Where Can I Purchase A Paypal Prepaid Card

Imagine needing to make an online purchase, but your credit card is maxed out, or perhaps you prefer not to share your bank details across the internet. You're browsing a website, the perfect item is staring back at you, but the payment options seem limited. You sigh, wishing there was a simple, secure way to complete the transaction without the usual financial hurdles.

For those seeking a convenient and secure way to manage their online spending or send money, the PayPal Prepaid Card can be a valuable tool. This article will guide you through the process of acquiring a PayPal Prepaid Card, outlining where you can purchase one and highlighting the benefits this card offers.

The Appeal of Prepaid: Security and Control

Prepaid cards offer a compelling alternative to traditional credit and debit cards. They provide a layer of security by limiting the amount of funds available, thus minimizing potential losses from fraud. This control makes them particularly attractive to those concerned about online security or those seeking to stick to a budget.

Unlike credit cards, prepaid cards don't require a credit check, making them accessible to a wider range of individuals. They are a practical solution for teenagers, students, or anyone who wants to manage their finances more effectively without the risk of accumulating debt.

Where to Find a PayPal Prepaid Card

Historically, PayPal Prepaid Cards were widely available at numerous retail locations. However, the landscape has shifted, and the primary method for obtaining a PayPal Prepaid Card is directly through the PayPal platform or their designated partner, Netspend.

Online Acquisition: The Primary Route

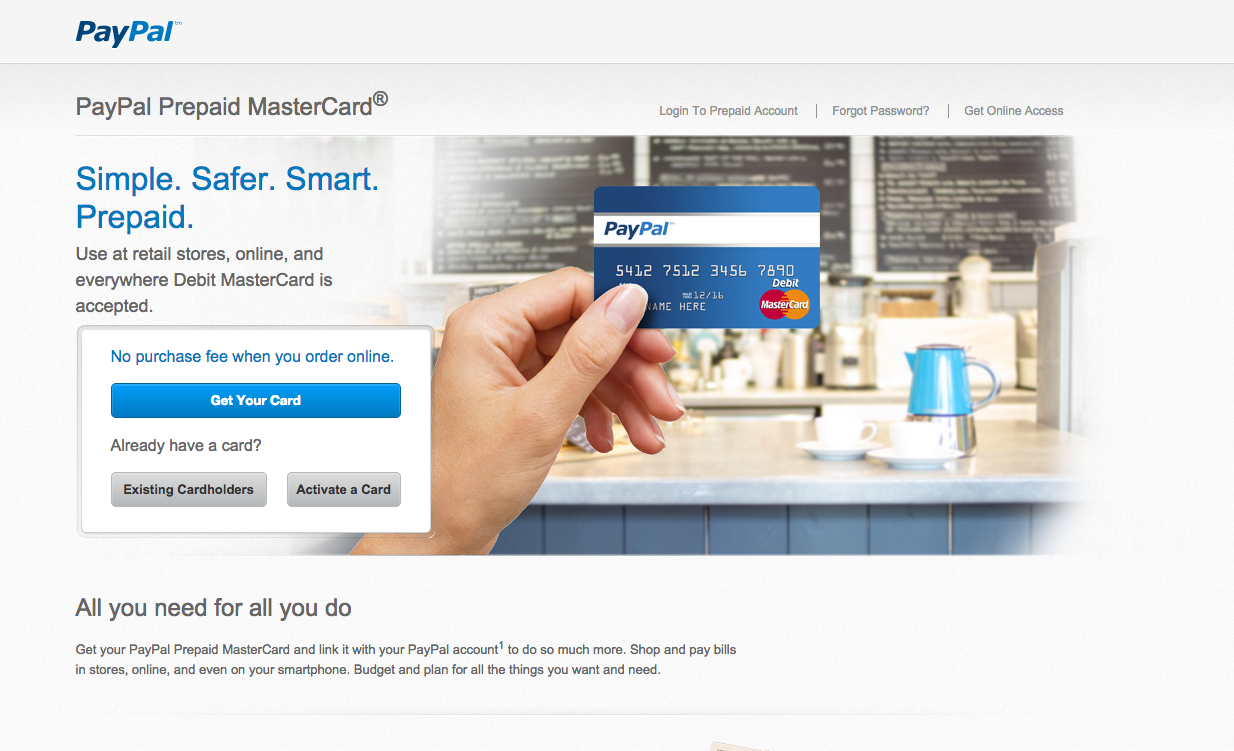

The most reliable way to get a PayPal Prepaid Card is to apply for one through your PayPal account online. This often involves linking your PayPal account to the prepaid card and providing the necessary identification information.

Netspend, a leading provider of prepaid debit cards, partners with PayPal to offer the PayPal Prepaid Card. You can typically find application links and information on the PayPal website or through promotional materials.

Retail Availability: A Diminishing Option

In the past, you could often find PayPal Prepaid Cards at major retailers like Walmart, CVS, Walgreens, and Dollar General. However, availability has decreased over time.

While some locations might still carry them, it's always best to call ahead to confirm before making a trip. Stock levels and participation can vary widely depending on the region and the retailer's policies.

"It's always a good idea to check with your local retailers directly to see if they currently stock the card," suggests a consumer finance expert.

Checking Online Marketplaces: Proceed with Caution

You might find PayPal Prepaid Cards listed on online marketplaces like eBay or Amazon. However, purchasing from these sources requires extra caution.

Ensure the seller is reputable and that the card is new and unregistered. It's crucial to avoid scams and fraudulent listings, which can be prevalent on such platforms.

