Personal Loans With Bad Credit In Massachusetts

For residents of Massachusetts grappling with less-than-ideal credit scores, securing a personal loan can seem like an uphill battle. However, despite the challenges, options do exist, albeit often with specific conditions and potentially higher costs.

This article explores the landscape of personal loans for individuals with bad credit in Massachusetts, examining the available avenues, associated risks, and providing insights for navigating this complex financial terrain.

Understanding the Challenges

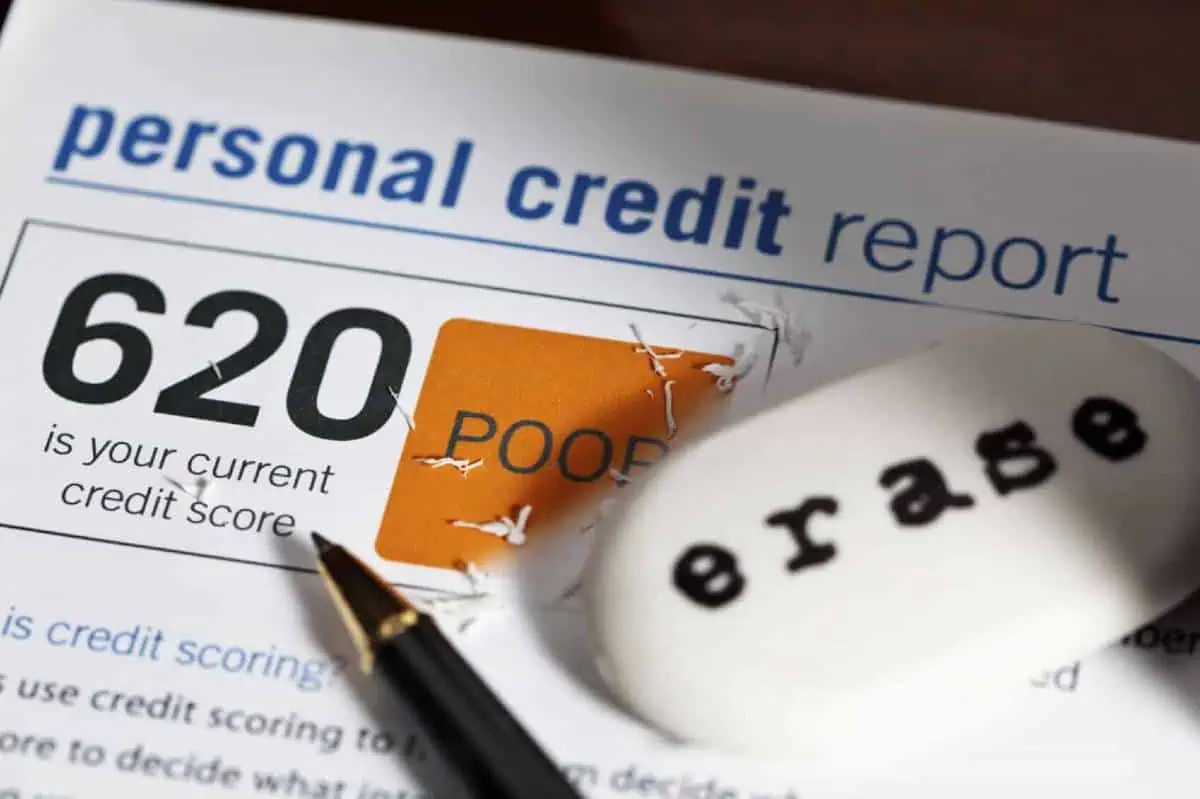

Having a low credit score in Massachusetts, typically considered below 630, limits access to traditional lenders such as banks and credit unions. These institutions prioritize borrowers with a proven history of responsible credit management.

A bad credit score signals a higher risk of default, leading traditional lenders to either deny loan applications outright or offer loans with significantly higher interest rates and less favorable terms. This is because lenders use credit scores to gauge the likelihood of repayment.

Alternative Lending Options

Fortunately, Massachusetts residents with bad credit aren't entirely without options. Several alternative lending sources cater specifically to this demographic.

Online lenders are a prominent player, often offering a wider range of loan products and more flexible eligibility criteria than traditional banks. These lenders frequently utilize technology to assess risk, considering factors beyond just a credit score, such as employment history and income stability.

Payday loans and title loans are short-term, high-interest options that are generally discouraged due to their predatory nature and potential to trap borrowers in a cycle of debt. These loans are often marketed to individuals with limited access to other credit sources, but their high fees and short repayment periods can quickly become unmanageable.

Credit unions, while generally more selective, may offer personal loans to members with bad credit, particularly if the member has a long-standing relationship with the institution. Local credit unions often have a better understanding of the local economy and the specific challenges faced by Massachusetts residents.

Secured personal loans are another possibility. These loans require borrowers to pledge an asset, such as a vehicle or savings account, as collateral. This reduces the lender's risk, potentially increasing the chances of approval and resulting in more favorable terms compared to unsecured loans.

Navigating the Loan Application Process

Regardless of the chosen lending option, borrowers with bad credit in Massachusetts should be prepared to present a strong case for their creditworthiness. This includes demonstrating a stable income, providing evidence of consistent employment, and having a clear plan for repaying the loan.

Obtaining a copy of your credit report and addressing any inaccuracies is a crucial first step. Errors on a credit report can negatively impact your score, so it's important to dispute any incorrect information with the credit bureaus.

Borrowers should also compare offers from multiple lenders, paying close attention to the annual percentage rate (APR), fees, and repayment terms. The APR represents the total cost of the loan, including interest and fees, making it the most accurate way to compare different offers.

The Human Impact

For many Massachusetts residents with bad credit, personal loans can serve as a lifeline in times of financial need. They can be used to cover unexpected medical expenses, consolidate high-interest debt, or finance essential home repairs.

However, the burden of high interest rates and fees can exacerbate financial difficulties, particularly for low-income individuals and families. Responsible borrowing and careful financial planning are essential to avoid falling into a cycle of debt.

Consider Maria Sanchez, a single mother from Boston, who used a personal loan to repair her car after it broke down. The car was essential for her to get to work and take her children to school.

While the loan helped her in the short term, the high interest rate made it difficult to repay, forcing her to cut back on other essential expenses. Her story highlights the complex challenges faced by many Massachusetts residents with bad credit who rely on personal loans to make ends meet.

Responsible Borrowing Practices

Massachusetts residents considering a personal loan with bad credit should prioritize responsible borrowing practices. This includes carefully evaluating their ability to repay the loan, avoiding borrowing more than they need, and exploring alternative options such as debt counseling or assistance programs.

The Massachusetts Division of Banks offers resources and information to help consumers make informed financial decisions. Their website provides access to educational materials and a directory of licensed lenders operating in the state.

Non-profit organizations such as the Consumer Credit Counseling Service of Massachusetts offer free or low-cost debt counseling services to help individuals manage their finances and develop a plan for overcoming debt.

Conclusion

While securing a personal loan with bad credit in Massachusetts is challenging, it is not impossible. By understanding the available options, comparing offers carefully, and practicing responsible borrowing habits, residents can access the funds they need while minimizing the risk of falling into debt.

Seeking guidance from financial professionals and exploring alternative resources can also help individuals navigate the complex landscape of personal loans and make informed decisions that support their long-term financial well-being.