Which Group Is An Example Of A Commodity Organization

The global landscape of commodity organizations is complex, often veiled in intricate trading mechanisms and geopolitical strategies. Understanding which groups truly embody the essence of a commodity organization is crucial for investors, policymakers, and consumers alike, influencing everything from energy prices to food security.

This article delves into the characteristics of commodity organizations, providing a detailed analysis of a prime example – the OPEC (Organization of the Petroleum Exporting Countries). We explore its structure, objectives, impact on global markets, and the controversies it faces, offering a comprehensive understanding of how commodity organizations function in the modern world.

Defining Commodity Organizations

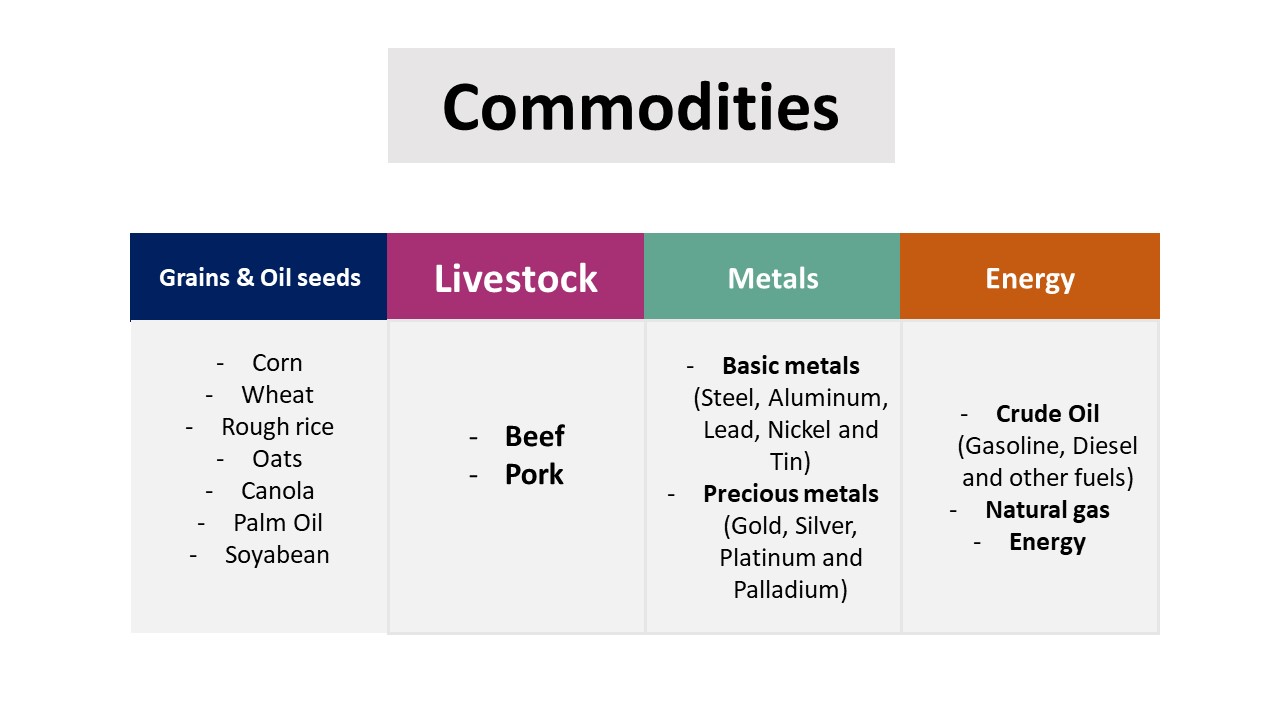

A commodity organization is a group of producers of a particular commodity that aims to coordinate policies and practices related to its production and sale. These organizations are formed to influence prices, stabilize markets, or enhance the collective bargaining power of their members. The primary goal often revolves around maximizing profitability and ensuring the long-term viability of the commodity in question.

These groups often involve international agreements, quotas, and coordinated strategies to regulate supply and demand. Transparency and market stability are often stated objectives, however, critics argue that the pursuit of profit often overshadows these ideals.

OPEC: A Case Study in Commodity Control

OPEC, established in 1960, stands as perhaps the most prominent example of a commodity organization. Its members, primarily oil-exporting nations, collectively control a significant portion of global crude oil production. The organization's influence extends far beyond its member states, shaping energy markets and impacting global economies.

