What Is The Minimum Car Insurance Coverage In Massachusetts

Imagine driving down a winding road in the Berkshires, the sun dappling through the trees, the air crisp and clean. Suddenly, another car swerves into your lane. A fender bender, thankfully, but now the real headache begins: insurance. In Massachusetts, navigating the world of car insurance can feel as complex as Boston's road system itself.

Understanding the minimum car insurance coverage required in Massachusetts is crucial for all drivers. It protects you financially in case of an accident. This article breaks down the minimum requirements, explores what they cover, and highlights why knowing these details can save you from significant financial strain.

The Bare Minimum: What Massachusetts Law Requires

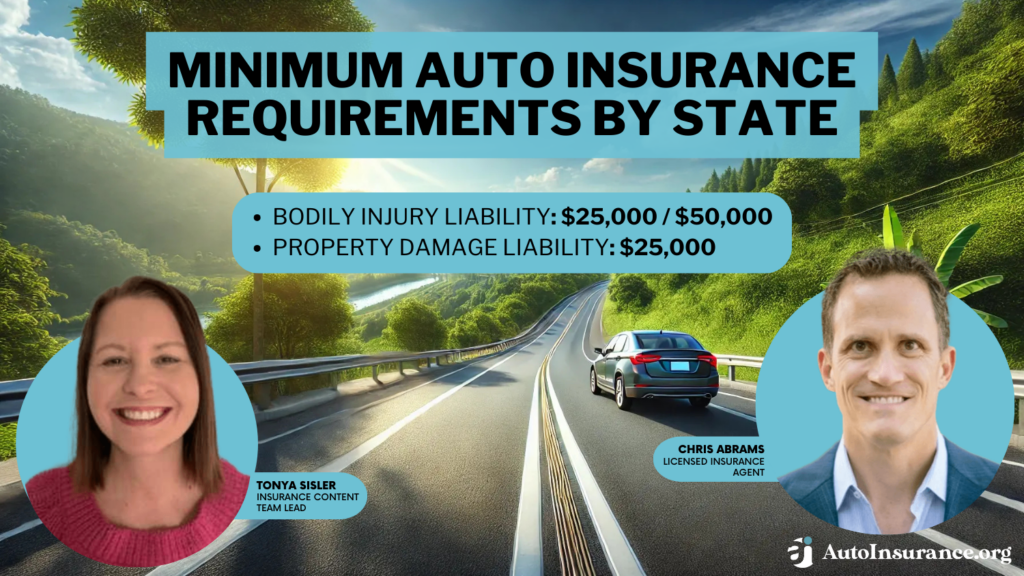

Massachusetts mandates all registered vehicles to carry specific minimum insurance coverage. These are the lowest allowable amounts. Drivers must be aware of the specifics to legally operate a vehicle.

