When Investors Purchase A Commodity They Believe

Global commodity markets are driven by a complex interplay of supply, demand, and, crucially, investor sentiment. When investors anticipate a future increase in the value of a particular commodity, their collective purchasing activity can significantly influence market prices and even the broader economy.

This phenomenon, where investor belief fuels market action, has been observed recently in several key commodity sectors, prompting scrutiny from economists and policymakers alike.

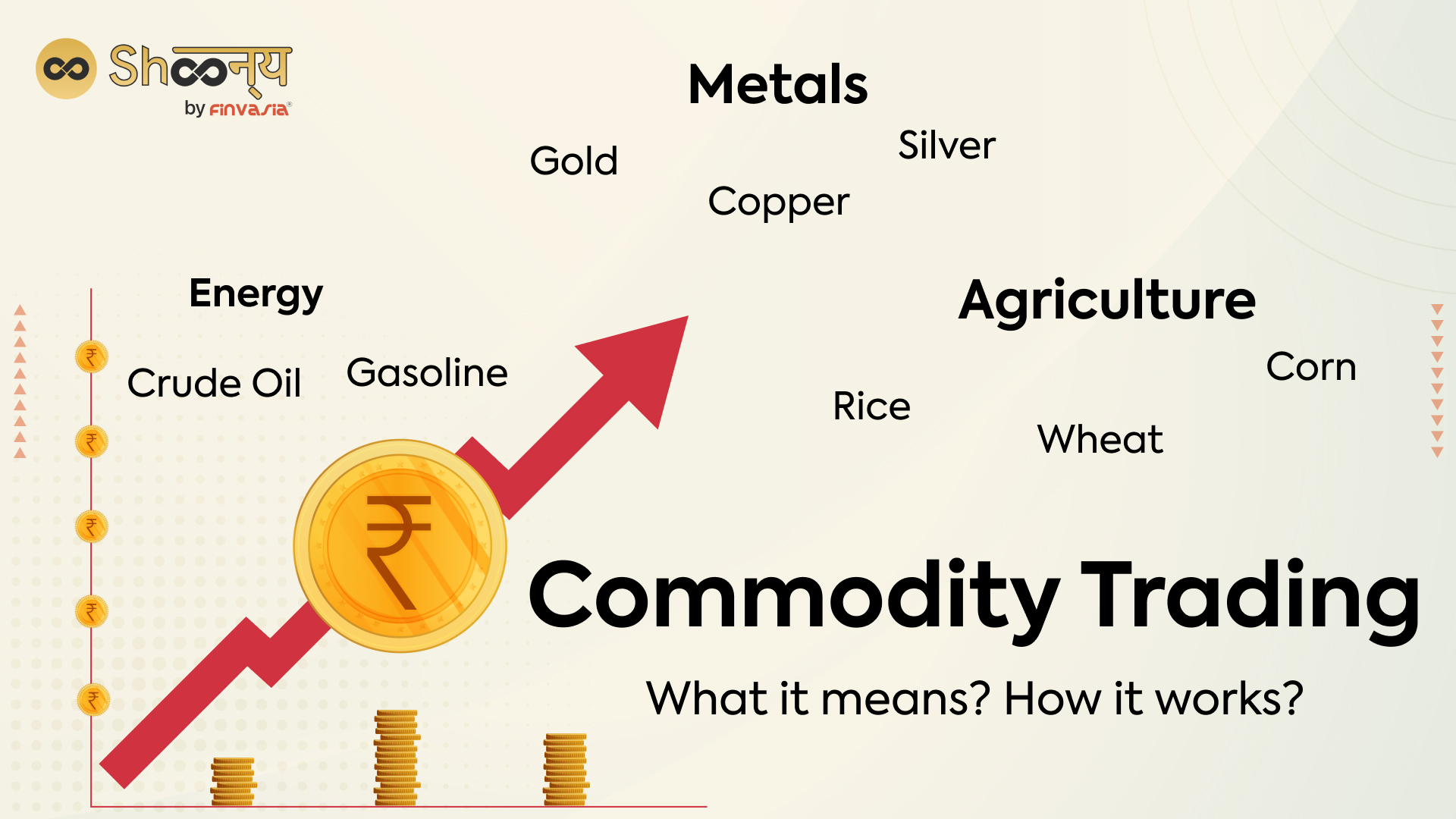

Understanding Investor-Driven Commodity Price Fluctuations

At the heart of this dynamic is the understanding that commodity prices are not solely determined by the immediate balance of supply and demand. Expectations about future supply and demand, geopolitical events, and macroeconomic trends all play a role in shaping investor perceptions. When a significant number of investors believe that a commodity's price will rise, they begin purchasing it, driving up demand and, consequently, the price itself.

