Where Can I Get A $500 Loan

Imagine this: your car sputters its last breath on a busy Monday morning, a surprise medical bill lands in your mailbox, or that must-attend networking event suddenly requires a last-minute flight. Life throws curveballs, often when your wallet is least prepared. The need for a quick infusion of cash, like a $500 loan, can feel like a lifeline in these moments. But where do you turn when you need that small, but significant, financial boost?

This article will explore the landscape of options available for securing a $500 loan. We’ll delve into various lenders, loan types, and key considerations to help you make an informed decision. Our aim is to provide a clear, practical guide to navigate this often-overwhelming process, ensuring you can access the funds you need responsibly and effectively.

Understanding Your Options

Securing a $500 loan involves exploring a range of potential sources. Each source comes with its own set of advantages and disadvantages. Understanding these differences is crucial for choosing the right option for your specific circumstances.

Personal Loans

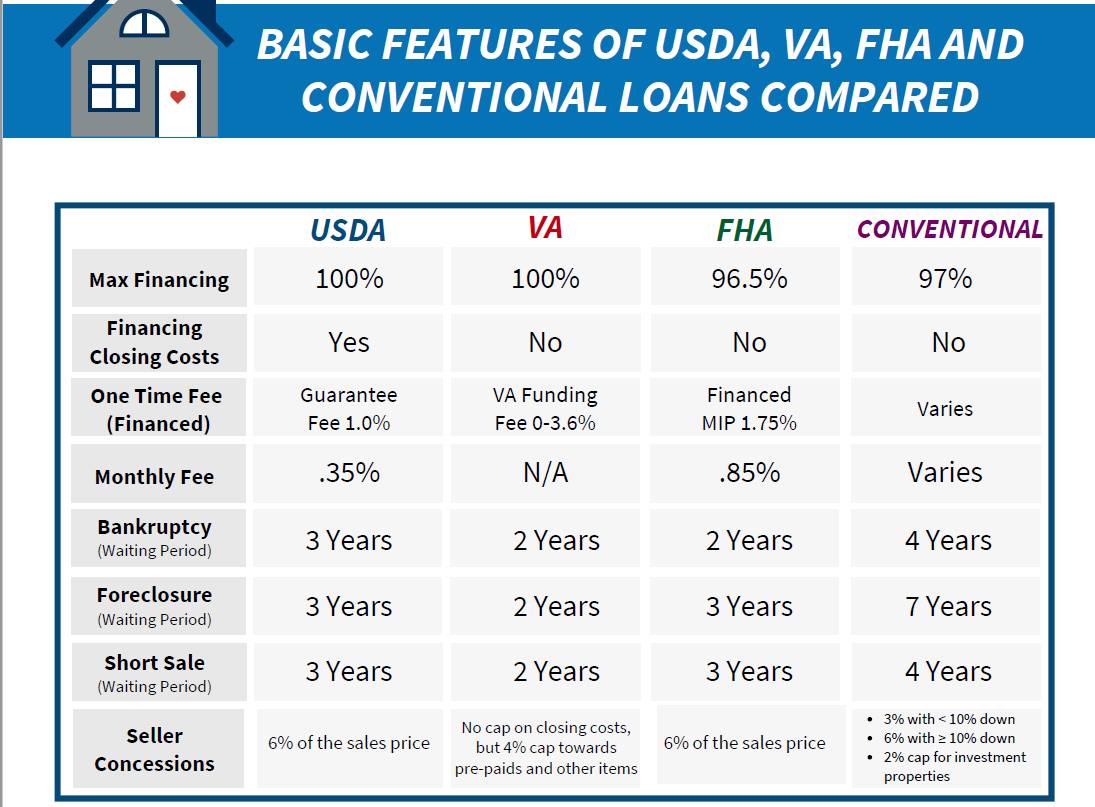

Personal loans, typically offered by banks and credit unions, are a common route. These loans are often unsecured, meaning they don't require collateral. The interest rates and repayment terms will vary significantly based on your credit score and the lender's policies.

A good credit score will unlock more favorable terms, while a lower score may result in higher interest rates or even denial. Credit unions, in particular, may offer better rates and more flexible terms to their members.

