Which Of The Following Accounts Directly Impact Equity

Understanding the financial health of a company requires a close examination of its equity, the residual value of assets after deducting liabilities. Several key accounts directly influence this crucial metric, reflecting the business's performance and financial decisions. Identifying these accounts is essential for investors, analysts, and business owners alike.

This article delves into the accounts that have the most significant impact on equity, providing a clear understanding of how they shape a company's net worth. We will explore the direct relationships between these accounts and the changes in equity, offering insights into the factors that drive financial performance. The information will be gathered from reputable financial sources and expert analysis to provide accurate and unbiased information.

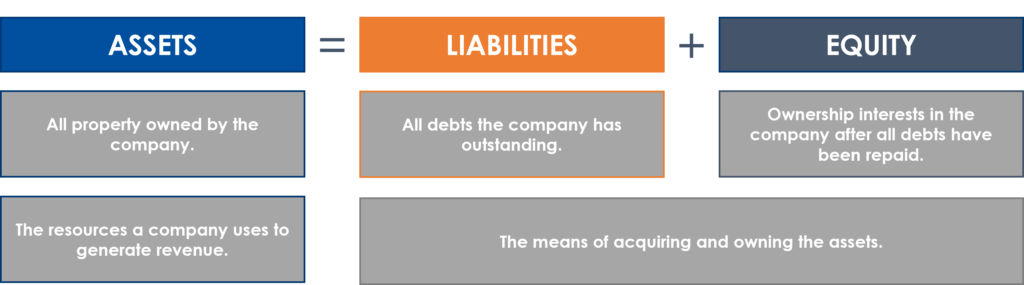

Understanding Equity and its Components

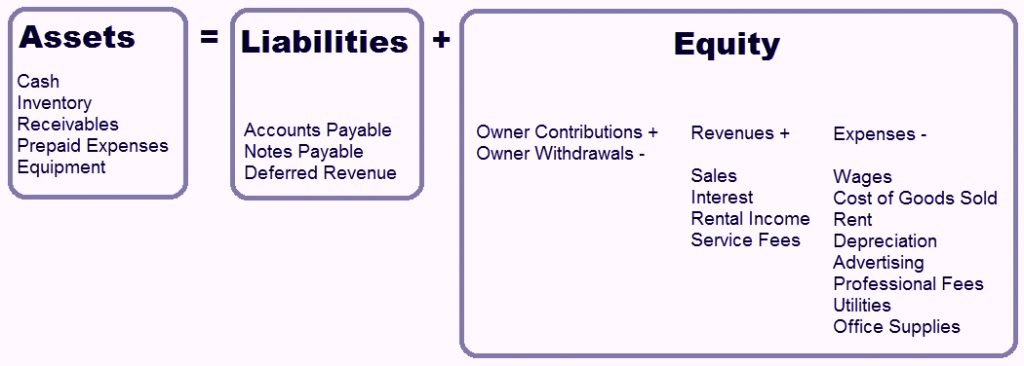

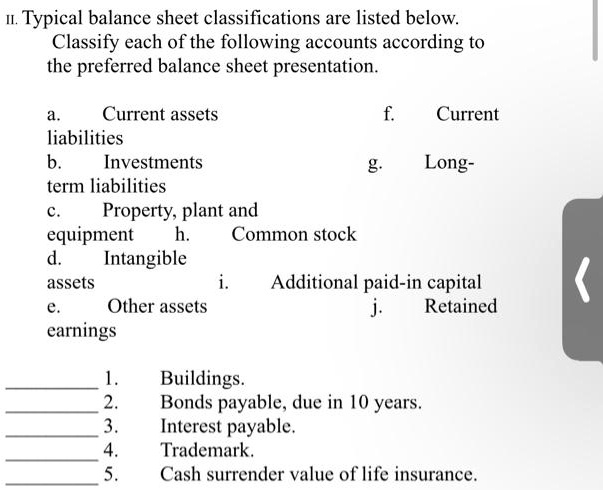

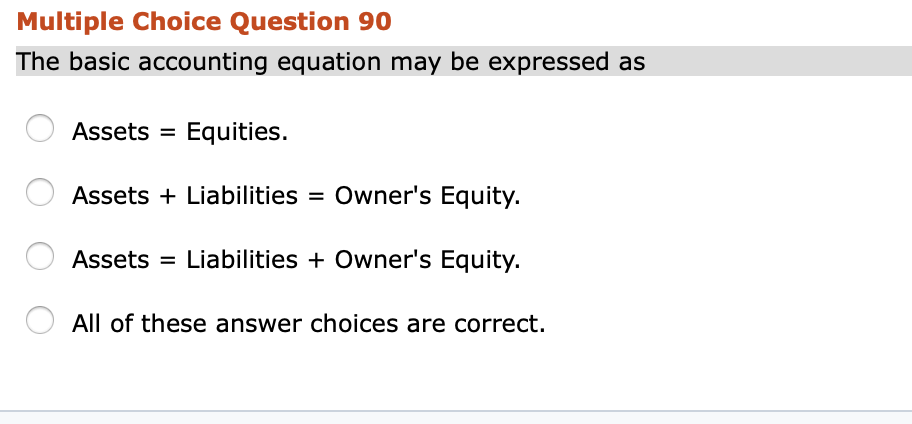

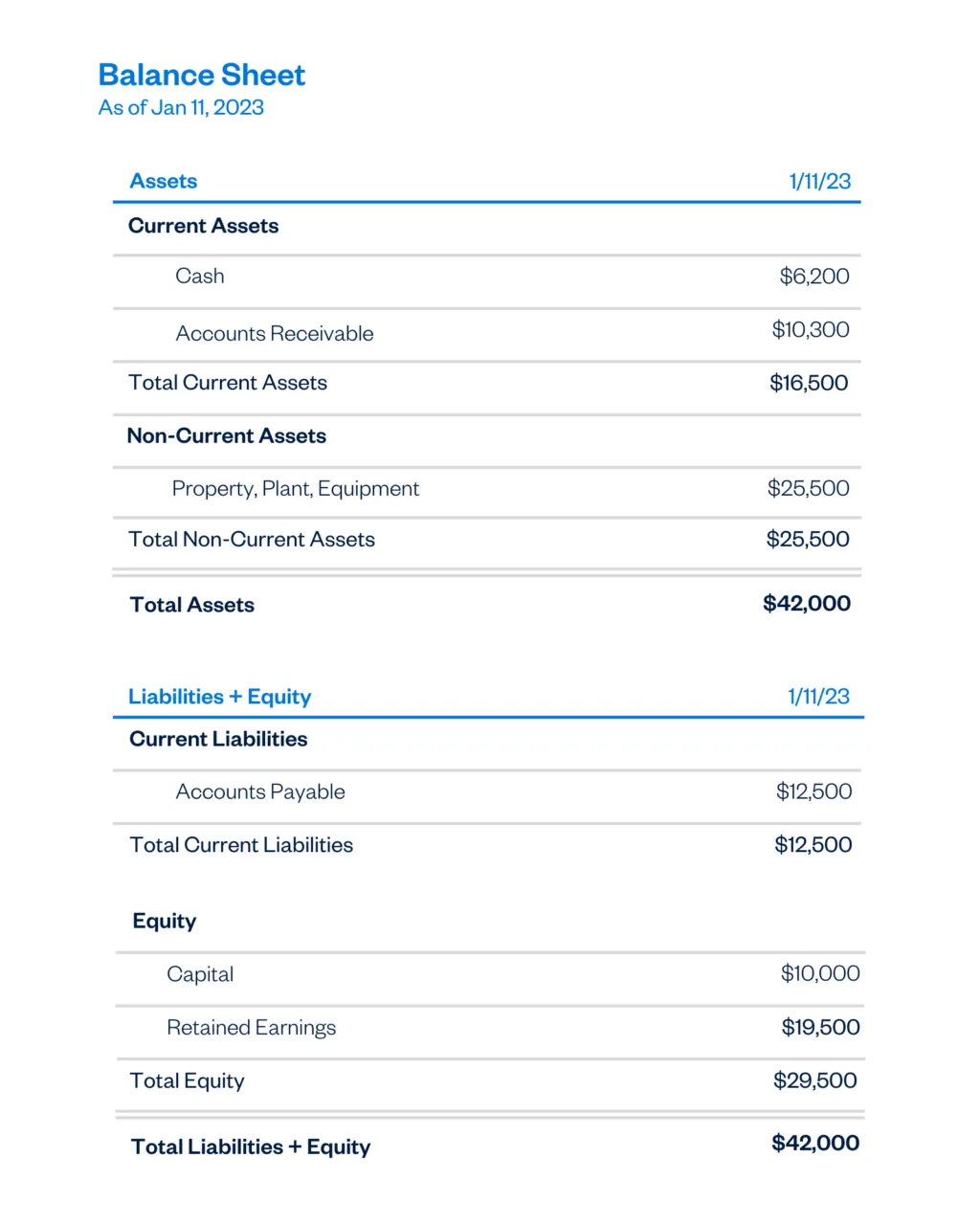

Equity, also known as shareholders' equity or net worth, represents the owners' stake in the company. It's the difference between a company's total assets and its total liabilities, reflecting the value remaining if all assets were sold and all debts paid. A healthy equity position is crucial for attracting investors and securing financing.