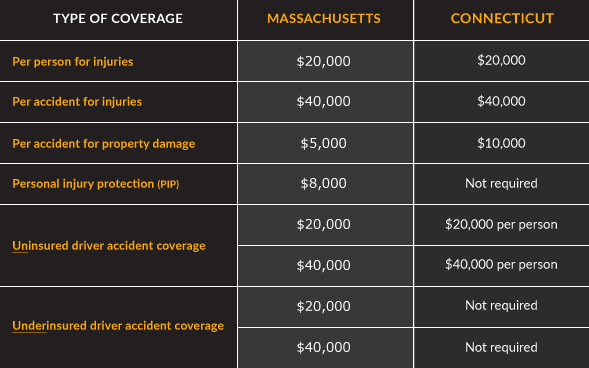

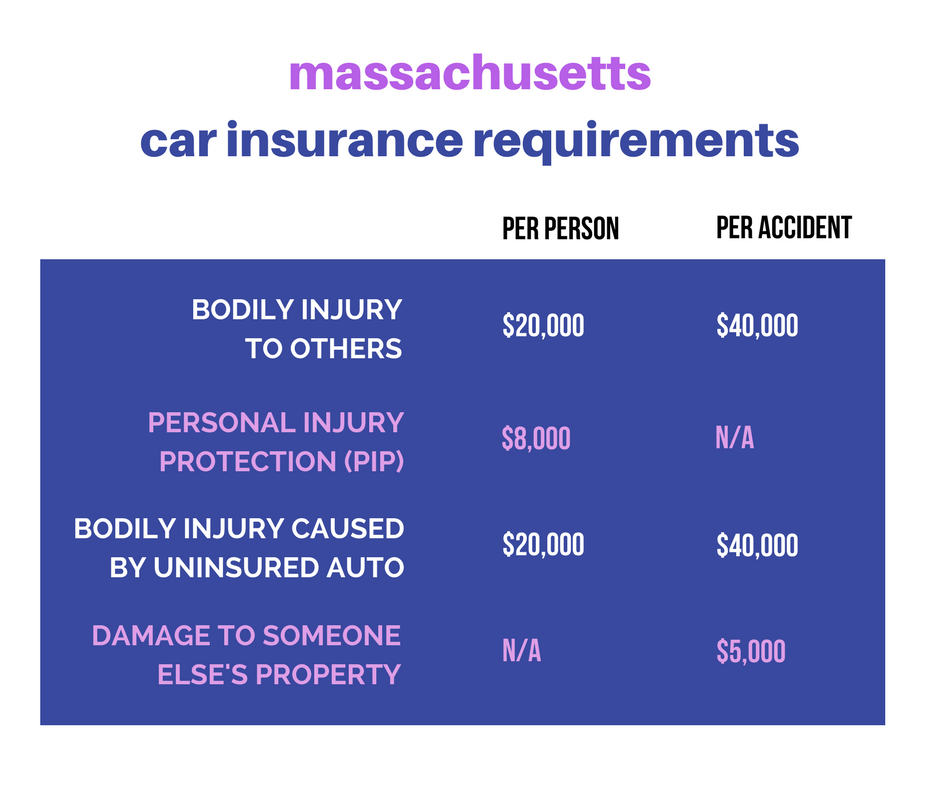

Bodily Injury Liability

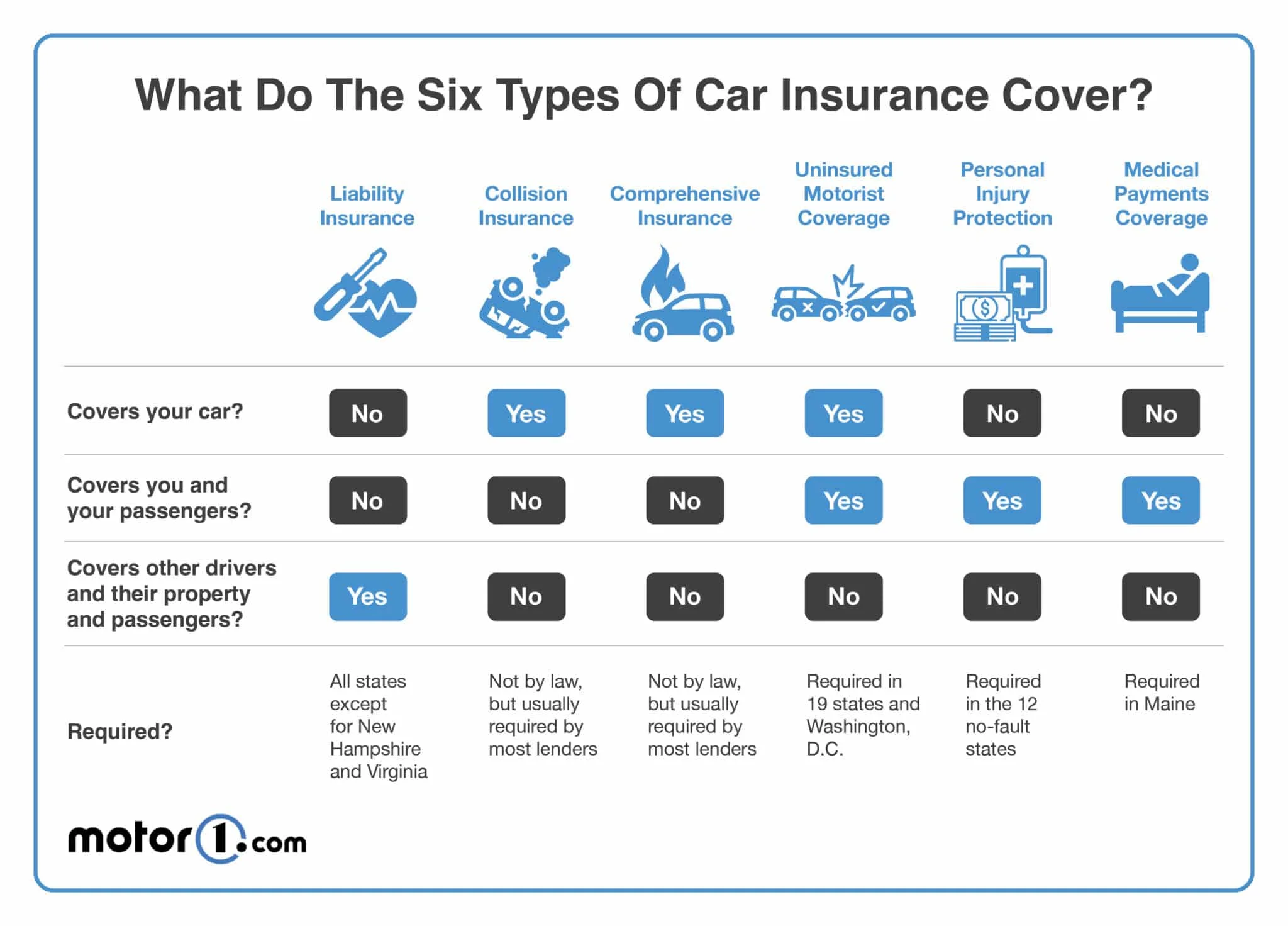

This coverage protects you if you injure someone else in an accident. The minimum requirement in Massachusetts is $20,000 per person and $40,000 per accident. This pays for the other person's medical bills and lost wages up to those limits.

Property Damage Liability

If you damage another person's car or property, this coverage kicks in. The minimum required is $5,000. This might not seem like much, considering the cost of modern car repairs.

Uninsured Motorist Bodily Injury

This coverage protects you if you're injured by an uninsured driver or a hit-and-run driver. The minimum is $20,000 per person and $40,000 per accident. It essentially acts as your own insurance when the other driver has none.

Personal Injury Protection (PIP)

PIP, often called "no-fault" insurance, covers your medical expenses and lost wages regardless of who caused the accident. The minimum PIP coverage in Massachusetts is $8,000. It's designed for quick access to funds after an accident, regardless of fault.

Understanding the Significance of Minimum Coverage

While meeting the minimum requirements fulfills the legal obligation, it’s important to understand the limitations. The minimums might not be adequate to cover all potential costs arising from an accident. This could leave you personally liable for remaining expenses.