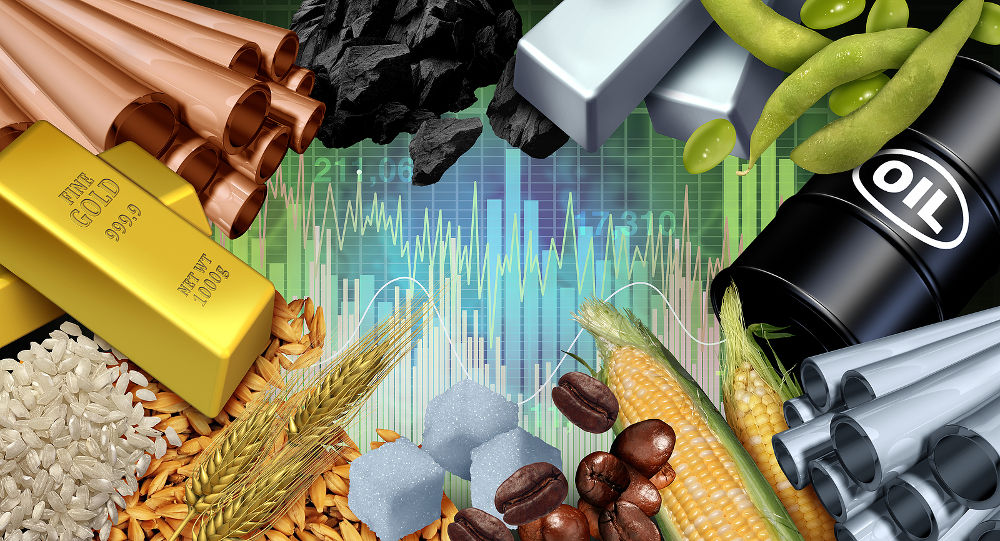

This self-fulfilling prophecy can occur for various reasons. For example, forecasts of increased industrial activity in emerging markets might lead investors to believe that demand for metals like copper and aluminum will rise.

Similarly, concerns about adverse weather patterns impacting agricultural yields could spur investment in commodities like wheat and corn.

The Role of Speculation

It's crucial to distinguish between investment based on genuine supply-demand fundamentals and pure speculation. Speculative investment involves purchasing commodities with the sole intention of profiting from short-term price fluctuations, regardless of the underlying market conditions.

While speculation can provide liquidity to the market, excessive speculation can also lead to price bubbles and increased volatility, which can be detrimental to both producers and consumers.

The Commodity Futures Trading Commission (CFTC) in the United States and similar regulatory bodies worldwide monitor commodity markets to prevent manipulation and excessive speculation.