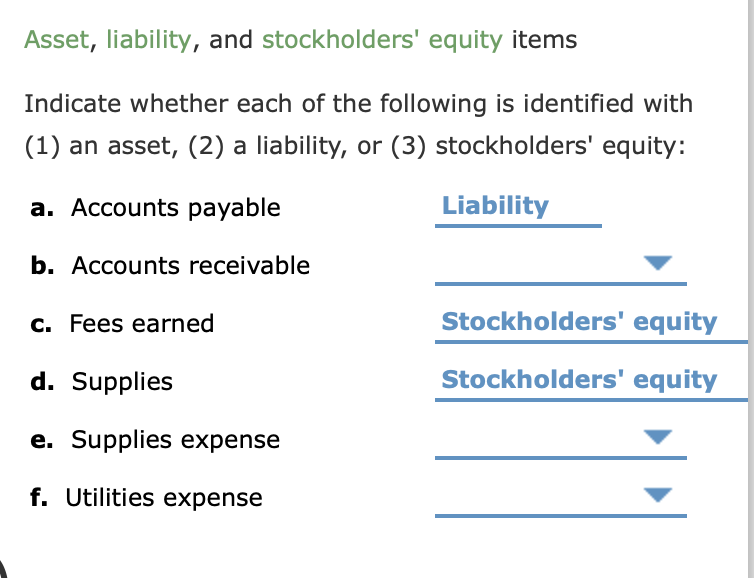

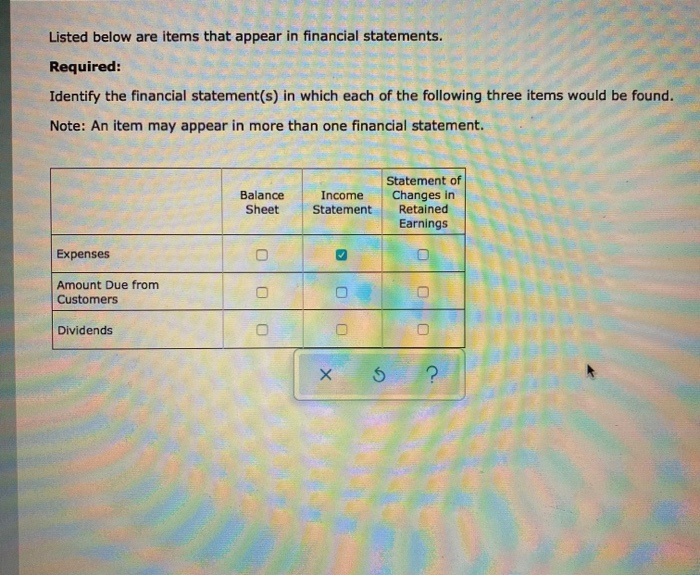

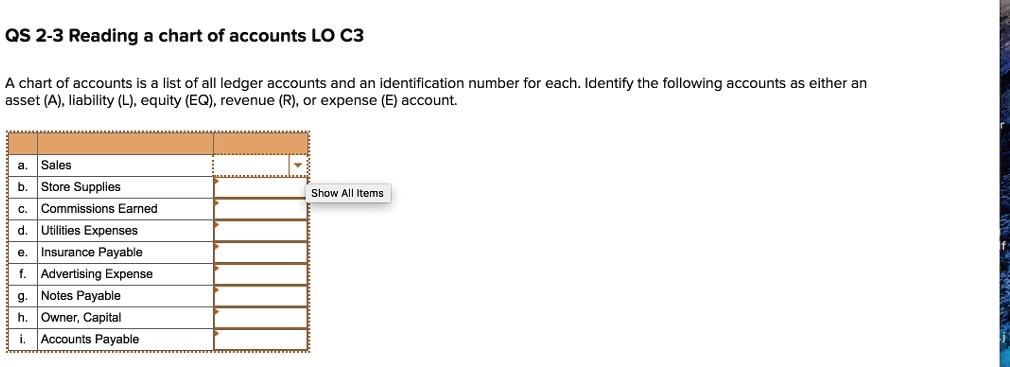

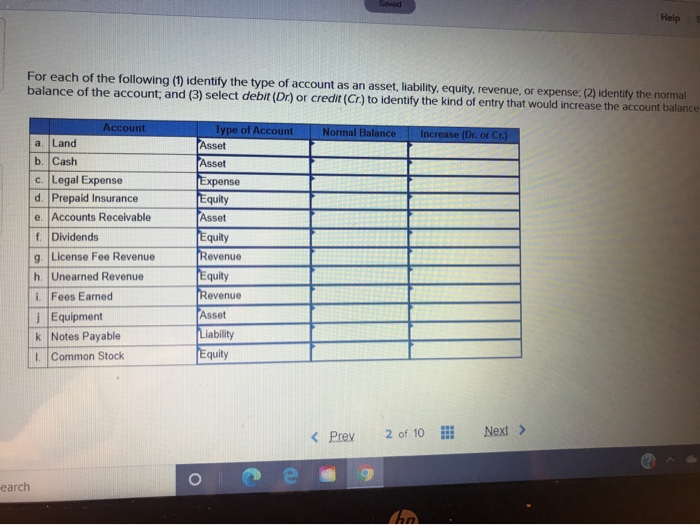

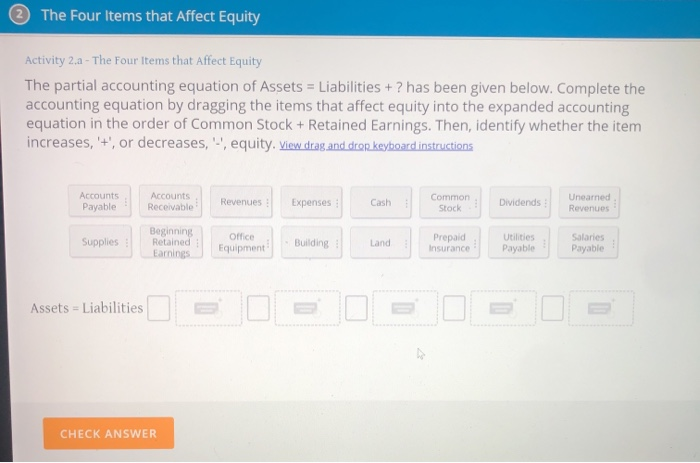