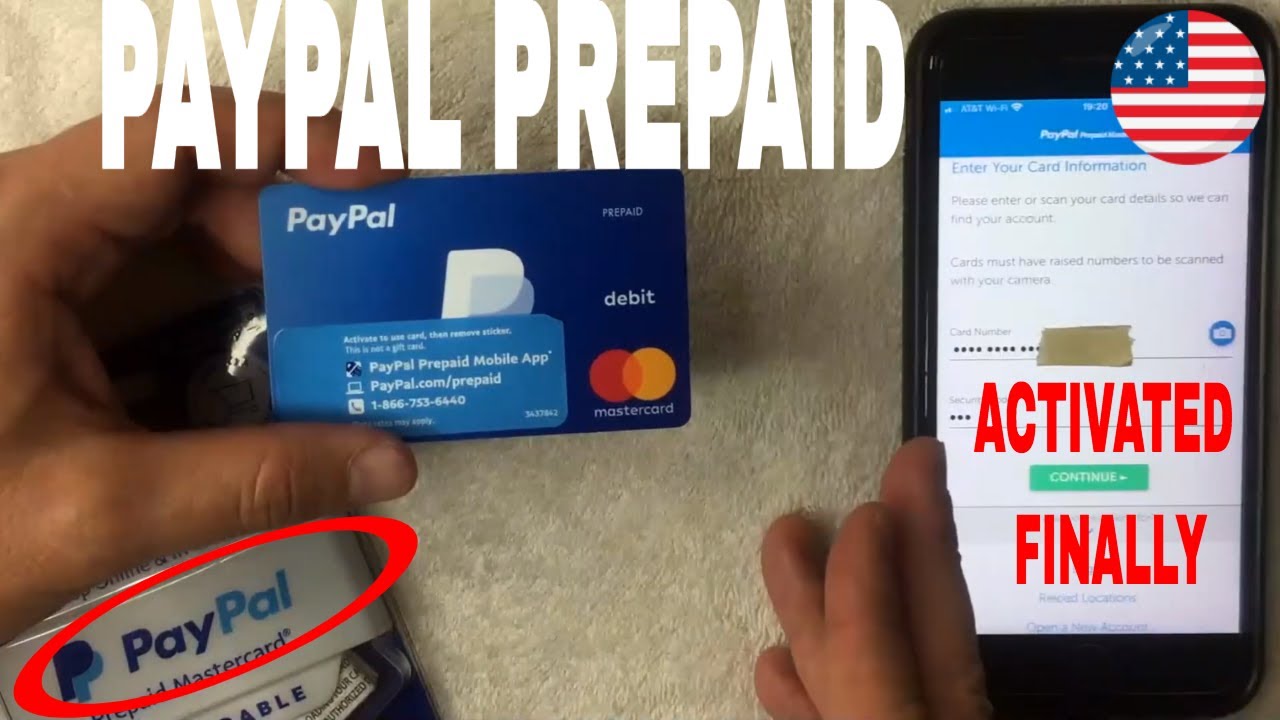

The Application Process and Activation

Whether you apply online or find a card in a retail location, you'll need to activate it before use. This usually involves providing personal information, such as your name, address, and date of birth, for identity verification purposes.

Activation typically takes place online or via a toll-free phone number provided on the card packaging. Be prepared to provide documentation, such as a driver's license or passport, to verify your identity.

Once activated, you can load funds onto the card using various methods, including direct deposit, bank transfers, or cash reloads at participating retail locations.

Benefits and Features of the PayPal Prepaid Card

The PayPal Prepaid Card offers a range of benefits that make it an attractive payment option. It allows you to access your PayPal balance without needing to transfer funds to a bank account.

You can use the card anywhere MasterCard or Visa debit cards are accepted, both online and in-store. This provides flexibility and convenience for everyday purchases.

The card also comes with features like online account access, mobile app support, and the ability to set up text alerts for transaction notifications. These features help you stay on top of your spending and manage your account effectively.

Fees and Considerations

It's important to be aware of the fees associated with the PayPal Prepaid Card. These can include monthly fees, transaction fees, ATM withdrawal fees, and inactivity fees.

Carefully review the cardholder agreement before applying to understand the fee structure. Compare the fees to those of other prepaid cards to determine if it's the best option for your needs.

Some cards offer ways to waive the monthly fee, such as maintaining a certain balance or making a minimum number of transactions each month. Check the terms and conditions for these options.

Alternatives to the PayPal Prepaid Card

If the PayPal Prepaid Card doesn't quite fit your needs, several alternative prepaid card options are available. Many banks and financial institutions offer their own prepaid debit cards with varying features and fee structures.

Consider options like the American Express Serve Card, the Bluebird by American Express card, or prepaid cards offered by major banks. Research the features and fees of each card to find the best fit for your spending habits and financial goals.

Another popular option is to use a virtual credit card or a temporary credit card number for online purchases. Many banks offer this service, which allows you to generate a temporary card number that expires after a single use or a set period.

Conclusion: Navigating the Prepaid Landscape

While the retail availability of PayPal Prepaid Cards has diminished, acquiring one remains possible, primarily through online application via PayPal or Netspend. The card offers a secure and convenient way to manage your spending, access your PayPal balance, and make purchases online and in-store.

Before committing, take the time to research the fees, compare it to alternatives, and ensure it aligns with your financial needs. Understanding your options will empower you to make informed decisions and find the best prepaid solution for your circumstances.

Ultimately, the choice of whether to use a PayPal Prepaid Card depends on your individual needs and preferences. By understanding the card's features, benefits, and fees, you can make an informed decision and take control of your finances in the digital age.

![Where Can I Purchase A Paypal Prepaid Card PayPal's Debit & Prepaid Cards - In-Depth Guide [2024]](https://upgradedpoints.com/wp-content/uploads/2020/07/PayPal-Cash-Card-Landing-Page.jpg?auto=webp&disable=upscale&width=1200)