For instance, imagine causing a multi-car pileup on the Mass Pike. The minimum property damage liability of $5,000 would likely be insufficient. You could be sued for the remaining repair costs of the other vehicles.

Similarly, medical bills can quickly exceed the $20,000 per person bodily injury liability limit. A serious injury could easily lead to expenses that far surpass this amount. This could mean significant out-of-pocket costs for you.

The Case for Higher Coverage Limits

Many insurance professionals recommend exceeding the minimum coverage requirements. This provides greater financial protection. It shields you from potentially devastating financial losses.

Consider increasing your bodily injury liability to $100,000/$300,000 or even higher. A higher limit offers a much greater cushion in case of a serious accident. Similarly, increasing your property damage liability to $50,000 or $100,000 can offer more peace of mind.

Paying a bit more in premiums for higher coverage limits is often worth it. It protects your assets and future earnings. It prevents a single accident from derailing your financial well-being.

The Impact of Optional Coverages

Beyond the mandatory minimums, Massachusetts offers several optional car insurance coverages. These provide further protection. Understanding these options is essential for a well-rounded insurance plan.

Collision Coverage

Collision coverage pays for damage to your vehicle resulting from an accident, regardless of who was at fault. It usually comes with a deductible, the amount you pay out of pocket before the insurance covers the rest. It’s particularly beneficial for newer or more valuable cars.

