What Crypto Should I Invest In Today

Imagine a digital frontier, buzzing with innovation and the promise of financial freedom. The air crackles with the energy of new technologies, decentralized dreams, and the ever-enticing allure of potential returns. But amidst this vibrant landscape, a single question echoes through the digital canyons: "What crypto should I invest in today?"

This question, while simple on the surface, is fraught with complexity. The cryptocurrency market is a dynamic, often volatile ecosystem, and navigating it requires careful consideration and informed decision-making. This article aims to provide a thoughtful exploration of the current crypto landscape, offering insights and perspectives to help you make a well-informed investment choice.

Understanding the Crypto Landscape

The world of cryptocurrencies has evolved dramatically since the inception of Bitcoin in 2009. Initially a fringe technology embraced by cypherpunks, it has now entered the mainstream consciousness, attracting interest from institutional investors and everyday individuals alike.

Today, the market is populated by thousands of different cryptocurrencies, each with its unique value proposition, technological underpinnings, and risk profile. Understanding the different categories and their purposes is crucial.

Bitcoin: The Digital Gold Standard

Often referred to as "digital gold," Bitcoin remains the dominant cryptocurrency in terms of market capitalization and name recognition. Its limited supply and decentralized nature continue to appeal to investors seeking a store of value and a hedge against inflation.

While Bitcoin's price volatility can be significant, its long-term track record has established it as a relatively stable player in the volatile crypto market.

Ethereum: The Platform for Decentralized Applications

Ethereum is more than just a cryptocurrency; it's a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps). This functionality has fueled the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs), creating a vast ecosystem of innovation.

The ongoing transition to Ethereum 2.0, a more scalable and energy-efficient version of the platform, is a key development to watch.

Altcoins: Exploring the Alternatives

Beyond Bitcoin and Ethereum lies a vast landscape of alternative cryptocurrencies, often referred to as "altcoins." These coins offer a wide range of functionalities and address various needs, from faster transaction speeds to enhanced privacy features.

However, altcoins also carry a higher degree of risk compared to Bitcoin and Ethereum, as they are often subject to greater price volatility and uncertainty.