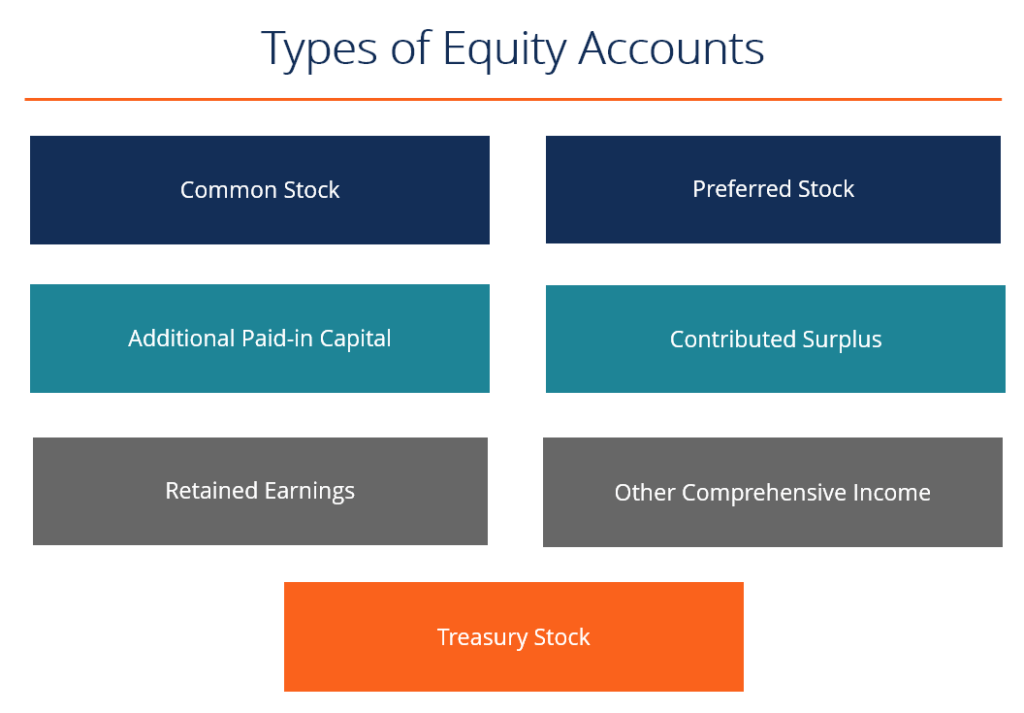

Several accounting entries directly affect a company’s equity. These entries are related to profits, losses, dividends, stock issuances, and treasury stock.

