure of an Amex card is often met with a crucial question: What credit score is needed to qualify?

This article dives into the credit score requirements for various American Express cards, offering a detailed overview of the factors that influence approval and providing insights for individuals aiming to add an Amex to their wallet.

Understanding Credit Score Requirements

The "nut graf" for anyone eyeing an American Express card lies in understanding that a "good" to "excellent" credit score is generally required. This typically translates to a FICO score of 670 or higher.

However, it's not quite as simple as having a single magic number. American Express considers a range of factors, including credit history, income, and overall financial standing, before making a decision.

The Spectrum of American Express Cards

American Express offers a diverse portfolio of cards catering to different needs and preferences. Some cards are easier to obtain than others.

Entry-level or co-branded cards may have slightly lower credit score requirements compared to premium travel rewards cards like the Platinum Card or Gold Card.

General Credit Score Guidelines

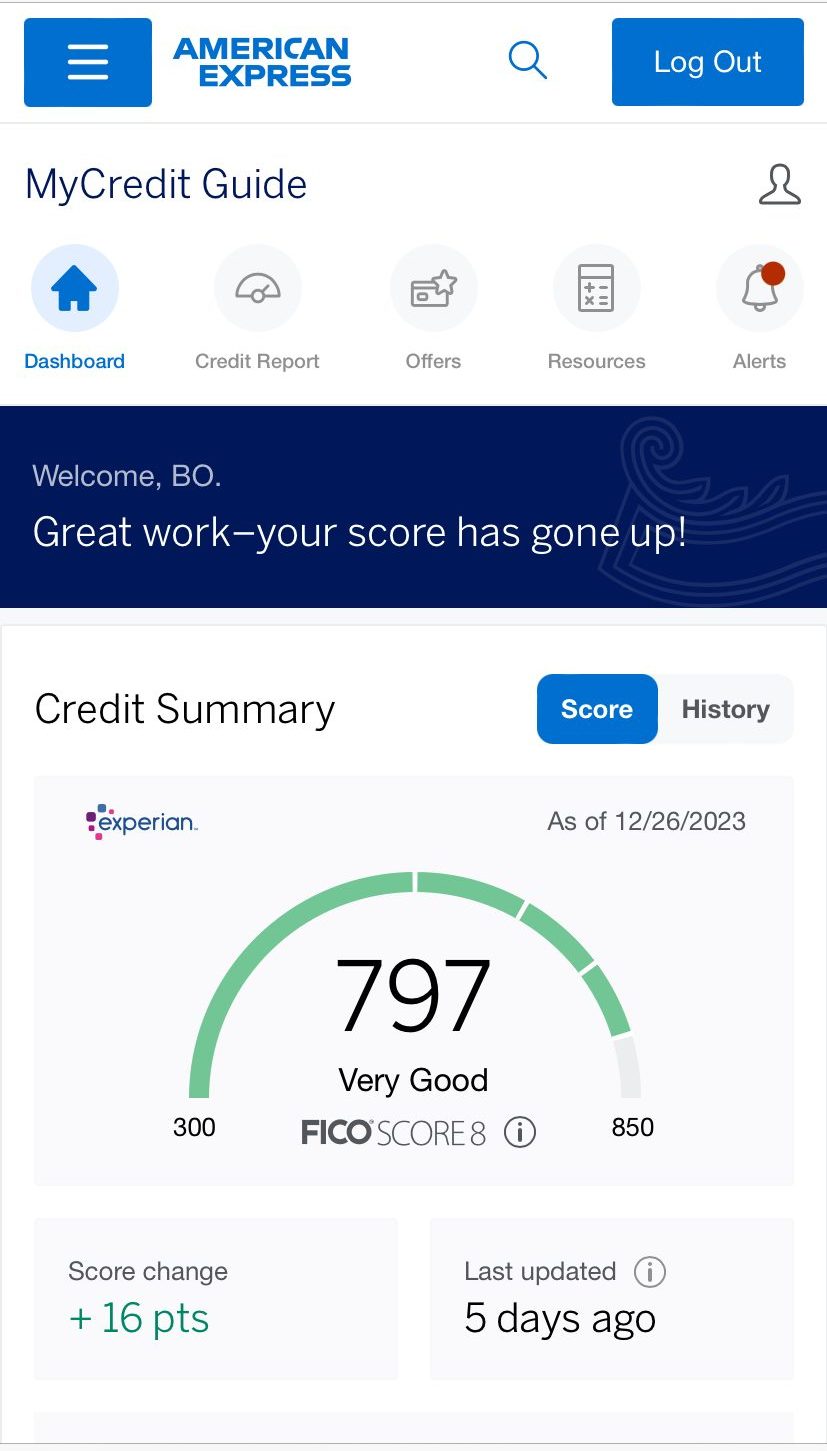

For most American Express cards, a FICO score in the "good" range (670-739) increases your chances of approval. A score in the "very good" range (740-799) significantly improves your odds.

Applicants with "excellent" scores (800+) are generally considered prime candidates.

Keep in mind these are just general guidelines. Individual circumstances play a vital role.

Factors Beyond Credit Score

American Express conducts a comprehensive review that extends beyond just your credit score. Your credit report, detailing your payment history, outstanding debts, and credit utilization, is scrutinized.

Consistent on-time payments and low credit utilization are viewed favorably. Conversely, a history of late payments, defaults, or high credit balances can hinder your application.

Income is another critical factor. American Express needs assurance that you can realistically manage your credit card debt.

A stable income and a reasonable debt-to-income ratio are essential for approval.

Specific Card Examples

The American Express Blue Cash Everyday Card, often considered an entry-level option, may be accessible to those with a credit score in the upper end of the "fair" range (around 650), though a "good" score is still preferred.

The American Express Platinum Card, with its premium rewards and benefits, typically requires a credit score in the "good" to "excellent" range.

These requirements can fluctuate based on American Express's internal risk assessment models and prevailing economic conditions. Always check American Express's official website for latest update.

Building and Maintaining a Good Credit Score

Improving your credit score is an investment that pays dividends. Start by obtaining a copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

Dispute any errors or inaccuracies that you find. Focus on making timely payments on all your debts, even if it's just the minimum amount.

Keep your credit utilization low by using only a small portion of your available credit limit.

Avoid opening too many new credit accounts in a short period, as this can lower your average account age and negatively impact your score.

Alternatives for Those with Lower Credit Scores

If your credit score is not yet in the "good" range, consider secured credit cards or credit-builder loans. These options can help you establish or rebuild your credit history.

Secured credit cards require a cash deposit as collateral, while credit-builder loans are designed to help you build credit through regular, on-time payments.

Once you've improved your credit score, you can then explore applying for an American Express card.

Looking Ahead

The credit card landscape is constantly evolving. American Express, like other issuers, may adjust its credit score requirements and approval criteria based on market conditions and internal risk assessments.

Staying informed about the latest requirements and maintaining a healthy credit profile are crucial for anyone aspiring to own an American Express card.

By understanding the credit score requirements, taking steps to improve your credit, and carefully considering your financial situation, you can increase your chances of being approved for the American Express card that aligns with your needs and aspirations.