When Is Deadline To Send Out 1099

The aroma of pine needles still lingered in the air, a ghost of Christmas past, while the remnants of New Year's resolutions hung heavy with good intentions. But amidst the quiet of January, a different kind of deadline loomed, less about self-improvement and more about fulfilling civic duty. It was the annual rite of passage for businesses and individuals alike: the 1099.

Navigating the labyrinth of tax season can often feel daunting, and one of the first hurdles is understanding the deadlines for sending out 1099 forms. This article aims to clarify those deadlines, explain the types of 1099 forms, and offer some helpful tips to ensure compliance and avoid penalties.

Understanding the 1099 Landscape

The Internal Revenue Service (IRS) requires businesses to file 1099 forms to report certain types of payments made to individuals and entities who are not employees. These payments can include everything from independent contractor fees and rent to royalties and dividends.

The purpose of the 1099 is to ensure that all income is properly reported to the IRS, facilitating accurate tax collection. Failing to issue these forms correctly and on time can result in penalties, making understanding the process crucial.

Key 1099 Forms and Their Deadlines

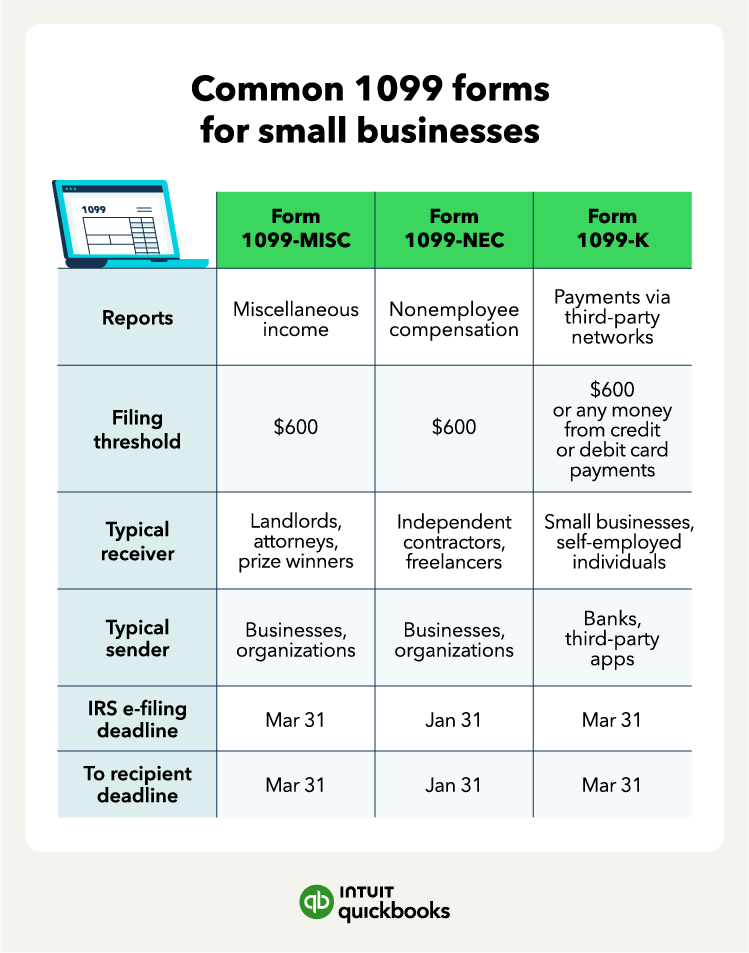

Several types of 1099 forms exist, each designed to report specific kinds of income. The most common include the 1099-NEC, 1099-MISC, and 1099-INT.

The 1099-NEC (Nonemployee Compensation) is used to report payments made to independent contractors for services rendered. This is arguably the most frequently used 1099 form.

The deadline to send the 1099-NEC to both the recipient and the IRS is January 31st. This deadline applies whether filing electronically or by mail.

The 1099-MISC (Miscellaneous Income) is used to report various types of income, such as rent, royalties, and other income payments. However, its usage has shifted somewhat with the reintroduction of the 1099-NEC.

For the 1099-MISC, the deadline to send the form to the recipient is also January 31st if reporting payments in Box 8 (Substitute payments in lieu of dividends or interest) or Box 10 (Gross proceeds to an attorney). For all other payments reported on Form 1099-MISC, if filing on paper, the deadline for filing with the IRS is February 28th. If filing electronically, the deadline is March 31st.

The 1099-INT (Interest Income) is used to report interest income paid to individuals. This form is typically used by banks, credit unions, and other financial institutions.

The deadline to send the 1099-INT to the recipient is January 31st. The deadline for filing with the IRS is February 28th if filing on paper and March 31st if filing electronically.

Electronic Filing vs. Paper Filing

The IRS encourages electronic filing of 1099 forms. It’s generally faster and more efficient than paper filing.

Businesses that are required to file 250 or more information returns (including 1099s) must file electronically. Even if not required, electronic filing is a convenient option for businesses of all sizes.

The IRS provides several resources for electronic filing, including the Filing Information Returns Electronically (FIRE) system. Tax preparation software can also simplify the electronic filing process.

Consequences of Missing the Deadline

Failing to meet the 1099 filing deadlines can result in penalties from the IRS. The amount of the penalty depends on how late the forms are filed.

As of 2023, penalties can range from $50 to $290 per return, depending on the lateness of the filing. For intentional disregard of the filing requirements, the penalty is even higher, at $580 per return.

These penalties underscore the importance of staying organized and proactive in managing 1099 filings.