Net Income (or Net Loss)

The most significant driver of equity is net income, the profit a company generates after all expenses are deducted from revenues. A positive net income increases retained earnings, a component of equity, thereby boosting overall equity. Conversely, a net loss decreases retained earnings and lowers equity.

According to generally accepted accounting principles (GAAP), net income is calculated on the income statement. It's crucial to examine this statement to understand how profits are generated and what factors contribute to the overall financial performance.

Dividends

Dividends are payments made to shareholders out of a company's accumulated profits. These payments directly reduce retained earnings, a key component of equity. While dividends can be attractive to investors, they also represent a reduction in the company's equity position.

Companies must carefully balance dividend payouts with the need to reinvest in the business for future growth. High dividend payments can strain a company's financial resources if not supported by sufficient profits.

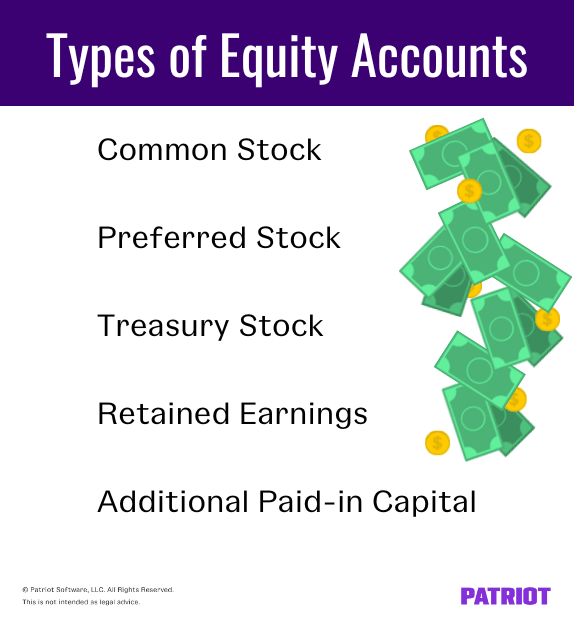

Issuance of Stock

When a company issues new shares of stock, it receives cash or other assets in exchange, increasing the contributed capital component of equity. This influx of capital strengthens the company's financial position and enhances its ability to invest in growth opportunities. Issuing stock is a common way for companies to raise capital.

The specific impact on equity depends on the price at which the stock is issued. If shares are sold above par value, the excess is recorded as additional paid-in capital, further boosting equity.

Treasury Stock

Treasury stock refers to shares of a company's own stock that it has repurchased from the open market. Repurchasing stock decreases the number of outstanding shares and reduces equity. It's essentially the opposite of issuing stock.

Companies often repurchase stock to increase earnings per share (EPS) or to return capital to shareholders. While treasury stock reduces equity, it can also signal that management believes the company's stock is undervalued.

Other Comprehensive Income (OCI)

Other comprehensive income (OCI) includes items that are not included in net income but still affect equity. These items typically arise from unrealized gains or losses on certain investments, foreign currency translation adjustments, and changes in pension liabilities.

OCI is reported separately from net income and is accumulated in a component of equity called accumulated other comprehensive income (AOCI). While often overlooked, OCI can have a material impact on a company's overall equity position.

The Significance of Equity Analysis

Understanding which accounts directly impact equity allows investors and analysts to gain a deeper understanding of a company's financial health and performance. Changes in these accounts can provide valuable insights into a company's profitability, capital structure, and dividend policy. By carefully monitoring these accounts, stakeholders can make informed decisions about investing in or lending to a company.

Furthermore, tracking equity fluctuations can highlight potential risks or opportunities for improvement. A decline in equity could signal financial distress, while a steady increase could indicate strong financial performance and growth prospects. Analyzing the relationship between these accounts offers a more complete financial picture.

Conclusion

Net income, dividends, stock issuances, treasury stock, and other comprehensive income are the key accounts that directly impact a company's equity. Understanding how these accounts interact and influence equity is critical for assessing a company's financial health and making informed investment decisions. By carefully analyzing these elements, stakeholders can obtain a comprehensive understanding of a company's net worth.

It is important to consult with financial professionals and to use reliable financial data sources when performing equity analysis. This will ensure that the analysis is accurate and based on sound financial principles. By understanding the dynamics of these accounts, individuals can make confident and informed investment and business decisions.