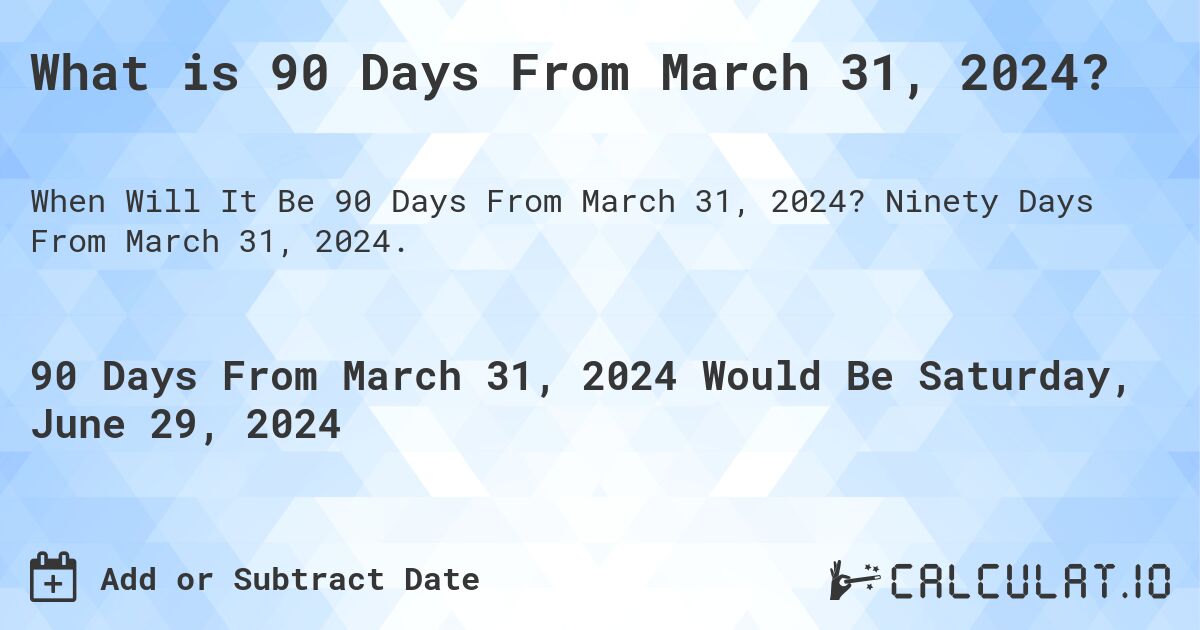

90 Days From March 31 2024

Critical deadlines loom: key provisions of the Corporate Transparency Act (CTA) become enforceable in just 90 days from March 31, 2024.

Millions of small businesses must comply by reporting their beneficial ownership information or face significant penalties.

CTA Compliance Countdown: July 1, 2024 Looms

The clock is ticking for businesses formed before January 1, 2024 to comply with the CTA.

They have until January 1, 2025 to file their initial beneficial ownership information (BOI) reports with the Financial Crimes Enforcement Network (FinCEN).

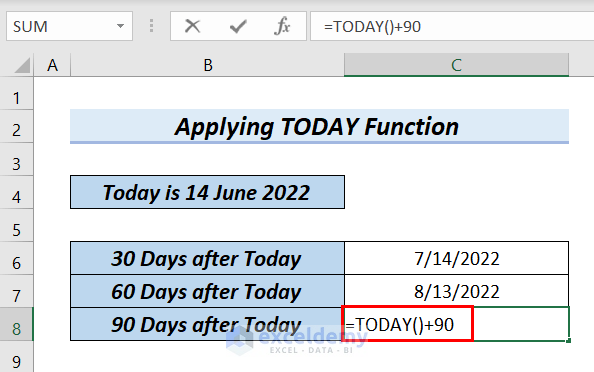

For entities created on or after January 1, 2024, the deadline is much tighter: 30 days from the date of formation. This timeline is extended to 90 days for entities created in 2024 until January 1, 2025.

Who Must Report?

The CTA primarily targets "reporting companies," which are generally corporations, limited liability companies (LLCs), and other entities created by filing documents with a secretary of state or similar office.

There are exceptions. A key exemption includes entities with more than 20 full-time employees in the U.S., more than $5 million in gross receipts or sales, and a physical operating presence in the U.S.

However, understanding these exemptions is crucial. Incorrectly claiming an exemption can result in penalties.

What Information Needs to Be Reported?

Reporting companies must disclose information about their beneficial owners.

A beneficial owner is any individual who, directly or indirectly, either exercises substantial control over the entity or owns or controls at least 25% of its ownership interests.

Required information for each beneficial owner includes their full legal name, date of birth, current address, and a unique identifying number from an acceptable identification document (e.g., a driver's license or passport), along with an image of the document.

Where and How to Report

BOI reports must be filed electronically with FinCEN through its secure filing system.

As of March 31, 2024, the system is operational.

Companies can access the filing system and related resources on the FinCEN website.

Penalties for Non-Compliance

The consequences of failing to comply with the CTA are significant.

Willful failure to report complete or updated BOI can result in civil penalties of up to $500 per day that the violation continues.

Criminal penalties can also include fines of up to $10,000 and imprisonment for up to two years. These penalties apply not only to the reporting company but also potentially to individuals who willfully cause the company to fail to report.

Why the CTA Matters

The CTA is aimed at combating illicit finance, money laundering, and other financial crimes.

By requiring businesses to disclose their beneficial owners, the government hopes to make it more difficult for criminals to hide their identities and assets behind shell companies.

This increased transparency is expected to strengthen national security and protect the U.S. financial system.

Resources and Assistance

FinCEN has published extensive guidance and FAQs on its website to help businesses understand and comply with the CTA.

The Small Business Administration (SBA) is also offering resources to assist small businesses with compliance.

Businesses should consult with legal and accounting professionals to ensure they are meeting all of the requirements of the CTA.

Next Steps

Businesses should immediately determine if they are considered "reporting companies" under the CTA.

If so, they need to gather the required information about their beneficial owners and prepare to file their BOI report with FinCEN before the applicable deadline.

FinCEN continues to update its guidance and answer frequently asked questions, so businesses should monitor the FinCEN website for the latest information.