What Credit Score Is Needed For At&t Wireless

Securing a new cell phone plan often involves more than just choosing the latest device and data package. Many major carriers, including AT&T, use credit checks as part of their customer approval process.

This practice raises questions for consumers: What credit score is needed to qualify for AT&T wireless service, and how does a credit check impact plan options and upfront costs?

Understanding AT&T's Credit Assessment

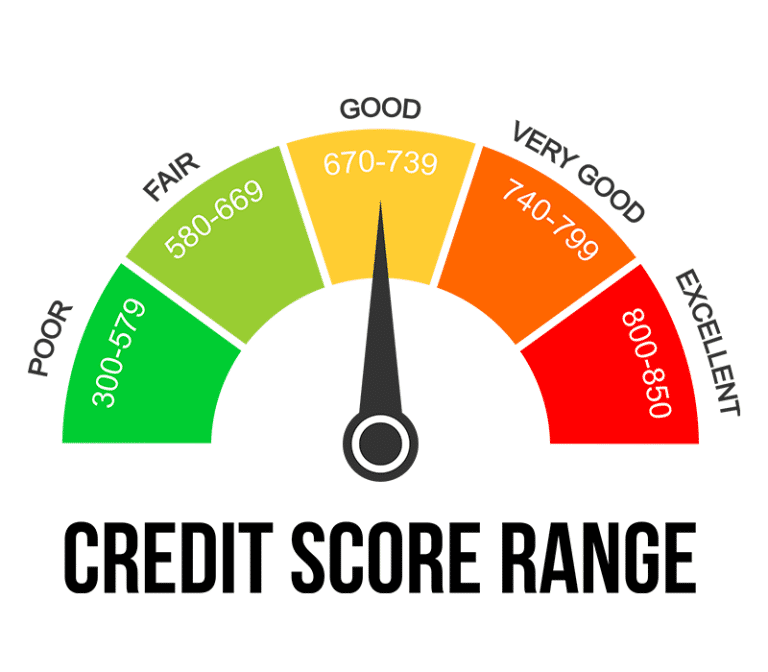

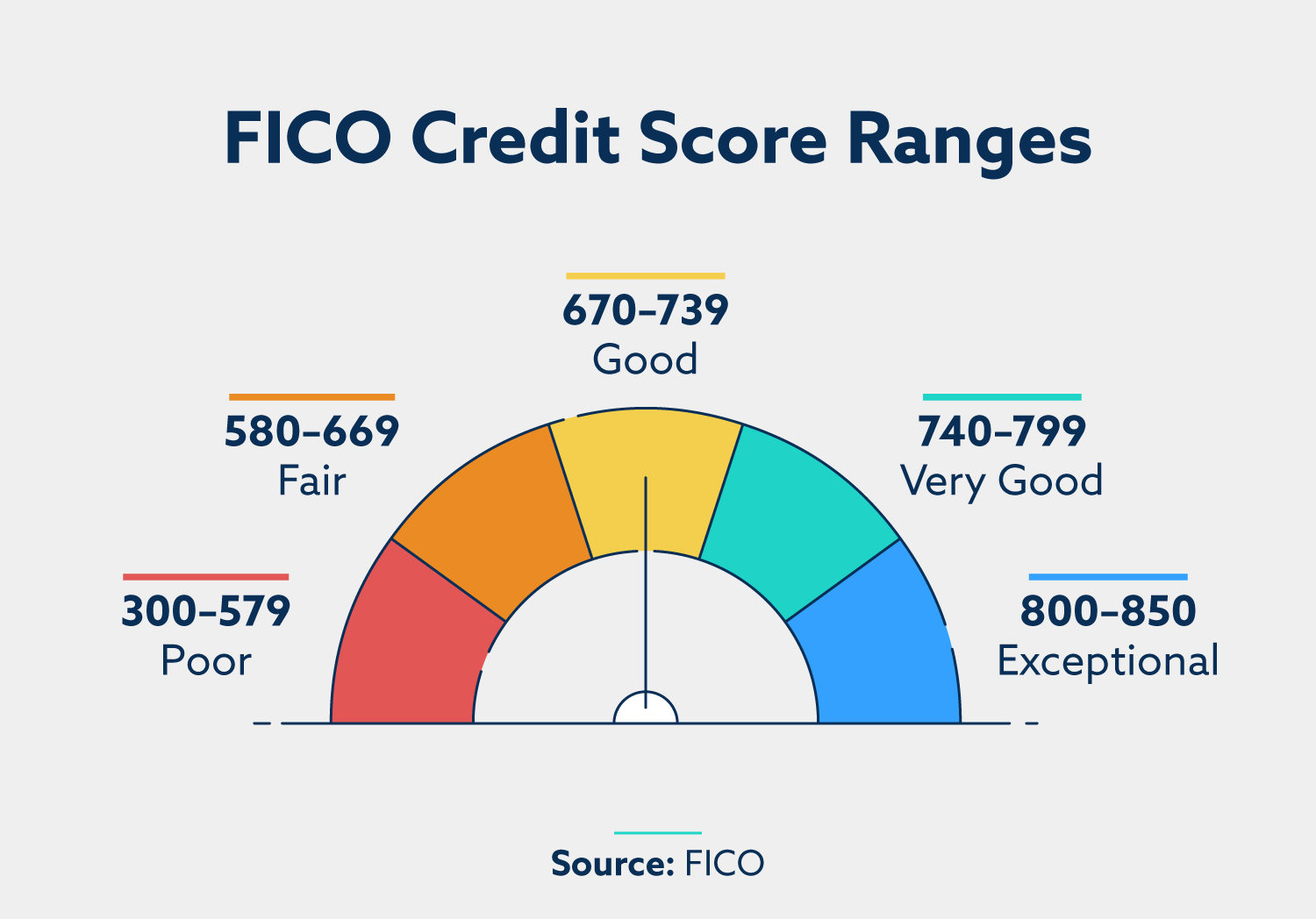

While AT&T doesn't publicly disclose a specific minimum credit score requirement, industry analysis and customer reports suggest a general range. Consumers with scores above 600 typically have a higher chance of approval for standard plans without a large security deposit.

However, approval isn't solely based on a single credit score; AT&T considers several factors. Payment history, credit utilization, and the length of credit history also play a role in the overall assessment.

AT&T performs a soft credit inquiry, which doesn't impact your credit score, to determine eligibility. This inquiry allows them to view your credit report without negatively affecting your credit rating.

Credit Tiers and Plan Options

Applicants with lower credit scores might still be able to obtain AT&T service, but their options may be limited. AT&T may require a security deposit, which can range from $200 to $500, depending on the individual's credit profile.

Prepaid plans are another alternative. These plans don't require a credit check and offer a pay-as-you-go or monthly payment structure.

Prepaid options provide flexibility and eliminate the risk of incurring debt. They're an excellent choice for individuals with no credit history or those looking to rebuild their credit.

Alternatives for Building or Rebuilding Credit

For those concerned about their credit score, there are steps to improve it. Paying bills on time, reducing credit card balances, and avoiding new credit applications can positively impact your credit rating.