Tips for Ensuring Timely Filing

To avoid penalties and ensure timely filing, consider the following tips:

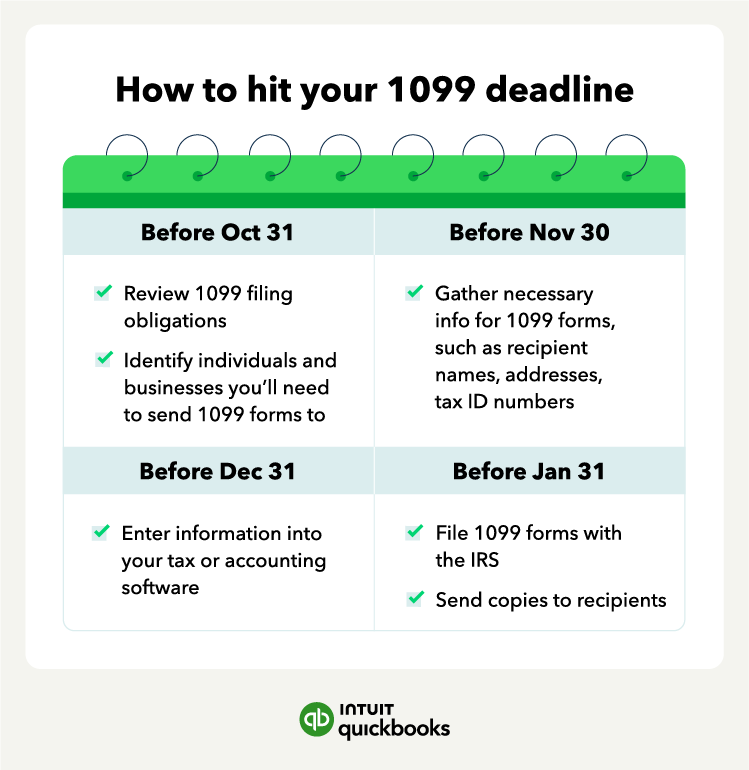

Maintain Accurate Records: Keep accurate and up-to-date records of all payments made to independent contractors and other recipients throughout the year.

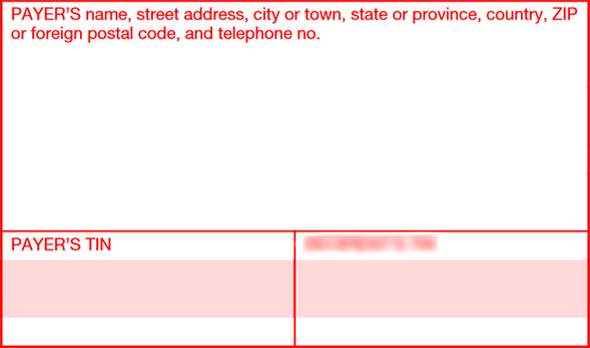

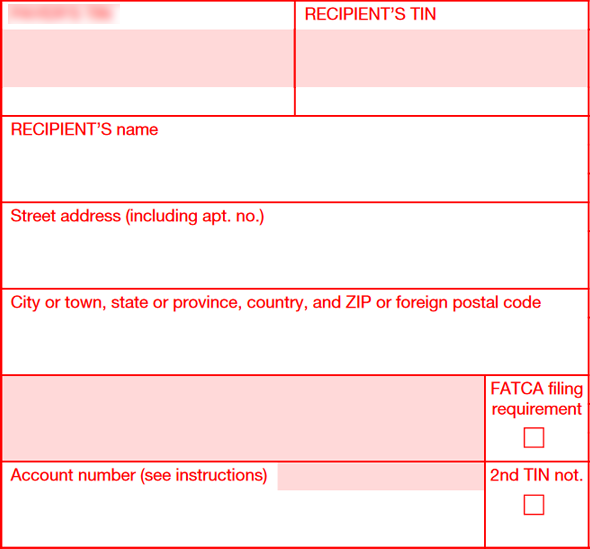

Collect Taxpayer Identification Numbers (TINs): Before making payments, request a completed Form W-9 from each independent contractor or vendor. This form provides the necessary information, including the recipient’s TIN (Taxpayer Identification Number), to accurately complete the 1099 form.

Use Accounting Software: Utilize accounting software that can track payments and generate 1099 forms automatically. Many software programs offer electronic filing options as well.

Plan Ahead: Don't wait until the last minute to prepare and file 1099 forms. Start gathering the necessary information well in advance of the deadlines.

Consult with a Tax Professional: If you are unsure about any aspect of 1099 filing, consult with a qualified tax professional for guidance.

A Glimpse at the Future of 1099 Filing

The landscape of tax filing is constantly evolving, with increasing emphasis on automation and digital solutions. The IRS is continually working to improve its electronic filing systems, making it easier for businesses to comply with their tax obligations.

Looking ahead, we can expect to see even greater integration of technology in the 1099 filing process, with the potential for real-time reporting and streamlined data exchange.

Conclusion

While the prospect of 1099 filing might not inspire excitement, understanding the deadlines and requirements can alleviate stress and prevent costly penalties. By staying organized, utilizing available resources, and seeking professional guidance when needed, businesses and individuals can navigate this annual task with confidence.

So, as the post-holiday quiet settles and the new year unfolds, remember that the 1099 deadline is a friendly reminder to wrap up the financial loose ends of the previous year, setting the stage for a smooth and successful year ahead. It’s not just about compliance; it’s about playing a part in a system that supports our communities and future.