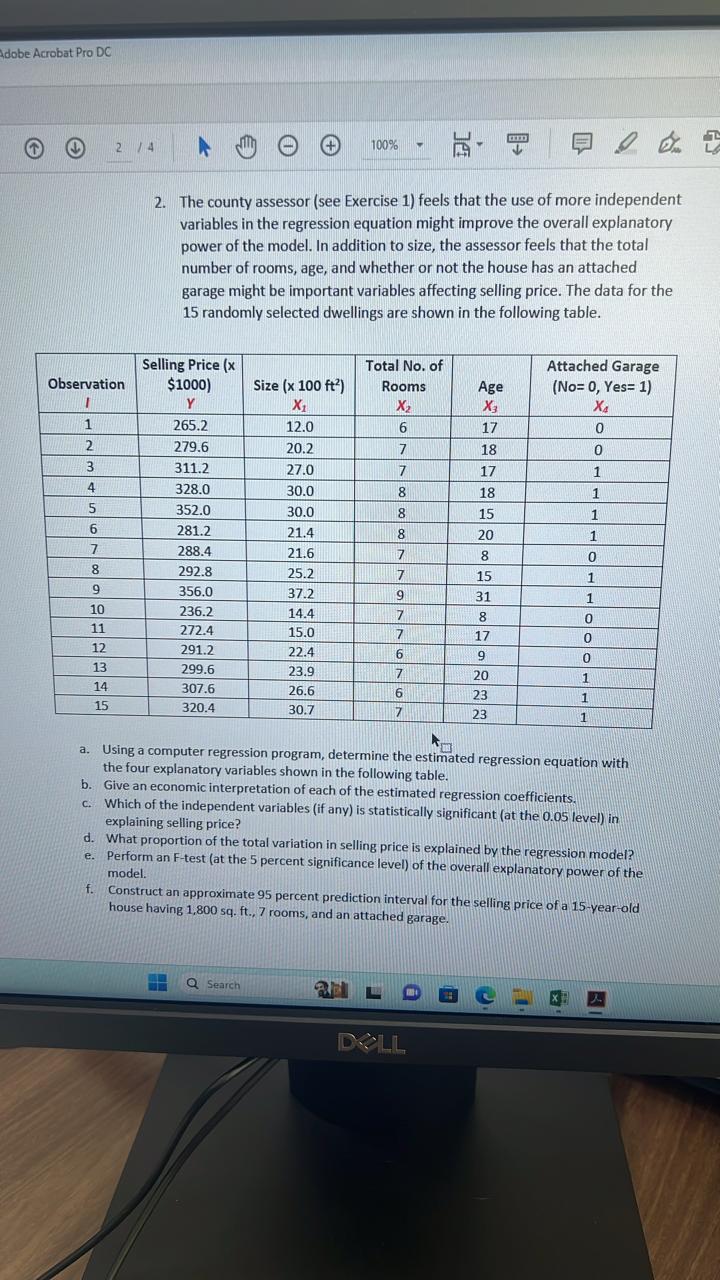

Where Can I Borrow $100 Instantly

The question echoes across the internet, whispered in hushed tones on social media and frantically typed into search engines: "Where can I borrow $100 instantly?" In an era defined by financial precarity, this plea for immediate, small-sum assistance underscores a harsh reality for many Americans facing unexpected expenses or income shortfalls.

This article delves into the landscape of options, examining the available avenues for securing a quick $100 loan. We will explore the potential benefits and significant drawbacks of each, providing a balanced perspective on navigating this challenging financial situation. It's crucial to understand the costs associated with instant lending and the potential long-term consequences of relying on such solutions.

Paycheck Advance Apps

Paycheck advance apps, like Earnin and Dave, have gained popularity as a way to access earned wages before payday. These apps typically allow users to borrow a small amount, often capped at $100 or $200, based on their anticipated earnings.

The catch is that many of these apps rely on "tips" rather than traditional interest, which can still translate to a high APR if not carefully considered. Some apps also require linking your bank account and providing access to your employment information.