Structure and Objectives

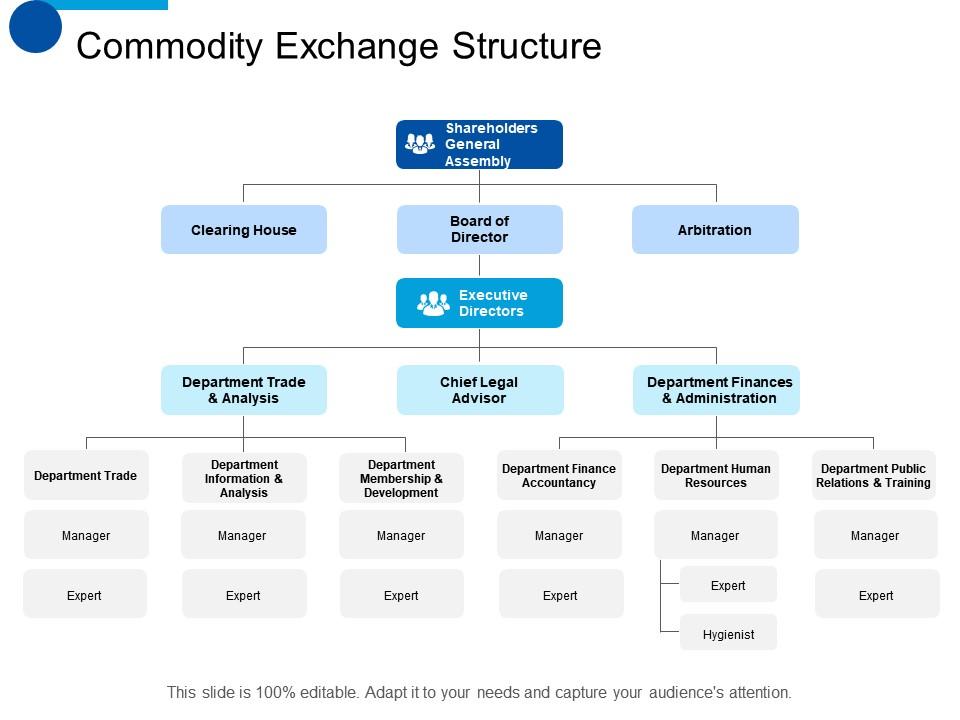

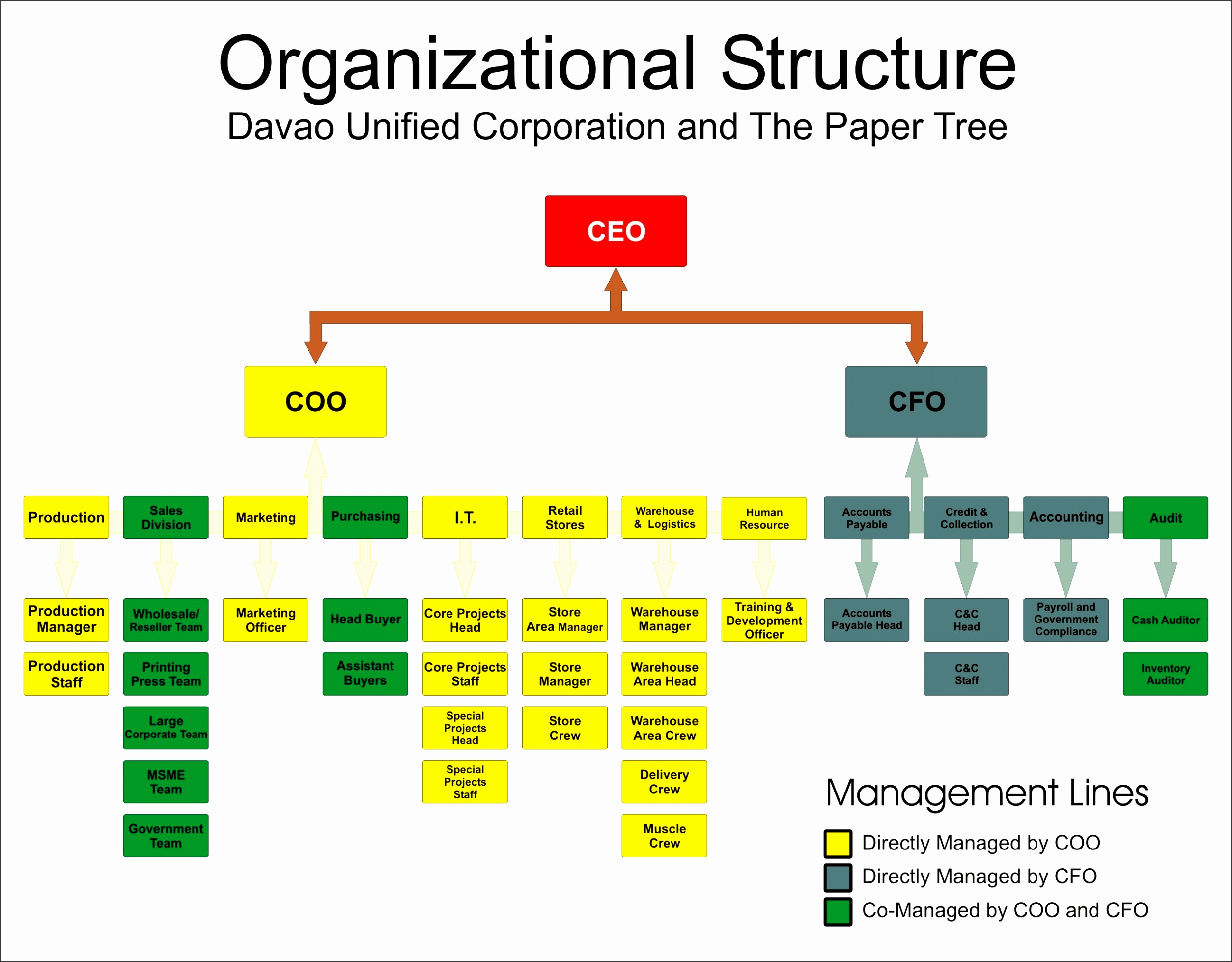

The core of OPEC's structure is the Ministerial Conference, where representatives from each member country convene to determine production quotas and overall policy. These decisions are aimed at balancing supply and demand, influencing prices to achieve what OPEC deems a fair return for its members. The Secretariat, based in Vienna, Austria, supports the organization's activities with research and administrative functions.

OPEC's stated objectives include coordinating and unifying the petroleum policies of its member countries and ensuring the stabilization of oil markets. In practice, this translates to managing production levels to prevent price volatility and maintain a steady stream of revenue for its members.

Impact on Global Markets

OPEC's control over a substantial portion of global oil production gives it considerable influence on energy prices. By adjusting production levels, OPEC can directly impact the supply of oil available to consumers, thereby influencing prices at the pump and across various industries. These decisions reverberate throughout the global economy, affecting transportation, manufacturing, and even geopolitical relations.

Throughout its history, OPEC has wielded its power to influence oil prices, sometimes triggering significant economic consequences. The oil crises of the 1970s, for example, demonstrated the organization's ability to disrupt global economies through production cuts and price hikes.

Controversies and Criticisms

OPEC's actions have not been without controversy. Critics argue that the organization's efforts to control prices can distort markets and harm consumers, particularly in developing countries. Concerns about price manipulation and unfair practices have been raised repeatedly.

