When Does H&r Block Start Emerald Advance

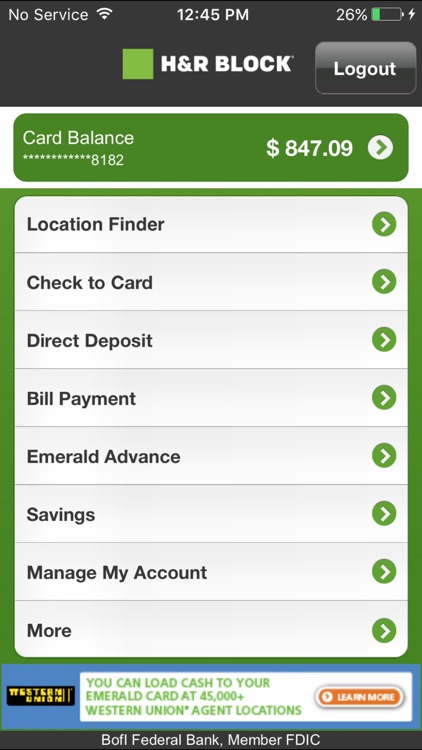

Tax season is often accompanied by a flurry of financial activity, and for many, access to early funds through refund advances can be a lifeline. H&R Block's Emerald Advance, a line of credit offered during the tax season, is a popular option for those seeking such financial assistance.

Understanding the availability of the Emerald Advance is crucial for individuals planning their tax season finances. This article delves into when H&R Block typically starts offering the Emerald Advance, its significance, and what potential borrowers should know.

The Emerald Advance: A Tax Season Staple

The Emerald Advance is a line of credit offered by H&R Block through Axos Bank. It allows eligible customers to access funds before their tax refund arrives. This can be particularly beneficial for covering immediate expenses or managing financial obligations.

The exact timing of when H&R Block begins offering the Emerald Advance can vary slightly from year to year. However, it generally becomes available in mid-November to early January.

Factors Influencing the Start Date

Several factors can influence the precise start date of the Emerald Advance. These include internal preparations at H&R Block, regulatory considerations, and the overall economic climate. The company typically announces the official start date through its website and other marketing channels.

Checking the H&R Block website or contacting a local office directly is the most reliable way to confirm the specific start date for the current tax year. You can also sign up for H&R Block email updates to receive notifications about the Emerald Advance and other tax-related news.

Key Details and Considerations

While the Emerald Advance can be a convenient option, it's important to understand its key features and potential implications. The Emerald Advance is not a direct refund advance but rather a line of credit.

This means that you will be responsible for repaying the borrowed amount, typically from your tax refund. Understanding the terms and conditions, including interest rates and fees, is crucial before applying.

Eligibility requirements for the Emerald Advance typically include a credit check and verification of income and identity. H&R Block and Axos Bank will assess your creditworthiness and ability to repay the borrowed funds.

Potential Impact and Significance

The availability of the Emerald Advance can have a significant impact on individuals and families, particularly those with limited access to traditional credit. It provides a way to bridge the gap between immediate financial needs and the arrival of a tax refund.

For some, the Emerald Advance can be a critical resource for covering essential expenses such as rent, utilities, or medical bills. It can also help avoid late fees or other penalties associated with delayed payments.

However, it's crucial to approach the Emerald Advance responsibly and avoid overborrowing. Carefully consider your ability to repay the borrowed funds from your tax refund to avoid accumulating debt.

A Word of Caution

Before applying for the Emerald Advance or any other tax refund advance product, it's essential to explore all available options. Consider alternatives such as short-term loans from reputable lenders or assistance programs offered by local charities or government agencies.

Remember to compare the costs and benefits of different options before making a decision. Pay close attention to interest rates, fees, and repayment terms. Be wary of predatory lenders who may charge exorbitant fees or engage in deceptive practices.

Consumer Financial Protection Bureau (CFPB) offers resources and tools to help consumers make informed financial decisions. Utilize these resources to protect yourself from potential scams and financial pitfalls.

Staying Informed

Keeping abreast of the latest updates regarding the Emerald Advance is crucial for anyone considering this option. Monitor the H&R Block website and social media channels for announcements and updates.

Also, consult with a qualified tax professional to discuss your individual financial situation and determine whether the Emerald Advance is the right choice for you. Seek professional advice from a financial advisor regarding the implications of taking advance.

By staying informed and seeking expert guidance, you can make a well-informed decision about whether the Emerald Advance aligns with your financial needs and goals.

Conclusion

The H&R Block Emerald Advance typically becomes available in mid-November to early January, offering eligible customers access to a line of credit before their tax refund arrives.

While it can be a helpful resource, it's crucial to understand its terms, potential costs, and impact on your overall financial situation. Always explore all available options and seek professional advice before making a decision.

Responsible financial planning and informed decision-making are key to navigating the tax season successfully. Understand interest rates and repayment terms.