When Does H&r Block Start Emerald Advance 2025

H&R Block’s Emerald Advance for 2025 is highly anticipated by many seeking early access to funds. Taxpayers are eagerly awaiting the official announcement regarding the application start date.

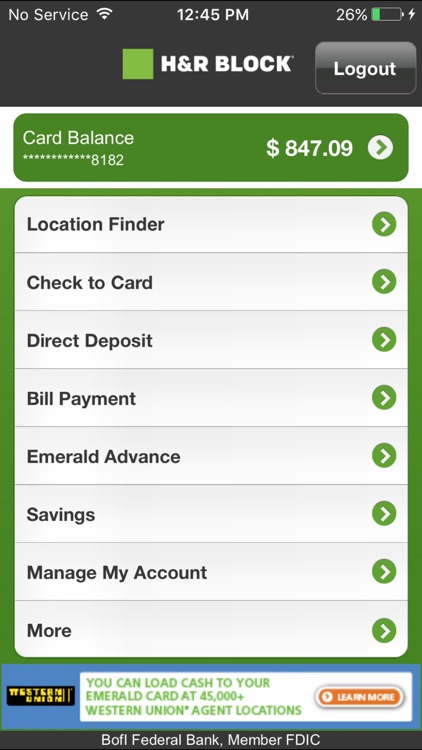

The Emerald Advance, a line of credit offered through H&R Block and Republic Bank & Trust Company, provides eligible clients access to funds before their tax refund arrives. It’s crucial for individuals needing immediate financial assistance during the tax season.

When to Expect the Emerald Advance Application

While the exact launch date for the 2025 Emerald Advance remains unconfirmed, historical data provides clues. In previous years, the application period typically opened in late November or early December.

For instance, information available online suggests that in some past years, the application window commenced around the end of November. Taxpayers should monitor H&R Block's official channels for updates.

Monitoring Official Channels

The most reliable information will come directly from H&R Block. Check their official website, social media accounts, and email newsletters for announcements.

Keep an eye out for press releases or dedicated pages on the H&R Block site that specifically mention the Emerald Advance program. Visiting a local H&R Block office and speaking with a representative is another way to stay informed.

Eligibility Requirements

To qualify for the Emerald Advance, applicants must meet certain criteria. These requirements often include a credit check, verification of identity, and proof of income.

Specific criteria can vary from year to year. Review H&R Block's official details closely when the application period opens to confirm eligibility.

Understanding the Emerald Advance

The Emerald Advance isn't a direct refund advance. It's a line of credit that you can use throughout the year. This is a crucial distinction to understand.

It's also important to recognize that the Emerald Advance accrues interest. Carefully consider the terms and conditions before applying, including interest rates and repayment schedules.

Comparing Alternatives

Explore alternative options before committing to the Emerald Advance. Consider other short-term loan options from banks or credit unions.

Assess the interest rates, fees, and repayment terms of all available options. This will help you make the most financially sound decision.

Potential Impact of IRS Processing Times

IRS processing times can influence the timing of your actual tax refund. Delays in IRS processing could potentially affect the repayment timeline for the Emerald Advance.

Stay informed about any potential IRS processing delays. Consult the IRS website for the latest updates on refund processing times.

Staying Updated on the 2025 Emerald Advance

The most current information will come directly from H&R Block. Bookmark their website and follow their social media for instant updates.

Be wary of unofficial sources and focus on verified announcements. Await the official launch date confirmation before making any financial plans based on the Emerald Advance.

Continue to monitor official H&R Block communication channels for the confirmed launch date of the 2025 Emerald Advance. Prepare to act quickly once the application window opens.