Furthermore, the organization's influence can create geopolitical tensions, as consuming nations often feel vulnerable to OPEC's decisions. The balance of power between oil-producing and oil-consuming nations remains a constant source of friction.

Alternative Perspectives: Beyond OPEC

While OPEC is the most well-known, other commodity organizations exist, albeit with varying degrees of influence. Examples include associations of coffee, cocoa, and copper producers. However, these organizations generally lack the market dominance and political clout of OPEC.

These smaller organizations often face challenges related to internal disagreements, fluctuating market conditions, and the difficulty of enforcing production quotas. Their impact on global markets is typically less pronounced than that of OPEC.

The Future of Commodity Organizations

The future of commodity organizations like OPEC is uncertain, facing challenges from technological advancements, shifting energy policies, and growing concerns about climate change. The rise of renewable energy sources and the increasing emphasis on energy efficiency are gradually reducing the world's dependence on oil.

Furthermore, the shale oil revolution in the United States has altered the global energy landscape, diminishing OPEC's market share. The organization must adapt to these evolving conditions to maintain its relevance and influence in the years to come.

In conclusion, understanding the dynamics of commodity organizations, particularly OPEC, is essential for navigating the complexities of the global economy. These organizations play a crucial role in shaping markets, influencing prices, and impacting the lives of consumers worldwide. As the global landscape continues to evolve, their future remains a topic of significant interest and debate.