Consider secured credit cards designed for individuals with low credit scores. These cards require a cash deposit that acts as collateral, making them easier to obtain.

Regularly monitoring your credit report for errors is crucial. Correcting inaccuracies can lead to a significant improvement in your credit score.

Impact on Consumers

AT&T's credit check policy has a broader impact on consumers, particularly those with limited or damaged credit. Requiring security deposits or limiting plan options can create a barrier to accessing essential communication services.

This can disproportionately affect low-income individuals and those who are new to credit. It highlights the importance of financial literacy and responsible credit management.

However, AT&T's stance is rooted in managing risk. By assessing creditworthiness, they aim to minimize defaults and protect their business interests.

Navigating the Approval Process

Before applying for AT&T wireless service, it's wise to check your credit score and review your credit report. This will provide a clear understanding of your credit standing.

Explore all available plan options, including prepaid plans and those that might require a security deposit. Contact AT&T directly to inquire about specific credit requirements and potential alternatives based on your individual circumstances.

Document any communication with AT&T and retain copies of all application materials. In the event of a denial, you have the right to understand the reasons and potentially appeal the decision.

The Bottom Line

While a specific credit score isn't explicitly stated by AT&T, aiming for a score above 600 generally increases your chances of approval for standard wireless plans. Understand your credit standing, explore all available options, and take steps to improve your credit to access the plans you want without unnecessary financial burdens.

Ultimately, being proactive and informed is key to navigating AT&T's credit assessment process and securing the wireless service that best meets your needs.