Where Do I Get Money To Start A Business

Imagine this: you’re sitting at your kitchen table, a steaming mug warming your hands. A business plan sketches dance across the pages in front of you, filled with dreams of a thriving cafe, a revolutionary app, or a handcrafted goods empire. But a nagging question persists, hovering like a persistent housefly: Where do I get the money to make this real?

For aspiring entrepreneurs, securing funding is often the biggest hurdle between aspiration and reality. This article explores the diverse landscape of funding options available to new business owners, offering practical advice and shedding light on resources that can help turn your entrepreneurial dreams into a tangible business.

Bootstrapping: The DIY Approach

Many successful ventures begin with bootstrapping, a method of self-funding using personal savings, revenue from early sales, or even selling personal assets.

It demands resourcefulness and frugality, but it allows you to maintain complete control over your company.

According to a 2023 report by the Small Business Administration (SBA), a significant percentage of startups initially rely on personal funds and contributions from friends and family.

Friends, Family, and Fools (Angels in Disguise?)

Speaking of friends and family, tapping into your personal network is a common early-stage funding strategy.

Often referred to as "friends, family, and fools," this approach leverages relationships to secure initial capital.

While the terms might sound harsh, the reality is that those closest to you may be willing to invest in your vision when traditional lenders are hesitant.

Small Business Loans: A Traditional Route

Small business loans remain a popular option, offered by banks, credit unions, and other financial institutions.

The SBA partners with lenders to offer loan guarantees, making it easier for small businesses to qualify.

However, securing a loan typically requires a solid business plan, a good credit score, and collateral.

Grants: The Holy Grail of Funding

Grants, essentially free money, are highly sought after but also highly competitive.

Government agencies, foundations, and corporations offer grants to support specific types of businesses or projects, often focused on innovation, community development, or social impact.

Websites like Grants.gov are valuable resources for searching for federal grant opportunities, while state and local governments often have their own programs.

Angel Investors: Experienced Backers

Angel investors are individuals or groups who invest their own money in early-stage companies with high growth potential.

They often provide mentorship and guidance in addition to capital.

Angel networks and online platforms can help connect entrepreneurs with potential investors, but be prepared to present a compelling pitch and a clear understanding of your market.

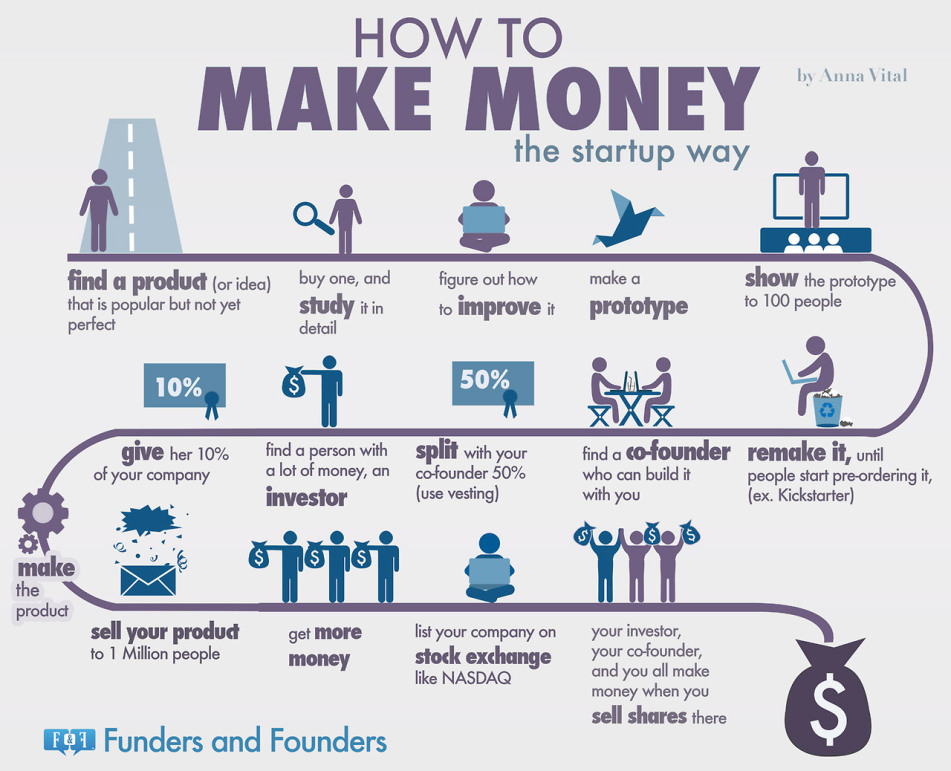

Venture Capital: Fueling Rapid Growth

Venture capital (VC) firms invest in companies with significant growth potential, typically in exchange for equity.

VC funding is often sought after by startups that are scaling rapidly and require substantial capital to expand their operations.

Securing VC funding is a rigorous process that requires a strong business model, a talented team, and a proven track record of growth.

Crowdfunding: Tapping the Power of the Crowd

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise funds from a large number of people, often in exchange for rewards or pre-orders.

This approach is particularly effective for businesses with a compelling story or a unique product that resonates with a target audience.

Successful crowdfunding campaigns require careful planning, a strong marketing strategy, and engaging content to attract backers.

Incubators and Accelerators: More Than Just Money

Incubators and accelerators provide startups with resources, mentorship, and networking opportunities, often in exchange for equity.

These programs can be invaluable for early-stage companies, providing access to expertise and support that can significantly increase their chances of success.

Many incubators and accelerators also offer seed funding, helping startups get off the ground.

Choosing the right funding source is a critical decision that depends on your business model, your stage of development, and your risk tolerance.

Thorough research, careful planning, and a clear understanding of your financial needs are essential for navigating the funding landscape.

Remember, the journey of entrepreneurship is rarely linear. Be prepared to adapt, learn, and persevere as you pursue your dreams.

Ultimately, funding is simply a tool. The real magic lies in your vision, your passion, and your unwavering commitment to building something meaningful. So, take a deep breath, sharpen your pencil, and get ready to make your mark on the world.