Factors to Consider Before Investing

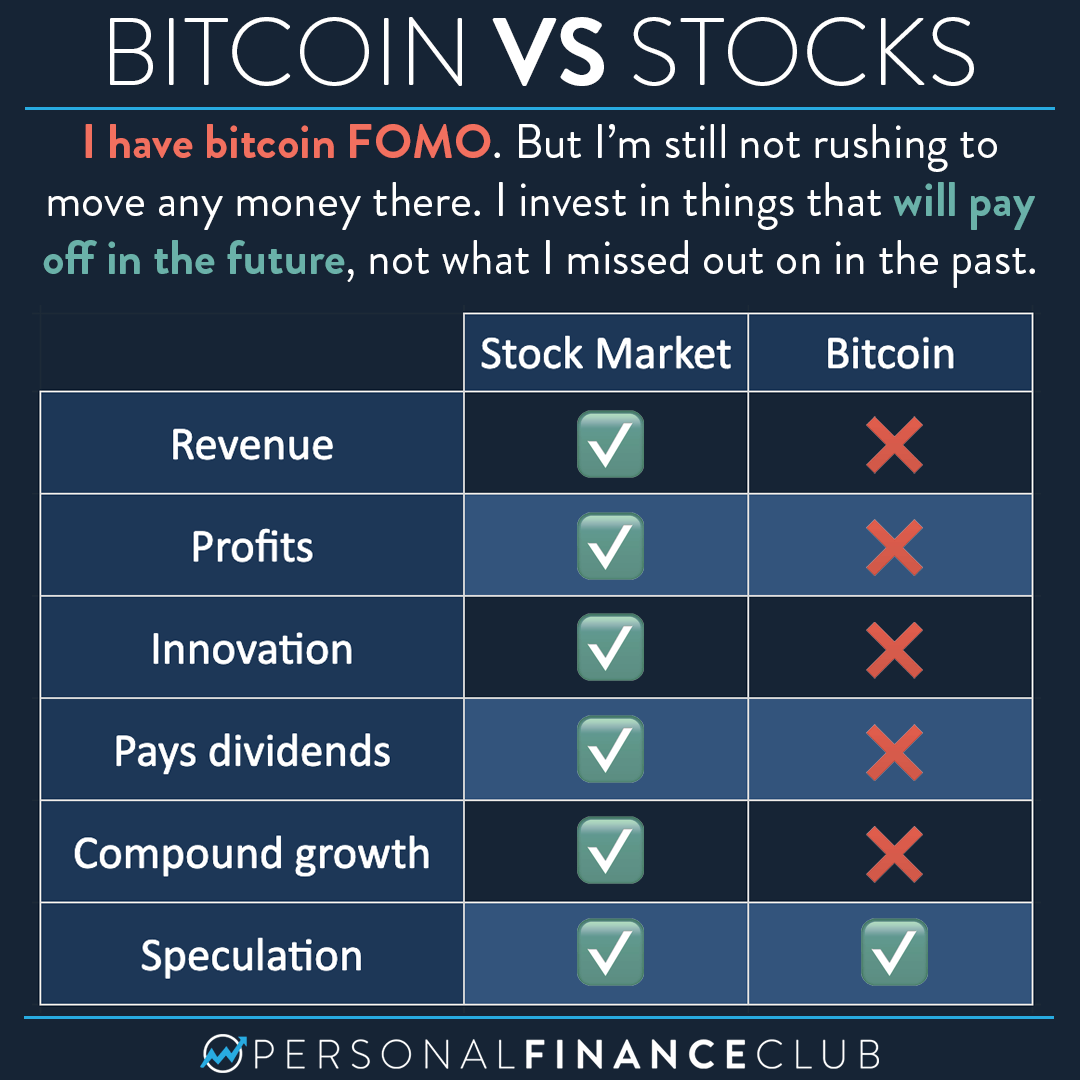

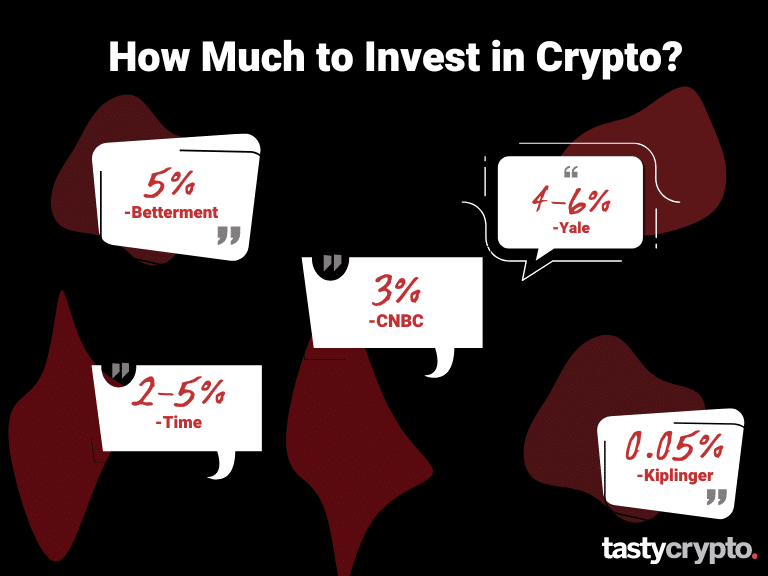

Before diving into any specific cryptocurrency, it's essential to consider your own investment goals, risk tolerance, and financial situation. Investing in crypto should only be done with capital you can afford to lose.

Diversification is key to mitigating risk. Spreading your investments across different cryptocurrencies can help reduce your exposure to the volatility of any single asset.

Research is paramount. Before investing in any cryptocurrency, thoroughly research its underlying technology, team, and market potential. Reputable sources like

CoinDeskand

CoinMarketCapoffer valuable information and analysis.

The Future of Crypto

The future of cryptocurrencies is uncertain, but the underlying technology – blockchain – holds immense potential. As regulatory frameworks evolve and mainstream adoption increases, cryptocurrencies could play an increasingly significant role in the global financial system.

However, it's important to approach the market with a realistic perspective. The crypto market is subject to rapid changes, and it's crucial to stay informed and adaptable.

Ultimately, the best crypto investment for you depends on your individual circumstances and risk appetite. Investing should align with your long-term financial goals.