Comprehensive Coverage

Comprehensive coverage protects your car from damage not caused by a collision. This includes theft, vandalism, fire, and natural disasters. It’s also often subject to a deductible. Living in an area prone to severe weather might make this coverage particularly appealing.

MedPay

MedPay (Medical Payments) is similar to PIP, covering medical expenses regardless of fault. However, it often has higher limits than PIP. It can supplement your health insurance coverage.

Rental Car Reimbursement

If your car is damaged in an accident and you need a rental car while it's being repaired, this coverage can help. It provides reimbursement for the cost of a rental vehicle. It avoids disruption while waiting for your car repair.

Navigating the Massachusetts Insurance Landscape

Choosing the right car insurance can feel daunting. However, several resources can help you make informed decisions. The Massachusetts Division of Insurance offers valuable information on coverage options and consumer rights.

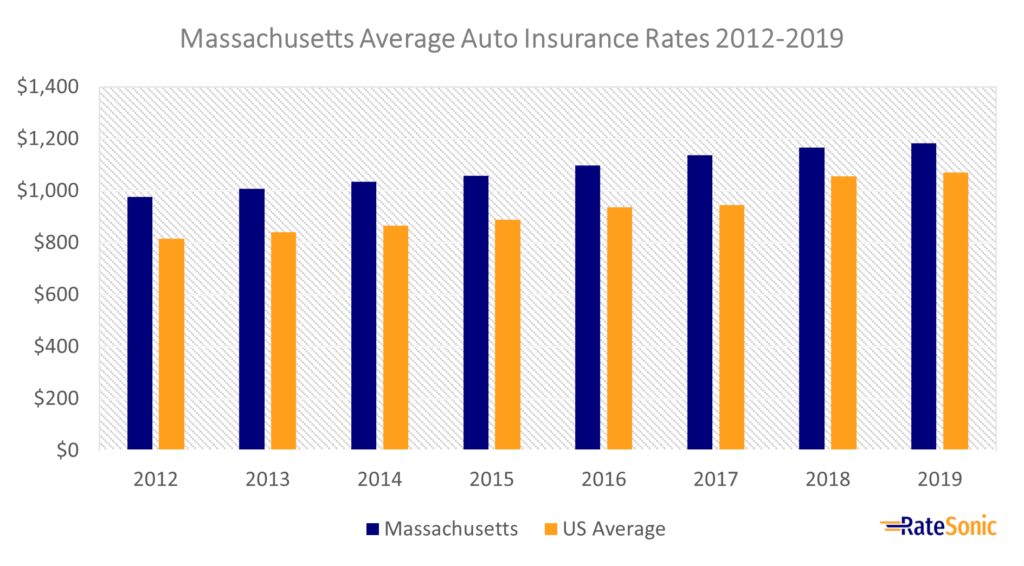

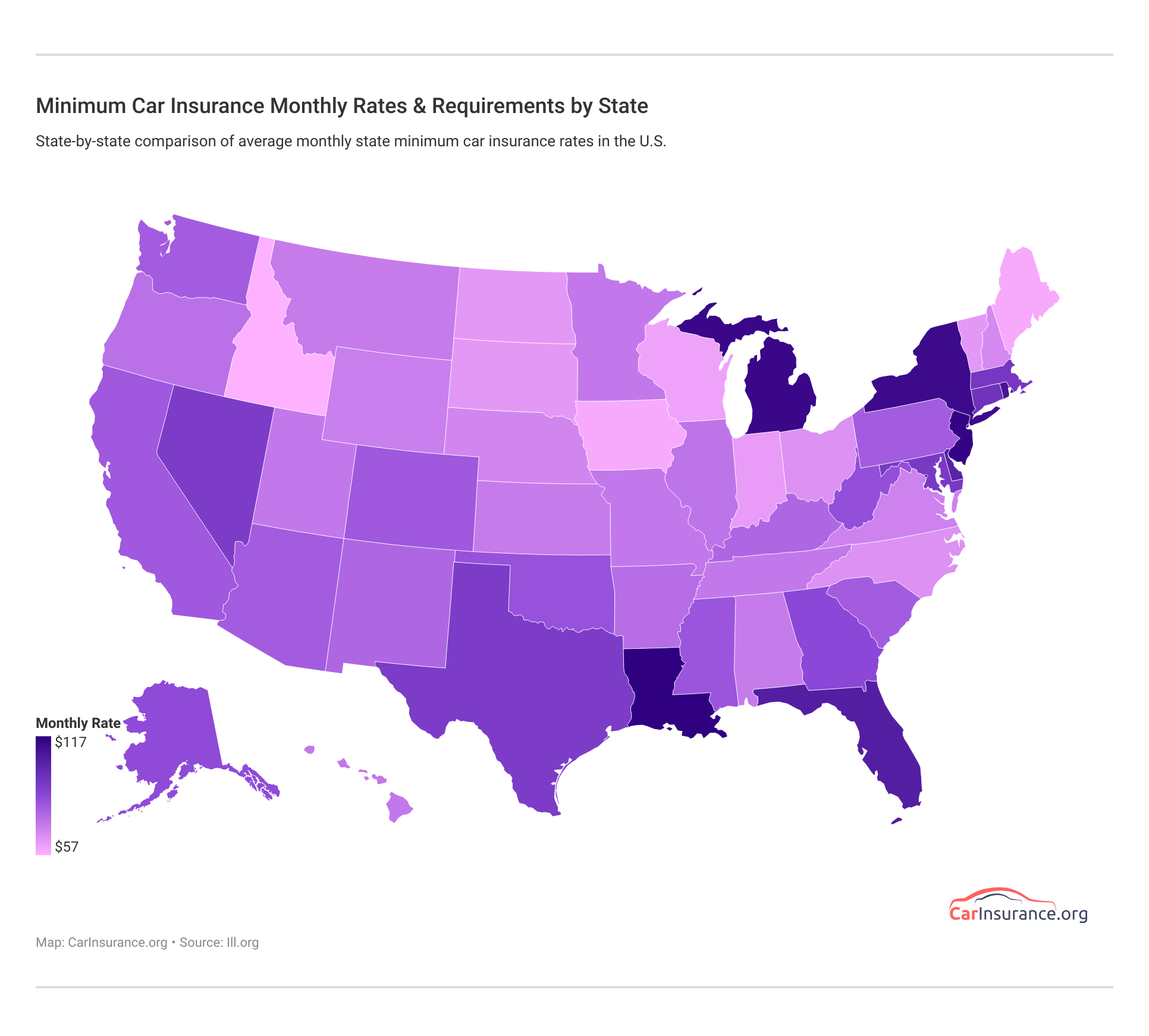

Comparing quotes from multiple insurance companies is crucial. Rates can vary significantly based on your driving record, vehicle, and other factors. Online comparison tools can help you get a sense of the market.

Consulting with an independent insurance agent can also be beneficial. They can assess your individual needs and recommend the most appropriate coverage. They guide you through policy details and offer personalized advice.

The Importance of Staying Informed

Car insurance laws and regulations can change. Staying updated on the latest requirements is crucial. This ensures you remain in compliance and adequately protected.

Regularly review your insurance policy. Assess whether your coverage still meets your needs. Life changes, such as purchasing a new car or moving to a different area, may necessitate adjustments.

Consider taking a defensive driving course. You potentially will lower your insurance premiums. You will improve your driving skills. Also become a safer driver overall.

Conclusion: Driving with Confidence

Understanding the minimum car insurance coverage in Massachusetts is more than just ticking a box. It’s about taking responsibility for your financial well-being and the safety of others. While the minimums provide a basic level of protection, they may not be enough to cover all potential costs.

By exploring your coverage options, increasing your limits, and staying informed, you can drive with greater confidence. You can have the peace of mind knowing you're prepared for whatever the road may bring. Remember, insurance is an investment in your future, protecting you from unforeseen circumstances and allowing you to navigate the roads of Massachusetts with greater security.

So, the next time you're cruising along the coast or navigating the city streets, remember the importance of adequate car insurance. Drive safely, stay informed, and protect yourself and others on the road.