When Is 990 Due With Extension

Nonprofit organizations navigating the complexities of IRS regulations often find themselves seeking extensions for filing their annual information returns. Understanding the nuances of Form 990 due dates, especially when extensions are involved, is crucial for maintaining compliance and avoiding potential penalties.

This article provides a comprehensive overview of Form 990 filing deadlines with an extension, outlining the process, key considerations, and potential implications for nonprofit organizations.

Understanding the Form 990 Filing Deadline

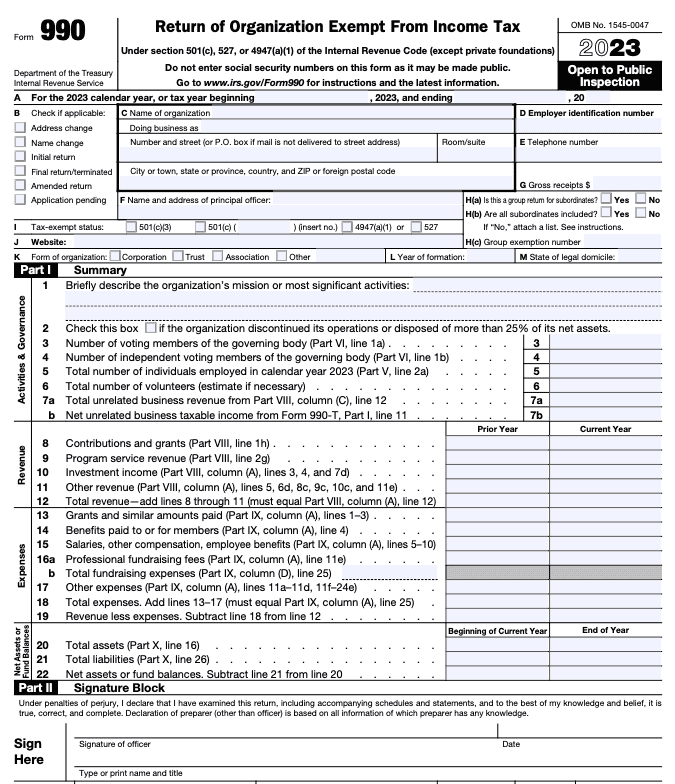

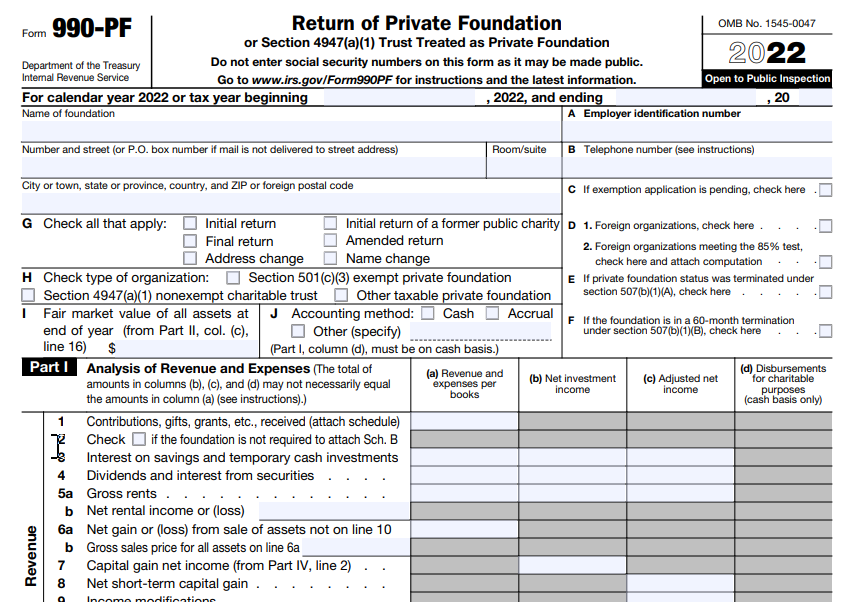

Form 990, Return of Organization Exempt From Income Tax, is an annual information return that most tax-exempt organizations must file with the IRS. It provides the IRS and the public with financial information about the organization, including its activities, governance, and finances.

The standard due date for Form 990 is the 15th day of the fifth month after the end of the organization's accounting period. For organizations with a calendar year-end (December 31), the standard due date is May 15th of the following year.