Recent Examples and Market Dynamics

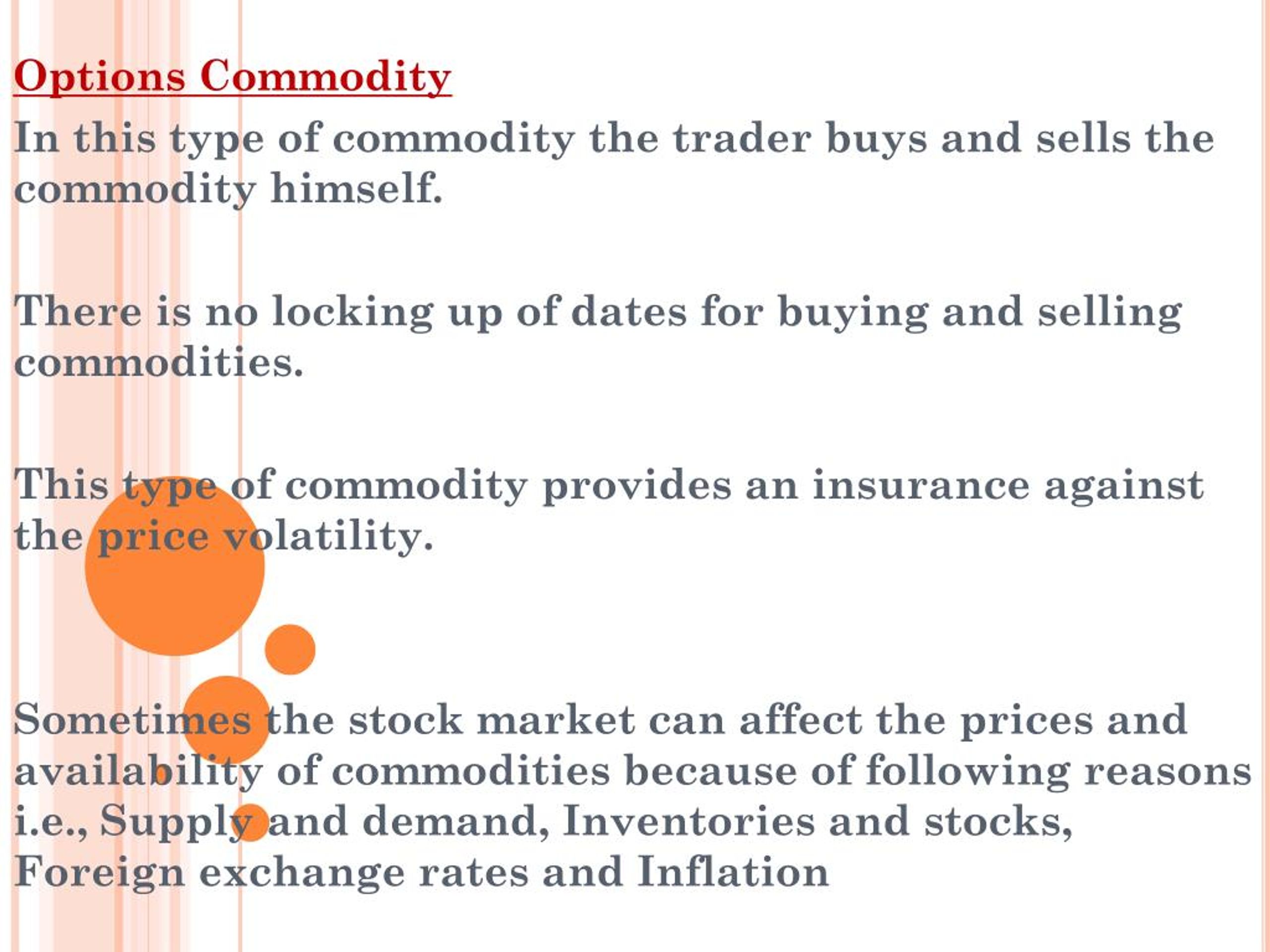

The energy sector has been particularly susceptible to investor sentiment in recent times. Concerns about geopolitical instability in key oil-producing regions, coupled with growing demand from recovering economies, have fueled bullish sentiment among investors.

This has led to increased investment in crude oil futures and other energy-related assets, contributing to the rise in global oil prices.

Similarly, the demand for lithium, a key component in electric vehicle batteries, has soared in recent years. Investors anticipating continued growth in the electric vehicle market have poured money into lithium mining companies and lithium futures contracts, driving up prices and attracting further investment.

In the agricultural sector, weather patterns and supply chain disruptions have created uncertainty, leading to increased volatility and investor interest in commodities like wheat, corn, and soybeans.

The Impact on Consumers and Producers

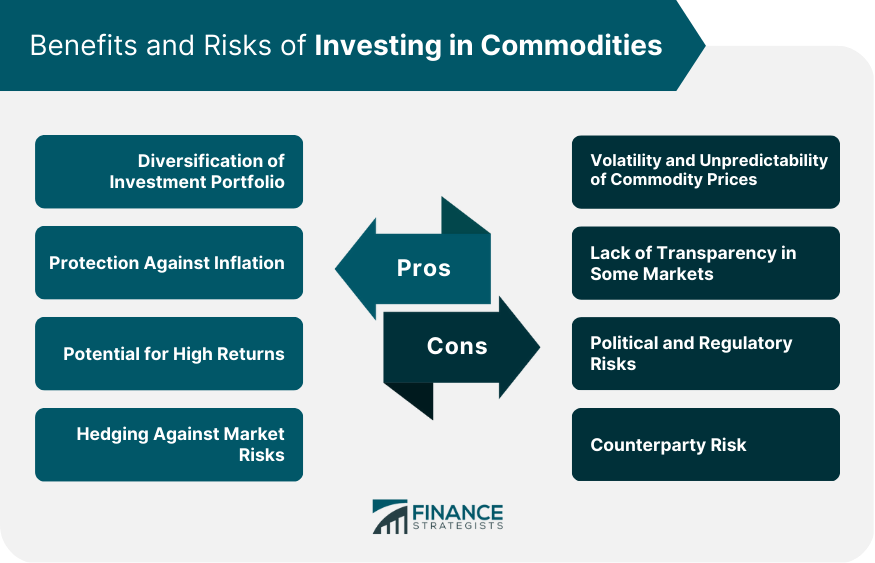

The impact of investor-driven commodity price increases is felt throughout the economy. Higher energy prices translate into increased transportation costs and higher prices for goods and services.

Rising food prices disproportionately affect low-income households, who spend a larger share of their income on food.

For producers, the impact is more complex. While higher prices can increase profitability in the short term, they can also incentivize increased production, which could eventually lead to a surplus and a subsequent price decline.

Mitigating Risks and Ensuring Market Stability

Given the potential for investor sentiment to amplify commodity price fluctuations, policymakers and regulators must remain vigilant. Strengthening market oversight, promoting transparency, and implementing measures to curb excessive speculation are crucial for ensuring market stability.

Diversifying supply chains and investing in alternative energy sources can reduce dependence on volatile commodities and mitigate the impact of price shocks. International cooperation is also essential for addressing global commodity market challenges.

For instance, the International Energy Agency (IEA) plays a critical role in coordinating energy policies among its member countries and providing timely analysis of global energy markets.

Looking Ahead

The role of investor sentiment in commodity markets is likely to remain significant in the years to come. As global economic growth continues and new technologies emerge, demand for certain commodities will undoubtedly increase.

However, it's crucial to remember that commodity markets are dynamic and complex. Factors such as technological advancements, geopolitical events, and policy changes can all influence investor perceptions and market outcomes.

Staying informed, carefully analyzing market trends, and adopting a long-term perspective are essential for navigating the complexities of commodity investing.

:max_bytes(150000):strip_icc()/commodity-market-c13b0044c1da45dea230710a5c993bc6.jpg)

:max_bytes(150000):strip_icc()/commodity-economics-definition-1146936_final-328266ecd48e4a88aa723402cd3ce026.png)