Which Is Better Progressive Or Geico

Car insurance rates are skyrocketing, and consumers are desperately seeking the best deal. The showdown: Progressive versus Geico, which insurer offers the most bang for your buck?

Choosing between Progressive and Geico can be daunting. This article dissects their key features, coverage options, discounts, and customer satisfaction ratings to help you make an informed decision amidst rising premiums.

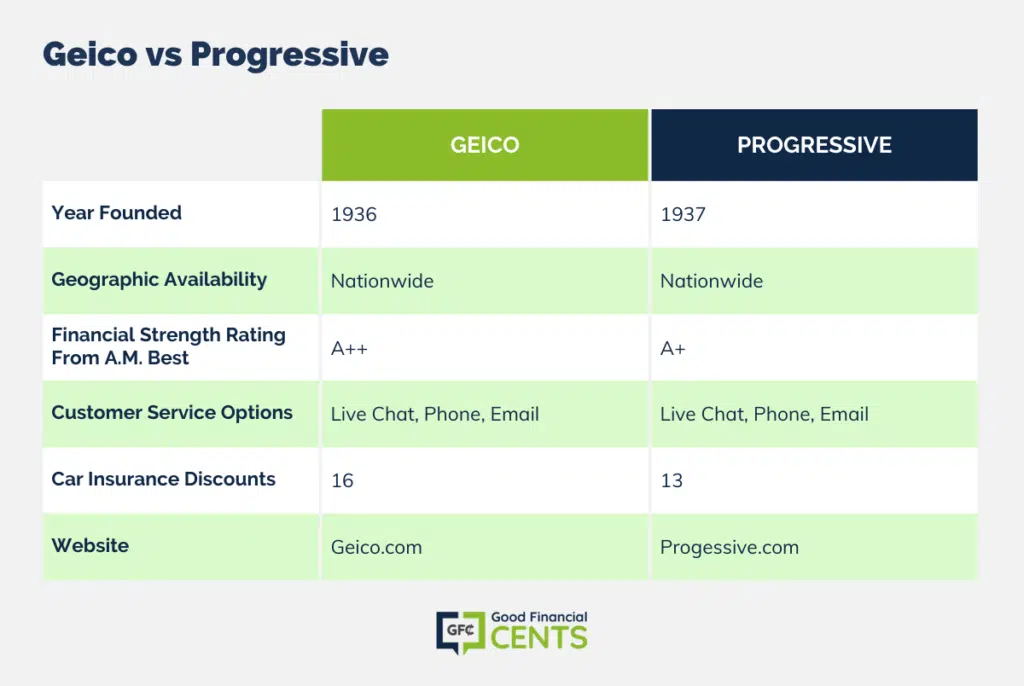

Coverage Options: A Side-by-Side Look

Both Progressive and Geico offer standard auto insurance coverage. This typically includes liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP) where required.

Progressive stands out with its "Name Your Price" tool, allowing customers to customize coverage based on their budget. This can be a game-changer for those seeking to lower premiums.

Geico, however, boasts a slightly wider range of add-on coverages. These include mechanical breakdown insurance (MBI) and rideshare insurance, catering to specific needs.

Discounts: Maximizing Savings

Both insurers offer a plethora of discounts to attract customers. Safe driver discounts, good student discounts, and multi-policy discounts are common.

Geico frequently promotes discounts for federal employees and members of the military. This can be a significant advantage for those eligible.

Progressive's Snapshot program tracks driving habits, offering potential discounts for safe driving. This telematics-based approach can lead to substantial savings.

Customer Satisfaction: Weighing the Reviews

Customer satisfaction is a critical factor when choosing an insurer. Various organizations, like J.D. Power, conduct annual surveys to gauge customer experiences.

Historically, Geico has often received slightly higher customer satisfaction ratings than Progressive. However, results can vary year to year, and regional differences can play a role.

The National Association of Insurance Commissioners (NAIC) complaint index is another valuable resource. A lower score indicates fewer complaints relative to market share. Always check the latest data for the most up-to-date information.

Pricing: The Bottom Line

Ultimately, the best insurer depends on individual circumstances and needs. Comparing quotes from both Progressive and Geico is crucial.

Factors such as age, driving record, location, and vehicle type significantly impact premiums. Get personalized quotes to determine which insurer offers the best rate for your situation.

Remember to consider deductible options when comparing prices. A higher deductible typically results in a lower premium.

The Verdict: No Clear Winner

There's no universally "better" insurer. The optimal choice hinges on your specific needs and priorities.

Geico and Progressive both offer competitive rates, diverse coverage options, and a range of discounts. Thoroughly research and compare quotes to make an informed decision.

Next steps involve obtaining quotes from both companies and reviewing their customer satisfaction ratings. Consult with an independent insurance agent for personalized advice.