Automatic Extension with Form 8868

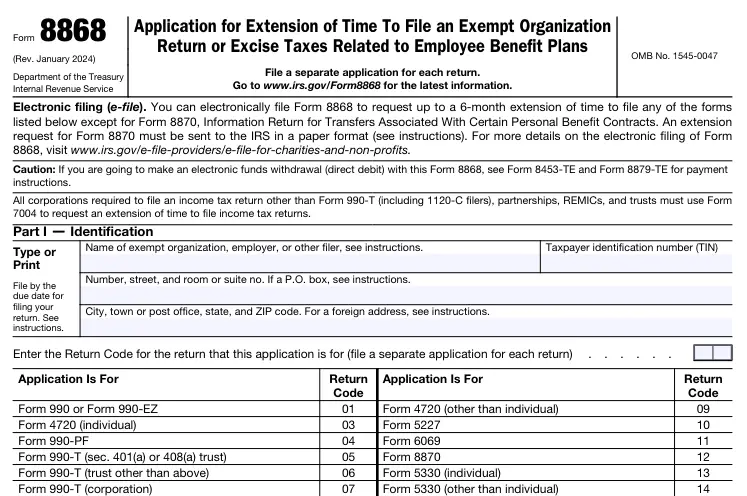

If a nonprofit organization anticipates needing more time to prepare and file Form 990, it can request an automatic six-month extension by filing Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return.

Form 8868 must be filed on or before the original due date of Form 990. Filing this form grants an automatic six-month extension from the original due date.

The IRS provides clear guidelines on the filing process. Failure to submit the extension request on time invalidates the extension.

When Is Form 990 Due with Extension?

With an approved extension, the Form 990 due date is automatically pushed back by six months. For a calendar year-end organization, the extended due date would be November 15th.

It's important to note that this is a flat six-month extension, regardless of the original due date. If the original due date falls on a weekend or holiday, the extended due date is still calculated as six months from the original date, not the next business day.

Organizations must be aware of their specific extended due date and ensure timely filing to avoid penalties.

Example Scenarios

To illustrate, consider a nonprofit with a June 30 fiscal year-end. Their original Form 990 due date is November 15.

If they file Form 8868 on or before November 15, their extended due date becomes May 15 of the following year. Another organization with a March 31 fiscal year-end would have an original due date of August 15.

Filing Form 8868 on time extends their deadline to February 15 of the next year.

Potential Consequences of Late Filing

Failing to file Form 990 by the due date, even with an extension, can result in significant penalties. The IRS imposes penalties for late filing based on the organization's gross receipts.

Smaller organizations with annual gross receipts of less than \$1 million face penalties of \$20 per day, up to a maximum of \$10,000. Larger organizations with gross receipts of \$1 million or more face penalties of \$100 per day, up to a maximum of \$50,000.

Furthermore, failure to file Form 990 for three consecutive years can result in automatic revocation of the organization's tax-exempt status.

Protecting Tax-Exempt Status

Maintaining tax-exempt status is paramount for nonprofits. Adhering to IRS regulations, including timely filing of Form 990, is crucial for continued compliance.

Organizations should establish internal controls and processes to ensure accurate and timely filing. This includes assigning responsibility for Form 990 preparation and review and implementing a system for tracking deadlines.

Seeking professional guidance from qualified accountants or tax advisors can also help nonprofits navigate the complexities of Form 990 compliance.

Staying Compliant

The IRS offers resources and guidance to help nonprofits understand their filing obligations. The IRS website provides information on Form 990 instructions, filing requirements, and frequently asked questions.

Nonprofit organizations can also utilize online filing services to simplify the Form 990 preparation and submission process. These services often provide built-in checks and validations to help ensure accuracy and compliance.

Staying informed about changes to tax laws and regulations is essential for maintaining compliance. Organizations should subscribe to IRS updates and consult with tax professionals to stay abreast of any changes that may affect their filing requirements.

"Understanding the nuances of Form 990 filing deadlines is paramount for maintaining compliance and avoiding penalties," emphasizes Emily Carter, a leading expert in nonprofit tax law.

Form 990 filing, especially with an extension, requires careful planning and execution. Understanding the rules surrounding Form 8868 and the implications of both the original and extended due dates is important.

By prioritizing compliance and implementing sound internal controls, nonprofit organizations can protect their tax-exempt status and ensure the long-term sustainability of their missions.

.jpg)