Eligibility and Repayment

Eligibility for paycheck advance apps usually depends on factors like a regular pay schedule, consistent direct deposits, and a verifiable bank account. Repayment is typically automated, with the borrowed amount plus any tips deducted from your next paycheck.

Missing a payment can lead to overdraft fees or restrictions on future borrowing. Be wary of relying on these apps repeatedly, as it can create a cycle of dependence and financial instability.

Credit Card Cash Advances

Another option, albeit often an expensive one, is a credit card cash advance. Most credit cards allow you to withdraw cash from an ATM, but these advances come with significant fees and high interest rates.

Cash advance APRs are typically higher than purchase APRs, and interest accrues immediately with no grace period. Consider this option only as a last resort, understanding that you will likely pay a substantial premium for the convenience.

Fees and Interest

Expect to pay a cash advance fee, often a percentage of the amount withdrawn, in addition to the high interest rate. These fees can quickly add up, making a $100 advance significantly more costly to repay.

Furthermore, cash advances can negatively impact your credit utilization ratio, potentially lowering your credit score. Responsible credit card use involves paying off balances in full and avoiding cash advances whenever possible.

Pawn Shops

Pawn shops offer short-term loans secured by collateral, meaning you must provide an item of value as security. You can pawn items like jewelry, electronics, or tools in exchange for a loan, typically a fraction of the item's value.

If you fail to repay the loan within the agreed-upon timeframe, the pawn shop keeps your item. While this might seem like a quick solution, the interest rates charged by pawn shops are notoriously high.

Risks and Considerations

The APR on a pawn shop loan can exceed triple digits, making it one of the most expensive borrowing options. Moreover, you risk losing your valuable possessions if you cannot repay the loan.

Before pawning an item, consider its sentimental or replacement value. It's often wiser to sell the item outright rather than risk losing it to a high-interest loan.

Asking Friends and Family

While potentially awkward, borrowing from friends and family can be a more affordable and understanding option. It's crucial to approach the situation with transparency and respect.

Offer to create a written agreement outlining the loan amount, repayment schedule, and any interest (if applicable). This helps formalize the arrangement and avoid misunderstandings.

Maintaining Relationships

Treat the loan as a serious financial obligation and prioritize repayment as agreed. Failure to repay a friend or family member can strain relationships and create lasting resentment.

Consider offering something in return, even if it's not monetary, to show your appreciation for their willingness to help. Clear communication and mutual respect are essential for a successful borrowing experience with loved ones.

Short-Term Online Loans

Numerous online lenders offer small-dollar loans, often marketed as "instant" or "no credit check" loans. These loans are typically characterized by high interest rates and short repayment terms.

While the allure of quick cash might be tempting, these loans can quickly trap borrowers in a cycle of debt. The Consumer Financial Protection Bureau (CFPB) has issued warnings about the dangers of payday loans and similar short-term credit products.

Predatory Lending Practices

Many online lenders engage in predatory lending practices, charging exorbitant fees and interest rates that can exceed hundreds of percent APR. These loans are often marketed to vulnerable individuals with limited credit options.

Before accepting any online loan, carefully review the terms and conditions, including the APR, fees, and repayment schedule. Be wary of lenders who promise guaranteed approval or require upfront fees.

Looking Ahead

The persistent need for small-dollar, instant loans highlights the ongoing challenges many Americans face in managing unexpected expenses. Addressing this issue requires a multifaceted approach, including promoting financial literacy, increasing access to affordable credit, and strengthening consumer protections.

For individuals, building an emergency fund, even a small one, can provide a buffer against financial shocks. Exploring alternative income streams and seeking professional financial advice can also help improve long-term financial stability.

While the immediate need for $100 might seem overwhelming, carefully weighing the available options and understanding the associated risks is crucial. Choosing the right path can make the difference between a temporary setback and a long-term financial burden. Remember to prioritize responsible borrowing and seek help when needed.

![Where Can I Borrow $100 Instantly FREE EARNING APP Paid Me $13 [₦21,000] INSTANTLY For FREE! Make Money](https://i.ytimg.com/vi/tZqnAOGFYRw/maxresdefault.jpg)

.jpg)