Payday Loans

Payday loans are short-term, high-interest loans designed to be repaid on your next payday. While they offer quick access to funds, they come with exorbitant interest rates and fees.

These loans should be considered a last resort due to the potential for a debt trap. According to the Consumer Financial Protection Bureau (CFPB), the annualized interest rates on payday loans can reach as high as 400% or even higher.

Cash Advance Apps

Cash advance apps like Dave, Earnin, and MoneyLion offer small-dollar advances, often without interest fees. These apps typically require you to link your bank account and verify your income.

They analyze your spending habits and offer advances based on your expected paycheck. While convenient, these apps may charge membership fees or ask for optional tips, which can add to the overall cost.

Credit Card Cash Advances

Many credit cards offer a cash advance option, allowing you to withdraw cash from your available credit line. While convenient, cash advances typically come with higher interest rates than regular purchases.

They also often incur a transaction fee and do not qualify for grace periods, meaning interest accrues immediately. This can make them a costly way to borrow $500.

Borrowing from Friends and Family

Consider borrowing from friends and family. This can be a less formal and potentially interest-free option.

However, it's important to approach this with clear communication and a written agreement to avoid straining relationships. Be prepared to discuss repayment terms and treat the loan with the same seriousness as you would with a financial institution.

Key Considerations Before Borrowing

Before taking out a $500 loan, it's essential to carefully consider several factors. These considerations will help you make a responsible decision and avoid potential financial pitfalls.

Assessing Your Needs

Determine if the loan is truly necessary. Can you postpone the expense or find alternative solutions? Avoiding unnecessary debt is always the best course of action.

Explore if there are other resources available, such as community assistance programs or temporary hardship assistance from creditors. Sometimes, a temporary reprieve can be a better solution than taking on more debt.

Understanding Interest Rates and Fees

Compare the interest rates and fees associated with each loan option. Don't just focus on the headline interest rate; look at the Annual Percentage Rate (APR), which includes all fees and costs.

Pay close attention to any prepayment penalties or late payment fees. These can significantly increase the overall cost of the loan.

Evaluating Repayment Terms

Carefully review the repayment terms. Ensure you can comfortably afford the monthly payments without jeopardizing your financial stability.

Consider the loan's duration; a longer repayment period may result in lower monthly payments but higher overall interest costs. Choose a repayment schedule that aligns with your budget and financial goals.

Checking Your Credit Score

Your credit score plays a significant role in determining the interest rates and terms you'll receive. Check your credit report for any errors and work to improve your score if necessary.

A higher credit score will unlock more favorable loan options. You can obtain a free copy of your credit report from each of the major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com.

The Importance of Responsible Borrowing

Borrowing, even a small amount like $500, should always be approached with caution and responsibility. Making informed decisions and understanding the terms of your loan can help you avoid financial difficulties down the road.

Building a strong credit history and maintaining financial stability are crucial for long-term financial well-being. Prioritize saving and budgeting to minimize the need for borrowing in the future.

Seeking Professional Advice

If you're unsure about the best course of action, consider seeking advice from a financial advisor or credit counselor. These professionals can provide personalized guidance based on your specific financial situation.

Nonprofit credit counseling agencies can offer free or low-cost assistance with budgeting, debt management, and credit repair. They can help you develop a plan to address your financial challenges and improve your financial health.

Remember, there's no shame in seeking help. Proactive financial management is a sign of strength, not weakness.

Conclusion

Navigating the world of small loans can feel daunting, but with the right information and a thoughtful approach, you can find a solution that meets your needs. Remember to prioritize responsible borrowing, carefully consider your options, and seek professional advice when needed.

Ultimately, a $500 loan can be a helpful tool to navigate unexpected expenses, but it's crucial to approach it with awareness and a plan for repayment. By understanding the landscape of available options and prioritizing responsible financial habits, you can confidently address your short-term financial needs and build a more secure financial future.

The power to make informed decisions is in your hands. Choose wisely and borrow responsibly, and you'll be well on your way to achieving your financial goals.

:max_bytes(150000):strip_icc()/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

:max_bytes(150000):strip_icc()/approved-car-loan-application-98570101-5b800241c9e77c0050572c53.jpg)